U.S. Stock Market Outlook | Three Major Index Futures Rise Together, U.S. Government "Shutdown" May Delay Non-Farm Payroll Release

U.S. stock index futures are all up, as the market focuses on the potential impact of a government shutdown on the release of the non-farm payroll report. Dow futures rose 0.24%, S&P 500 futures rose 0.18%, and Nasdaq 100 futures rose 0.18%. The government shutdown has lasted for three days, and the Senate will vote to end the shutdown, but progress is slow. This shutdown is the 15th since 1981 and affects the wages of approximately 2 million federal workers

- As of October 3rd (Friday) before the US stock market opens, the three major US stock index futures are all up. As of the time of writing, Dow futures are up 0.24%, S&P 500 futures are up 0.18%, and Nasdaq 100 futures are up 0.18%.

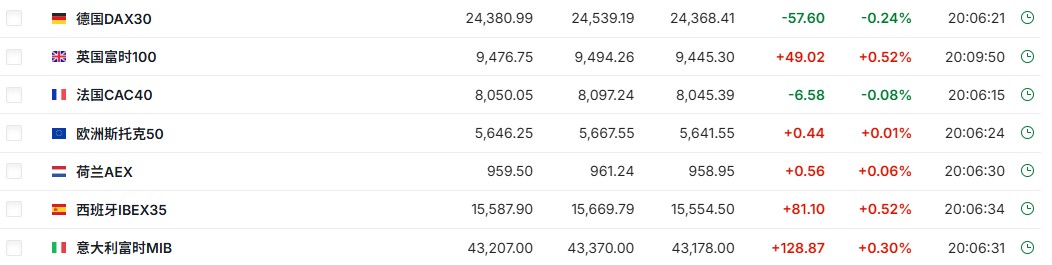

- As of the time of writing, the German DAX index is down 0.24%, the UK FTSE 100 index is up 0.52%, the French CAC40 index is down 0.08%, and the Euro Stoxx 50 index is up 0.01%.

- As of the time of writing, WTI crude oil is up 0.35%, priced at $60.69 per barrel. Brent crude oil is up 0.37%, priced at $64.35 per barrel.

Market News

Tonight's non-farm payroll may not be released as planned. According to the emergency plan of the U.S. Bureau of Labor Statistics during the government shutdown, the agency has suspended all operations and will not release economic data during the shutdown. The non-farm employment report originally scheduled for release tonight at 20:30 will be affected. Previously, the weekly unemployment claims report scheduled for release on Thursday was not published. According to CNN, the non-farm data for September has been collected and may be ready for release. However, this report has not received a response from the Bureau of Labor Statistics.

The U.S. Senate will vote on both parties' proposals to end the government shutdown, but neither is likely to pass. The U.S. Senate will vote again on Friday on two conflicting proposals from the Democrats and Republicans to end the government shutdown that has lasted for three days, but there are currently no signs that either proposal will pass. Lawmakers seem to have made no progress in reaching an agreement that would restore funding to the government, and Democrats and Republicans have been blaming each other over their failure to ensure continued government funding before October 1st (the start of the fiscal year). This government shutdown is the 15th since 1981, suspending scientific research, economic data reporting, financial regulation, and many other activities. Approximately 2 million federal workers have had their pay suspended, but military personnel, airport security staff, and others deemed "essential" are still required to report to work U.S. banking system reserves fall for eight consecutive weeks, dropping below $3 trillion; Fed's balance sheet reduction may be nearing a turning point. The reserves of the U.S. banking system have decreased for eight consecutive weeks, falling below the $3 trillion mark for the first time, raising market concerns about whether the Federal Reserve will end its balance sheet reduction early. According to data released by the Fed on Thursday, for the week ending October 1, bank reserves decreased by $20.1 billion to $2.98 trillion, the lowest level since January of this year. The decline in reserves is closely related to the U.S. Treasury's increased bond issuance. Since raising the debt ceiling in July, the Treasury has accelerated the issuance of government bonds to rebuild cash balances, absorbing market liquidity. This has directly impacted the liabilities side of the Fed's balance sheet, including the overnight reverse repurchase (RRP) tool and commercial bank reserves. As RRP gradually depletes, commercial bank reserves held at the Fed have become the main "bleeding point." This change comes as the Fed continues to implement quantitative tightening (QT). QT tightens financial system liquidity by reducing the holdings of government bonds and mortgage-backed securities (MBS). Earlier this year, the Fed slowed the pace of balance sheet reduction, reducing the amount of maturing bonds each month to avoid triggering market turbulence.

