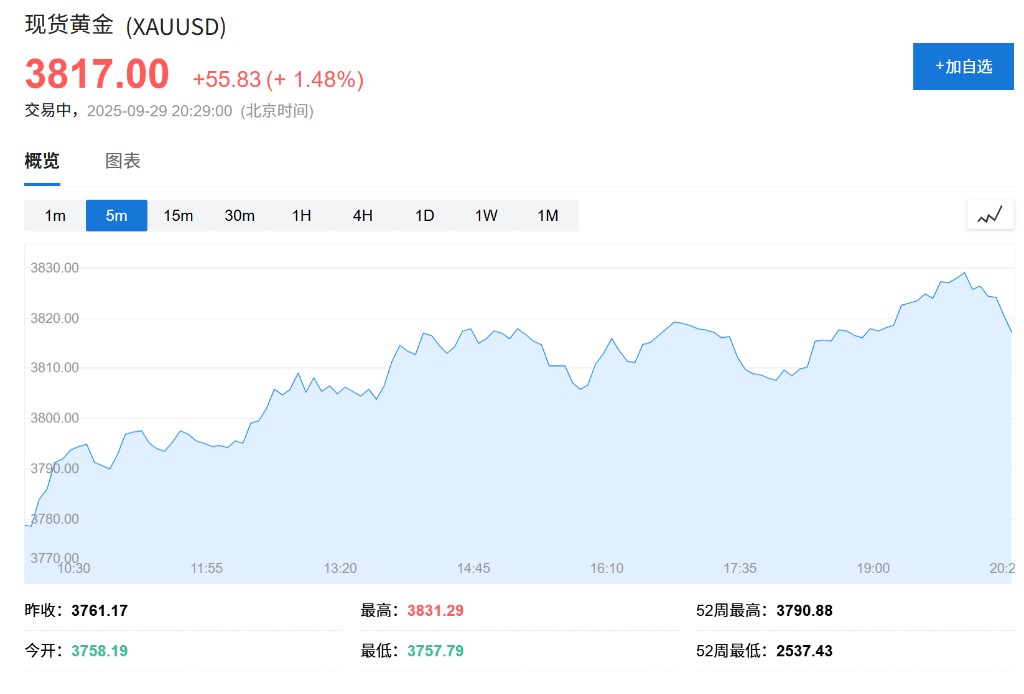

After a record surge, the value of U.S. gold reserves reaches $1 trillion

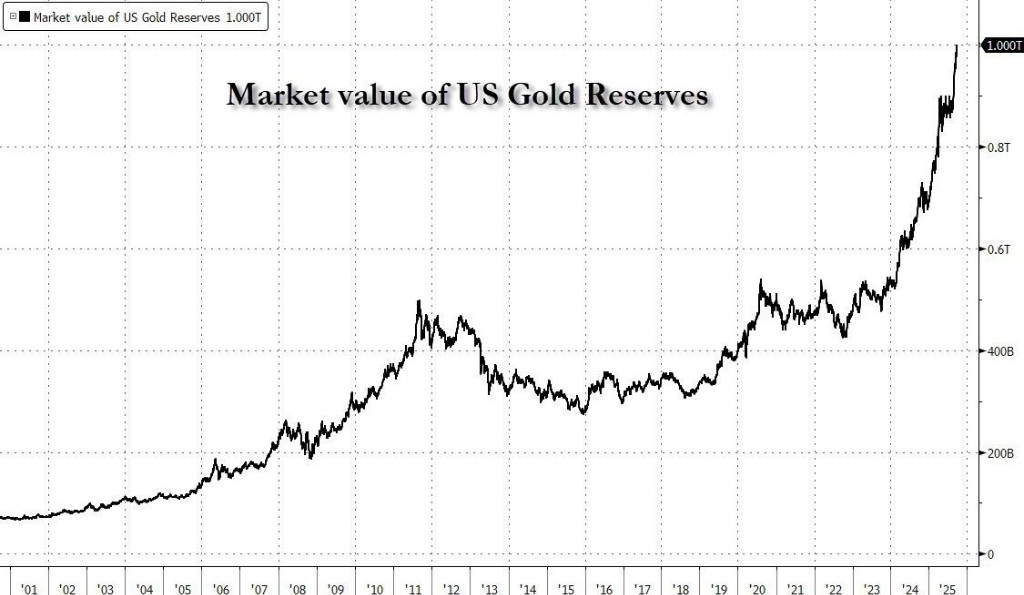

As gold prices break through historical highs, the value of the U.S. Treasury's 261.5 million ounces of gold reserves has exceeded $1 trillion, but its official book value remains fixed at $42.22 per ounce (approximately $11 billion) since 1973. If revalued at market price, it would release about $990 billion in funds for the U.S. Treasury. Against the backdrop of the government's debt ceiling constraints, this amount of money is undoubtedly quite tempting

As gold prices soar and hit a new historical high, the market value of the gold reserves held by the U.S. Treasury has for the first time surpassed the $1 trillion mark.

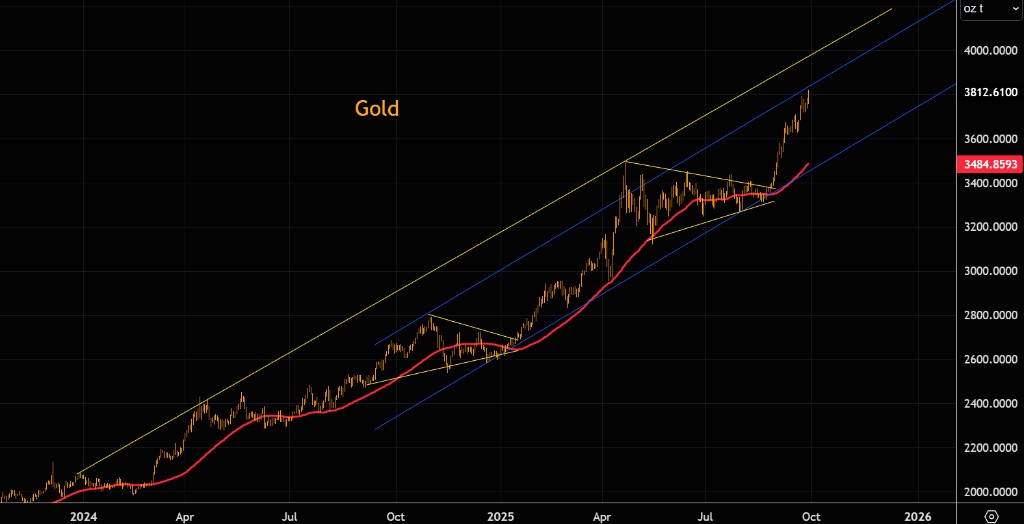

On Monday, gold prices briefly exceeded $3,824.5 per ounce, with a cumulative increase of 45% this year, driving up the value of the U.S.'s largest gold reserves in the world. Behind this surge is the growing concern among investors seeking safe havens amid trade wars, geopolitical tensions, and potential government financing crises in the U.S. Additionally, the continued inflow of funds into gold exchange-traded funds (ETFs) and the Federal Reserve's resumption of interest rate cuts have provided strong momentum for rising gold prices.

However, the official value of gold on the U.S. government's balance sheet remains fixed at just over $11 billion, a valuation based on the price of $42.22 per ounce set by Congress in 1973. The vast difference between the two means that the market value of U.S. gold reserves is more than 90 times the book value.

If the gold reserves were revalued at current market prices, it would release approximately $990 billion in funds for the U.S. Treasury. Earlier this year, an offhand comment by U.S. Treasury Secretary Janet Yellen sparked market speculation that the U.S. government might value its gold reserves at market value, thereby releasing hundreds of billions of unexpected wealth. However, Yellen later denied this, stating that the idea had not been seriously considered.

