Countdown to Government Shutdown: The U.S. Economic Outlook May Fall into "Data Fog"

The U.S. federal government shutdown crisis is imminent, which may prevent policymakers, business leaders, and investors from accessing the key data needed to assess the state of the U.S. economy. If Congress fails to reach an agreement by this Tuesday, most federal agencies will suspend operations, and the Bureau of Labor Statistics will stop releasing important economic data, including the non-farm payroll report and the Consumer Price Index (CPI). This data delay could impact the Federal Reserve's policy decisions, particularly regarding interest rate cuts

According to the Zhitong Finance APP, the crisis of a federal government shutdown in the United States is imminent, which may prevent policymakers, business leaders, and investors from accessing the key data needed to assess the state of the U.S. economy.

If Congress fails to reach an agreement before the end of the current fiscal year this Tuesday, most federal agencies will suspend operations, and non-essential employees will face unpaid leave or layoffs. According to the latest guidelines, the U.S. Bureau of Labor Statistics, which is responsible for releasing several authoritative economic data, will cease operations, and the non-farm payroll report originally scheduled for release on Friday is likely to be postponed.

Currently, there are still doubts about the impact of Trump's various policies on the U.S. economy, and in this context, the employment, inflation, and consumption data released by the federal government are particularly important. Any delay in data could disrupt key policy decisions—such as whether the Federal Reserve should cut interest rates again when it meets next month.

Gregory Daco, chief economist at EY-Parthenon, stated, "No one wants to 'navigate blindly' in an already murky environment."

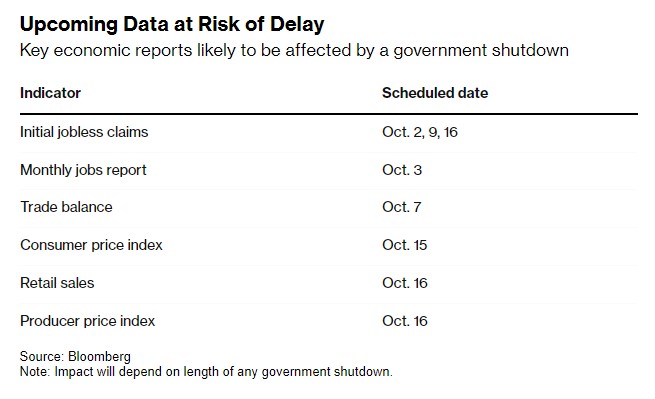

If the government shuts down after September 30, the first important data to be affected will be the employment report from the Bureau of Labor Statistics, originally scheduled for release on October 3. The core inflation data released by the agency—the Consumer Price Index (CPI)—will be the next key indicator likely to be delayed, while the retail sales data and new residential construction data planned for release by the Census Bureau also face the risk of delay.

The Federal Reserve announced its first interest rate cut of the year at the September meeting, primarily based on evidence of a cooling labor market; currently, policymakers are closely monitoring whether there are further signs of deterioration in the market.

The Department of Labor, which oversees the Bureau of Labor Statistics, has issued the latest guidance, clearly stating that during a budget appropriation interruption, the Bureau of Labor Statistics will suspend all operations and data collection work, and the economic data originally scheduled for release will also be postponed.

The guidance also noted that it is expected to take half a day for the entire Department of Labor to complete preparations related to the shutdown, but tasks related to the Bureau of Labor Statistics' system backup could take up to three days.

In fact, the Bureau of Labor Statistics was forced to delay the release of employment reports and CPI data during the government shutdown in 2013. The U.S. also experienced a government shutdown from 2018 to 2019, but because relevant funding had been secured beforehand, the Bureau of Labor Statistics was still able to release key data as planned.

There are still third-party economic data available for reference, such as the private sector employment data released by ADP Research Institute and the existing home sales data released by the National Association of Realtors. However, the comprehensiveness of these data is generally considered to be inferior to that of government-released data.

Stephen Stanley, chief U.S. economist at Santander US Capital Markets, pointed out that the next Federal Reserve meeting is scheduled for October 28-29, and without the latest government data to support it, the rationale for another interest rate cut will be harder to argue. Some Federal Reserve officials are already cautious about cutting rates, hoping to see more data before making a decision Stanley stated: "Although there is private sector data available, Federal Reserve officials can get a rough understanding of economic dynamics through contacts with various parties, the difficulty of assessing the economic situation will undoubtedly increase significantly without the macro summary data we usually rely on."

Neil Bradley, Chief Policy Officer of the U.S. Chamber of Commerce, believes that while a government shutdown may not directly push the U.S. economy into recession, it will still incur economic costs and exacerbate the uncertainty that businesses and business leaders are already facing.

Bradley stated in an online seminar on September 23: "We must be clear that being stuck in such political deadlock is actually harming the economy—by increasing uncertainty, we are suppressing economic growth."