Fed's Williams: Central banks must be prepared for unexpected situations. FOMC permanent voting member and New York Fed President Williams stated on Friday that unpredictable changes are inevitable, and central banks need to recognize this and develop strategies to respond to these environments. He indicated that addressing uncertainty means central banks need to establish strong principles and strategies to handle a range of emergencies, while noting that new situations will still arise. Williams also mentioned that previously unconventional strategies such as bond purchases are no longer novel but are now a normal part of the toolbox. Additionally, Williams emphasized that stabilizing inflation expectations is crucial and should not be taken for granted.

Japan's LDP presidential election is coming tomorrow; hedge funds are tightening their strategies: hedging and betting on yen appreciation. The election for the president of Japan's Liberal Democratic Party (LDP) will take place on October 4. Hedge funds are employing various strategies to profit from the Japanese election, including plans to sell stocks, bet on the appreciation of the yen against the dollar, or reduce risk assets. Currently, poll results show divergence. Among the leading candidates, Sanae Takaichi tends to promote economic growth through more aggressive fiscal expansion, particularly by increasing local government subsidies and supporting low- and middle-income families. Shinjiro Koizumi's "economic priority" policy focuses on promoting wage growth and expanding investment, advocating for fiscal stimulus measures supported by tax surpluses to maintain fiscal sustainability. Many observers of the Bank of Japan believe that if Takaichi wins, the pace of interest rate hikes may slow, as she is a representative of accommodative monetary policy. Koizumi, on the other hand, is seen as more inclined towards gradual reform and is keen on raising wages and productivity levels.

Bank of America: AI boom leads to record inflows into tech stocks. Bank of America’s global research department stated in a report on Friday that in the latest week, global stock market inflows reached $26 billion, with tech stocks attracting the largest share. According to EPFR data, tech stocks attracted $9.3 billion, setting a record for the largest weekly inflow in the industry’s history. Despite the U.S. government shutting down due to a congressional funding impasse, expectations that the Fed's interest rate cuts will support risk assets drove stock prices higher, with both U.S. and European stock markets soaring to historic highs this week Technology stocks are also rising on the back of the ongoing capital expenditure boom in artificial intelligence. Additionally, the gold market saw an inflow of $5.9 billion this week, pushing gold prices close to the historical high of $3,900.

JP Morgan: Without non-farm data, the Federal Reserve can confidently cut interest rates in October. According to reports, due to the government shutdown, the U.S. Bureau of Labor Statistics is not expected to release the non-farm payroll report on Friday. However, several recent private sector indicators show weak hiring, limited layoffs, moderate wage growth, and easing labor demand in September. The data generally aligns with the low hiring and low layoffs situation observed before the government data suspension. Michael Feroli, Chief U.S. Economist at JP Morgan, stated, "Even without the non-farm payroll report, we can have a rough understanding of the labor market conditions. Given everything we see, I believe the Federal Reserve can confidently cut interest rates later this month."

Goldman Sachs: The U.S. economy will accelerate in 2026, with potential market pullbacks in the next 1-2 years. Goldman Sachs CEO David Solomon expects the U.S. economy to accelerate into 2026, driven by ongoing stimulus and technology spending, which outweighs the softening labor market and geopolitical turmoil. Solomon noted that government spending and "all AI infrastructure construction" mean that the economy is "still in quite good shape" overall, despite the impact of tariffs and a weak U.S. job market. Solomon warned on September 10 that the U.S. economy is softening, attributing it partly to Trump's trade policies. He anticipates further increases in U.S. merger and acquisition activity. "Changes in the regulatory environment" mean that CEOs are increasingly ambitious about M&A. Solomon also indicated that he expects market pullbacks in the next 12 to 24 months, but this is not surprising given the long-term accumulation of inventory.

