Historic short squeeze, historic prices! Silver soars, returning to the price of the "Hunt Brothers squeeze"

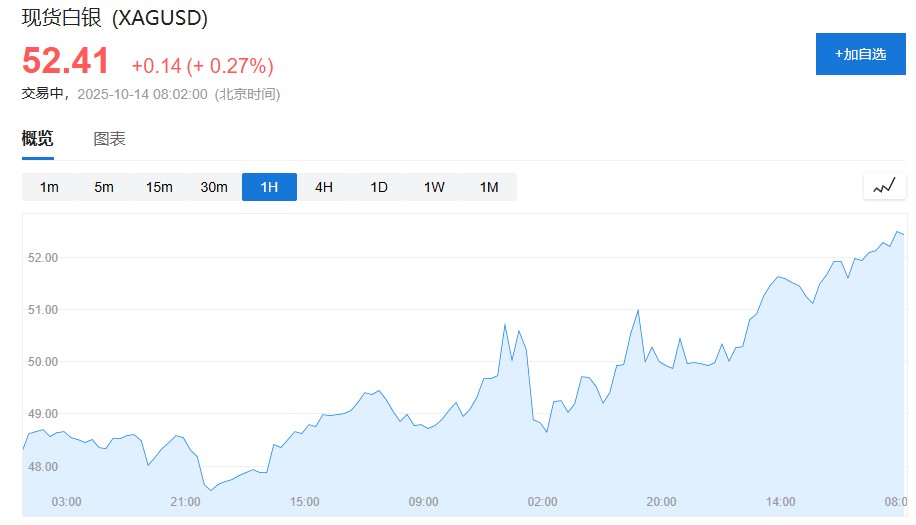

A historic short squeeze is sweeping the silver market, with the London spot silver price rising by 0.4% at one point, reaching a historic high of $52.5868 per ounce. Goldman Sachs warned that this round of gains is primarily driven by physical tightness in the London market, and as a large influx of physical silver from China and the United States is expected to alleviate this tightness in the next 1-2 weeks, silver prices may face a sharp adjustment

A historic short squeeze is sweeping through the London silver market, with severe spot shortages pushing silver prices to unprecedented heights, breaking the record set in 1980 when the Hunt brothers attempted to manipulate the market.

According to Bloomberg data, the London spot silver price once rose by 0.4%, reaching a historic high of $52.5868 per ounce. This price surpasses the $52.50 peak set in January 1980 at the Chicago Mercantile Exchange (now defunct), when Texas billionaire Hunt brothers attempted to corner the market by hoarding silver.

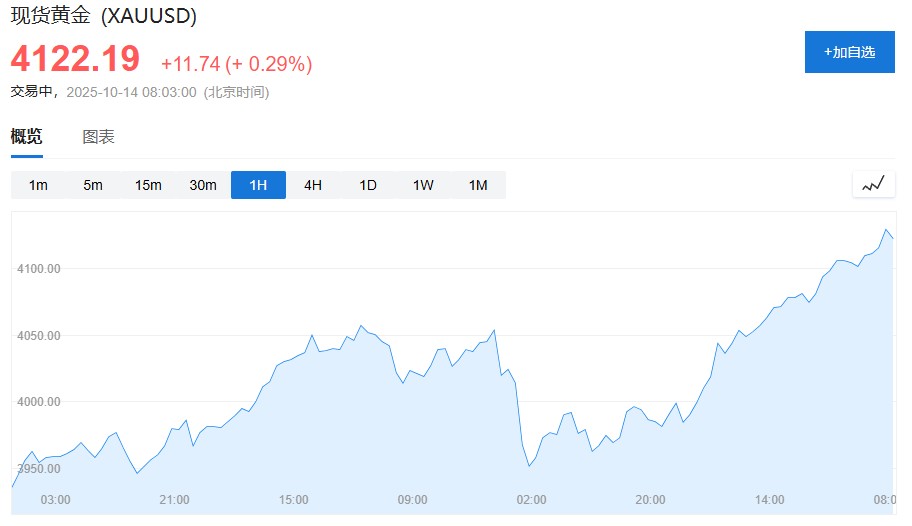

Driven by silver, spot gold also climbed to $4,150 per ounce, setting a new historical high.

Wallstreetcn previously mentioned that due to strong safe-haven demand, a surge in Indian buying, and concerns over potential tariffs in the U.S., London silver inventories have been rapidly depleted, leading to a global rush for silver amid this liquidity crisis.

At one point, the London spot price was $3 higher than the New York futures price, an unprecedented premium that prompted traders to take extreme measures—chartering cargo holds on transatlantic flights to airlift silver bars, a costly operation typically reserved for transporting gold. Although the premium fell back to about $1.55 in Tuesday's early trading, market tensions remain unabated.

London Liquidity Crisis, Borrowing Costs Soar

Liquidity in the London silver market has nearly dried up, putting immense pressure on traders holding short positions. Unable to find physical silver available for delivery in the market, they are forced to pay exorbitant rollover costs. Data shows that the one-month leasing rate for London silver (the cost of borrowing silver) has surged to over 30%, while the annualized overnight borrowing cost even briefly exceeded 100%.

"I have never seen anything like this before," said Anant Jatia, Chief Investment Officer of Greenland Investment Management. "What we are seeing in the silver market is completely unprecedented, and there is almost no liquidity in the market."

The extreme lack of liquidity is due to the sharp decline in the available silver inventory for trading in London vaults. According to Bloomberg data, since mid-2019, the freely available silver inventory in the London market has plummeted by 75% from about 850 million ounces to only around 200 million ounces. Robert Gottlieb, former Managing Director at JP Morgan and precious metals trader, pointed out, "Banks are unwilling to quote each other, leading to extremely wide bid-ask spreads." "This has caused a significant liquidity shortage."

This round of forced liquidation is the result of multiple overlapping forces.

First, against the backdrop of global economic uncertainty, investors have flocked to safe-haven assets such as gold and silver to hedge against U.S. debt risks, fiscal deadlock, and currency devaluation risks. Secondly, the unexpected surge in demand from India in recent weeks has further drained the already tight inventories in London. In addition, concerns in the market about the U.S. government potentially imposing tariffs on key minerals, including silver, under the "Section 232" provision have also led to some metals being preemptively withdrawn from the market, exacerbating supply tightness. The London Bullion Market Association (LBMA) has issued a statement saying it is "actively monitoring the situation."

Goldman Sachs Issues Warning of Severe Adjustments

In the face of historic prices, market institutions have differing views on the future of silver. Bank of America analysts have raised their silver price target for the end of 2026 from $44 per ounce to $65 per ounce, citing ongoing supply shortages, high fiscal deficits, and a low-interest-rate environment.

However, Goldman Sachs has issued a warning, stating that the current price surge is primarily driven by physical tightness in the London market, and as a large influx of physical silver from China and the U.S. is expected, this tightness is anticipated to ease in the next 1-2 weeks, but the adjustment process will be "extremely volatile."

Goldman Sachs analysts wrote in a report: "The liquidity in the silver market is worse, with a scale of about one-ninth that of gold, which amplifies price volatility. In the absence of central bank buying as a price anchor, even a temporary decline in investment flows could trigger a disproportionate correction."