On October 16th, "Analyst Day," Oracle attracted the attention of the entire market

The unprecedented RPO growth in Q1 has created high expectations. During this "Analyst Day," investors' focus shifted to the capital expenditures and margin impacts required for the success driven by AI. Additionally, analysts have concerns about the deliverability of the large-scale AI contracts signed by Oracle with OpenAI, NVIDIA, and others

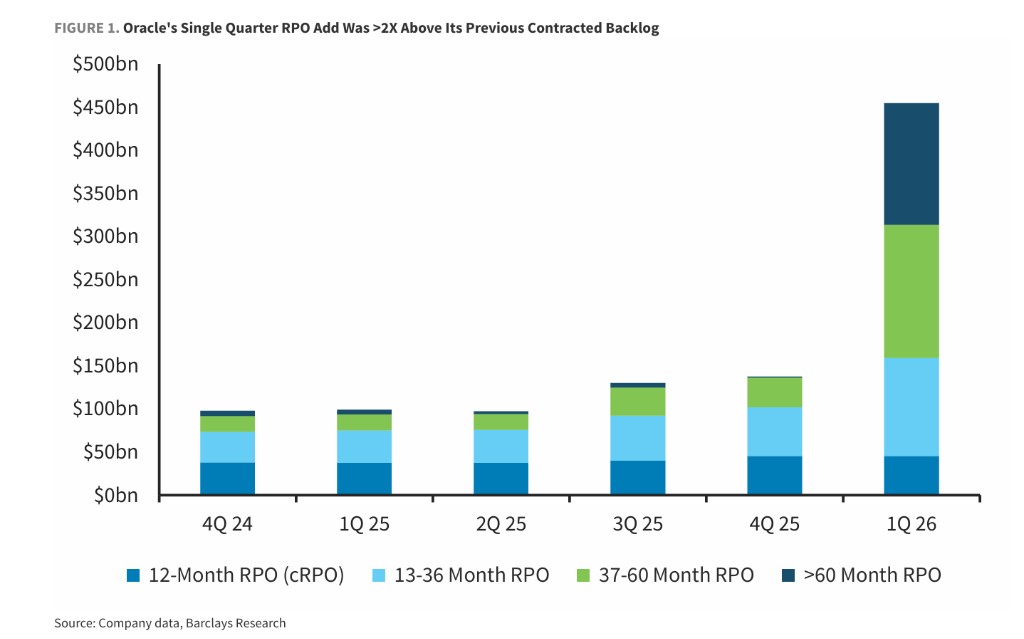

Oracle is set to hold its Financial Analyst Day on October 16, attracting unprecedented attention, with an unprecedented increase of $317 billion in remaining performance obligations (RPO) for the first fiscal quarter and a subsequent 36% rise in stock price creating extremely high expectations.

According to Wind Information, Barclays analysts believe in a report on the 13th that although the company has raised its mid-term growth expectations in its financial report, management still has the opportunity to help investors enhance their confidence in the complex factors behind its AI-driven success, which may attract more investor interest.

Oracle's quarterly increase in remaining performance obligations (RPO) reached an unprecedented $317 billion, fundamentally changing Wall Street's expectations for its future growth. This unprecedented performance drove the stock price up 36% in a single day, marking the largest single-day increase since 1992. The company expects RPO to exceed $500 billion by the end of the year, a 12-fold increase from five years ago.

However, the enormous opportunities also bring equally large challenges. The market is generally uneasy about the massive computing power required to support these AI-related RPOs and recent supply chain constraints, raising concerns about whether Oracle can deliver contracts within the expected timeframe. These execution risks, combined with recent large AI computing agreements with companies like OpenAI, NVIDIA, and AMD, have made investors eager for clearer information at the Analyst Day.

The market's focus has shifted from surprises in revenue growth to a deep exploration of actual execution and financial impact. Barclays analysts believe that management has the opportunity to help investors build confidence at this event by detailing the "moving parts" behind the massive orders, which may attract more incremental investor interest. Therefore, this Analyst Day is not only a stage for Oracle to showcase its achievements but also a critical test for addressing market concerns and consolidating confidence.

Historic RPO Growth Sets a Positive Tone, Capital Expenditure and Profit Margins Become Focus Areas

