Chasing the profits of "Chainsaw"! Investors are betting big on the return of volatility in the US stock market

Investors are heavily buying exchange-traded products (ETPs), betting that stock market volatility will rise. Despite the assets under management of Barclays iPath S&P 500 VIX Short-Term Futures ETN increasing by over 300%, holding them for too long may lead to diminished returns. Analyst Eric Balchunas compares VIX-related ETPs to a "chainsaw," effective in specific situations but also potentially leading to losses. Investors need to accurately grasp the timing of entry and exit, or they may face losses of up to 78%

According to Zhitong Finance APP, investors are flocking to buy exchange-traded products (ETPs), betting that stock market volatility will rebound from its current extremely low levels. However, while they wait for volatility to surge significantly for profit, a special mechanism in the market is causing their returns to continuously shrink.

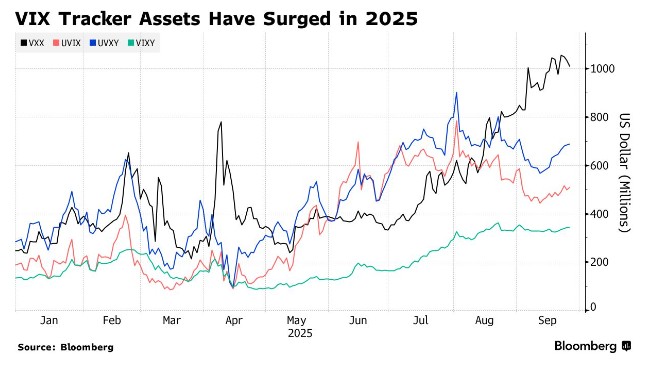

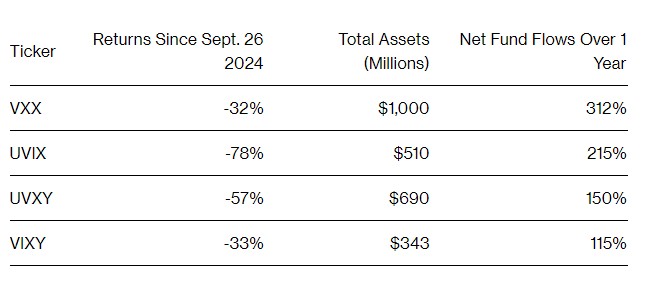

The largest product tracking the performance of Cboe Volatility Index (VIX) futures, Barclays iPath S&P 500 VIX Short-Term Futures ETN, has seen its assets under management grow by over 300% this year, surpassing $1 billion. The appeal of such products lies in the fact that if the current record stock market rally fades, market volatility will spike, leading to substantial returns.

However, for investors holding these securities for too long, there are hidden traps: when traders believe that future market volatility will exceed the current levels, these products will continuously consume capital. As funds keep pouring in, the cost of holding these positions exacerbates the loss effect.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, likens VIX ETPs to a "chainsaw"—very effective for specific scenarios, "but it can also saw off your own arm."

These products promise that if the VIX index surges, investors will reap substantial returns. With proper timing, one can make a significant profit. For example, on April 1, if an investor bought the "VelocityShares 2x Long VIX Futures ETF" just before the U.S. imposed large tariffs and sold it a week later on April 8, their capital could have doubled.

However, to achieve such returns, investors must accurately time their entry and exit. Compiled data shows that if one had held this fund for the past year, the loss could be as high as 78%.

Michael Thompson, co-portfolio manager at Little Harbor Advisors, stated: "The price of these products can experience significant increases, resembling options, but without an expiration date. Therefore, even if the anticipated market correction or decline does not occur before the option's expiration, one can still hold these 'long volatility' ETP shares."

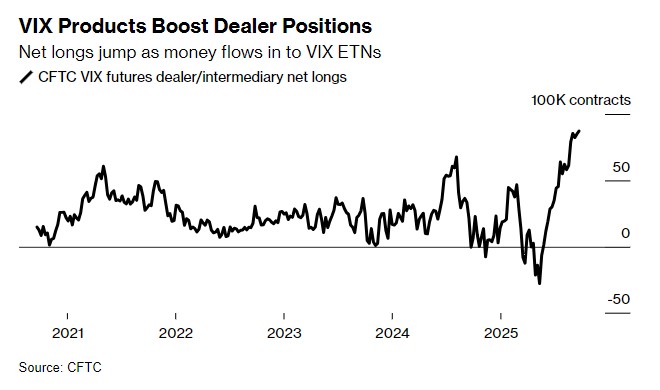

For investors who only take long positions, these tools provide a convenient hedging method—after all, when the S&P 500 index declines, the volatility index often rises. Unlike in 2018 (when a large amount of speculative capital flowed into "short VIX" products, triggering a volatility spike known as "volatility apocalypse"), the influx of hedging funds this time is not expected to disrupt the market Rocky Fishman, founder of research firm Asym 500, pointed out that retail traders "want to adopt cautious and protective strategies." He estimates that currently about 40% of the open contracts in VIX futures are held by VIX-related ETPs.

