Where does the $1 trillion deal money for OpenAI come from?

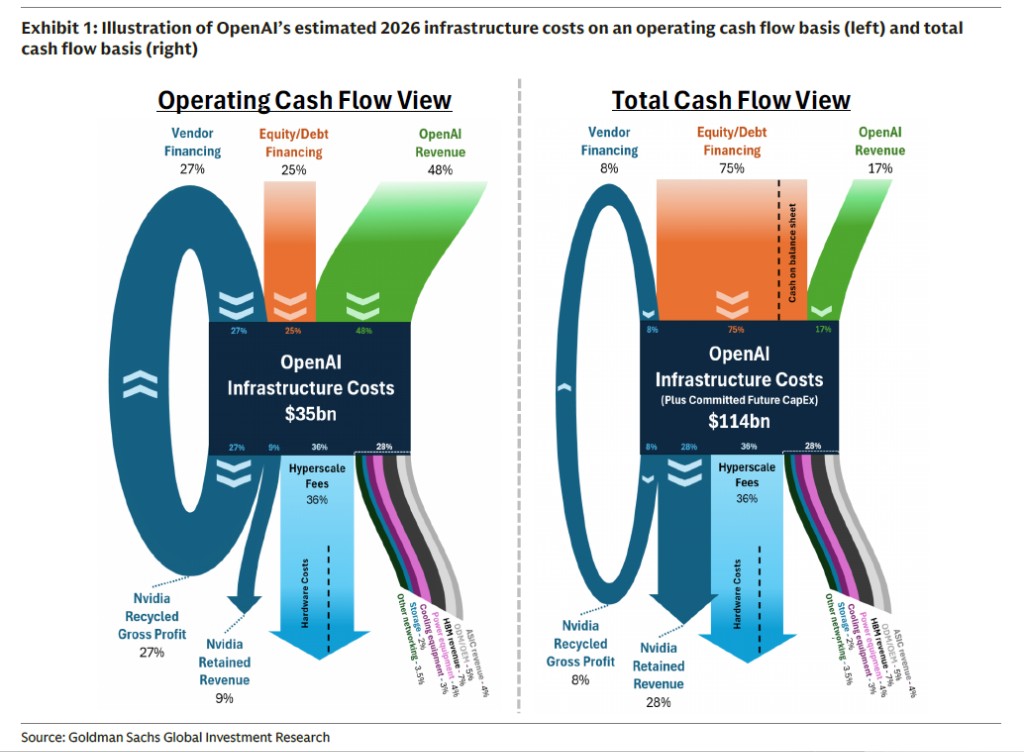

By deeply binding suppliers through "revolving financing" and the pioneering model of "equity for procurement," OpenAI is rewriting the capital rules of the AI era. According to Goldman Sachs' estimates, after accounting for future massive capital expenditures, OpenAI's total funding requirement for the year 2026 will soar from $35 billion to approximately $114 billion, with the proportion of external equity and debt financing needs surging to 75%

OpenAI has signed computing power procurement agreements totaling nearly $1 trillion, but clearly, it does not have that much money in its bank account.

Since the beginning of this year, this company, which leads the global AI wave, has signed computing power agreements totaling nearly $1 trillion with giants such as NVIDIA, AMD, and Oracle at an unprecedented speed, far exceeding its own revenue and financing capacity.

This has raised a core question in the market: how can a startup that is still incurring huge losses and continuously "burning cash" support this gamble?

The answer is not traditional equity or debt financing, but a carefully designed "financial alchemy": by deeply binding suppliers through "circular financing" and an innovative "equity-for-procurement" model, OpenAI is rewriting the capital rules of the AI era.

Behind the Trillion-Dollar Computing Orders: A Capital Game of "Getting Partners Involved"

OpenAI's trillion-dollar computing landscape consists of a series of heavyweight agreements with tech giants.

