The iPhone 17 is selling like hotcakes, Morgan Stanley is more optimistic: there are still 1 billion old devices in circulation, and the iPhone 18 will be even stronger

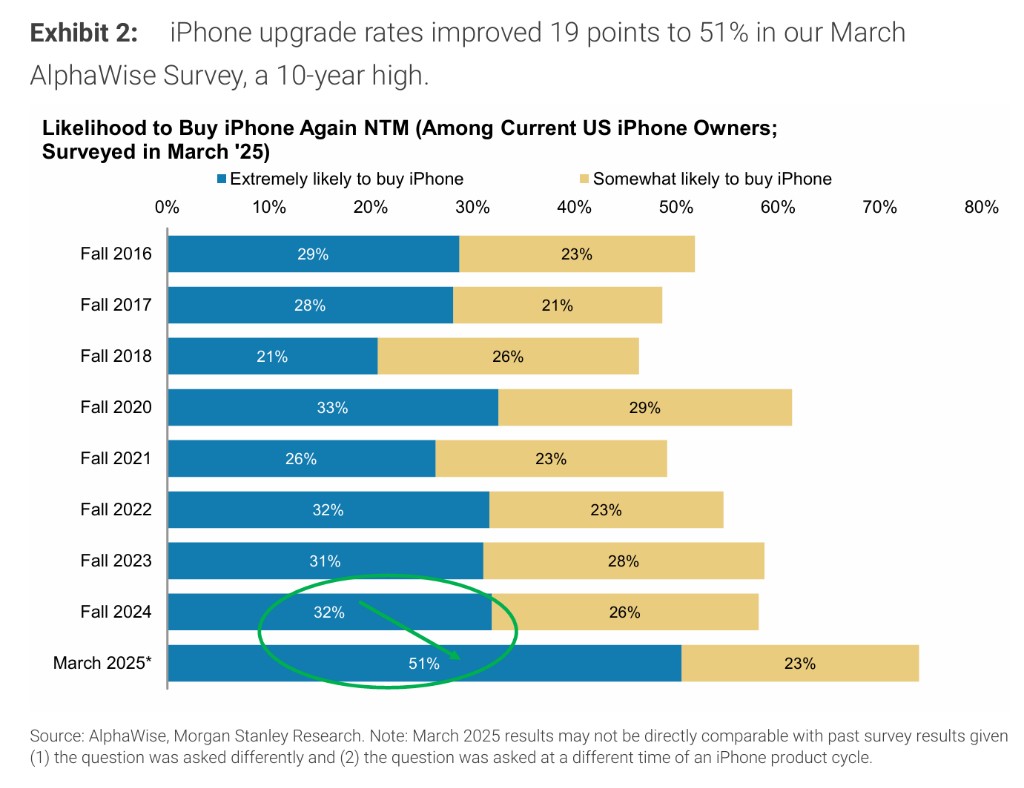

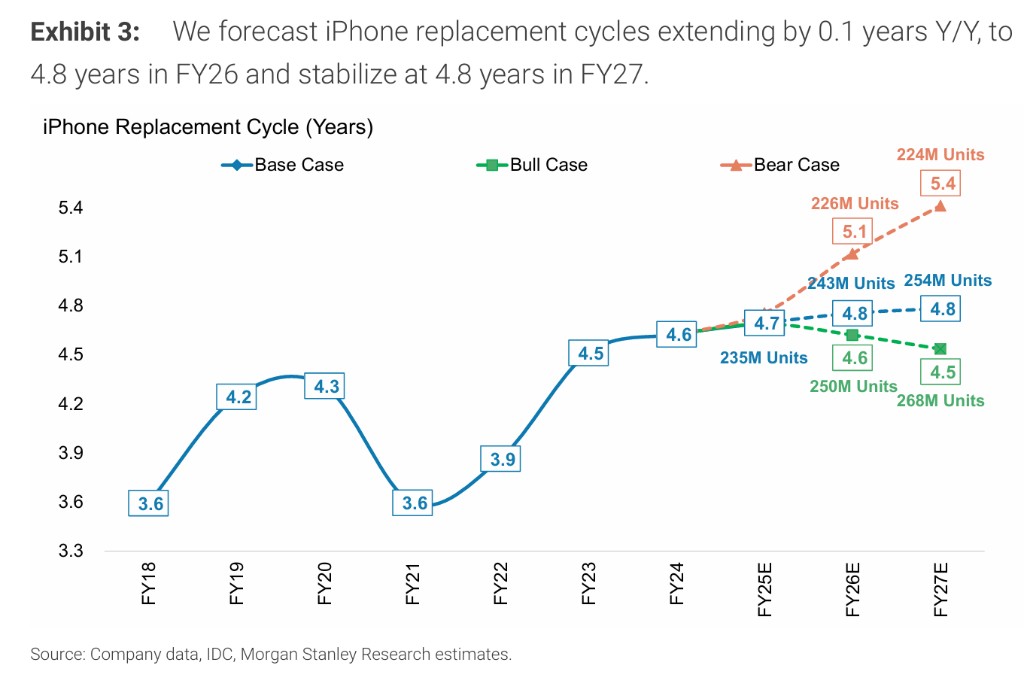

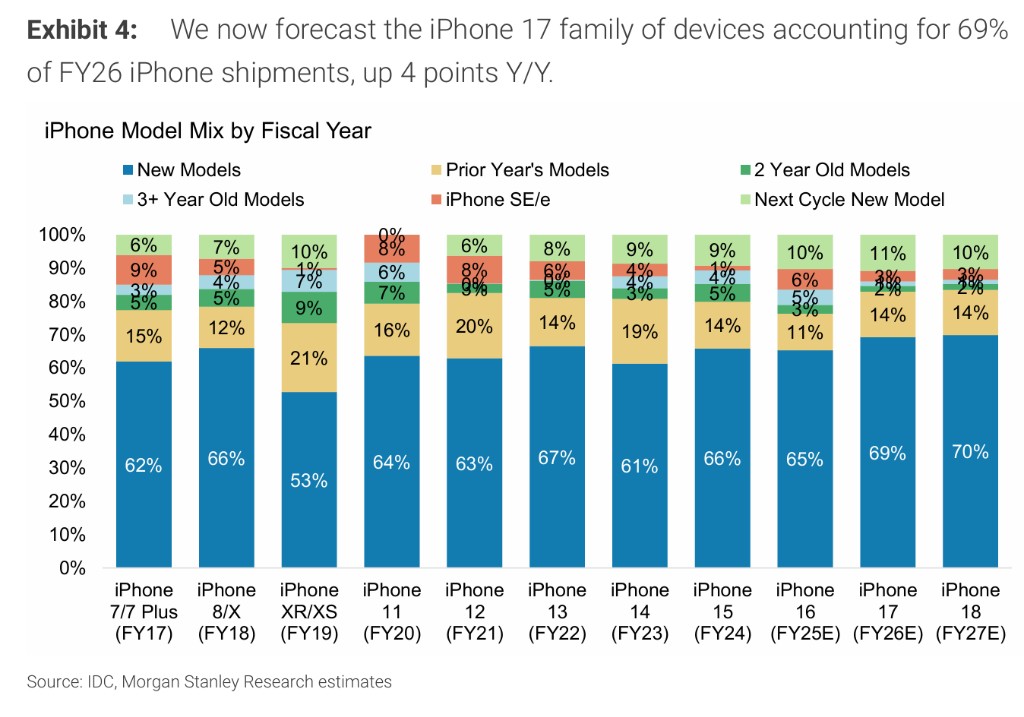

Morgan Stanley expects that production orders for the iPhone 17 may be raised from 84 million-86 million units to over 90 million units, and it has raised the iPhone shipment forecast for fiscal year 2026 to 243 million units. The firm believes that the real growth driver will be the iPhone 18 cycle, with an estimated 1 billion old iPhones entering the upgrade window, combined with the release of the first foldable iPhone, which will drive continuous revenue growth in fiscal year 2027

Morgan Stanley painted a more optimistic picture for Apple Inc. in its latest report. Although the current iPhone 17 cycle has started stronger than expected, a potentially stronger iPhone 18 cycle driven by upgrades from existing devices and significant product innovations is brewing.

