Next week's heavy schedule: China's inflation and foreign trade data, Oracle AI conference, Taiwan Semiconductor and Cambricon financial report

The U.S. September CPI release has been postponed to October 24 due to the government shutdown, with Goldman Sachs speculating that the government may end the shutdown on October 15. The Oracle AI World Conference is approaching, and Cambricon, ASML, Taiwan Semiconductor, and Samsung Electronics will announce their earnings. China's CPI, PPI, import and export data will be released. Next week, the IMF/World Bank summit will take place, where global central banks may focus on stock market risks

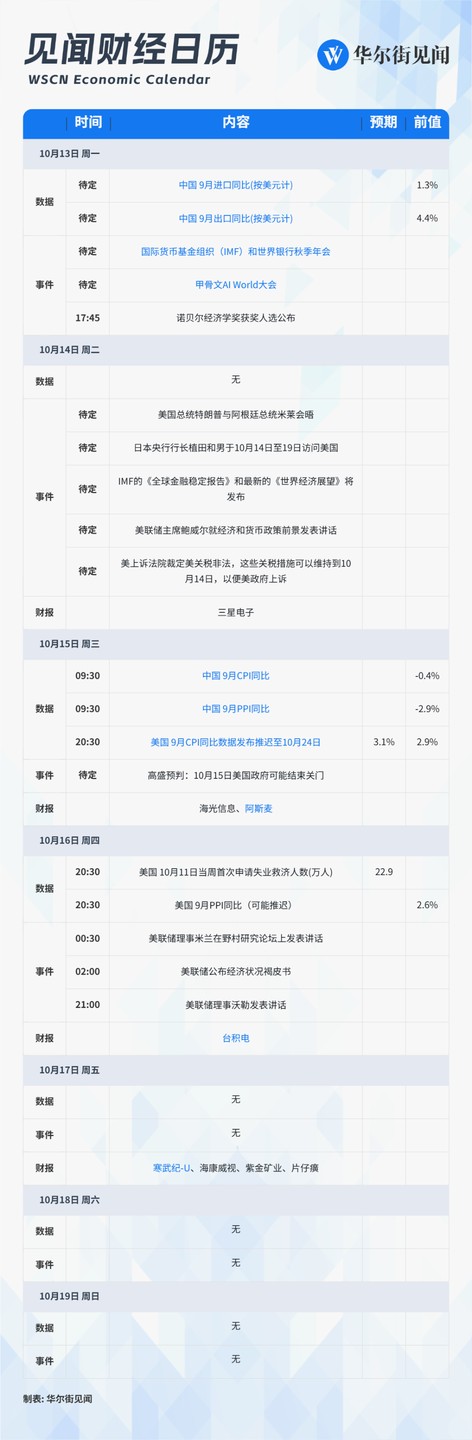

October 13 - October 19 Weekly Major Financial Events Overview, all times in Beijing:

Key focus for next week: Oracle AI Conference, whether the U.S. government can end the shutdown, and the release of September CPI, as well as China's CPI, PPI, and import/export data. The IMF/World Bank summit will take place next week, where global central banks may focus on the risk of stock market crashes. The Federal Reserve will release the Beige Book reflecting economic conditions across the U.S. ASML, Taiwan Semiconductor, and Samsung Electronics will announce their earnings.

In addition, the Nobel Prize in Economic Sciences winners will be announced. Several U.S. investment banks will release earnings reports, including Goldman Sachs, JP Morgan, Morgan Stanley, Citigroup, and BlackRock. The 2025 World Intelligent Connected Vehicle Conference will also be held in Beijing. Meanwhile, legal disputes regarding U.S. tariff policies are expected to make progress.

Regarding official speeches, Federal Reserve Chairman Jerome Powell is scheduled to speak next Tuesday about the economic and monetary policy outlook. Additionally, Federal Reserve governors Waller, Michael Barr, Milan, and several regional Fed presidents will also give speeches.

Economic Indicators

- U.S. September CPI

The U.S. September CPI, originally scheduled for release on October 15, has been postponed to October 24 due to the government shutdown. This data is not only related to next year's Social Security adjustments but is also a key basis for the Federal Reserve's assessment of inflation trends ahead of its October 28 meeting. Although inflation remains above target, the market generally expects the Federal Reserve to continue cutting interest rates, and this CPI data will directly impact the pace and scale of rate cuts.

