Powering AI -- What will the U.S. do next?

Morgan Stanley's report points out that the U.S. AI industry faces a dual bottleneck of electricity access and key raw materials, which may prompt the next government to take significant policy actions. The report emphasizes that the contradiction between the demand for AI computing power and the tight electricity supply is intensifying, which may lead the Trump administration to focus heavily on reducing foreign dependence. The report lists nearly 20 key materials and extrapolates the measures the government may take to reshape the domestic supply chain and support AI infrastructure development

According to news from the Wind Trading Platform, a report released by Morgan Stanley strategist Stephen Byrd's team on October 13 is circulating among professional investors on Wall Street. The report points directly to two major bottlenecks facing the U.S. AI industry: "time to power" and reliance on key raw materials, and predicts significant actions that the next government may take. For investors trying to grasp the pulse of geopolitical and industrial policy amid the massive wave of AI, this report undoubtedly provides a crucial decision-making roadmap.

The core argument of the report is that the explosive demand for AI computing power and the increasingly strained electricity supply and dependence on key materials are rapidly intensifying. The risk of this "computing power desert" is forcing policymakers to elevate energy security and supply chain autonomy to an unprecedented strategic height.

Dual Bottlenecks of Energy and Materials

Morgan Stanley points out that the interconnectivity between AI, electricity, chips, and key materials is giving rise to a series of profound changes. The report believes that the U.S. government, particularly a potential Trump administration, will act with great urgency to address the delays in electricity access for data centers and the reliance on foreign key materials. The breadth and depth of this dependence far exceed common market perceptions.

Morgan Stanley believes:

The intersection of these factors may lead the Trump administration to take significant action regarding "time to power" and key materials... We see the connections between AI large language model capabilities, electricity, chips, and key materials becoming increasingly tight, which may lead to... (the government) being highly focused on reducing U.S. dependence on external sources for a wide range of key materials.

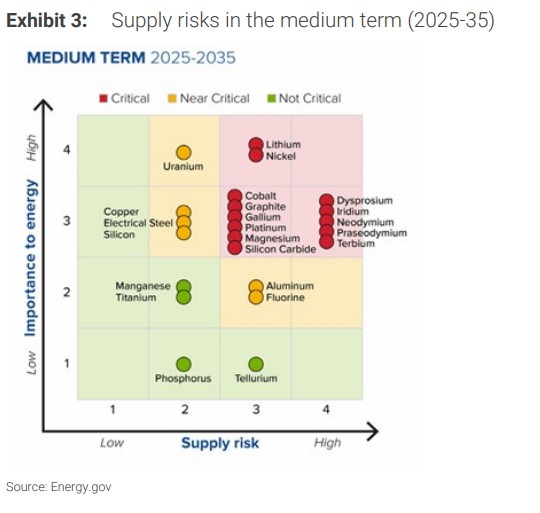

The report details nearly 20 materials with high dependence, ranging from heavy rare earths, silicon carbide to lithium, graphite, cobalt, tungsten, etc., all of which are the cornerstones supporting modern military, energy, and semiconductor industries.

Potential Policy Combinations

In the face of this severe challenge, the report outlines a set of "combinations" that the U.S. government may deploy. These potential measures are clearly aimed at reshaping domestic supply chains through strong administrative intervention and clearing obstacles for AI infrastructure development. Specific measures may include:

(1) Establishing an accelerated grid interconnection process for gas turbines related to data center development... to ensure that developers bringing new generation capacity can gain priority access to connect data centers to the grid.

(2) Providing U.S. government support for increasing gas turbine (and potential fuel cell) manufacturing in the U.S. and integrating orders from large tech companies.

(3) Establishing public-private partnerships in nuclear fuel conversion and enrichment.

If these ideas are implemented, they will directly benefit specific companies in the fields of electrical equipment, natural gas, nuclear energy, and related infrastructure, forming a clear investment trajectory.

The Strategic Value of "Time to Power"

The report creatively introduces the concept of "time to power M&A." With the nonlinear growth of AI capabilities, quickly obtaining power is becoming an extremely valuable scarce resource.

The report estimates that for a high-performance computing data center, each year it connects to the grid earlier is worth at least $4 per watt. The value of this "time arbitrage" is sharply rising, and companies that can provide rapid power solutions will see their strategic value reassessed by the market and may become potential acquisition targets for tech giants. As the president of OpenAI has expressed concern, the entire industry is facing a "supply-demand imbalance in computing power."

In summary, Morgan Stanley's analysis paints a picture of the second half of the AI race: the battlefield has extended from algorithms and chips to power plants and mines. The U.S. Department of Energy has launched the "Speed to Power initiative," signaling a shift in policy direction.

For investors, closely monitoring those companies that can address energy and material bottlenecks and may gain national support could be key to achieving excess returns in the next phase.

The above exciting content comes from the Wind Trading Platform.

For more detailed interpretations, including real-time analysis and frontline research, please join the【 **Wind Trading Platform ▪ Annual Membership**】

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at your own risk