Goldman Sachs: Tencent's valuation is not considered harsh; it remains the most certain AI application beneficiary stock in China

Goldman Sachs believes that AI can empower almost all of Tencent's business lines. Currently, Tencent's price-to-earnings ratio for 2026 is 19 times (16 times excluding investments), which is lower than Meta and Google. Goldman Sachs has raised its forecast for Tencent's capital expenditure to RMB 350 billion and is optimistic about the accelerated growth of the mixed Yuan model in LMarena and the cloud business sector

Goldman Sachs reiterated its "Buy" rating on Tencent Holdings in a recent research report and raised its target price, believing that despite the significant rise in the company's stock price this year, its valuation is not harsh compared to global peers. Tencent remains the most certain beneficiary of AI applications in the Chinese market.

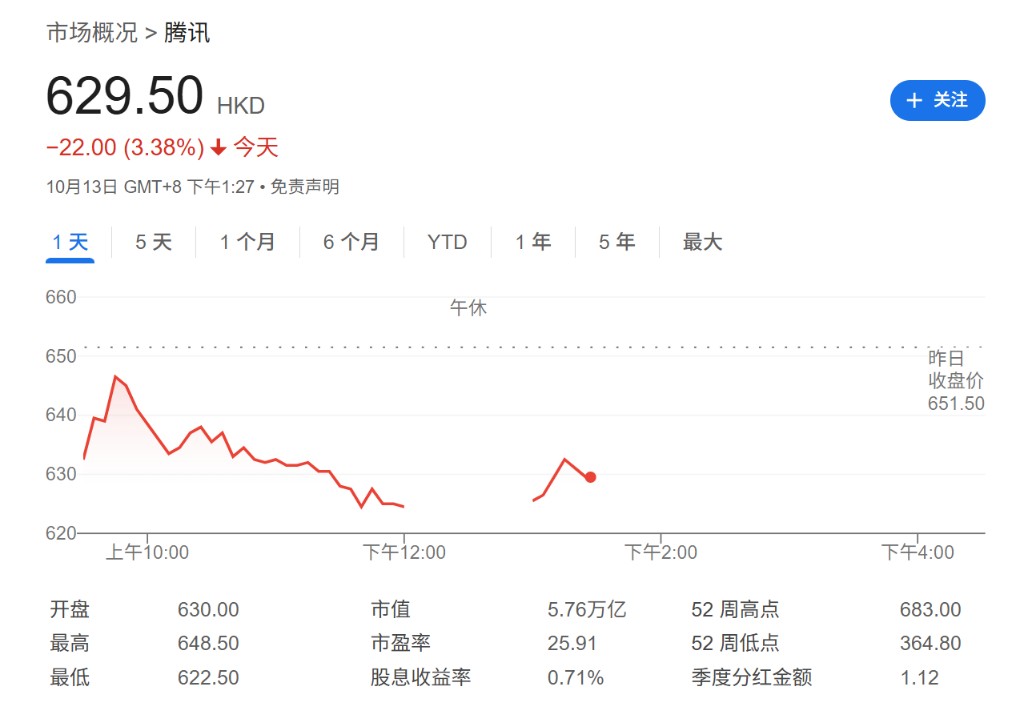

According to news from the Wind Trading Desk, in a report released on the 12th, Goldman Sachs analysts Ronald Keung and others raised Tencent's 12-month target price from HKD 701 to HKD 770. So far this year, Tencent's stock price has risen by 51%, outperforming the 44% increase of the Hang Seng Tech Index during the same period.

Goldman Sachs believes that despite renewed investor concerns about geopolitical risks, Tencent's fundamentals remain strong. Its valuation level, monetization potential in multiple AI application areas, and stable shareholder return policy together form its core investment logic.

The firm expects that the market will focus on Tencent's upcoming third-quarter results, to be announced on November 13, particularly regarding its AI applications and capital expenditure outlook, foundational and multimodal large model capabilities, as well as the growth visibility of core businesses such as gaming and advertising. It is expected that Tencent's Q3 revenue will grow by 13% year-on-year, and earnings per share will increase by 18% year-on-year, with the latter's growth rate continuing to reach 1.5 times that of revenue growth. This is mainly driven by high-margin businesses such as advertising, gaming, and consumer finance, as well as the overall operational leverage of the company.