However, the cost of holding these instruments cannot be ignored. Taking UVIX (VIX-related ETF) as an example, its public expense ratio reaches 2.8%, and currently, this ETF holds two VIX futures contracts expiring in October and November. The fund sells part of the October contracts daily and buys November contracts until the October contracts expire; subsequently, the positions in November contracts will gradually shift to December contracts, and so on.

Since the price of the October contracts is lower than that of November, the fund is essentially "selling low and buying high," continuously consuming capital. Worse still, this contract roll-over operation will further depress the prices of near-month futures while increasing the cost of holding next-month futures.

Matthew Thompson, co-portfolio manager and brother of Michael Thompson, explained: "To maintain a 30-day weighted maturity, they must sell near-month contracts and buy next-month contracts daily. This inevitably leads to an expansion of the price spread between the near-month and next-month contracts, ironically further increasing the holding costs of such instruments."

These ETPs are not the first products to encounter contract roll-over issues. Over a decade ago, retail investors attempting to track oil price increases flocked to the United States Oil Fund ETF, only to see their returns lag far behind the gains in spot crude oil prices.

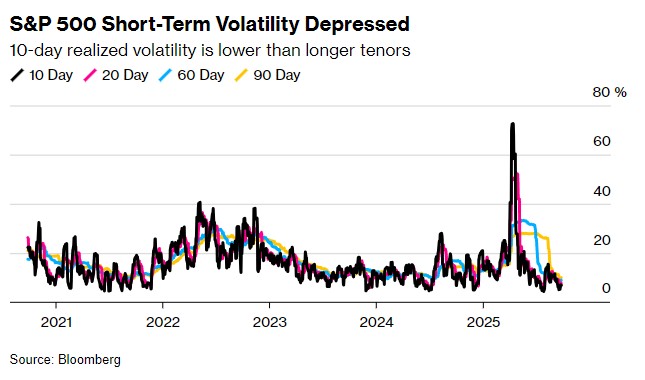

As the stock market steadily rises, implied volatility (the market's best estimate of future price fluctuations) has been largely suppressed. The core reason is that the recent actual volatility has been low—if recent trends indicate a low likelihood of significant price fluctuations, traders are unwilling to pay high prices for options betting on volatility.

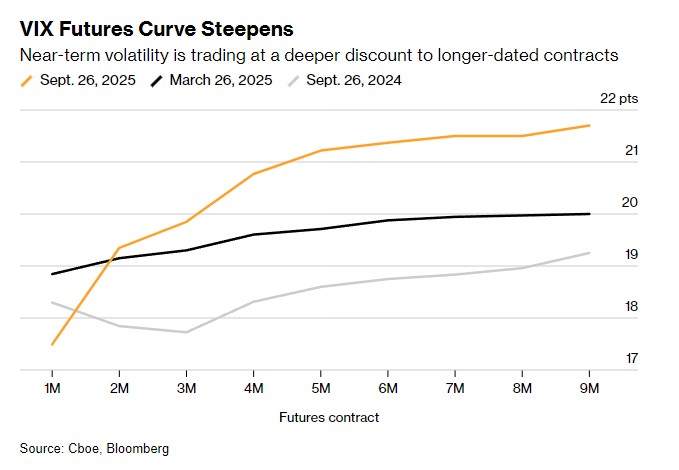

This phenomenon is particularly pronounced in short-term volatility, as the trading range of the S&P 500 index continues to narrow. This keeps the implied volatility of short-term options at low levels, thereby depressing the VIX spot index and near-month futures prices.

Strategists at Société Générale proposed an arbitrage strategy utilizing the "deep contango" of the futures curve. In a report released on Thursday, they noted that the current VIX futures curve is not only in a premium state but also exhibits a "concave" characteristic—meaning the closer it gets to the expiration date, the steeper the slope of the curve.

The essence of this trading strategy is to short the near end of the VIX curve, such as selling near-month futures and buying next-month futures. The reason is that as the expiration date approaches, the price decline of near-month futures often exceeds that of next-month futures.

The essence of this trading strategy is to short the near end of the VIX curve, such as selling near-month futures and buying next-month futures. The reason is that as the expiration date approaches, the price decline of near-month futures often exceeds that of next-month futures.

Of course, this type of trading also carries risks. Strategists including Brian Fleming and Kunal Thakkar emphasize that "the main risk lies in a sharp and turbulent decline in the stock market, which will cause the VIX curve to shift significantly upward and become inverted."

For investors looking to hedge against potential portfolio losses from a stock market decline, their sensitivity to "capital outflow" may be lower than that of retail investors. This demand may continue to drive capital inflows into such funds.

Additionally, Robert Harlow, the global multi-asset research deputy head at T. Rowe Price Group Inc., stated that hedge funds are also using such products, especially for short-term trading.

He pointed out, "For macro hedge funds that are not equipped with various options trading frameworks, these products are easy to operate, requiring only a simple 'enter and exit.'"