The cryptocurrency circle's "largest liquidation in history," who suffered the most? The "new darling of perpetual contracts" Hyperliquid is a hard-hit area

The cryptocurrency market experienced a "bloodbath" over the weekend, with Bitcoin plummeting from a historical high of $126,000 to around $100,000, resulting in nearly $20 billion in leveraged positions evaporating and over 1.6 million traders being liquidated. The hardest hit was the perpetual contract exchange Hyperliquid, where over a thousand wallet assets went to zero, and more than $10 billion in positions were liquidated, far exceeding Binance's $2.4 billion, with its automatic deleveraging mechanism being blamed for exacerbating the market crash

This weekend, the cryptocurrency market experienced the most severe liquidation event in history.

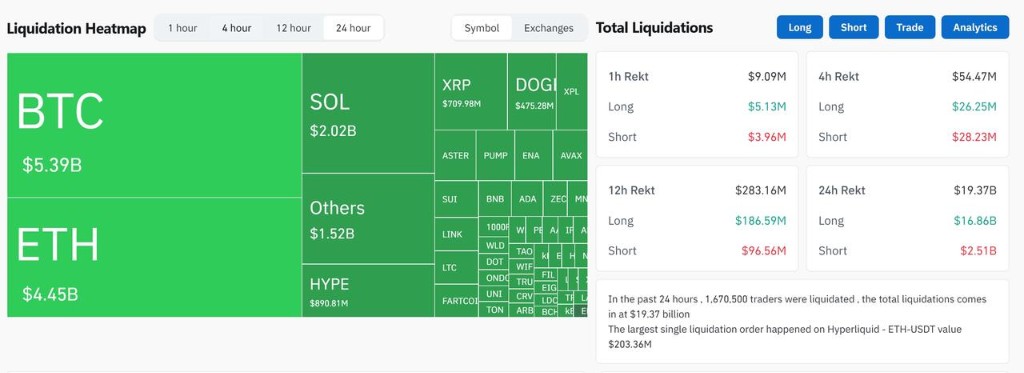

On October 11, according to data tracking agency CoinGlass, nearly $20 billion worth of cryptocurrency bets were forcibly liquidated in the past 24 hours, with over 1.6 million traders being liquidated, the vast majority of whom were long positions.

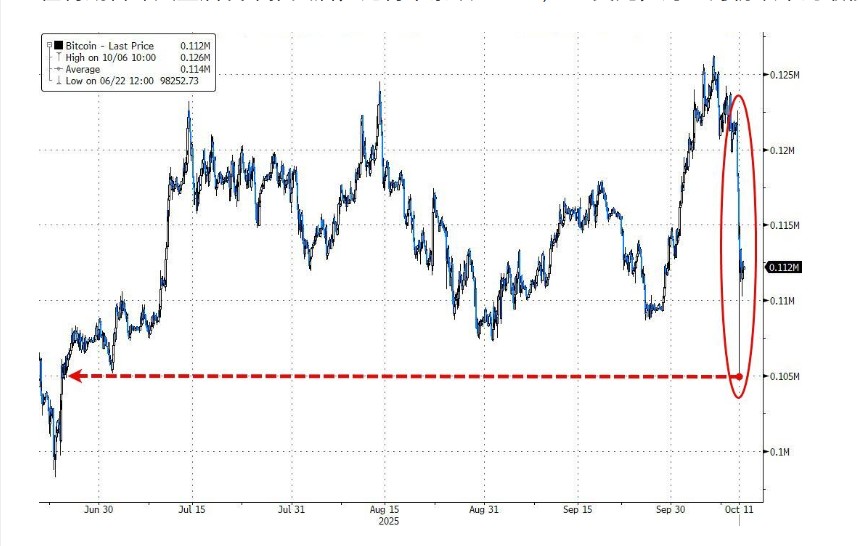

Yesterday, the price of Bitcoin plummeted from a historic high of over $126,000 to a several-month low of $105,000, although it later rebounded to above $110,000. Notably, in the first week of October, Bitcoin had surged over 10%, breaking through the historic high of $126,000.

