"Arguments are questionable, incomplete, and hardly persuasive"! Wall Street questions "Trump's guru" Miran's "significant interest rate cut theory"

Federal Reserve's new board member Stephen Miran calls for a significant interest rate cut to 2.5% or lower, which has been strongly questioned by Wall Street. JP Morgan criticized his arguments as "suspect, incomplete, and hardly persuasive," pointing out flaws in the neutral interest rate analysis, overly limited inflation analysis, and incorrect policy impact assessment. Meanwhile, U.S. economic data shows strong performance, contradicting Miran's call for rate cuts

The new Federal Reserve governor, "Trump's guru" Stephen Miran, has sparked strong skepticism on Wall Street with his first major policy speech, as economists criticize his argument for significant interest rate cuts as unconvincing.

On September 22, Miran delivered a speech to the New York Economic Club calling for substantial interest rate cuts to quickly reach a neutral interest rate level, which was met with unanimous skepticism from Wall Street economists. JPMorgan economists provided a comprehensive rebuttal in their latest research report.

On September 30, according to Wind Trading Desk news, JPMorgan pointed out in its latest research report that Miran proposed to rapidly lower the federal funds rate to 2.5% or lower, but his argument is "suspect," "incomplete," and "almost unconvincing."

The report stated that JPMorgan analysts raised multiple questions about Miran's argumentative methods, including the controversy over the neutral interest rate (r) and flaws in inflation analysis. The bank also criticized Miran's "selective quoting" of policy arguments in his speech.

Meanwhile, the latest economic data further undermined Miran's arguments, as multiple economic indicators showed strong performance in the U.S. economy, contradicting Miran's call for rate cuts.

Miran Becomes an "Outlier" at the Federal Reserve

Stephen Miran, appointed by Trump as the new Federal Reserve governor, called for significant interest rate cuts to quickly reach a neutral interest rate level in his speech to the New York Economic Club on September 22.

Miran's core argument is that the Trump administration's policies on trade, immigration, taxation, and regulation have significantly lowered the interest rate levels needed to guard against inflation, thus the current benchmark rate is too high. He advocates for achieving the neutral level through a "very short series" of 50 basis point cuts.

He expressed dissent against a 25 basis point cut at the Federal Reserve meeting on September 16-17, supporting a larger cut of 50 basis points, and stated he would continue to hold a dissenting position in future meetings.

After the September FOMC meeting, many policymakers were cautious about supporting further rate cuts, let alone rapid consecutive significant cuts.

St. Louis Fed President Alberto Musalem stated that given high inflation, there is "limited room" for further easing. San Francisco Fed President Mary Daly, while expressing support for further rate cuts, insisted that the timeline remains unclear.

JPMorgan States "Almost Unconvincing"

JPMorgan Chief Economist Michael Feroli bluntly criticized in the research report: "We find some of his arguments suspect, others incomplete, and hardly any of them convincing."

Analysts raised multiple questions about Miran's argumentative methods:

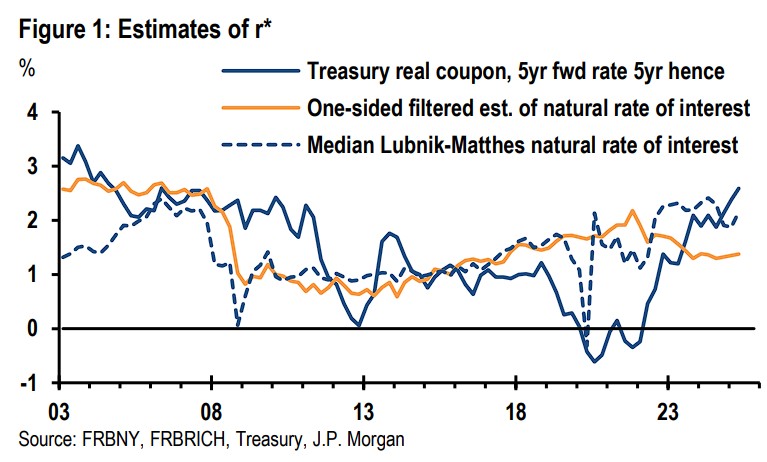

Controversy over the neutral interest rate (r): Miran mentioned r as many as 36 times in his over 11-page speech, but JPMorgan pointed out that accelerated productivity growth should actually lead to an increase in r, not a decrease. One economic logic is that expectations of faster future income growth will encourage people to increase current consumption, thus actual interest rates must rise to incentivize deferred consumption

Defects in Inflation Analysis: Miran focuses almost entirely on the discussion of rent inflation, assuming that other price components "will continue to run at the current pace." JP Morgan criticizes this approach for the risk of confusing relative price changes with overall price level inflation.

The research report points out that when arguing the impact of trade policy, Miran cites an academic paper predicting that tariff shocks will reduce the neutral interest rate by 30 basis points, but "fails to note that this result stems from the model predicting a contraction in GDP relative to the baseline."

In assessing fiscal impacts, Miran relies on estimates from the White House Council of Economic Advisers, believing that increased tariff revenue will reduce the fiscal deficit, thereby lowering the demand for loanable funds. However, JP Morgan points out that the Congressional Budget Office and market consensus expectations indicate that the cost of extending the Tax Cuts and Jobs Act will exceed the revenue generated by tariffs, leading to an expansion rather than a reduction of the deficit.

JP Morgan believes that unless there are significant changes in economic fundamentals or a fundamental adjustment in the composition of the Federal Reserve, it will be difficult for Miran to persuade colleagues. The bank maintains its gradual rate cut expectations, forecasting that rates will be gradually lowered by 25 basis points to a range of 3.25%-3.5% by early next year.

Economic Data Does Not Support Aggressive Rate Cuts

Multiple economic indicators show that the U.S. economy is performing strongly, contradicting Miran's call for rate cuts:

The U.S. economy grew at its fastest pace in nearly two years in the second quarter.

August business equipment orders and goods trade deficit data suggest strong growth in the third quarter.

Initial jobless claims fell to their lowest level since mid-July.

Consumer spending in August grew at a steady pace.

The Fed's preferred core inflation measure remains stubbornly at 2.9%, nearly 1 percentage point above the central bank's 2% target.

Carl B. Weinberg, Chief Economist at High Frequency Economics, stated after the release of the personal consumption expenditures and core PCE price index report last Friday:

"This report completely does not support Stephen Miran's suggestion that policy rates must be significantly cut immediately; in fact, these data do not suggest any monetary easing at all!"

Bloomberg economists Tom Orlik and Jamie Rush noted in their report:

"Inflation has been above target for over four years, and consensus expectations indicate that inflation will remain elevated in the coming years while unemployment remains moderate; the burden of proof for extreme easing lies with Miran."