Safe-haven Demand and Easing Policies Resonating, Gold Prices Reach New Highs

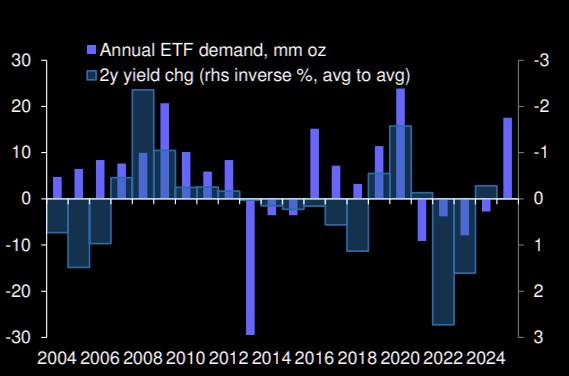

This year, gold prices have repeatedly broken records, driven primarily by strong safe-haven demand from investors. Faced with ongoing trade frictions, escalating geopolitical risks, and concerns about potential financing crises for the U.S. government, market participants have flocked to gold as a traditional safe-haven asset. As the Federal Reserve resumes interest rate cuts, the lower interest rate environment reduces the opportunity cost of holding non-yielding gold, further enhancing its appeal.

In addition to macro factors, institutional and official buying has also provided solid support for gold prices. Data from Deutsche Bank shows that since resuming year-on-year growth in February, demand for gold ETFs has rebounded strongly, making this one of the strongest years of the century.

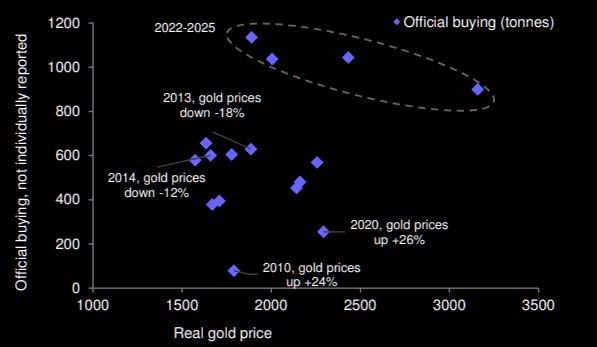

Official purchases also show a "price-insensitive" characteristic. The pace of gold purchases by central banks has increased, indicating that their buying decisions are less influenced by price fluctuations

