U.S. Government Shutdown + Rising Rate Cut Expectations, Gold Prices Rise for Five Consecutive Days, Setting New Historical Highs

With the U.S. government shutdown and weak private employment data, traders have increased their bets on a Federal Reserve rate cut. Gold prices have stabilized after rising for five consecutive days, currently close to $3,860 per ounce. The government shutdown may prevent the Federal Reserve from obtaining key economic data, leading economists and traders to rely more on non-government data. Gold prices have risen 47% this year, poised to record the largest annual increase since 1979. Concerns over the independence of the Federal Reserve have intensified, increasing safe-haven demand and driving inflows into gold ETFs

According to Zhitong Finance APP, as the U.S. government begins to shut down and private employment data weakens, traders are increasing their bets on the Federal Reserve cutting interest rates. Gold prices have stabilized after rising for five consecutive days and reaching a new high.

Gold is currently close to $3,860 per ounce, about $35 lower than the peak reached on Wednesday. The government shutdown may prevent the Federal Reserve from obtaining key economic data needed for interest rate decisions. This has led economists, traders, and policymakers to rely more on non-government data, such as the ADP Research report released on Wednesday, which showed a significant reduction in private sector jobs in September.

The non-farm payroll data originally scheduled for release on Friday will be delayed due to the government shutdown, which could further exacerbate pressure on the U.S. dollar. Traders are increasing bets that the Federal Reserve will cut rates two more times this year to support the weak labor market. Lower borrowing costs tend to boost non-yielding gold, and when the dollar weakens, gold becomes cheaper for most buyers.

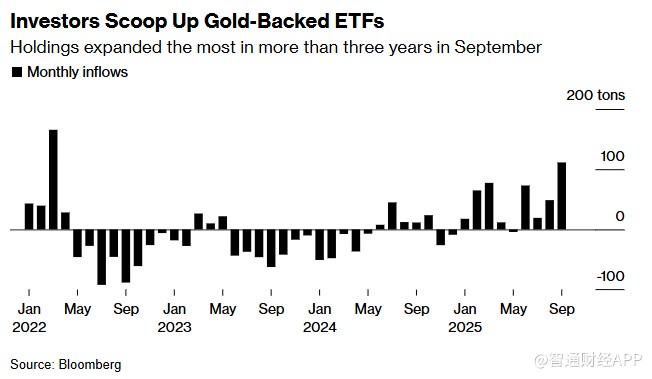

So far this year, gold prices have surged 47%, on track for the largest annual increase since 1979. This rise is attributed to purchases by major central banks and increased holdings in gold ETFs, while the Federal Reserve has also resumed rate cuts. Data compiled by Bloomberg shows that the monthly inflow into ETFs in September reached a three-year high.

Investors are flocking to buy gold ETFs

As concerns about the independence of the Federal Reserve grow, the demand for safe-haven assets has also boosted gold. On Wednesday, the U.S. Supreme Court rejected President Donald Trump's request to immediately dismiss Federal Reserve Governor Lisa Cook, who is suing to keep her position. This has thwarted Trump's efforts to strengthen control over the Federal Reserve.

As of the time of writing, spot gold prices have slightly decreased by 0.2% to $3,859.22 per ounce, after closing up 0.2% on Wednesday. The Bloomberg Dollar Spot Index is flat. Silver prices have fallen after reaching a 14-year high in the previous trading session. Platinum and palladium prices have also declined