Specifically, these agreements include collaborations worth up to $500 billion with chip giant NVIDIA, up to $300 billion with AMD, and $300 billion with cloud service provider Oracle, as well as transactions exceeding $22 billion with data center group CoreWeave, aimed at providing OpenAI with over 20 gigawatts (GW) of computing power over the next decade—its energy consumption is roughly equivalent to that of 20 nuclear reactors.

Behind this grand blueprint lies a harsh financial reality. OpenAI is consuming cash at an astonishing rate. Gil Luria, an analyst at DA Davidson, bluntly stated, "OpenAI has no ability to make any of these commitments," and predicted that it could lose about $10 billion this year.

So, where does the money come from?

Media analysis suggests that the answer lies in OpenAI's clever use of Silicon Valley's essence of "fake it until you make it," through so-called "circular arrangements," allowing a number of tech giants to have "skin in the game" for its future.

In other words, this is essentially a capital game: OpenAI leverages its leading position in the AI field and huge market expectations to persuade suppliers to fund its computing power expansion in non-traditional ways, turning future growth potential into current purchasing power.

"Circular Revenue" and "Equity-for-Procurement": The Financial Alchemy Behind the Trillion-Dollar Orders

OpenAI's financial magic is mainly achieved through two distinctly different but logically connected innovative models with AMD and NVIDIA. These two models clearly demonstrate how AI computing power has evolved from a mere capital expenditure into a financializable and securitizable asset class.

(1) AMD Model: "Equity-for-Procurement" Based on Future Performance The agreement with AMD is a groundbreaking achievement in the history of semiconductors.

On the surface, OpenAI plans to purchase and deploy up to 6GW worth $90 billion of AMD Instinct series GPUs. However, at the core of the agreement is AMD issuing warrants to OpenAI, allowing it to purchase up to 160 million shares of AMD stock at a nominal price of just $0.01 per share.

This structure is essentially a financial instrument that cleverly transforms hardware sales into equity allocation. According to estimates, if AMD's stock price rises to $600 due to the large-scale adoption of its GPUs, the potential value of the shares held by OpenAI will reach $96 billion, which is roughly equal to the total value of the hardware procurement. This means that if the collaboration goes smoothly and the market outlook is positive, OpenAI can almost obtain this computing power "for free."

The brilliance of this model lies in its performance-based equity incentive. It directly links AMD's long-term valuation with OpenAI's infrastructure growth, forming a powerful symbiotic relationship and creating a potential "self-funding" path for OpenAI: as procurement milestones are achieved and AMD's stock price rises, OpenAI can liquidate the exercised shares to fund subsequent GPU purchases, significantly alleviating its capital expenditure pressure.

(2) NVIDIA Model: A More Direct "Circular Revenue"

The collaboration with NVIDIA adopts a different, more direct circular logic. NVIDIA plans to invest up to $100 billion in OpenAI over the next decade. This funding provides OpenAI with cash that can be directly used to purchase NVIDIA chips.

Goldman Sachs refers to such transactions in its in-depth analysis report as "circular revenue": NVIDIA injects funds into OpenAI, which then uses this money to place GPU orders with NVIDIA.

The institution believes that customers under this model are not "self-funding," and when the supplier's equity investment ultimately flows back as revenue, investors will scrutinize the "circular" nature of this revenue more rigorously, which may lead the company to adopt a "more cautious" attitude towards the valuation multiples of core partners like NVIDIA.

Goldman Sachs Analyzes OpenAI's Cash Flow

Despite the clever design of financial instruments, OpenAI's actual funding gap may still be significant.

To better understand OpenAI's financial situation, Goldman Sachs analyzed OpenAI's finances from two perspectives:

First, from the perspective of Operating Cash Flow, the situation seems manageable. Goldman Sachs estimates that OpenAI's annual operating infrastructure costs (including inference, training, personnel, etc.) will be about $35 billion in 2026. The sources of funding for this expenditure are roughly composed as follows:

-

OpenAI's own revenue: Contributing about 48%.

-

Vendor Financing: Contributing about 27%

-

External equity/debt financing: Contributes about 25%.

