AI optimism heats up, European stocks are set for their best weekly performance since May, U.S. stock futures are collectively rising before the market opens, and London copper hits a new high for the year

On October 3rd, due to market expectations of a Federal Reserve interest rate cut, the Stoxx Europe 600 index rose by 0.4%, reaching a record high, with European stocks expected to achieve their best weekly performance. U.S. stock futures rose collectively, with technology stocks boosting the S&P 500 index, which is expected to rise for the sixth consecutive time. The yield on the U.S. 10-year Treasury bond rose to 4.1%, while the U.S. dollar index fell slightly. Commodity prices generally increased, with copper prices reaching a year-to-date high of $10,577 per ton. Cryptocurrency performance was weak, with both Bitcoin and Ethereum declining

On October 3rd, as market bets on a Federal Reserve interest rate cut intensified, the Stoxx Europe 600 index rose 0.4%, reaching a record high, with European stocks expected to record strong weekly gains, led by bank and mining stocks.

In pre-market trading in the U.S., boosted by technology stocks, the three major U.S. stock index futures rose collectively. The S&P 500 index is set to rise for the sixth consecutive time, marking the longest upward momentum since July.

In the bond market, the yield on the U.S. 10-year Treasury rose by 1 basis point to 4.1%. The U.S. dollar index fell by 0.12% to 97.77.

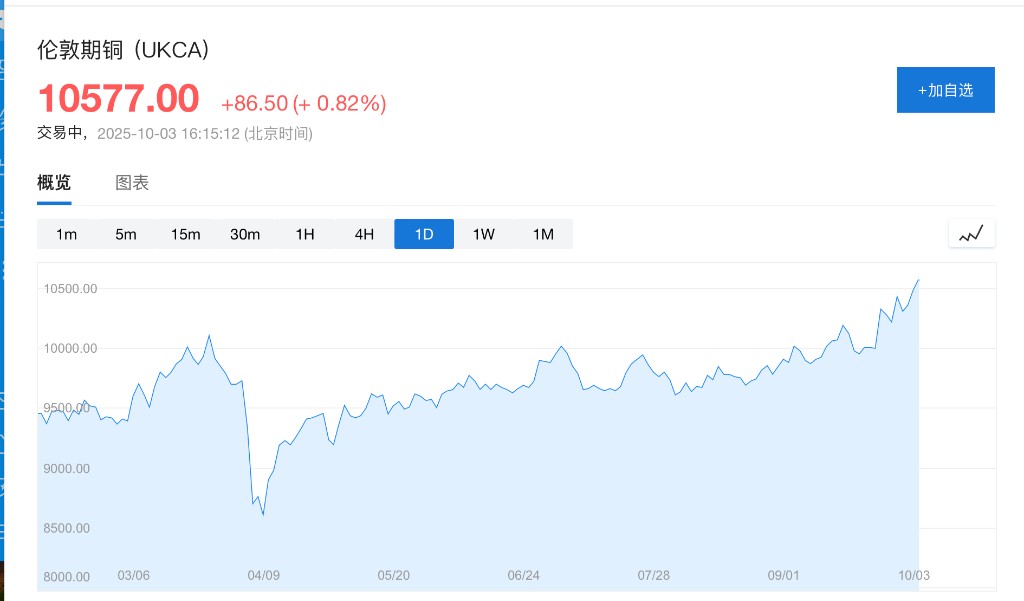

Most commodities rose, with gold, silver, and crude oil increasing, and copper prices surged, with London copper prices soaring to a year-high of $10,577 per ton.

Cryptocurrency performance was weak, with Bitcoin and Ethereum declining.

- The Stoxx Europe 600 index rose 0.4%, reaching a record high.

- The Euro Stoxx 50 index opened up 0.35%, the UK FTSE 100 index rose 0.49%, the French CAC 40 index rose 0.28%, and the German DAX index rose 0.18%.

- S&P 500 index futures rose 0.2%, Nasdaq 100 index futures rose 0.3%, and Dow futures rose 0.2%.

- The Euro Stoxx 50 index rose 0.42%, the UK FTSE 100 index rose 0.49%, the French CAC 40 index rose 0.28%, and the German DAX index rose 0.18%.

