Since the explosive IPO, executives of the "AI Cloud New Star" CoreWeave have "cashed out" over 1 billion USD

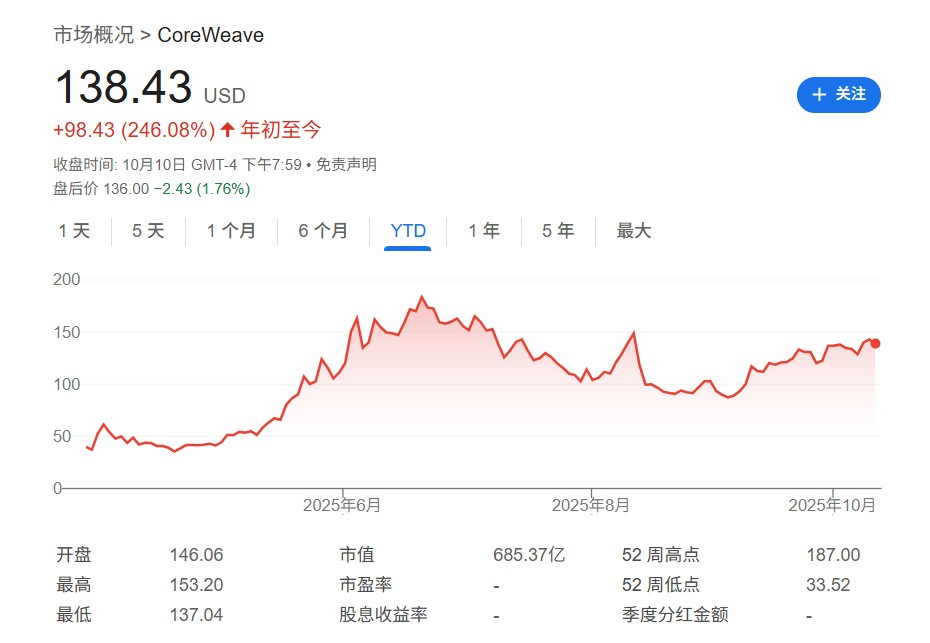

CoreWeave's executives and board members sold over $1 billion worth of stock after the stock lock-up period ended in mid-August. Since its IPO, the company's stock price has soared over 250%. This phenomenon is not an isolated case; data shows that among the top ten internal sellers in the third quarter, seven are from AI-related companies, with Amazon founder leading the way with a reduction of $4.9 billion. Jensen Huang also cashed out over $700 million by selling shares

Is the AI cash-out wave starting?

The artificial intelligence boom is not only reshaping the market landscape but also creating immense wealth for insiders at companies, who are converting these paper gains into real cash.

On October 12, according to data from Washington Service tracking such transactions, insiders at CoreWeave, an AI computing company at the center of this wave, quickly sold over $1 billion worth of stock after the lock-up period for its IPO ended in mid-August.

This marks the first opportunity for insiders to cash out on a large scale since the company's stock price soared over 250% following its listing in March this year.

This trend is not limited to CoreWeave. Among the top ten insider sellers in the third quarter, seven were from companies profiting from AI.

CoreWeave Executives Lead the Cash-Out Wave

As a rising star in the AI field, CoreWeave has seen remarkable stock performance since its listing in March, providing substantial returns for early investors and the executive team. Once the lock-up period ended, significant cash-outs followed.

According to Washington Service, the company's director Jack Cogen sold $477 million worth of stock in the third quarter, becoming the largest seller among insiders. He was followed by co-founder Brannin McBee, who raised $426 million through stock sales.

Reports indicate that both sales were executed under a pre-established "10b5-1" trading plan, which is tied to the stock price reaching specific targets.

In addition to executives, CoreWeave's largest institutional shareholder, Magnetar Financial LLC, also sold nearly $1.9 billion worth of shares during the same period.

However, an October filing shows that the Illinois-based hedge fund still holds over 20% of the company's Class A shares after the reduction. Both CoreWeave and Magnetar declined to comment on the related transactions.

AI Boom Creates Major "Stock Sellers," Jensen Huang Cashes Out Over $743 Million

The insider sell-off at CoreWeave is just a microcosm of the wealth realization across the entire AI industry. The presence of AI-related companies is evident throughout the insider seller rankings in the third quarter, confirming the significant impact of this technological revolution on personal wealth.

The stock price of networking equipment company Arista Networks reached an all-time high following its analyst day in September. Its CEO, Jayshree Ullal, sold over 6 million shares in the third quarter under her "10b5-1" plan, totaling $861 million, placing her second on the list.

As the absolute leader in the AI chip sector, NVIDIA CEO Jensen Huang continued to execute his planned sales, cashing out over $743 million in the third quarter. According to Washington Service, the total amount sold by NVIDIA insiders has approached $1.5 billion in the first three quarters of 2025 **

Cashing out $4.917 billion, Amazon founder Jeff Bezos tops the list

Despite frequent sell-offs by executives in the AI sector, the largest insider seller in the third quarter remains Amazon founder Jeff Bezos.

He completed a sale of 21.675 million shares in the third quarter, cashing out a total of $4.917 billion, a figure that exceeds the combined total of the other nine sellers on the list.

This sale is part of his plan to sell 25 million shares worth nearly $5.7 billion between June and July. According to data compiled by Bloomberg, Bezos often uses the proceeds from stock sales to fund other projects, including his space company Blue Origin.

Other notable faces on the list

In addition to the aforementioned individuals, the top ten sellers in the third quarter also included several other billionaires from the technology and finance sectors.

-

Frank Slootman: Chairman of cloud data company Snowflake, sold $463 million worth of stock.

-

Tony Ressler: Co-founder of investment firm Ares Management Corp., sold $357 million worth of stock.

-

Herald Chen: Director and former CFO of mobile advertising technology company AppLovin Corp., sold nearly $313 million worth of stock.

-

Baiju Bhatt: Co-founder of trading platform Robinhood Markets Inc., sold nearly $300 million worth of stock.

-

Brian Armstrong: CEO of cryptocurrency exchange Coinbase Global Inc., sold $268 million worth of stock, stating on social media that the proceeds would be used to fund scientific research and his co-founded biotechnology startup