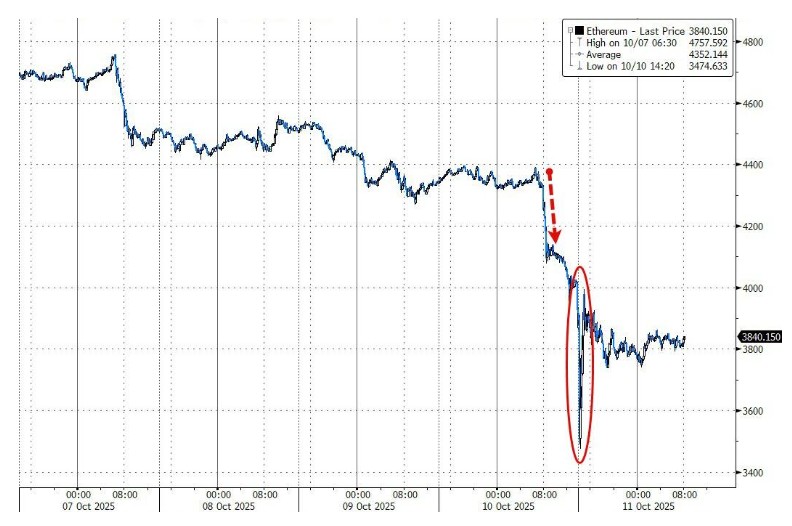

The second-largest cryptocurrency, Ethereum, also saw its price drop from a recent high of around $4,700 to below $3,500.

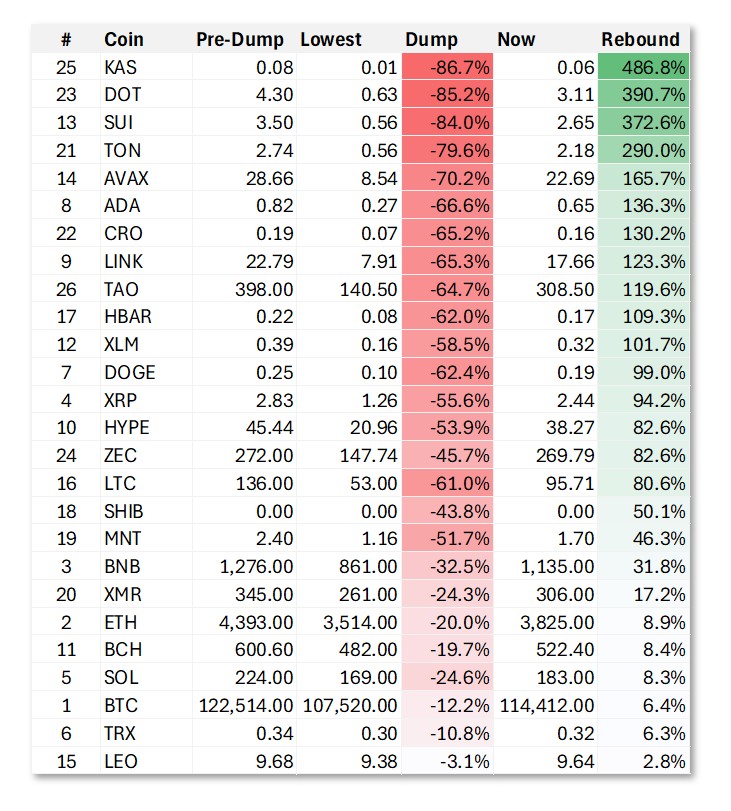

The real disaster occurred in the altcoin market.

ATOM dropped from $4 to $0.001;

SUI fell from $3.4 to $0.56;

APT decreased from $5 to $0.75;

SEI went from $0.28 to $0.07;

LINK fell from $22 to $8;

ADA dropped from $0.8 to $0.3.

The nearly $20 billion in losses may still be a conservative estimate. CoinGlass mentioned on the social platform X that “the actual total could be much higher—Binance reports only one liquidation order per second.”

The $19.31 billion in liquidation is more than ten times the liquidation losses of $1.2 billion and $1.6 billion during the pandemic and the FTX collapse, respectively. The agency described this event as:

The largest liquidation event in cryptocurrency history.

Market analysis suggests that this crypto “catastrophe” is closely related to the latest tariff remarks made by U.S. President Trump.

Meanwhile, Kris Marszalek, CEO of Crypto.com, called for “regulators to investigate the exchanges with the highest number of liquidations in the past 24 hours.”

So, who suffered the most in this storm?

The emerging perpetual contract exchange Hyperliquid unexpectedly became the center of the liquidation event, despite its scale being much smaller than its competitors, its liquidation amount ranked first

Storm Center Hyperliquid: Massive Liquidations and Mechanism Controversies

Despite being much smaller than competitors like Binance, Hyperliquid recorded the highest liquidation amount in the entire market at $10.31 billion, according to CoinGlass data. In comparison, Bybit and Binance had liquidation amounts of $4.65 billion and $2.41 billion, respectively.

Zaheer Ebtikar, founder of the crypto fund Split Capital, pointed out that there is "the largest amount of long liquidations and the least matching liquidity" on Hyperliquid.

