The Federal Reserve Chairman's "valuation warning" has instead become the best "catalyst" for U.S. stocks?

Federal Reserve Chairman Jerome Powell once again warned that U.S. stock market valuations are too high, but the market reacted calmly. Historical data shows that such warnings often do not trigger market corrections and may even lead to stock market increases. JP Morgan pointed out that since 1996, after issuing valuation warnings, the S&P 500 index has averaged an increase of nearly 13%. Despite current valuation multiples being higher than historical levels, complacency regarding valuations still exists on Wall Street, and investors need to remain vigilant

According to the Zhitong Finance APP, recently, Federal Reserve Chairman Jerome Powell once again mentioned the issue of overvaluation in the U.S. stock market, but the market seems to remain indifferent.

Historical experience suggests that this attitude may not be without reason: past warnings have not only failed to trigger immediate pullbacks but have often corresponded with periods of market rallies—at least in the short term.

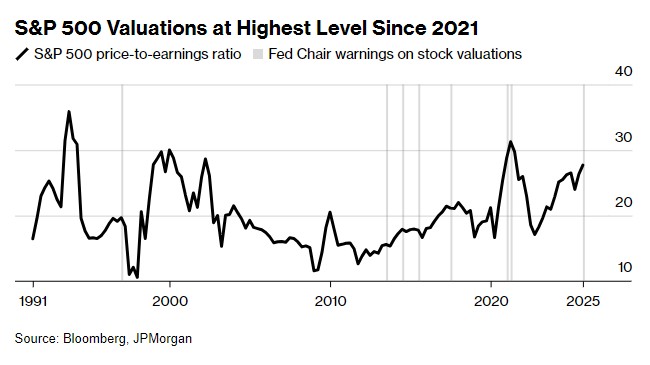

Data from JP Morgan shows that since 1996, after each valuation warning issued by the Federal Reserve Chair, the S&P 500 index has averaged a nearly 13% increase over the following 12 months. The bank also pointed out that during the year following these warnings, U.S. stocks typically outperformed global markets.

At the time Powell claimed last week that "stock valuations are high," many strategists were gradually reaching a consensus: rising valuations are becoming the new normal on Wall Street. They believe that the profit growth momentum driven by the technology sector should support higher valuation multiples.

Matt Maley, Chief Market Strategist at Miller Tabak + Co LLC, commented on Powell's valuation remarks, stating, "There is no doubt that the market is unfazed by this." Since Powell made his comments, the S&P 500 index has remained flat overall.

However, Maley also noted that investors "still need to remain vigilant." He observed that there is a general sense of complacency on Wall Street regarding the current high valuations, and the current valuation multiples have far exceeded the levels when former Federal Reserve Chairman Alan Greenspan warned of "irrational exuberance" in 1996.

At the time Powell made his remarks, the expected price-to-earnings ratio of the S&P 500 index was hovering near its highest level since 2021—when Powell also commented on stock market valuations, he more directly pointed out that "asset prices are too high."

Fabio Bassi, Head of Cross-Asset Strategy at JP Morgan, believes that Powell's remarks are similar to the valuation warnings issued by former Federal Reserve Chairs such as Janet Yellen, Ben Bernanke, and Alan Greenspan, none of which triggered panic-induced immediate pullbacks in the market.

Bassi wrote in a report: "Over the past few years, especially during the long period of significant increases in risk assets following the global financial crisis, several Federal Reserve Chairs have issued warnings about high stock market valuations and potential complacency in the market."

However, data shows that after valuation warnings from previous Federal Reserve Chairs, the expected price-to-earnings ratio of the S&P 500 index tends to experience slight contractions over the next 1 month, 6 months, and year.

Ed Yardeni, President and Chief Investment Strategist of Yardeni Research Inc., stated that Powell's remarks have heightened his concerns about the continued rise of the market. Although Yardeni still maintains a target of 6,800 points for the S&P 500 index this year, he also pointed out that the current price-to-earnings ratio of the index is nearing historical highs, and the price-to-sales ratio has reached an all-time high Nevertheless, since the second half of this year, the stock market has continued to rise, indifferent to warnings from strategists, investors, and even the current Federal Reserve Chairman. The S&P 500 index has closed above the 50-day moving average for 104 consecutive trading days, with BTIG's Chief Market Technician Jonathan Krinsky noting that this is the longest duration since April 2024 and the fifth longest record since 1990.

Krinsky stated in the report: "The primary trend remains strongly bullish, but the market should have undergone a consolidation."

Indeed, when looking at a longer time span, some of the Federal Reserve's previous warnings about stock market valuations appear more prescient. In April 2021, Powell stated that "asset prices are too high," and the S&P 500 index subsequently fell nearly 20% over the next year; after Greenspan issued a warning about "irrational exuberance" in 1996, market enthusiasm intensified, but ultimately the dot-com bubble burst, leading to significant losses for many tech stock investors.

However, Wall Street has once again ignored the Federal Reserve's warnings—at least for now, as corporate earnings continue to grow.

Bassi from JPMorgan stated: "The issues of overvaluation and concentrated positions are unlikely to trigger a market correction."