Oil prices may see the largest weekly drop since late June, with concerns over oversupply intensifying ahead of the OPEC+ meeting. Crude oil prices may record the largest weekly drop since late June. Ahead of the upcoming OPEC+ meeting, market concerns over oversupply have intensified, with expectations that the meeting will bring back more idle capacity. Brent crude futures are trading around $64 per barrel, down about 8% this week; West Texas Intermediate crude is below $61 per barrel. The OPEC+ alliance is scheduled to hold an online meeting on Sunday to decide on November's production levels and may discuss accelerating output increases as the alliance seeks to regain market share.

Individual Stock News

Chevron (CVX.US) refinery in California catches fire, accounting for over 16% of the state's total refining capacity. On the evening of October 2, a refinery owned by Chevron near El Segundo, California, suddenly exploded and caught fire. Although no evacuation order has been issued, authorities have advised nearby residents to keep their doors and windows closed. Local air quality monitoring has reportedly not indicated a threat to public health. The refinery is located close to Los Angeles International Airport and SoFi Stadium. It is reported that this refinery covers an area of over 5 square kilometers and can process 269,000 barrels of crude oil per day, accounting for over 16% of California's total refining capacity, supplying more than 40% of aviation fuel and over 20% of automotive fuel for the entire Southern California region U.S. chip equipment export restrictions escalate! Applied Materials (AMAT.US) expects a further $600 million revenue decline in fiscal year 2026. Applied Materials, the largest semiconductor manufacturing equipment supplier in the U.S., stated that the scope of restrictions on its product exports to China has expanded, which will lead to further revenue reductions. In a regulatory filing on Thursday, the company mentioned that the U.S. Department of Commerce's Bureau of Industry and Security issued a new regulation this week that broadens the range of companies subject to export restrictions. The company expects this to result in a $600 million revenue loss in fiscal year 2026, which ends in October next year.

Tesla (TSLA.US) begins selling Cybertruck in Qatar. Tesla announced on Friday that it has started selling its Cybertruck in Qatar, following its earlier operations in Saudi Arabia earlier this year. This move highlights Tesla's determination to expand its international influence amid slowing demand in its core market and increasing competition. Tesla achieved record delivery volumes in the third quarter, thanks to a rush of American buyers before the tax credit expiration on September 30, but analysts expect a sharp decline in the fourth quarter as incentives for electric vehicle purchases will disappear.

Boeing's (BA.US) 777X commercial flight plan reportedly delayed until early 2027, potentially leading to billions in accounting losses. According to insiders, Boeing's 777X commercial flight plan will be postponed until early 2027, rather than the originally scheduled next year. This news is a new blow to the American aircraft manufacturer and could lead to the need for billions in accounting losses. Lufthansa is the launch customer for this wide-body aircraft and is already working on related delay plans. It is reported that the German airline will not incorporate the 777X into its fleet planning until 2027. Officials from Emirates, the largest customer of the 777X, have also become more cautious as they consider that it may not enter service until after 2027. Analysts estimate that this non-cash accounting charge could range from $2.5 billion to $4 billion, but Boeing has not detailed the specific cost amount. However, according to one insider, company executives have held meetings with major investors in recent weeks and are developing a communication strategy to address the losses, indicating that the financial impact will be spread across the entire aircraft program.

Important Economic Data and Event Forecasts

Beijing time 20:30 U.S. September non-farm payrolls change (seasonally adjusted), U.S. September unemployment rate

Beijing time 22:00 U.S. September ISM Non-Manufacturing PMI

Beijing time next day 01:30 2026 FOMC voting member, Dallas Fed President Logan speaks

Beijing time next day 01:40 Federal Reserve Vice Chairman Jefferson speaks