Under this model, OpenAI seems able to cover most of its daily operating expenses through self-financing and support from partners, with a relatively balanced capital structure.

However, once future significant capital commitments are taken into account, a completely different picture emerges.

Goldman Sachs pointed out that, in addition to operating costs, OpenAI has made significant external capital commitments to ensure future computing power supply. These commitments include: building its own data centers in collaboration with NVIDIA (expected to require about $60 billion in capital by 2026), and funding for the "Stargate" project (expected to be $19 billion by 2026).

When these future massive capital expenditures are included, Goldman Sachs estimates that OpenAI's total funding needs for 2026 will soar from $35 billion to about $114 billion. Faced with this enormous funding gap of $114 billion, the structure of funding sources undergoes a dramatic change:

-

External equity/debt financing: Reliance increases to an overwhelming 75%.

-

OpenAI's own revenue: Contribution ratio diluted to 17%.

-

Supplier financing: Contribution ratio plummets to 8%.

In this model, its capital structure is completely unbalanced. The demand for external equity and debt financing surges to 75%, while its own revenue contribution is diluted to only 17%.

In other words, even with various innovative financial tool designs, if significant capital commitments are to be fulfilled, OpenAI's reliance on external capital remains astonishing. The construction of its grand computing power empire cannot be supported merely by its own business or clever supplier agreements; the ability to continuously and massively secure financing from external capital markets such as VC and debt markets has become the key to whether this gamble can succeed.

Gamble, Risks, and Future: AI Bubble or Industry Cornerstone?

Whether it is AMD's equity incentives or NVIDIA's direct investments, these agreements have immediately boosted the market value of partners. For example, after announcing cooperation with OpenAI, Oracle and AMD saw their market values soar by $244 billion and $63 billion, respectively.

This rise in stock prices, in turn, enhances market confidence in this cooperation model, forming what seems to be a perfect positive feedback loop, but at the same time, it has also sounded the alarm for the "AI bubble" increasingly louder.

Currently, OpenAI's complex financial structure, while solving the computing power sourcing issue in the short term, also carries significant risks:

-

Credit and growth risks: Rating agency Moody's has issued a warning to Oracle due to its future data center business being overly reliant on OpenAI, a client that has yet to prove its profitability. The prosperity of the entire ecosystem is built on the assumption that AI applications will continue to grow exponentially Once user growth or willingness to pay slows down, this capital cycle chain supported by high expectations may break.

-

Lack of cost discipline: A senior Silicon Valley investor commented that OpenAI "naturally lacks cost discipline," comparing it to early Amazon and Oracle, both of which only began to strictly control costs "after being on the brink of bankruptcy." Its CEO, Sam Altman, has also publicly stated that achieving profitability "is not among my top ten concerns." This cost-agnostic, growth-prioritized strategy can advance rapidly when capital is abundant, but may face immense pressure when the market turns.

-

Deep changes in industry structure: A report from Goldman Sachs further points out that this trend is changing the customer structure of upstream companies like NVIDIA. Its revenue is increasingly shifting from traditional, financially stable hyperscalers to AI startups and sovereign AI funds that rely on external financing and carry higher risks. Goldman Sachs predicts that by 2027, AI startups and sovereign AI will contribute $66 billion and $46 billion in revenue to NVIDIA, respectively. While this change in customer structure brings new growth points, it undoubtedly increases the volatility of the entire industry chain and the uncertainty of valuations.

Epilogue

OpenAI's trillion-dollar computing power deal is a capital operation that maximizes financial innovation, industry bundling, and market expectations. Through a "circular financing" model, it has leveraged resources several times its own size, accelerating the construction of AI infrastructure.

However, the foundation of this system is a firm belief in future technological breakthroughs and sustained market enthusiasm.

Is this laying a solid computing power foundation for the next industrial revolution, or is it a castle in the air built on circular credit and capital bubbles? Time will provide the final answer. But undoubtedly, OpenAI has pushed itself and its partners to an unprecedented gambling table