According to social media account @LookOnChain, during this market crash, over 1,000 wallets on Hyperliquid were completely emptied, and over 6,300 wallets were in a state of loss, with total losses exceeding $1.23 billion.

Market participants have pointed fingers at the platform's Auto-Deleveraging (ADL) mechanism. ADL is designed to automatically liquidate the positions of profitable or highly leveraged counterparties to protect the exchange when the insurance fund is insufficient to cover forced liquidation losses.

However, many market participants believe that this mechanism exacerbated the sell-off in this incident.

Spencer Hallarn, global head of over-the-counter trading at crypto investment firm GSR, stated, "This mechanism brings complex issues, especially for participants with more complex portfolios," as it may lead to the premature liquidation of hedging positions by quantitative market makers, thereby destabilizing their overall investment portfolios.

Some Happy, Some Sad: Who Profited from the Plunge?

However, this disaster was not all bad news for everyone. According to CoinDesk, data shows that the top 100 traders on Hyperliquid collectively earned $1.69 billion, while the top 100 traders with the most losses lost $743 million. This means a net profit of up to $951 million concentrated in the hands of a few highly leveraged short sellers.

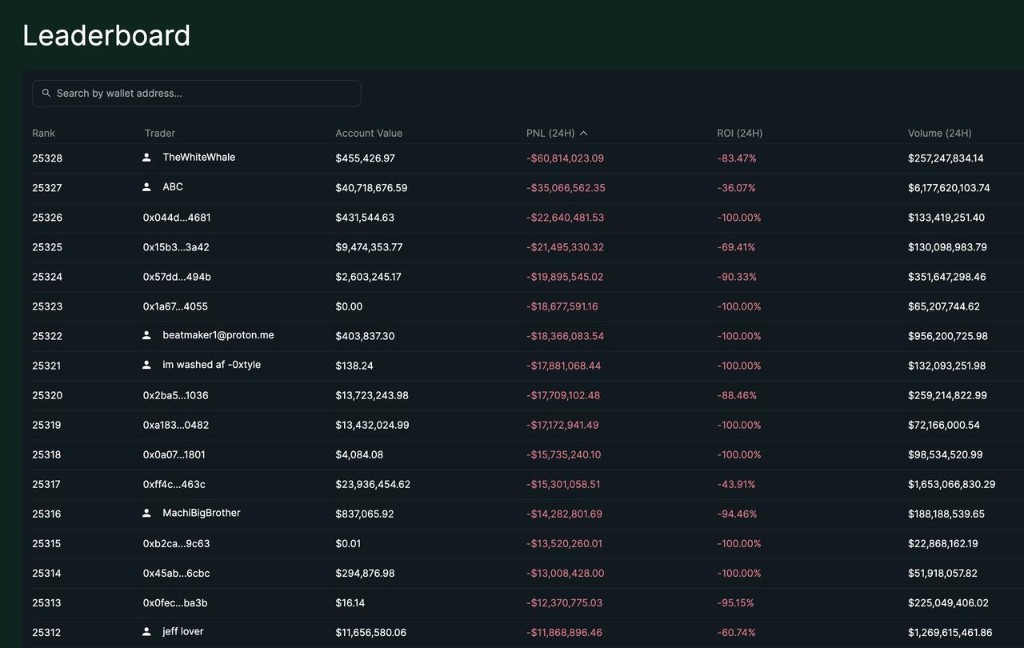

Among them, the biggest winner was a trader with the wallet address 0x5273…065f, who profited over $700 million from shorting. The biggest loser, an account named "TheWhiteWhale," lost $625,000. Additionally, a community treasury named Hyperliquid Provider (HLP) profited over $30 million from taking over and liquidating losing positions during this sell-off

Market Aftershocks Persist, Will Bitcoin Drop Below $100,000?

Although the market has begun to recover some ground after the sharp decline over the weekend, the full impact of the event may take days or even weeks to fully manifest.

Edward Chin, CEO of the crypto hedge fund Parataxis, stated, "I suspect that in the coming days or weeks, we will hear news of some funds facing liquidation or market makers suffering heavy losses."

Currently, the market's focus has shifted to counterparty risk and whether the event will trigger broader contagion. Caroline Mauron, co-founder of Orbit Markets, pointed out that Bitcoin's next major support level is at $100,000, and falling below this level "would mark the end of the bull market cycle of the past three years."

Vincent Liu, Chief Investment Officer of Kronos Research, believes that this decline "was triggered by concerns over U.S.-China tariffs but exacerbated by institutional over-leverage," highlighting the close connection between cryptocurrencies and the macroeconomy. He expects the market to remain volatile but advises paying attention to rebound signals after the market clears