Valuation Still Has Room, Below Global Peers

Although the stock price has undergone a round of revaluation, Goldman Sachs believes that Tencent's valuation is still not harsh. The report points out that Tencent's current valuation corresponds to a 19 times expected non-IFRS price-to-earnings ratio for 2026, which drops to 16 times when excluding its investment portfolio. In international comparisons, its IFRS-based price-to-earnings ratio is 22 times, lower than global tech giants like Meta (24 times) and Google (23 times).

Goldman Sachs provided valuations for Tencent's stock price under three scenarios: base case, bull market, and bear market, at HKD 770, HKD 846, and HKD 541 respectively, believing that its risk-return profile leans towards the positive. Analysts believe that the commercialization level of Tencent's assets is relatively insufficient, and AI will bring multiple new monetization drivers to various business lines, leaving room for future growth. As of the time of writing, Tencent's stock price is HKD 629 per share.

AI Fully Empowering, Breakthroughs in Mixed Yuan Large Models

Goldman Sachs views Tencent as "one of the best-positioned core targets for AI applications in the Chinese internet industry," **with the core logic being that AI can empower almost all of Tencent's business lines, including gaming, advertising, fintech, cloud services, and e-commerce, and achieve implementation through its unique WeChat ecosystem and global gaming assets **

The report particularly emphasizes Tencent's latest breakthroughs in the AI field. Its self-developed Hunyuan Image 3.0 large model recently ranked first on the authoritative text-to-image model leaderboard LMarena, outperforming global leading peers, including models under OpenAI. This marks the first time the Hunyuan large model has topped a global benchmark test. Additionally, its AI application "Yuanbao" App achieved a 12% quarter-on-quarter growth in daily active users (DAU) in the third quarter (according to QuestMobile data).

Goldman Sachs believes that by drawing on the example of Kakao's collaboration with OpenAI to integrate its model into KakaoTalk, WeChat is expected to explore more AI agent functionalities beyond AI search and productivity features in the future, further strengthening its position as a "super app."

Upgraded Capital Expenditure and Cloud Business Expectations

Based on an optimistic assessment of AI demand, Goldman Sachs has raised its capital expenditure forecast for Tencent. The firm has increased its total capital expenditure forecast for Tencent from RMB 300 billion to RMB 350 billion for the fiscal years 2025 to 2027, and expects annual capital expenditures to reach RMB 100 billion, RMB 117 billion, and RMB 129 billion respectively for 2025 to 2027.

Goldman Sachs believes that the increase in domestic chip supply in the coming years will support Tencent's AI inference demand. The increase in capital expenditure will directly benefit the cloud business. Therefore, Goldman Sachs has significantly raised its revenue growth forecast for Tencent Cloud, expecting growth rates of 11%, 25%, and 20% for 2025, 2026, and 2027 respectively, far exceeding previous forecasts of 8%, 7%, and 6%. Based on the higher growth expectations, Goldman Sachs has also raised the valuation of Tencent's cloud business from HKD 38 per share to HKD 48 per share.

Steady Growth in Game Advertising and Continuous Margin Expansion

Goldman Sachs maintains an optimistic outlook for traditional core businesses as well.

- Gaming Business: It is expected that game revenue will grow by 16% year-on-year in the third quarter of 2025 and by 18% for the full year. The growth momentum comes from the strong performance of new games such as "Delta Force" and the steady operation of evergreen games like "Honor of Kings." Additionally, the pipeline of heavyweight games such as "Path of Exile 2" provides a clear roadmap for future growth.

- Advertising Business: It is expected that marketing services revenue growth will be 19% in both the third quarter and for the full year of 2025. AI-driven upgrades in advertising technology have improved click conversion rates, while the increased loading rates of video account ads and the release of new inventory such as WeChat search ads will continue to drive advertising revenue growth.

- Profit Margins: Goldman Sachs expects Tencent's profit margins to continue expanding, with the operating profit margin (OPM) in the third quarter of 2025 expected to expand by 212 basis points. However, as AI-related GPU depreciation costs, R&D investments, and marketing expenses increase, the gap between profit growth and revenue growth may gradually narrow in the future