AI ignites memory demand, Samsung profits hit the highest since 2022, stock price reaches a new high

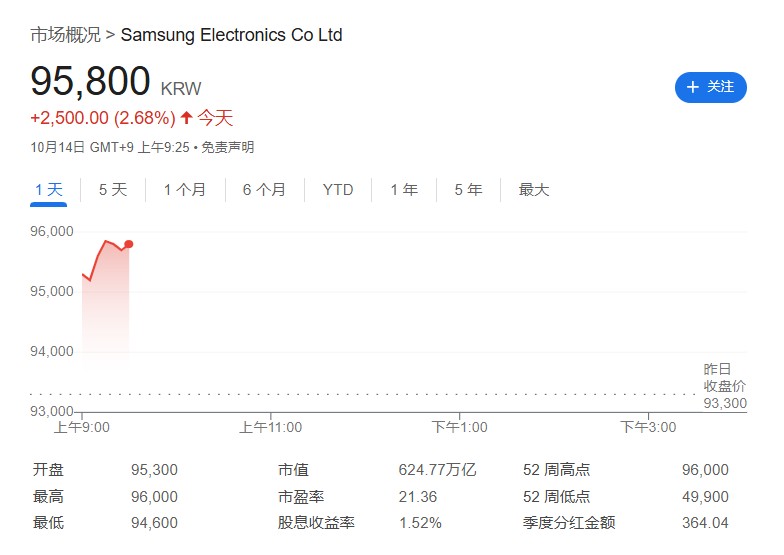

Thanks to the surge in demand for memory chips driven by AI development, Samsung Electronics' operating profit in the third quarter reached 12.1 trillion won, far exceeding the expected 9.7 trillion won, marking the highest quarterly profit since 2022. At the same time, Samsung has made progress in the HBM chip sector, having secured orders from AMD and is seeking final approval from NVIDIA, striving to catch up with competitor SK Hynix. The company's stock price rose over 3% today, setting a new high

Thanks to the global chip boom triggered by artificial intelligence (AI), Samsung Electronics' profitability is experiencing a strong rebound.

According to a preliminary financial report released on Tuesday, October 14, the largest South Korean company reported an operating profit of 12.1 trillion won (approximately $8.5 billion) for the third quarter, far exceeding analysts' expectations of 9.7 trillion won. Revenue rose about 9% to 86 trillion won. The company will provide a complete financial statement, including net income and details by department, on October 30.

This strong performance has greatly boosted market confidence. Investors are more optimistic about the durability of demand for AI servers and memory chips. Encouraged by signs of recovery in its key semiconductor division, Samsung's stock price has soared more than 60% since early June. Typically, the semiconductor business contributes 50% to 70% of Samsung's annual profits.

The company's stock price continued to rise, increasing by 3.1% at one point in early trading on Tuesday in the Seoul market, reaching an all-time high.

Samsung is actively adjusting its strategy to seize the enormous opportunities brought by AI in the coming years. The company has made progress in its latest high-bandwidth memory (HBM) chips and has received orders from AMD, while its HBM3E chips are awaiting final approval from NVIDIA.

Strong Demand for AI Chips, Semiconductor Business Recovery

The core of Samsung's performance rebound lies in the recovery of its semiconductor division.

Bloomberg analyst Masahiro Wakasugi pointed out that Samsung's DRAM profits in the third quarter may have increased due to strong sales of traditional DRAM and high-bandwidth memory (HBM) chips. Meanwhile, thanks to AI demand, profits from NAND chips may also have improved.

The analyst also added that the company's display division profits may have increased due to high-end smartphone customers, while profits in the mobile division may have grown due to the strong sales of new foldable phones.

In the lucrative AI chip sector, Samsung is striving to catch up.

Due to some previous missteps in research and development, Samsung was once overtaken by competitor SK Hynix in the HBM market. Now, investors are betting that Samsung can catch up and supply HBM chips to AI giants like NVIDIA. Samsung stated in its July earnings call that it expects "meaningful expansion" of high-end memory products for servers in the second half of the year.

Market optimism has also been fueled by major industry projects. Reports indicate that this month, both Samsung and SK Hynix have reached agreements to supply chips for OpenAI's "Interstellar Gateway" project. The expected HBM demand from this project is more than twice the current global total capacity.

This outlook, combined with the continuous rise in memory chip prices, has prompted dozens of analysts to recently raise their target stock prices for Samsung