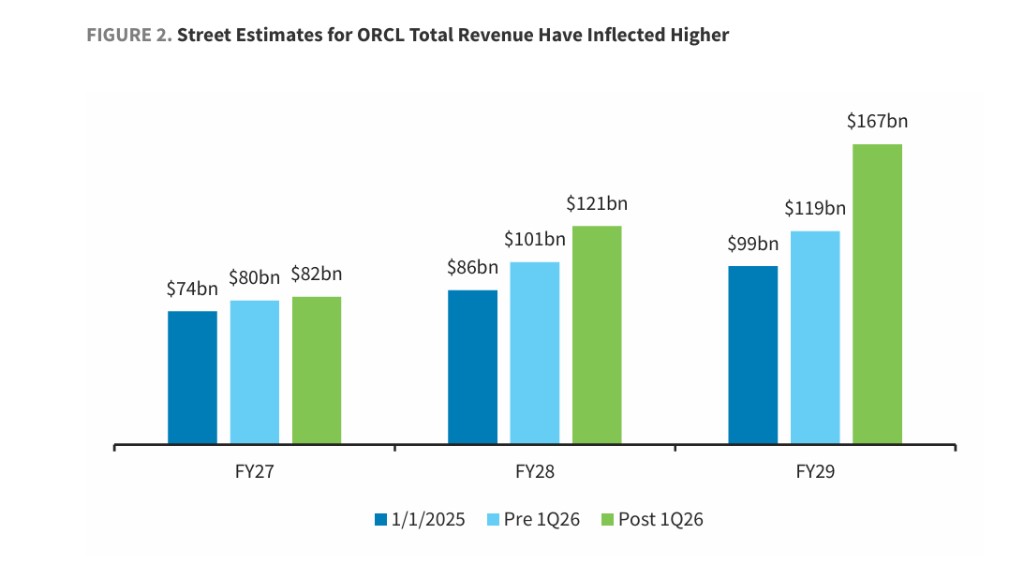

After achieving a record $317 billion increase in RPO in the first fiscal quarter (more than double its previous RPO stock), Oracle has successfully presented a grand narrative about long-term growth to investors. This astonishing growth has prompted market analysts to significantly raise their expectations, with revenue forecasts for Oracle's fiscal year 2029 soaring from $99 billion to $167 billion.

According to Barclays analysis, much of the revenue growth potential from these large AI contracts may already be reflected in the updated general expectations. Oracle provided mid-term revenue guidance for its cloud infrastructure (OCI) business in its first fiscal quarter financial report but did not update the company's total revenue targets. As a result, investors' core concerns have now shifted to the capital expenditure (CapEx) and profit margin impacts behind these deals. Oracle has raised its capital expenditure guidance for fiscal year 2026 from "over $25 billion" to $35 billion, but analysts generally expect that future expenditures will rise significantly to deliver the contracted computing power The more critical issue lies in profit margins. Barclays estimates that the gross margin for AI training businesses is slightly above 25%. Therefore, the market generally expects that the increase in AI revenue will compress the company's overall operating profit margin. Investors will closely monitor management's explanations regarding unit economics (such as capital expenditures and revenue per gigawatt, payback periods, etc.) to better assess Oracle's profit prospects. Additionally, recent media reports indicate that Oracle's GPU server business has a gross margin of about 14%, and Barclays expects Oracle to refute this claim on Analyst Day to stabilize investor confidence in the business's profitability.

Large Contracts Raise Concerns About Feasibility and Single-Client Risk

Among all new contracts, the deal with OpenAI is the most notable and has raised the most questions. Oracle has signed a $300 billion cloud computing agreement with OpenAI to develop up to 4.5 gigawatts of "Stargate" AI data center capacity over five years. The size of this massive contract has led investors to have concerns about its feasibility from two dimensions.

On one hand, the market worries about whether Oracle can handle potential power and data center equipment supply chain constraints to deliver such massive computing power on time. On the other hand, given that the contract amount far exceeds OpenAI's current revenue levels and its high cash burn, investors also have doubts about its payment capability.

These concerns were further exacerbated after OpenAI recently announced large-scale computing power agreements with other suppliers. Among them, NVIDIA announced it would provide OpenAI with up to $100 billion in funding to help build a data center scalable to 10 gigawatts; meanwhile, AMD also announced a strategic partnership with OpenAI to deploy 6 gigawatts of AMD GPUs. These developments naturally raised more questions among investors regarding the stability of Oracle's partnership with OpenAI and the risks associated with a single large client. Barclays believes that Oracle's management has an opportunity to provide more information on these issues during Analyst Day to alleviate market concerns.

Management Changes and Major Transactions Become New Highlights

At a critical moment of business transformation, Oracle also announced significant management changes. Following the long-term successful leadership of Larry Ellison and Safra Catz, the company promoted former OCI President Clay Magouyrk and former Industrial President Mike Sicilia to Co-CEOs. Ellison and Catz will continue to remain active in the company to ensure a smooth transition in leadership.

This unexpected move initially caused some confusion in the market, but the feedback ultimately trended positive. Barclays analysts pointed out that Oracle's long-standing highly centralized management structure had raised investor concerns about succession planning, and this adjustment helps to form a more traditional corporate governance structure, eliminating a long-standing risk Investors are expected to seek more details on how the new Co-CEO structure will collaborate during Analyst Day.

To support its massive AI data center construction plan, Oracle recently successfully raised $18 billion in the bond market, with the issuance receiving nearly $88 billion in oversubscription. This indicates that the market understands the necessity for Oracle to finance its RPO. The company's financing needs, leverage levels, and the impact on earnings per share are expected to be another core topic at Analyst Day.

Additionally, it has been reported that Oracle will become a major investor in TikTok's U.S. operations alongside Silver Lake and MGX. Oracle is expected to maintain its existing role as a cloud service provider in this transaction and may play a broader role in the company's operations. The details of this transaction and its investment impact may also become one of the discussion topics at Analyst Day.

Barclays maintains Oracle's "Overweight" rating and raises the target price from $347 to $367, based on a 33 times price-to-earnings ratio for an expected earnings per share of $14.82 in 2029. As of the time of writing, Oracle's U.S. stock rose 0.35% to $308 per share, indicating a 12% upside potential to the target price