According to the trading desk, Morgan Stanley analyst Erik W Woodring stated in the report that the early demand signals for the iPhone 17, particularly the strong performance of the base model and Pro models, have prompted him to raise his financial forecasts for Apple for the fiscal year 2026. Supply chain surveys indicate that due to strong demand, Apple is about to increase production orders for the iPhone 17.

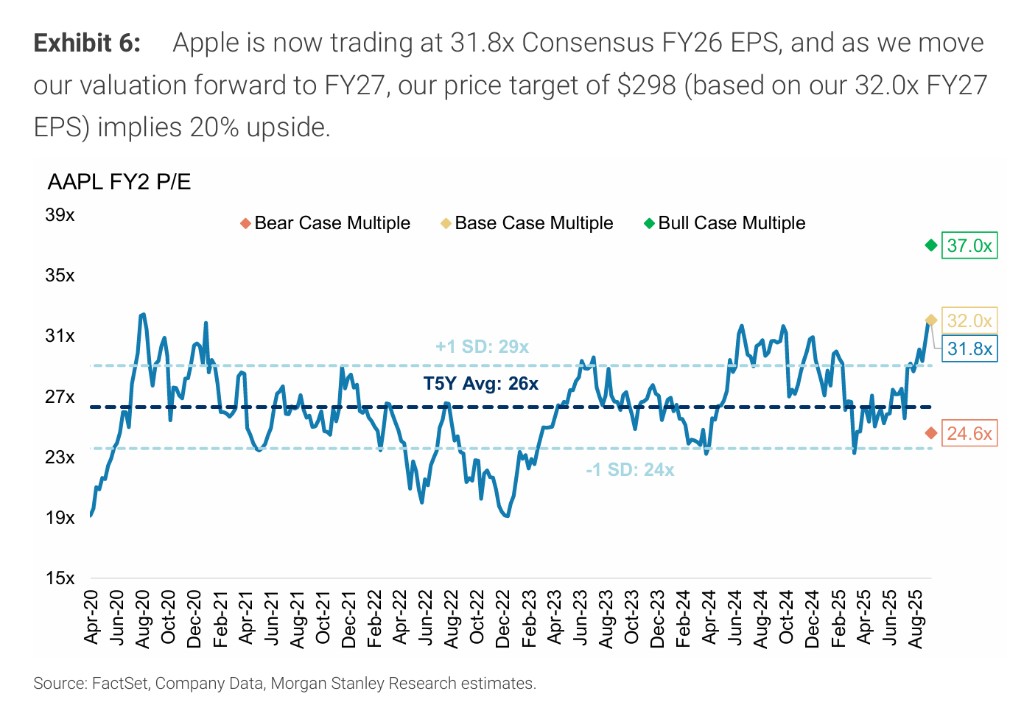

Based on this, Morgan Stanley significantly raised Apple's target price from $240 to $298. However, analysts also warned that the recent rise in stock prices may have already priced in the market's optimistic expectations for the iPhone 17, and for the stock price to continue to outperform the market, further upward revisions to earnings forecasts will be needed.

The firm believes that the key to driving Apple's long-term growth lies in the next product cycle. The report predicts that approximately 1 billion old iPhones will enter the upgrade window, combined with the launch of Apple's first foldable phone, which is described as "the most innovative new device in years," is expected to jointly drive Apple's revenue to achieve sustained growth in the fiscal year 2027.

iPhone 17 Starts Stronger Than Expected

Morgan Stanley pointed out that the initial demand momentum for the iPhone 17 cycle is much stronger than they had anticipated. This assessment is based on two key data points:

First, shipping wait times have significantly increased. Data as of September 30 shows that the wait times for most models and regions of the iPhone 17 series are longer year-over-year (Y/Y). Notably, the base model iPhone 17, seen as the preferred upgrade choice for old users, has seen its wait time extend, being nearly 1 month longer in the Chinese market compared to the same period last year.

