AI "fundamentally reshapes the chip industry," is there still "ample space" in this round of the "semiconductor cycle"?

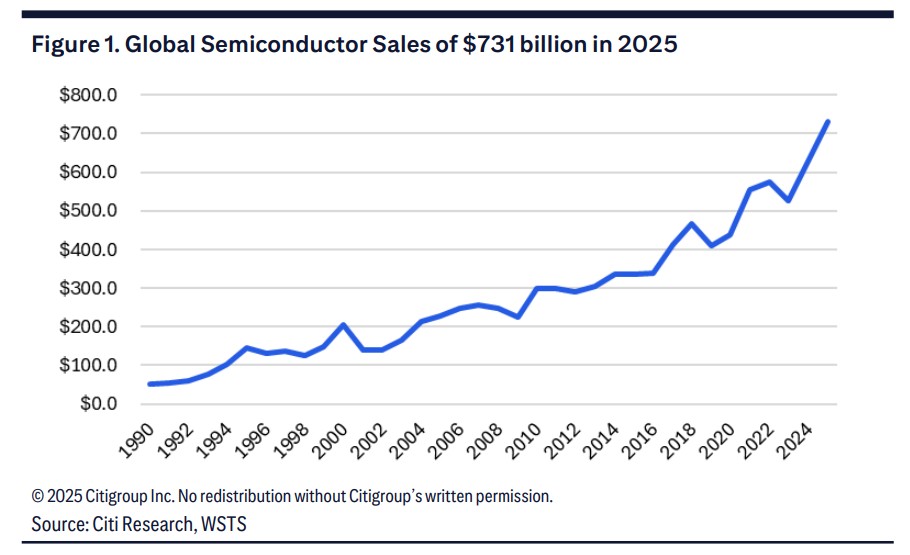

Citigroup stated that AI-related sales will increase from zero to over 25% market share within five years. Global semiconductor sales are expected to grow by 16% to a record high of $731 billion in 2025, but the growth is entirely driven by price, with shipment volumes still 11% below peak levels, indicating low inventory and ample growth potential. Despite the semiconductor index being valued at a 34% premium, the high growth rate supported by AI effects makes the valuation reasonable, and there is still upward potential in this semiconductor cycle

AI is fundamentally reshaping the semiconductor industry, becoming the core variable in this round of the semiconductor cycle.

On October 5th, according to Hard AI news, Citigroup stated in its latest research report that in just five years, AI-related sales have grown from zero to account for over 25% of the entire semiconductor market, driving the semiconductor industry to achieve its first growth acceleration in 25 years.

Citigroup analyst Christopher Danely pointed out that although global semiconductor sales are expected to grow by 16% to USD 731 billion by 2025, setting a historical high, this round of revenue growth is entirely driven by price, while shipment volumes remain far below peak levels. This phenomenon indicates low inventory levels, and the industry still has ample growth potential.

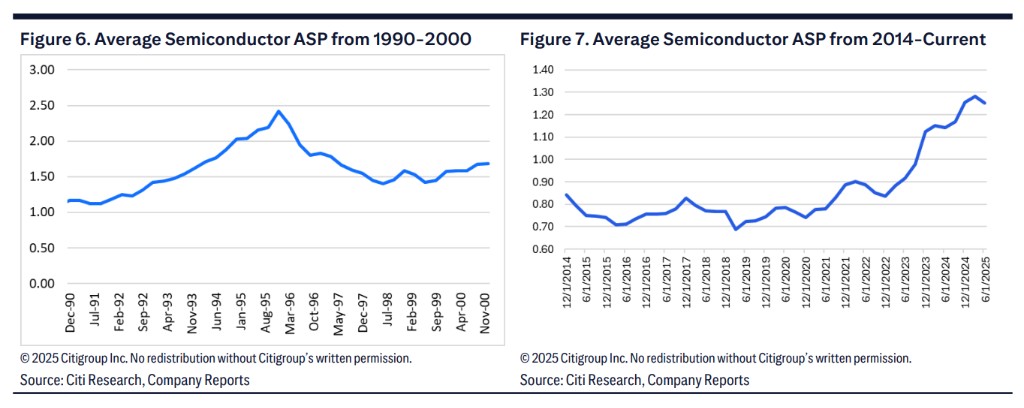

Analysis shows that the average price of semiconductors has risen from about USD 0.72 in 2019 to about USD 1.26 in 2025, an increase of 75%. Since 2022, prices have surged by 45%, marking the largest increase in 30 years. This continuous price increase over four years is a phenomenon not seen since 1992-1995.

Citigroup expects that the share of semiconductor sales for AI data centers will grow from less than 5% in 2022 to about 27% in 2025, and further reach 40% by 2028. Driven by AI demand, the revenue growth rate of the semiconductor industry is expected to rise from the historical average of 7% to 10%.