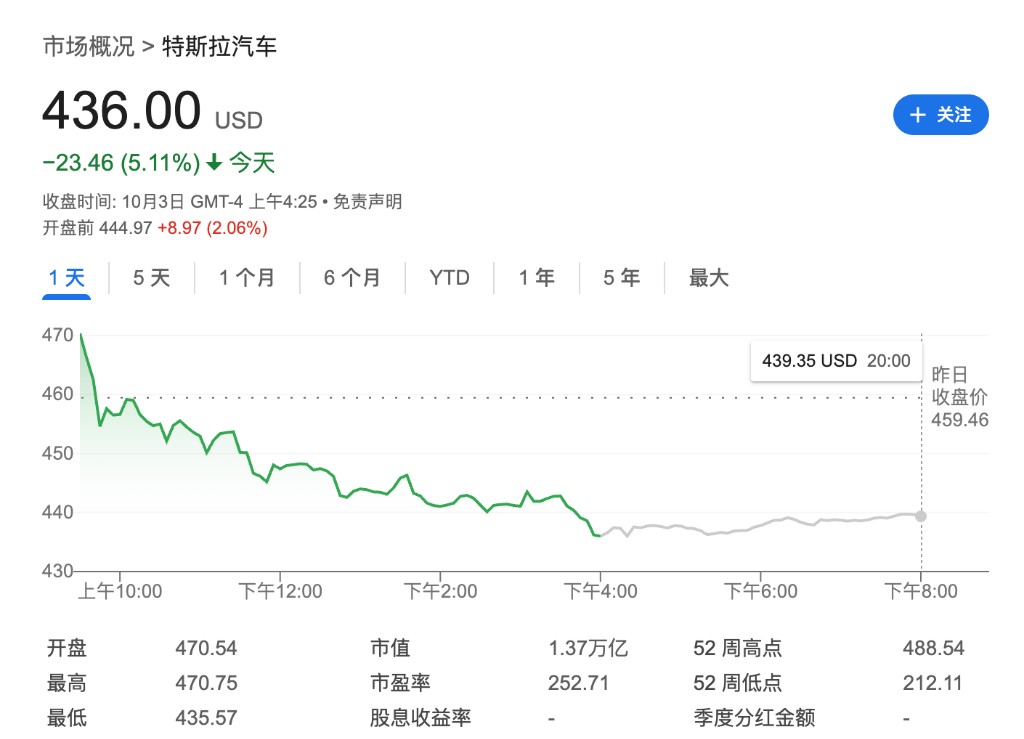

- Tesla's U.S. stock rose 2% in pre-market trading, after falling over 5% in the previous trading day.

- The yield on the U.S. 10-year Treasury rose by 1 basis point to 4.1%.

- Spot gold was reported at $3,863.81 per ounce.

- Spot silver was reported at $47.35 per ounce.

- Brent crude oil rose 0.9% to $64.7 per barrel.

- Copper prices surged, with London copper prices soaring to a year-high of $10,577 per ton.

- Bitcoin and Ethereum fell by 0.7%.

S&P 500 index futures rose 0.2%, Nasdaq 100 index futures rose 0.3%, and Dow futures rose 0.2%.

This round of increases was driven by technology stocks. In news, Japan's Hitachi has partnered with OpenAI in energy and related infrastructure, and Fujitsu has expanded its collaboration with NVIDIA. With a new wave of large-scale artificial intelligence collaborations, investors are betting that the billions of dollars flowing into the AI sector will translate into profits, allowing technology stocks to continue their upward trend. This optimism has eased investor concerns about the Trump administration's plan to cut thousands of federal jobs the day after the government shutdown.

Meanwhile, due to the U.S. government shutdown, the weekly initial jobless claims data scheduled for release on Thursday has been postponed, and traders are coping with the impact of the temporary halt in economic data. The non-farm payroll data to be released by the U.S. Bureau of Labor Statistics on Friday may also be delayed due to the government shutdown

Tesla's U.S. stock rose 2% in pre-market trading, following a drop of over 5% in the previous trading day. Tesla reported record vehicle deliveries in the third quarter, ending months of decline and exceeding analysts' expectations.

Copper prices surged, with London copper futures soaring to a year-high of $10,577 per ton. The immediate trigger for this round of increase was a significant accident at Freeport-McMoRan's Grasberg copper mine in Indonesia, which announced a force majeure, leading to a sharp tightening of market supply expectations.

Continuously updated.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk