HSBC plans to privatize HANG SENG BANK for USD 13.6 billion, with a premium of over 30%

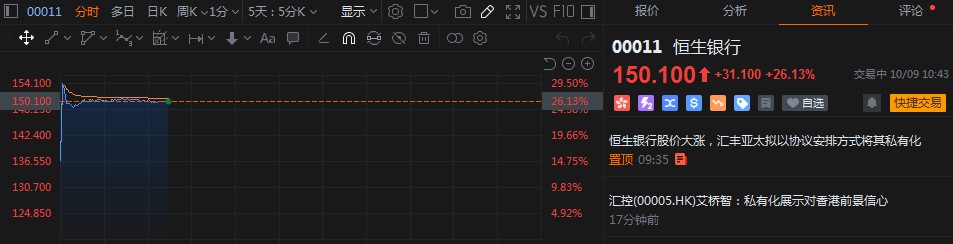

After the announcement, HSBC HOLDINGS' Hong Kong stock price plummeted by more than 6%, while HANG SENG BANK surged by over 26%, setting a record for the largest single-day increase in history

HSBC plans to privatize Hang Seng Bank through a scheme of arrangement, with a premium of over 30% per share.

According to a report by Reuters on the 9th, HSBC Holdings plans to privatize its Hong Kong subsidiary Hang Seng Bank for a total price of approximately $13.6 billion. This move aims to address the performance pressures and deteriorating asset quality faced by Hang Seng Bank due to a weak real estate market.

HSBC Asia Pacific, as the offeror, has requested the Hang Seng Bank board to present a proposal to shareholders to privatize Hang Seng Bank through a scheme of arrangement under Section 673 of the Companies Ordinance.

If the plan takes effect, the scheme shares will be canceled in exchange for the scheme consideration, which means that each scheme share will receive HKD 155. The scheme consideration represents a premium of approximately 30.3% over Hang Seng Bank's last closing price of HKD 119.00 per share, with a transaction valuation of about HKD 106.1 billion ($13.63 billion).

HSBC CEO Noel Quinn stated in an interview that the initiative is purely a business decision based on strategic considerations, demonstrating the bank's confidence in Hong Kong's prospects, and is an investment to promote growth, unrelated to bad debt issues. He also mentioned that a 30% premium is a very substantial and attractive offer.

Following the announcement, HSBC Holdings' Hong Kong stock price plummeted over 6%, while Hang Seng Bank surged over 26%, potentially creating the largest single-day gain in history.

According to a report by Reuters last year, due to concerns about worsening global economic headwinds, HSBC began planning to tighten risk management for Hang Seng Bank in early 2024. This privatization is seen as a decisive step to strengthen control and directly intervene in risk management strategies.

HSBC stated that completing the transaction will impact its capital adequacy ratio. It is expected that this acquisition will reduce its Common Equity Tier 1 (CET1) capital adequacy ratio by approximately 125 basis points. As of the end of June, HSBC's CET1 ratio was 14.6%.

To address the decline in capital ratios, HSBC has developed corresponding plans. The bank expects that through organic capital growth and suspending its stock repurchase plan for the next three quarters, its CET1 ratio will recover to the target operating range of 14.0% to 14.5%