Countdown to the U.S. government shutdown, three major stock index futures decline, BHP's U.S. stock drops nearly 7% in after-hours trading, spot gold approaches $3,870 per ounce, and the U.S. dollar is under pressure

On September 30th, before the US stock market opened, the three major stock index futures declined, gold prices hit a new high, and the US dollar was under pressure. Most Chinese concept stocks rose, with Bilibili up about 5%, XPeng up about 2%, Alibaba up about 1%, and BHP's US stock night trading down nearly 7%

On September 30, ahead of the US stock market opening, investors remained cautious due to the ongoing risk of a US government shutdown, leading to a collective decline in the three major US stock index futures. The S&P 500 index futures fell by 0.2%, the Nasdaq 100 index futures dropped by 0.3%, and the Dow futures decreased by 0.2%. The US dollar came under pressure, and gold prices reached a new historical high.

Most Chinese concept stocks rose, with Bilibili up about 5%, XPeng up about 2%, and Alibaba up about 1%. BHP's US stock fell nearly 7% in after-hours trading.

Asian stock markets saw more declines than gains, with the Nikkei 225 closing down 0.2%, the Seoul Composite Index down 0.2%, the Vietnam VN Index down 1%, while the Singapore Straits Index rose by 0.4% and the Malaysian Index increased by 0.4%.

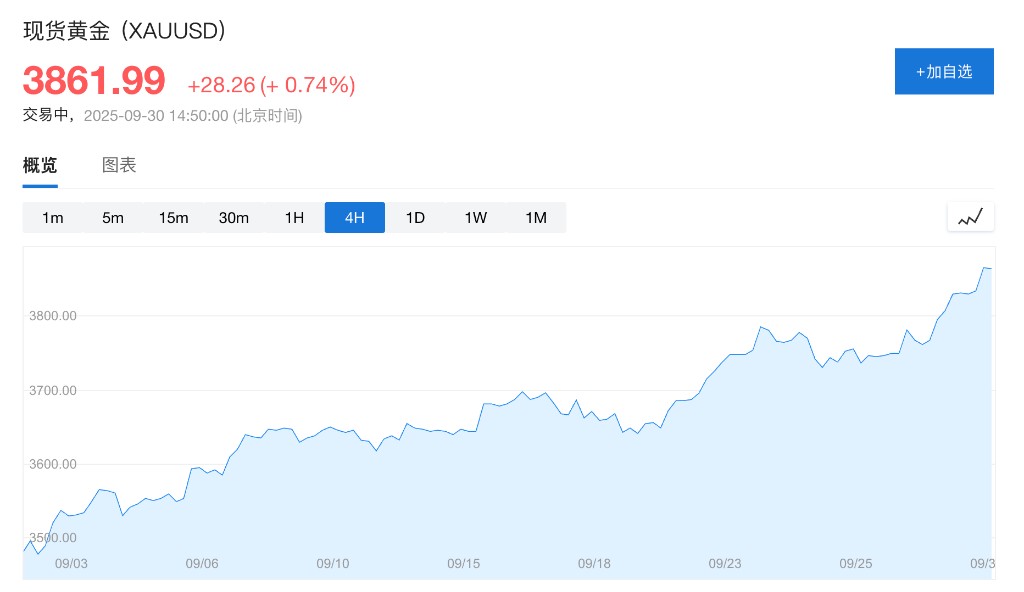

In commodities, spot gold rose nearly 1% to $3,868.8 per ounce, silver fell nearly 1%, copper saw a high-level correction, and crude oil declined.

The performance of core assets is as follows:

The three major US stock index futures collectively declined, with the S&P 500 index futures down 0.2%, the Nasdaq 100 index futures down 0.3%, and the Dow futures down 0.2%.

BHP's US stock fell nearly 7% in after-hours trading.

Most Chinese concept stocks rose, with Bilibili up about 5%, XPeng up about 2%, and Alibaba up about 1%.

The Nikkei 225 index closed down 0.2%, at 44,932.63 points.

The Seoul Composite Index closed down 0.2%, at 3,424.60 points.

The US dollar index fell by 0.15% to 97.79.

Spot gold rose nearly 1% to $3,868.8 per ounce.

Spot silver saw an intraday decline of 1.0%, at $46.39 per ounce.

The US dollar index fell by 0.15% to 97.79.

Brent crude oil fell by 0.5% to $66.73 per barrel.

The Nasdaq 100 index futures fell by 0.3%. Due to the unresolved risk of a US government shutdown, investors remained cautious. Trump met with Democrats on Monday Eastern Time, but no progress was made in reaching an agreement to avoid a government shutdown. Lawmakers must reach an agreement by 12:01 AM on Wednesday, or it will lead to a partial government shutdown.

If the government shuts down, it will stop releasing economic data, leaving the Federal Reserve without key data to formulate its interest rate path.

BHP's US stock fell nearly 7% in after-hours trading.

Affected by the risk of a US government shutdown, the US dollar came under pressure, with the US dollar index falling by 0.15% to 97.79.

Spot gold rose nearly 1% to $3,868.8 per ounce. This year, gold prices have surged 47%, on track to achieve the largest annual increase since 1979. This not only reflects market concerns over a potential U.S. government shutdown but also the impact of global trade tensions and the Federal Reserve's interest rate cuts.

Spot gold rose nearly 1% to $3,868.8 per ounce. This year, gold prices have surged 47%, on track to achieve the largest annual increase since 1979. This not only reflects market concerns over a potential U.S. government shutdown but also the impact of global trade tensions and the Federal Reserve's interest rate cuts.

Brent crude oil fell 0.5 to $66.73 per barrel.