Wallstreetcn mentioned that, according to the U.S. Bureau of Labor Statistics, the significant U.S. September CPI report will be released at 8:30 AM Eastern Time on October 24, which is a delay of 9 days from the original schedule. The latest September CPI release time also coincides with the Federal Reserve's FOMC policy meeting on October 28-29.

- China's September CPI and PPI

China will release September CPI and PPI data on October 15. Huatai Securities expects the CPI year-on-year to be -0.1%, while CICC predicts -0.3%, both showing improvement compared to August's -0.4%. This expectation is mainly based on two factors: marginal improvement in non-food items under low base effects, and core CPI is expected to continue its upward trend, with service consumption demand supporting core inflation.

At the same time, Huatai expects the year-on-year decline in PPI to continue narrowing to 2.4%. China's August PPI has ended its consecutive 8-month downward trend and stabilized, with the year-on-year decline narrowing to 2.9%.

- China's September Import and Export

China will release September import and export data on October 13. Market institutions hold an optimistic outlook for this month's export performance. Huatai Securities expects a year-on-year export growth rate of about 6.0% for September, while CICC predicts it could reach 7.4%, significantly accelerating compared to August's 4.4% Mainly benefited from the recovery of the global manufacturing cycle, robust exports to non-US regions, and low base effects.

Financial Events

- Oracle AI World Conference

Oracle will hold the global AI conference (Oracle AI World) in Las Vegas from October 13 to 16.

At the conference, Oracle is expected to launch the new Oracle AI Database service, further deepening its AI strategy and showcasing how it is transforming from a traditional software giant to a leader in AI infrastructure.

Before the conference, Oracle has already demonstrated strong momentum in the AI field. Although the company's recently released Q1 FY2026 financial report showed revenue and earnings per share slightly below analyst expectations, the remaining performance obligations (RPO) related to AI surged to $455 billion, a year-on-year increase of 359%, directly driving the stock price to a historic high.

Oracle's CTO Larry Ellison emphasized that the company is actively positioning itself for AI-driven cloud demand through innovative services such as MultiCloud Database and the upcoming Oracle AI Database.

- International Monetary Fund (IMF) and World Bank Autumn Meetings

The 2025 IMF and World Bank Autumn Meetings will be held from October 13 to 18. Central bank governors will focus on discussing stock market bubbles and potential collapse risks. IMF President Kristalina Georgieva has warned that current asset valuations are nearing levels seen during the internet bubble 25 years ago, and a significant market correction could drag down the global economy. The Federal Reserve, European Central Bank, and Bank of England have all expressed concerns about overvalued markets and the risks of a correction.

- Goldman Sachs Prediction: US Government Shutdown May End on October 15

Wall Street Journal reported that Goldman Sachs expects that while the US government shutdown may last for several weeks, it is unlikely to extend beyond the military pay date of October 15, as active-duty military personnel would miss their entire paycheck if the shutdown continues at that time.

A major point of contention between the two parties is the healthcare subsidy bill set to expire on November 1. Goldman Sachs believes that once Trump expresses a willingness to discuss health issues, the Democrats are likely to accept and agree to at least a short-term reopening of the government.

- 2025 World Intelligent Connected Vehicles Conference to be Held in Beijing

The 2025 World Intelligent Connected Vehicles Conference, co-hosted by the Ministry of Industry and Information Technology, the Ministry of Transport, and the Beijing Municipal Government, will be held in Beijing from October 16 to 18. This year's conference, themed "Gathering Wisdom and Energy, Connecting the Infinite," aims to convey voices on industry, technology, and cooperation globally.

The conference will focus on the application innovation of cutting-edge technologies in the automotive industry, including artificial intelligence, information communication, data utilization, and chips, sharing the latest technological breakthroughs and industry trends in China's intelligent connected vehicle sector with relevant officials and experts from overseas government agencies in multiple countries During the conference, multiple reports will be released on the achievements of "integrated vehicle-road-cloud" construction and various hot topics such as "artificial intelligence + automobiles." At the same time, new technologies, new products, new models, and new ecosystems will be fully showcased.

- Nobel Prize in Economic Sciences Candidates Announced

On October 13, the candidates for the Nobel Prize in Economic Sciences were announced.

