The U.S. stock market bull market welcomes its third anniversary! The "technology solo performance" is hard to sustain, and the U.S. stock market urgently needs to "expand its circle" to survive

The bull market in the U.S. stock market celebrated its third anniversary last Sunday, but it needs to broaden its gains to maintain momentum. The S&P 500 has risen 83% since October 2022, with a market capitalization increase of approximately $28 trillion. Despite facing risks such as the threat of Trump tariffs, it has still risen 13% over the past 12 months. History shows that bull markets typically need to continue rising in the fourth year, but current high valuations may pose challenges in the future. Investors need to pay attention to uncertainties surrounding government shutdowns, Federal Reserve policies, and earnings season

According to the Zhitong Finance APP, the current bull market in the U.S. stock market will celebrate its third anniversary this past Sunday. However, if history serves as a reference, it needs to quickly broaden its upward range to maintain momentum.

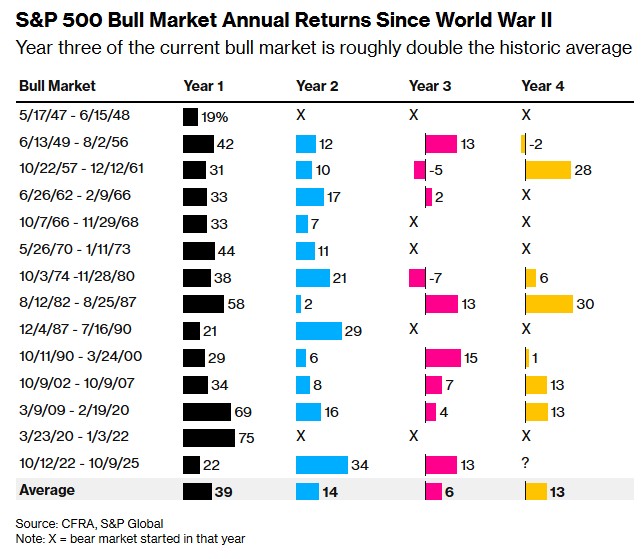

Data shows that the S&P 500 index has risen 83% since the current bull market began on October 12, 2022, with a market capitalization increase of approximately $28 trillion. Before the sell-off last Friday triggered by U.S. President Trump's tariff threats, the index's gain had once reached 88%. According to CFRA Research, even after this pullback, the S&P 500 has still risen 13% over the past 12 months, which is double the average gain in the third year of a bull market.

Since World War II, there have been 13 bull markets in the U.S., of which 7 extended into the fourth year, with an average cumulative gain of 88%. The current bull market has nearly achieved this level in just three years, bringing the past price-to-earnings ratio of the S&P 500 to 25 times—this is the highest level in the third year of previous bull markets. Sam Stovall, Chief Investment Strategist at CFRA and a veteran on Wall Street, stated, "I have never seen anything like this."

From the current situation, the battle between bulls and bears is becoming increasingly intense: Is the U.S. stock market rising too high and too fast?

Sam Stovall noted, "Due to high valuation multiples, tariff and economic concerns, and the fact that next year is a midterm election year in the U.S.—which typically means increased volatility due to policy uncertainty—2026 could be a tough year for U.S. stocks. However, history shows that the market has not fallen to a point where failure is inevitable; it just means that the rate of increase needs to moderate in the future."

Some Wall Street professionals are expressing concerns about potential risks. Investors experienced this risk last Friday—Trump's tariff remarks led to the worst single-day performance of the S&P 500 since April 10. Additionally, the market faces uncertainties such as a potential U.S. government shutdown, the Federal Reserve's interest rate path, and the upcoming third-quarter earnings season.

Louise Goudy Willmering, a partner at Crewe Advisors, stated, "Given that the market has risen too quickly, if companies express any growth concerns in their earnings reports, this earnings season could trigger volatility." Her wealth management firm is increasing its holdings in lower-valued international stocks.

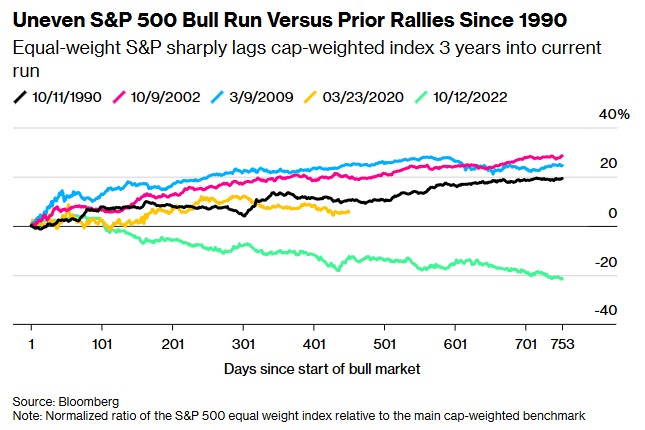

A key risk in the current U.S. stock bull market is its significant concentration, with the rise primarily driven by tech giants, such as Nvidia (NVDA.US) whose stock price has soared nearly 1500% over the past three years, and Meta Platforms (META.US) which has risen over 450%. However, many stocks are significantly lagging behind.

For example, the performance of the S&P 500 equal-weight index has lagged the S&P 500 index by 21 percentage points since October 2022—this is the largest relative lag of the equal-weight index at the beginning of a bull market since the 1990s. Data shows that in the subsequent three bull markets, the equal-weight index outperformed the main index by an average of 24 percentage points by the third year

Fidelity Investments' Global Macro Director Jurrien Timmer pointed out that this phenomenon is not unusual. Typically, the early stages of a bull market see broader participation, as the Federal Reserve often cuts interest rates to support the economy. However, this time it is quite the opposite—the Federal Reserve raised interest rates in 2022 to curb inflation, leading to a significant increase in market concentration. Currently, the so-called "seven giants" of U.S. stocks have reached a historic high in their weight within the S&P 500 index, accounting for about one-third.

However, well-known bull Jim Paulsen believes that despite this, almost no professional investors expect a bear market to arrive, as the Federal Reserve may intervene if the situation worsens. He anticipates that market breadth will gradually expand to equal-weight stocks and small-cap stocks, stating, "After three years of excessive gains, there may be some bumps." Jim Paulsen remarked, "Do not go against the Federal Reserve or market trends."

The risks at the current cycle stage are evident. Entering 2025, the S&P 500 has risen over 20% for two consecutive years, the first time since the late 1990s. As stock valuations approach historical highs, some investors are beginning to consider whether they should reduce their stock holdings. In a sense, this is precisely why last Friday's comments on tariffs by Trump triggered a sell-off—investors seized the opportunity to take profits and reduce some high-position holdings.

Rose Advisors portfolio manager Patrick Fruzzetti stated, "Now is the time to rebalance the portfolio." He chose to reduce his holdings in the technology sector and buy undervalued healthcare stocks. He added, "If you have made substantial profits from large tech stocks over the past few years, it makes sense to shift towards sectors that will benefit from interest rate cuts."

Nevertheless, stock market bulls still have historical data to support them. CFRA data shows that since World War II, bull markets have averaged 4.6 years in duration, with the S&P 500 index averaging a cumulative return of about 157%. Therefore, the current bull market, lasting only three years with an 83% return, theoretically still has considerable upside potential, providing room for sectors outside of tech giants to catch up.

Jurrien Timmer stated, "There are currently no signs that the stock market has entered a danger zone. The greater risk is that if yields rise back toward 5%, valuations may be forced to reset, and if the AI boom evolves into a bubble, it could trigger significant sell-offs. Therefore, expanding market participation from now on is crucial."