The Japanese yen and Japanese bonds plummet, while Japanese stocks surge! The market begins "high market early rice trading" to respond to the return of "Abenomics."

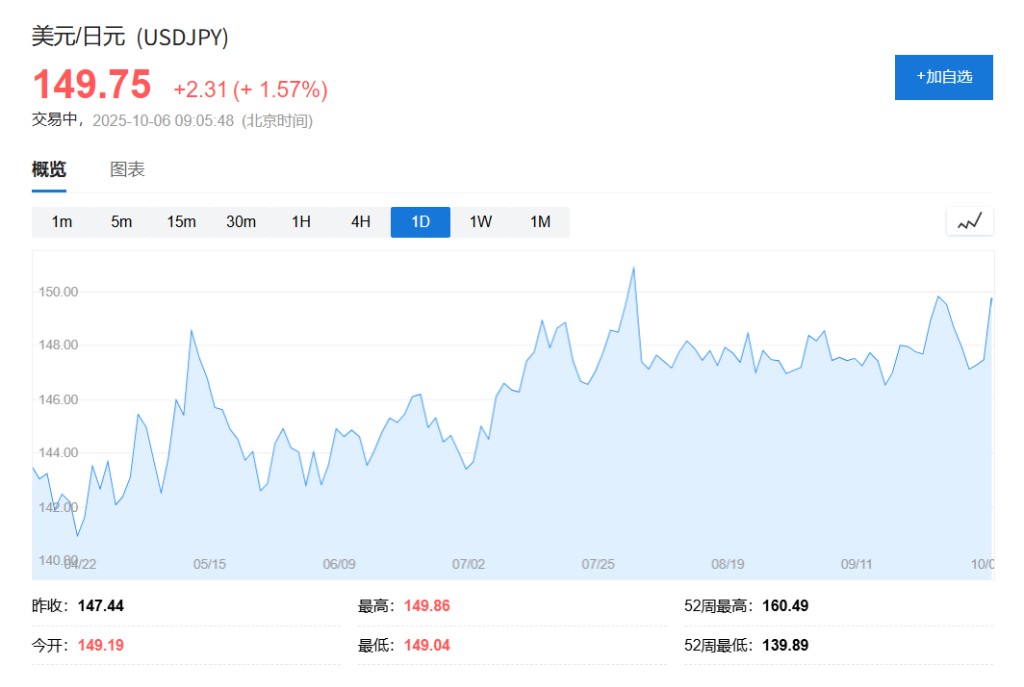

The Japanese financial market is rapidly pricing in the potential return of "Abenomics," with the Nikkei 225 index soaring over 4%, and the yen depreciating 1.5% against the US dollar, approaching the 150 mark. Japanese government bonds are also under pressure, with the 40-year Japanese government bond yield soaring 14 basis points to 3.52%. As a disciple of the late former Prime Minister Shinzo Abe, Sanae Takaichi advocates for aggressive fiscal expansion and may pressure the Bank of Japan to maintain loose monetary policy

With Sanae Takaichi winning the ruling party leadership election, who is seen as a disciple of the late Japanese Prime Minister Shinzo Abe, the Japanese financial market is quickly pricing in the potential return of "Abenomics."

Sanae Takaichi is set to become Japan's new Prime Minister, and the market expects her to restart an economic agenda centered on large-scale fiscal stimulus and ultra-loose monetary policy, which has rapidly ignited the Japanese stock market and triggered significant fluctuations in the foreign exchange market.

After the Tokyo market opened on Monday, the Nikkei 225 index surged more than 4%, marking the largest single-day gain in months, while the Tokyo Stock Exchange index rose by 3%.

Meanwhile, the yen weakened significantly against the dollar by 1.5%, approaching the closely watched key level of 150. The yen's exchange rate against the euro has also fallen to a historic low.

The bond market also experienced dramatic fluctuations, with concerns over future fiscal expansion pushing long-term interest rates higher; the yield on Japan's 40-year government bonds soared by 14 basis points to 3.52%.

These trends reflect that investors are actively positioning for the so-called "Takaichi trade." Wall Street Journal reported that the market generally expects Takaichi's advocacy for fiscal expansion and a politically right-leaning stance, viewing her as a disciple of the late Prime Minister Shinzo Abe. She has called for maintaining loose monetary policy, believing that the Bank of Japan should not raise interest rates.

Traders stated that the return of the "Abenomics" era could further weaken the yen, boost the stock market, and lead to a significant rise in long-term Japanese government bond yields. According to analysts at Bank of America Merrill Lynch, Takaichi's victory could lead to a weaker yen and a steepening of the Japanese government bond yield curve.

Policy Blueprint of the "Abenomics" Successor

According to CCTV News, on October 4 local time, the results of the ruling Liberal Democratic Party's presidential election were announced, with Sanae Takaichi defeating several competitors, including Shinjiro Koizumi, to successfully become the new president of the Liberal Democratic Party.

Sanae Takaichi's economic policy proposals bear a distinct "Abenomics" imprint. At a press conference following her election, she promised to take swift action to address inflation, with policy options including increasing subsidies to local governments and even not ruling out a reduction in the consumption tax In terms of monetary policy, Sanae Takaichi's position is clearer. She advocates for the government and the Bank of Japan to maintain consistency in economic policy and to communicate closely until demand-driven economic growth is achieved.

According to reports, she previously referred to the Bank of Japan's interest rate hike as "foolish," and this strong statement has prompted some analysts to change their expectations for a rate hike by the Bank of Japan in October.

Market Bets on Fiscal Expansion and Loose Monetary Policy

Takaichi's victory is a surprise for many investors who had previously expected the more fiscally conservative Yoshihide Suga to win.

Anna Wu, a cross-asset investment strategist at VanEck Australia, told Bloomberg that this "could be a positive surprise for the stock market."

Investors are preparing for potential fiscal expansion in Japan.

A senior broker at a major Japanese securities firm revealed, "The 'Takaichi trade' is generally favorable for stocks, but due to the risk of significant new fiscal stimulus, there may be some volatility in the Japanese bond and foreign exchange markets."

The market believes that Takaichi will prioritize economic growth over strict fiscal discipline.

Bond Market Under Pressure, Yields May Rise

Despite the stock market's enthusiasm, the bond market faces different pressures. There are concerns that larger-scale fiscal spending means the government will need to issue more bonds, increasing Japan's debt burden.

Shoki Omori, chief strategist at Mizuho, warned that if the policy of issuing more Japanese government bonds does not have a "safety net" in place, bonds may face selling pressure. This view aligns with Bank of America Merrill Lynch's prediction that the yield curve for Japanese government bonds may become steeper.

For investors, Takaichi's ascension opens a new trading paradigm. The market will closely watch how she balances the commitment to stimulate growth with the long-term challenge of controlling government debt, as well as how she will influence the future policy path of the Bank of Japan