Unprecedented! Global capital expenditure surges, while employment growth stagnates – the "AI era" has arrived

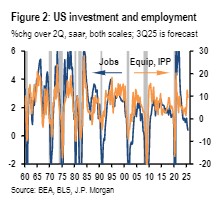

JP Morgan found that in the first half of 2025, global capital expenditures achieved an annualized growth of 11%, while the new employment in developed markets in the third quarter may only see a slight year-on-year increase of 0.4%. In the past 60 years of economic expansion cycles in the United States, such a situation of accelerated capital expenditure coexisting with stagnant employment growth has never occurred

The global economy is presenting an unprecedented picture: corporate capital expenditures are surging at an unprecedented rate, while employment growth in developed economies has almost completely stagnated.

As previously mentioned by Wall Street Watch, Walmart's CEO recently stated that "AI will change every job," and the company plans to maintain its total workforce of 2.1 million employees over the next three years, but there will be significant adjustments in job composition.

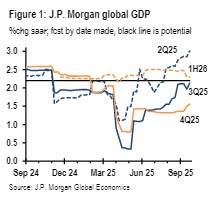

According to news from the Chasing Wind Trading Desk, JP Morgan stated in its recent research report that in the first half of 2025, global capital expenditures achieved an annualized growth of 11%, and this strong momentum continued into this quarter. In stark contrast, labor demand in developed markets is "stumbling," with new employment in the third quarter likely to increase by only 0.4% year-on-year.

The report shows that regarding this phenomenon, the optimistic view believes it marks the successful implementation of new technologies, significantly enhancing productivity, leading to an "employment-less recovery" in the economy; while the pessimistic view warns that this may just be a narrow, technology-driven capital expenditure bubble, which, once burst, combined with the general caution in business confidence, could lead to weak labor income and ultimately trigger a comprehensive demand contraction.

JP Morgan's baseline forecast attempts to merge these two narratives, predicting that global GDP will achieve trend growth, but employment in developed markets will continue to be weak, and this contradictory situation will become a core theme that investors must navigate in the coming quarters.

Hot Investment, Cold Employment

The data at hand clearly outlines the "decoupling" phenomenon between investment and employment.

According to JP Morgan's calculations, in terms of corporate equipment spending, global capital expenditures, after only a moderate growth of 4% in 2024, soared to an annualized growth rate of 10.2% in the first half of 2025, and this trend is widespread, with substantial acceleration in corporate equipment spending across almost all regions.

Meanwhile, global hiring has come to a standstill. Recruitment activities across the entire developed market have generally weakened, with an expected annualized growth rate of only 0.4% in the third quarter of 2025. The report specifically points out that, apart from during the lockdowns of the COVID-19 pandemic, this is the slowest growth rate since the early recovery period following the global financial crisis.

This coexistence of accelerated capital expenditure and stagnant employment growth is historically rare.

The report emphasizes that in the past 60 years of economic expansion cycles in the United States, such a phenomenon has never occurred. Weak employment growth is usually a reliable warning signal of an economic slide into recession, which is also the main reason for the Federal Reserve to restart its easing cycle.

Optimistic Interpretation: The AI Revolution Drives Productivity Prosperity

For this unusual phenomenon, a positive explanation is that the world is entering a new phase driven by technological revolution.

This view holds that strong investment growth and weak hiring may "reflect the successful implementation of new technologies and a response to the slowdown in labor supply."

At the core of this perspective is the idea that technological advancements represented by AI are reshaping the production function. Companies are investing heavily in equipment and intellectual property products (IPP) that can enhance efficiency, rather than traditional human expansion.

Data shows that the surge in AI-related technology capital expenditures is a key driver of the current investment boom, especially in the technology sectors of the United States and Asia. Under this narrative of the "AI era," strong productivity growth can offset the drag caused by the slowdown in labor supply. As long as the resulting wage and profit growth remains balanced, the economy can achieve sustainable growth without creating a large number of new jobs.

JP Morgan's forecast of a robust 4% annualized growth in U.S. productivity for the third quarter also provides data support for this theory.

Pessimistic Warning: Companies Are Concerned About Future Uncertainty

However, JP Morgan's report also presents a more cautious opposing viewpoint.

This perspective suggests that the current capital expenditure boom may be unstable, merely representing "a narrow-based rebound in technology capital expenditures," and could fade as some front-loaded spending in the U.S. and Asia comes to an end.

Meanwhile, the stagnation in job growth may reflect "a widespread shift towards business caution." Companies are concerned about future uncertainty and therefore choose to invest in automation and technology to cut long-term costs, rather than expanding their workforce. If this cautious sentiment spreads, it will pose significant risks.

For investors, the main concern is the potential formation of a negative feedback loop.

The report points out that the momentum of growth in U.S. labor income is weakening, and real labor income is expected to contract in the coming months. Although consumers are currently maintaining spending by lowering their savings rates, this pattern is unlikely to be sustainable.

If job growth continues to lag, households' confidence in future income will be eroded, which could ultimately lead to a decline in both consumer spending and corporate hiring, pushing the economy into a broader demand recession