The valuation of gold reserves has exceeded one trillion, when will the U.S. "monetize gold for debt," equivalent to 990 billion dollars of QE?

Unlike most countries that store their gold reserves in central banks, the United States holds its gold directly in the Treasury. The Federal Reserve holds gold certificates corresponding to the value of the Treasury's gold reserves and uses them to provide dollar credit to the government. This means that if the Treasury updates the value of its gold reserves based on current market prices, it could inject approximately $990 billion into its coffers, significantly reducing the need to issue new government bonds this year

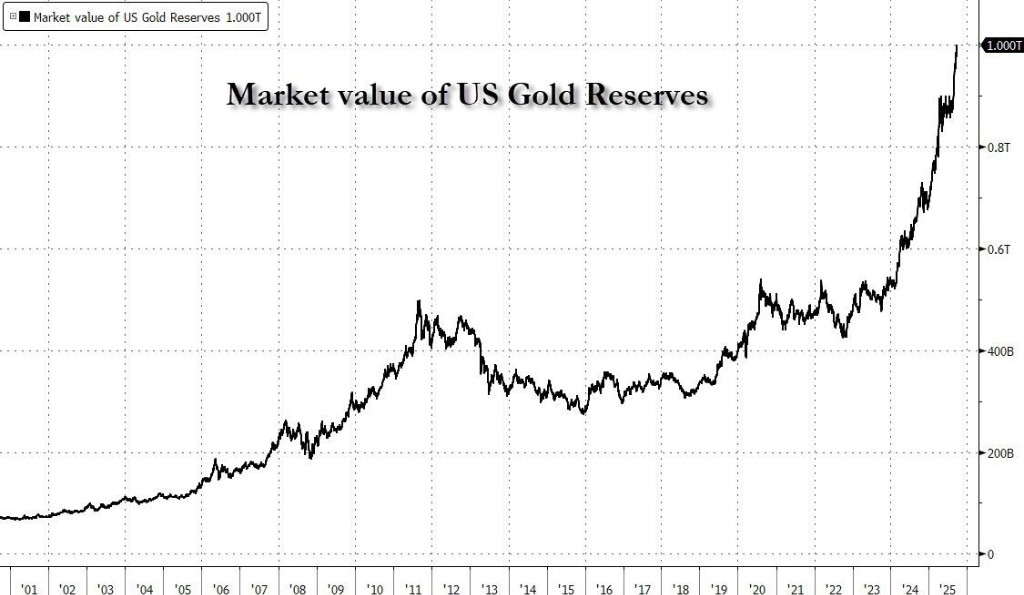

The market value of the U.S. gold reserves has surpassed $1 trillion for the first time, reigniting speculation about the possibility of the U.S. revaluing its gold reserves.

So far this year, gold prices have risen by 45%, and the valuation of the U.S. Treasury's gold reserves has exceeded $1 trillion for the first time in history, leading to renewed speculation about Treasury Secretary Janet Yellen potentially revaluing this batch of precious metal assets.

(Trend of U.S. gold reserve market value)

(Trend of U.S. gold reserve market value)

Unlike most countries that store their gold reserves in central banks, the U.S. gold is held directly by the Treasury. The Federal Reserve holds gold certificates corresponding to the value of the Treasury's gold reserves and uses them to provide dollar credit to the government.

This means that if the Treasury updates the value of its gold reserves based on current market prices, it could inject approximately $990 billion into its coffers, significantly reducing the need to issue new government bonds this year.

Market participants believe that although this move raises legal questions and may be seen as unorthodox, the probability of a gold revaluation is increasing, considering the aggressive style of the Trump administration.

"Unconventional" Operations Similar to QE

Revaluing gold reserves would directly impact the balance sheets of the U.S. Treasury and the Federal Reserve. Specifically, the assets of the U.S. Treasury would increase due to the revaluation of gold, while its liabilities would rise correspondingly due to the issuance of equivalent gold certificates to the Federal Reserve.

At the same time, the Federal Reserve's balance sheet would also expand accordingly. Its assets would increase with the equivalent gold certificates, while its liabilities would balance through an increase in deposits in the Treasury General Account (TGA).

The end effect is that the size of the Federal Reserve's balance sheet would expand, appearing as if a quantitative easing had taken place, but the entire process would require no open market purchase operations.

In simple terms, the Treasury only needs to agree to recognize the value of gold at fair value to create approximately $990 billion in funds out of thin air, which could be used to repay debt, fill deficits, or establish sovereign wealth funds and other priorities.

In the market, revaluing gold reserves would be seen as an unconventional policy tool.

The U.S. has not revalued its gold reserves for decades, primarily to prevent drastic fluctuations in the balance sheets of the Treasury and the Federal Reserve and to maintain the independence of fiscal and monetary authorities.

Reports indicate that this is not without precedent, as countries like Germany, Italy, and South Africa have made decisions to revalue their gold reserves in recent decades.

Market Concerns and Potential Risks

Regarding this unconventional operation, market analysts have pointed out potential risks.

Mark Cabana, a strategist at Bank of America and former New York Fed official, believes that using gold reserve revaluation to bolster cash accounts could stimulate macroeconomic activity, trigger inflation risks, and inject excess liquidity into the banking system.

He emphasized that this move would simultaneously loosen fiscal and monetary policies, and the market may not respond positively, as it amounts to a form of quantitative easing and could erode the independence of fiscal and monetary authorities In addition, the U.S. government's revaluation of gold itself may further drive up the prices of gold, Bitcoin, and other assets that may be "re-monetized" later.

Unless Treasury Secretary Basant provides more credible details on how to "monetize the asset side of the U.S. balance sheet," the probability of implementation remains low and there are legal issues.

However, considering the Trump administration's "swift action and breaking of norms" style, some analysts believe that the possibility of gold revaluation is rising sharply. They argue that this expectation is one of the important drivers behind the recent surge in gold prices approaching $4,000