Secondly, and more importantly, Morgan Stanley's supply chain survey shows that the increase in production orders for the iPhone 17 is "imminent." Although the official production volume has not yet been formally raised, communications with several exclusive suppliers indicate that the production plan for the iPhone 17 series in the second half of 2025 may be raised from the current 84 million to 86 million units to over 90 million units. The demand growth is concentrated on the iPhone 17 base model, Pro, and Pro Max models.

Based on these strong early signals, Morgan Stanley decided to raise its forecast for Apple for the fiscal year 2026, increasing the expected iPhone shipment volume by 7.5 million units to 243 million units (a year-over-year increase of 3.3%), and raising the total revenue forecast for iPhones in that fiscal year by 4%

Why iPhone 18 is More Anticipated

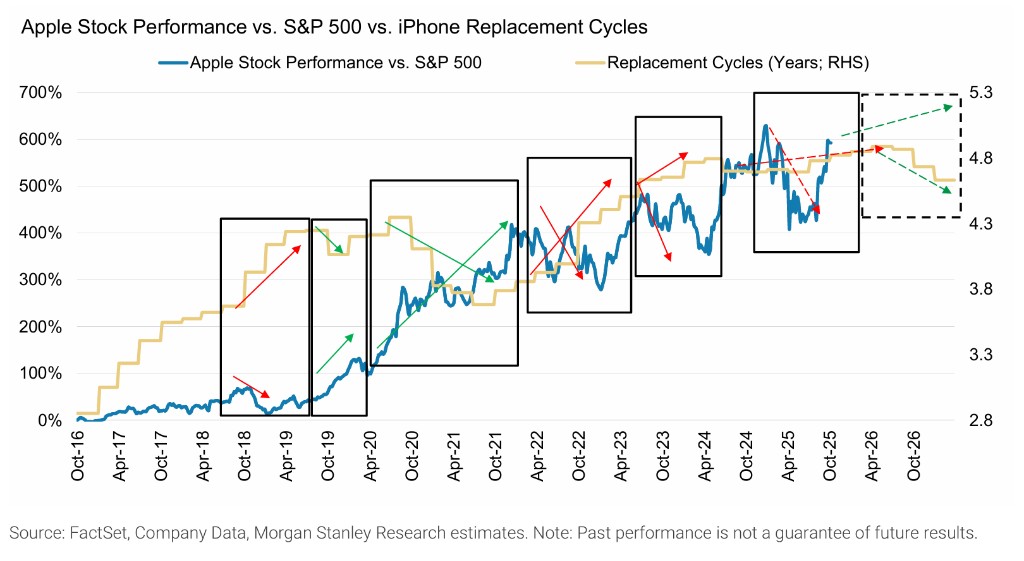

Since the day before the iPhone 17 launch event, Apple's stock price has risen by 7% to $255. Morgan Stanley believes that this increase has largely absorbed the market's optimistic sentiment regarding the iPhone 17 cycle. From a tactical perspective, market prices have reflected their latest FY26 baseline scenario forecast.

Although the iPhone 17 has performed well, Morgan Stanley is focusing more on the new cycle represented by the iPhone 18.

The report estimates that at the end of the iPhone 17 cycle (i.e., 12 months from now), only about 415 million iPhones (approximately 30%) out of Apple's massive device base will support all features of Apple Intelligence. This means that when Apple launches its most innovative product in years—the first foldable iPhone—in FY27 (starting in the fall of 2026), there will still be about 1 billion iPhones in the market that need upgrading to experience the full AI capabilities.

At that time, Apple will not only launch this revolutionary foldable phone but will also release a total of 6 new models in FY27. It is foreseeable that carrier subsidies and trade-in support will become even more aggressive. These factors together create an extremely favorable backdrop, supporting FY27 to be another year of iPhone sales growth. Therefore, Morgan Stanley initially predicts that iPhone shipments in FY27 will reach 253 million units, significantly higher than the previous forecast of 240.5 million units and the market consensus of 247 million units.

Based on the above judgments, Morgan Stanley has comprehensively raised its financial forecasts for Apple. The firm has increased its earnings per share (EPS) forecast for FY26 by 2% to $8.14 and raised its EPS forecast for FY27 by 6% to $9.30, both above market expectations.