Morgan Stanley: The Federal Reserve's remarks are "a leaf blocking the view," only seeing U.S. inflation and not global deflation

Morgan Stanley's report warns investors against ignoring global deflation trends while overly focusing on U.S. inflation. The report points out that the global CPI annual inflation rate has fallen to 3.3%, showing strong downward momentum. It advises investors to hedge against the risk of U.S. inflation decline by buying U.S. Treasury bonds and shorting the dollar. The report emphasizes that investors' reliance on central bank statements has led them to overlook broader cyclical trends and that they need to pay attention to the overall performance of the global economy

Morgan Stanley global macro strategist Matthew Hornbach and his team issued a significant report titled "Ignoring Global Deflation" on October 13, providing a clear and sharp warning to the market.

Morgan Stanley believes that the global inflation trend is clearly on a downward trajectory, and investors may be overly concerned about inflation in the United States. Before the impact of tariffs becomes clearly evident, it is recommended to hedge against the downside risk of U.S. inflation by buying U.S. Treasury bonds and shorting the dollar.

As Federal Reserve officials and many investors remain worried about high inflation in the U.S., this report offers a sobering global perspective for those investors "kidnapped" by hawkish Fed rhetoric and domestic U.S. data, with its core value lying in revealing significant disconnections in the macro view.

Ignoring the Major Trend of Global Deflation

The report sharply points out that current investors' reliance on central bank rhetoric has reached a 30-year peak, making them prone to overlook broader cyclical trends and becoming mere followers of individual central bank officials' opinions. The excessive focus on U.S. inflation is a typical case of "seeing the trees but not the forest." When we shift our gaze from the "tree" of the U.S. to the "forest" of the globe, the scene is entirely different.

Morgan Stanley emphasizes this overlooked reality with data:

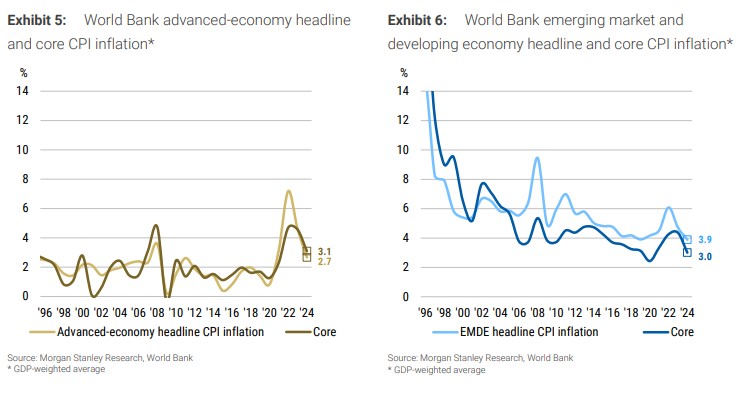

As of September, the global CPI annual inflation rate was 3.3%, having fallen to the bottom of the pre-pandemic steady-state range, significantly lower than the 4.5% a year ago. Since peaking at 10.3% in October 2022, the global CPI annual rate has been declining for 80% of the past 35 months—demonstrating its strong downward momentum.

The report further analyzes that the main driver of this round of global deflation comes from emerging markets and developing economies (EMDE), where core inflation and overall inflation have both fallen to decades-low levels. Contrary to market speculation over the years, the increasingly multipolar world order has not led to higher and stickier CPI inflation.

Tariffs: Catalyst for Inflation or Profit Killer?

Of course, tariffs are an obvious risk. However, Morgan Stanley believes the situation is not that simple. Companies may choose to sacrifice profit margins to absorb costs rather than directly pass them on to consumers, which could actually increase the downside risk for the labor market and CPI inflation. Alternatively, companies could digest costs by improving productivity, which could also suppress inflation.

The conclusion of the report is clear and powerful: investors should "look globally, act locally" to hedge against the downside risk of U.S. inflation. Specific recommendations include buying U.S. Treasury bonds (especially 5-year bonds) and shorting the dollar. In the face of global deflationary headwinds, making decisions solely based on U.S. inflation data is akin to seeing a leopard through a tube.

Risk Warning and Disclaimer The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk