The pricing is not "surprising" enough, Morgan Stanley predicts: Li Auto i6 may become a "slow-burning" model

Morgan Stanley stated that the starting price of the i6 model is 249,800 yuan, and the pricing strategy is relatively conservative, lacking "surprises." However, the technical strength of the product itself and the brand influence of Li Auto may still drive sales growth, with expected monthly sales of the i6 to exceed 8,000 units in the fourth quarter. Coupled with the recent stable upward trend in sales of the MEGA and i8 models, the rating for Li Auto is maintained at "Overweight."

Li Auto avoided the "shock pricing" strategy and did not choose the intense route of price competition. This may lead the i6 model to become another "slow-burning" product.

On September 29, according to news from the Chasing Wind Trading Desk, Morgan Stanley's latest research report shows that the pricing strategy for Li Auto's newly released L6 model did not bring any "surprises," with a starting price of 249,800 yuan, which is the same as the L6 Pro and only 30,000 yuan lower than the L6 Max.

The analyst team led by Tim Hsiao expects that this relatively conservative pricing strategy may cause the i6 to repeat the fate of the i8, becoming another "slow-burning" model.

However, Morgan Stanley believes that despite the relatively conservative pricing strategy, the technical strength of the product itself and Li Auto's brand influence may still drive sales growth, coupled with the recent steady increase in sales of the MEGA and i8 models, which proves the solid foundation of Li Auto's product strength.

Therefore, the firm maintains an "overweight" rating on Li Auto, with a target price of HKD 139, indicating a 39% upside potential from the current stock price.

i6 Pricing is Rational but Lacks Impact

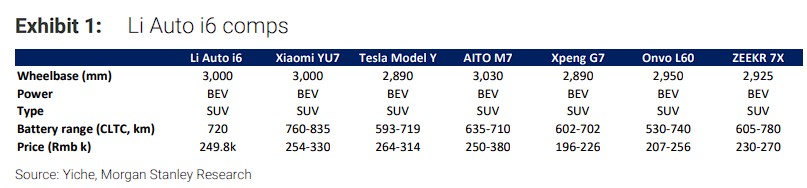

Morgan Stanley stated that, from a competitive product comparison, the i6 faces fierce competition in the same price range.

Compared to Xiaomi YU7 (254-330 thousand yuan), Tesla Model Y (264-314 thousand yuan), Aito M7 (250-380 thousand yuan), XPeng G7 (196-226 thousand yuan), Leapmotor L60 (207-256 thousand yuan), and ZEEKR 7X (230-270 thousand yuan), the pricing of the i6 is at a medium level.

Morgan Stanley pointed out that although the pricing strategy is relatively conservative, the technical strength of the product itself and Li Auto's brand influence may still drive sales growth.

It is reported that this model offers both rear-wheel drive and all-wheel drive versions, standard equipped with the AD Max intelligent driving system based on the Nvidia Thor chip, lidar, and 5C charging capabilities.

Notably, users who place orders before October 31 can enjoy a discount of 10,000 yuan and free optional configurations worth 25,000 yuan, including air suspension, an onboard refrigerator, and electric doors.

Morgan Stanley stated that the i6 features a wheelbase of 3,000 mm and a CLTC range of 720 kilometers, demonstrating competitive performance among products in the same class.

The technical highlights of this model focus on the intelligent driving system and charging efficiency, which are expected to become its differentiated advantages in the fierce market competition.

According to a previous article from Jianwen, Li Auto founder Li Xiang stated in the earnings call that the i6 "will become the most competitive product in the large five-seat SUV market," emphasizing the core competitive advantages of the i6:

VLA intelligent driving system, excellent performance, spacious interior, unique exterior design, and comprehensive adaptability in urban and rural driving scenarios.

The bank expects that the i series (i6+i8) will contribute over 50,000 units in sales by 2025, with i8 monthly sales exceeding 6,000 units and i6 monthly sales exceeding 8,000 units in the fourth quarter.

Meanwhile, the recent stable upward trend in sales of the MEGA and i8 models provides strong evidence of Li Auto's product strength. Therefore, Morgan Stanley maintains a positive outlook on Li Auto, stating:

Even though the initial performance of the i6 may be relatively "slow to heat up," with the comprehensive strength of the product and brand influence, this model is expected to gradually establish a solid position in the market