Occidental Petroleum fell 7.5%, as analysts questioned the timing and valuation of the sale of OxyChem to Berkshire Hathaway

Occidental Petroleum agreed to sell its chemical division OxyChem to Berkshire Hathaway for $9.7 billion to repay $6.5 billion in debt, aiming to reduce principal debt to below $15 billion and restart its stock buyback program. CEO Hollub stated that this is the final step in the company's 10-year transformation. However, analysts believe the transaction price is low, and the sale will pressure future free cash flow growth, raising doubts in the market about the company's expansion prospects. On Thursday, the stock price fell as much as 7.5%

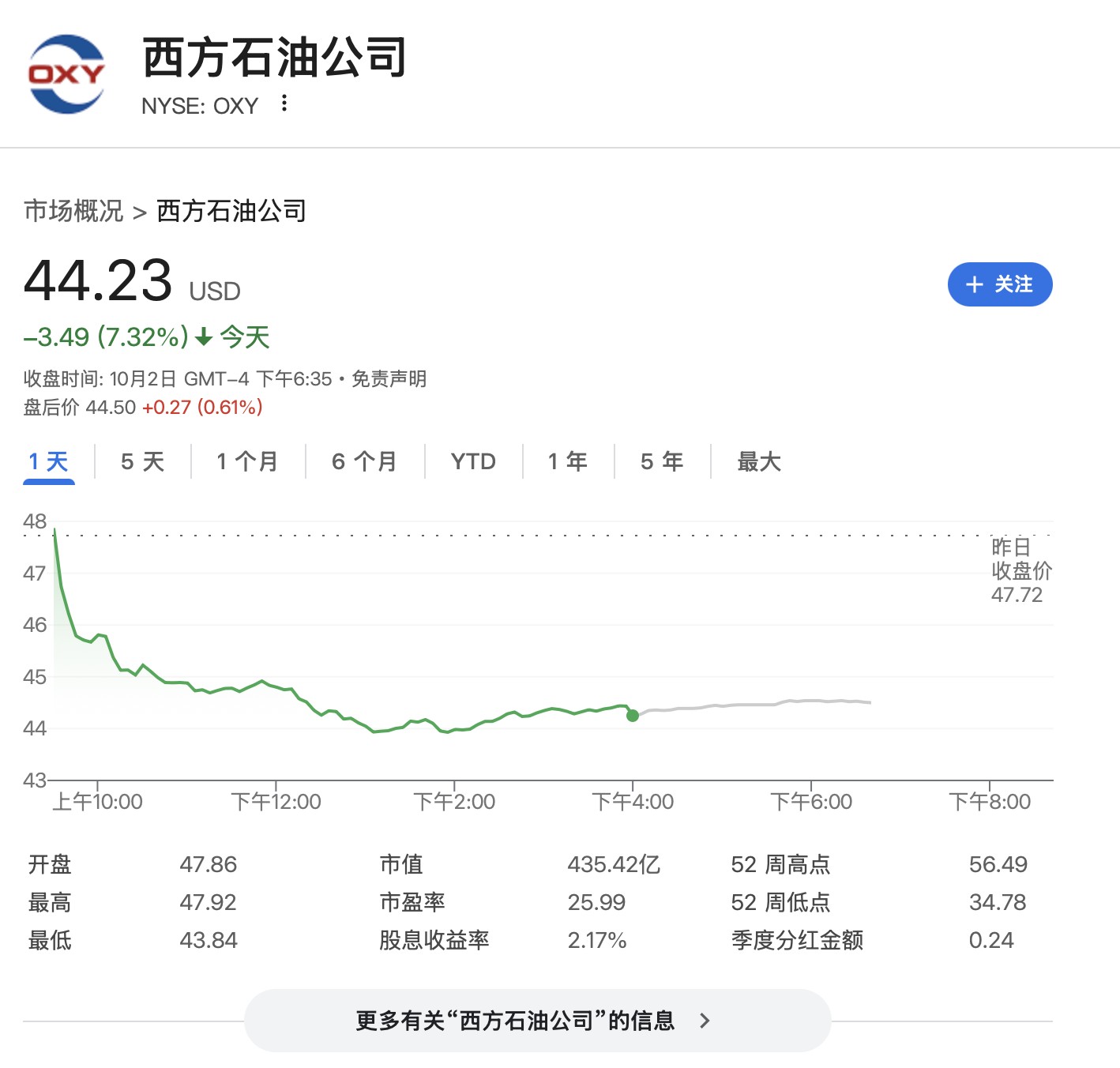

Occidental Petroleum's stock price plummeted 7.5% on Thursday, making it one of the biggest decliners in the S&P 500 index.

Reports indicate that the company has agreed to sell its chemical division, OxyChem, to Warren Buffett's Berkshire Hathaway for $9.7 billion to alleviate the heavy debt burden resulting from high-priced acquisitions over the years.

On Thursday, Occidental Petroleum closed down 7.32% at $44.23.

Occidental Petroleum CEO Vicki Hollub stated in a media interview that the company's biggest challenge is how to reduce debt more quickly. Previously, the company acquired Anadarko Petroleum in 2019 and CrownRock in 2024. Hollub pointed out that the company plans to use $6.5 billion from the transaction to pay down debt, aiming to reduce principal debt to below $15 billion.

Hollub emphasized that this transaction will "unlock the stock price," giving shareholders more confidence to increase their positions and attracting new investors.

"So now we can restart the stock buyback program... This is the last step we need to complete after our major transformation began 10 years ago."

However, TD Cowen analysts believe the timing of the transaction is not ideal. Although this deal helps reduce debt, it coincides with OxyChem's capital expenditures peaking during years of expansion, which will result in the loss of the expected free cash flow inflection point in the coming years.

Roth MKM analysts also stated that this sale may weaken future free cash flow growth, as the division was seen as a crucial support for the company's expansion.

Scotiabank analyst Paul Cheng pointed out that the transaction price is low, as he previously estimated the division's value to be around $12 billion.

Houston-based Occidental Petroleum is primarily known for its oil and gas business, with a current market capitalization of approximately $46 billion. Berkshire Hathaway is already its largest shareholder, holding over $11 billion in Occidental stock, with a stake of 28.2%. Buffett has previously stated that he would not take full control of the company founded by legendary oil tycoon Armand Hammer.

Occidental's chemical division, OxyChem, produces and sells a variety of chemical products used in applications such as water chlorination, battery recycling, and papermaking. As of the end of June, the division achieved sales of nearly $5 billion over the past 12 months