AI-Driven Semiconductor Pricing Hits 30-Year High

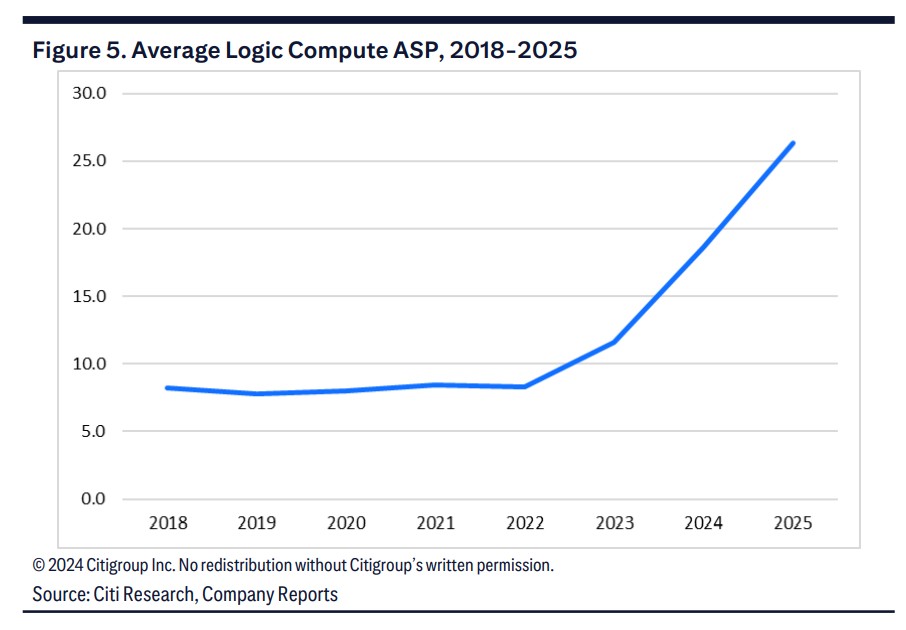

According to Citigroup data, the revenue growth in this round of the semiconductor industry is mainly driven by the increase in logic chip prices.

Citigroup stated that the average pricing of logic computing chips (including AI accelerators) has increased by 24% over the past three years, far exceeding the 2% increase of the previous decade. The share of logic computing chips in total semiconductor sales has also risen from 27% in 2020 to 39% in 2025.

Among them, logic computing revenue is growing rapidly at a compound annual growth rate of 53%, increasing from about USD 29.6 billion in 2022 to about USD 106.4 billion in 2025, with its share of total semiconductor sales jumping from 5% to 15%.

The average price of logic computing has significantly increased from USD 7.80-8.50 between 2018-2022 to an expected USD 26.40 in 2025, with a compound annual growth rate of 47%.

Citigroup stated that the rapid expansion of NVIDIA's data center business is a key factor driving this change. The share of this business in logic chip sales has surged from less than 10% in 2021 to 66% in 2025, while its share of total semiconductor sales has grown from less than 3% in 2021 to 24% in 2025

Shipment volume still below peak, inventory levels are low

Despite record high revenues, Citigroup analysis shows that there is still significant room for growth in semiconductor shipments.

Currently, the total semiconductor shipment volume is still about 11% lower than the previous peak, having only increased by 18% during this upward cycle, far below the historical average increase of 60%.

By product category, microcontroller shipments are still 27% lower than the peak in 2021, logic chips are down 15%, and microprocessors are down 12%.

Citigroup believes that the gap between current shipments and peak levels indicates that supply chain inventory levels are low, leaving ample room for future growth.

Citigroup analysts point out that in an industry where the average peak-to-peak unit growth is 50%, the current 11% shipment gap "gives us confidence that there is greater upward potential in this cycle."

Gross margin differentiation is evident, most companies still have room for improvement

Citigroup's analysis of 18 covered companies shows significant differentiation in industry gross margins.

Data shows that the weighted average gross margin is expected to reach 59% in the second quarter of 2025, close to the peak level of 60% in the fourth quarter of 2024, but this is mainly driven by the high gross margins of Nvidia and Broadcom.

If calculated using a simple average, the gross margin is only 52%, significantly lower than historical peaks.

The average gross margin of the covered companies is 7.8% lower than their respective peaks, with Intel, Broadcom (Microchip Technology), and AMD having the largest gaps from their respective gross margin peaks, at 18.7%, 14.5%, and 12.8%, respectively.

Among the 18 companies, 8 have gross margins that are more than 10% lower than their peaks, and 9 companies have operating profit margins that are more than 10% lower than their peaks. Citigroup believes this indicates that as the semiconductor cycle progresses, there is still significant room for margin improvement.

Valuation premium is reasonable, AI effect supports high growth

Although the semiconductor index SOX is currently trading at a forward P/E ratio of 31 times, a premium of 34% over the S&P 500 index, Citigroup believes this valuation level is reasonable.

Since the release of ChatGPT in November 2022, SOX has maintained an average premium of 31% over the S&P 500 Citi emphasized that the semiconductor industry's gross margin exceeds 50%, and operating profit margin exceeds 25%, significantly higher than the S&P 500's gross margin of 30%-35% and operating profit margin of 10%-15%.

In terms of growth, the semiconductor industry significantly outpaces the S&P 500 over 3-year, 5-year, and 10-year dimensions.

Regression analysis shows that operating profit margin excluding equity incentives is the largest driver of valuation, explaining 66% of the changes in forward price-to-sales ratio.

Citi expects that as long as the AI cycle continues, overall demand for semiconductors will remain strong, supporting industry valuation premiums.