The highly anticipated 2025 Nobel Prize award season will kick off on October 6 and continue until October 13. Starting with the Physiology or Medicine Prize, the six major awards including Physics and Chemistry will be announced in succession. This is not only an annual event in the scientific community but is also regarded by the capital market as an important barometer for insights into future industry trends.

Looking back at 2024, artificial intelligence (AI) emerged as the biggest winner, with its foundational contributions in machine learning (Physics Prize) and protein structure prediction (Chemistry Prize) being recognized. The market generally expects this trend, focusing on "applied" and "interdisciplinary" research, to continue this year. Analysts point out that the intersectionality of modern scientific awards is becoming increasingly evident; for example, the Chemistry Prize is often jokingly referred to as the "comprehensive science prize," which means investors need to pay attention to the disruptive nature of the technology itself rather than being confined to traditional disciplinary divisions.

- U.S. Appeals Court Rules Most Global Tariff Policies by U.S. Government Illegal; Tariff Measures Can Remain Until October 14 for Appeal

According to previous reports from CCTV News, a U.S. appeals court ruled that most of the global tariff policies implemented by President Trump are illegal. The court stated that these tariff measures can remain in place until October 14 to allow the U.S. government to appeal to the Supreme Court.

It is reported that the Federal Circuit Court of Appeals in Washington ruled that the International Emergency Economic Powers Act does not explicitly grant the U.S. president the authority to impose tariffs, and Trump's invocation of this law to impose tariffs exceeded his authority. Additionally, media reports indicate that this ruling does not affect tariffs imposed by the Trump administration under other provisions, such as the tariffs on steel and aluminum.

- Sharm El Sheikh Peace Summit to Be Held in Egypt

According to CCTV News, the Egyptian presidential office announced on the 11th local time that an international conference themed "Sharm El Sheikh Peace Summit" will be held in the Red Sea coastal city of Sharm El Sheikh on October 13. The summit will be co-hosted by Egyptian President Sisi and U.S. President Trump.

The summit aims to end the Gaza conflict and strengthen efforts to achieve peace and stability in the Middle East, opening a new chapter for regional security and stability. It is reported that leaders from over twenty countries and United Nations Secretary-General Guterres will attend the summit.

Financial Reports

- Cambricon

As the stock price breaks through 1520 yuan to reclaim the title of "King of A-shares" and market sentiment continues to soar, Cambricon will release its third-quarter financial report for 2025 on October 17. This report will be a key test to determine whether it can maintain its explosive growth momentum.

According to an article from Wallstreetcn, based on the performance in the first half of the year, Cambricon's revenue surged 4347.82% year-on-year to 2.881 billion yuan, successfully turning a profit with a net profit of 1.038 billion yuan Among them, the cloud product line contributed 99.6% of the revenue, highlighting the company's precise positioning in the explosive demand for AI computing power.

- Samsung Electronics

On October 14th, Samsung Electronics will announce its preliminary performance for the third quarter of 2025. The market generally expects that, driven by the semiconductor supercycle, the company's operating profit is likely to exceed 1 trillion Korean won, reaching a new high in over a year. This performance rebound is mainly attributed to the strong recovery of the semiconductor business, particularly the surge in demand for general memory from AI servers, which has significantly driven up DRAM prices. At the same time, the previously loss-making wafer foundry business is expected to see a substantial narrowing of losses, which may jointly drive an unexpected performance in the third quarter.

- ASML

Lithography giant ASML will release its third-quarter performance for 2025 on October 15th. Against the backdrop of the AI wave driving demand for high-end chips, the market expects its sales to reach 7.4 to 7.9 billion euros. This optimistic expectation mainly stems from its monopolistic position in high-end extreme ultraviolet (EUV) lithography systems, which are essential for manufacturing 3nm and 2nm chips that power AI accelerators and data centers. However, geopolitical risks and uncertainties in trade policies remain potential challenges that investors need to closely monitor.

- Taiwan Semiconductor

Taiwan Semiconductor will announce its third-quarter performance for 2025 on October 16th. Previously, its Q3 revenue was disclosed as NT$ 989.92 billion, a year-on-year increase of 30%, exceeding market expectations. Driven by strong demand for AI chips globally, especially from clients like NVIDIA and AMD, the company's performance has been impressive. The market will focus on the details of its profits and future performance guidance this time to verify whether the AI-driven growth momentum can be sustained and to provide important clues for the global semiconductor industry's outlook