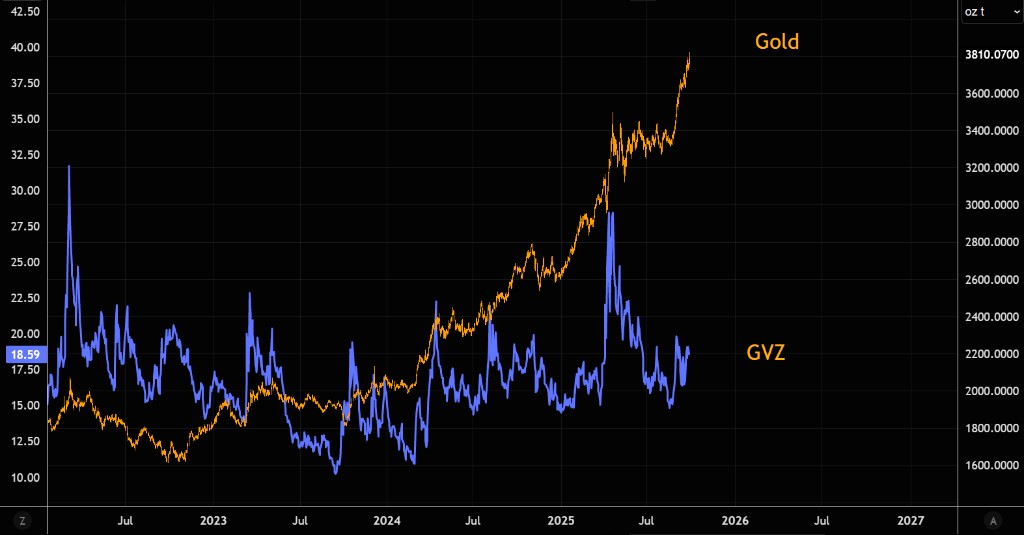

From the market positioning perspective, although speculative long positions have increased, they have not yet reached extreme levels, suggesting that market sentiment has not entered the "panic buying" stage. In addition, the volatility of gold is relatively cheap, making it more attractive to express bullish views through options strategies than to chase the spot price directly.

Analysis indicates that the price trend of gold has many similarities with the breakout market in early 2025, when gold prices rose by about 25% before bullish sentiment calmed down, suggesting that the current upward trend may still have room to grow. Technical analysis shows that the trend line connecting previous highs points to around $4,000, making it a potential target of interest for the market.

The Gap Between Book Value and Reality: Speculations on the "Revaluation" of Trillion-Dollar Reserves

There is an astonishing gap of nearly $990 billion between the market value of the U.S. gold reserves and the official book value, sparking discussions about the possibility of "revaluation." Unlike most countries where gold is held by central banks, the U.S. gold is directly held by the Treasury. The Federal Reserve holds gold certificates equal to the statutory value of the Treasury's gold reserves and uses them to provide dollar credit to the government.

This means that if the gold reserves were revalued at current market prices, it could theoretically inject about $990 billion into the U.S. Treasury. In the context of the government facing debt ceiling constraints, this amount of funding is undoubtedly quite tempting. However, this move would have profound effects on the financial system, including significantly increasing market liquidity and potentially prolonging the Federal Reserve's process of reducing its balance sheet.

Earlier this year, a spontaneous comment from U.S. Treasury Secretary Janet Yellen sparked market speculation that the U.S. government might value its gold reserves at market value, thereby releasing hundreds of billions of unexpected wealth. However, Yellen later denied this statement, saying that the idea had not been seriously considered.

Bank of America analyst Mark Cabana pointed out that gold revaluation is technically feasible but presents legal issues and may be perceived by the market as a dual easing of fiscal and monetary policy. Although Yellen previously rejected this suggestion, the potential trillion-dollar gains make the possibility of this operation increasingly likely.

Cabana analyzed that gold revaluation could lead to the Treasury's general account funds being spent in a way that stimulates macroeconomic activity, posing a risk of rising inflation and injecting excess cash into the banking system. This operation would essentially loosen both fiscal and monetary policy simultaneously. The U.S. gold has not been revalued for decades, primarily to guard against fluctuations in the Treasury and Federal Reserve's balance sheets, as well as concerns about the independence of fiscal and monetary policy Nevertheless, the United States is not without precedents to follow. Countries such as Germany, Italy, and South Africa have made decisions to reassess their gold reserves in recent decades.

Gold in Fort Knox: Storage and Rumors of 261 Million Ounces of Reserves

According to the U.S. Department of the Treasury, the total U.S. gold reserves amount to approximately 261.5 million ounces. The storage location of this massive reserve has always been a focal point of public interest. Slightly more than half of the gold is stored deep within the vault at the U.S. Army base near Fort Knox, Kentucky. This portion of gold was transferred here from New York and Philadelphia in the 1930s, partly to make it less vulnerable to foreign military attacks from the Atlantic.

The remaining gold is stored in various locations, including West Point, Denver's depositories, and the vault located 80 feet (24 meters) underground in the Federal Reserve Building in downtown Manhattan. In February of this year, conspiracy theories regarding the actual existence of the gold in Fort Knox circulated, fueled by comments from President Trump and Musk. Trump stated at the time:

"We will go to Fort Knox—the legendary Fort Knox—to ensure the gold is there. If the gold is not there, we will be very disappointed."