U.S. Stock Market Outlook | Futures for the three major indices all fell, stock prices remained flat after major industry earnings were released, and Powell's speech tonight may rewrite global risk sentiment

U.S. stock index futures all fell, and market sentiment was low. Dow futures fell by 0.54%, the S&P 500 fell by 0.85%, and the Nasdaq fell by 1.11%. Major European stock indices also generally declined, while WTI and Brent crude oil prices fell. Federal Reserve Chairman Jerome Powell will deliver a speech tonight, which may affect market expectations for monetary policy. The U.S. dollar strengthened against major currencies, becoming a safe-haven asset. Goldman Sachs predicts that by 2026, American households will become the largest buyers of U.S. stocks, with net purchases potentially reaching $52 billion

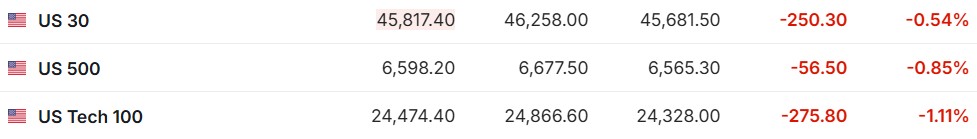

- As of October 14 (Tuesday) before the US stock market opens, the three major US stock index futures are all down. As of the time of writing, Dow futures are down 0.54%, S&P 500 index futures are down 0.85%, and Nasdaq futures are down 1.11%.

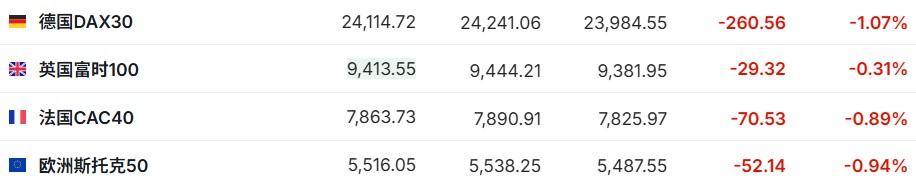

- As of the time of writing, the German DAX index is down 1.07%, the UK FTSE 100 index is down 0.31%, the French CAC40 index is down 0.89%, and the Euro Stoxx 50 index is down 0.94%.

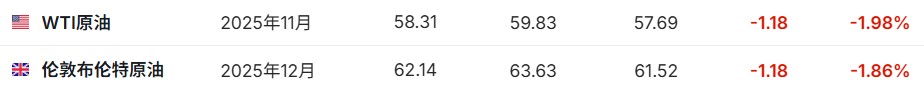

- As of the time of writing, WTI crude oil is down 1.98%, priced at $58.31 per barrel. Brent crude oil is down 1.86%, priced at $62.14 per barrel.

Market News

Powell's speech tonight may rewrite global risk sentiment. At 00:20 Beijing time on Wednesday, Federal Reserve Chairman Powell will deliver a speech at an event hosted by the National Association for Business Economics, with the theme "Economic Outlook and Monetary Policy." This speech comes at a time of significant volatility in global markets, driven by renewed trade tensions and a sharp correction in the digital asset market. Powell's remarks may influence market expectations regarding the pace of interest rate cuts and overall monetary policy, thereby determining whether the current downward trend in the cryptocurrency market deepens or stabilizes.

US-China tariff friction impacts the foreign exchange market: the dollar re-emerges as a safe haven. The dollar has strengthened against most major currencies, as the new situation of tariff friction between the US and China has shaken risk assets and prompted investors to turn to safe-haven assets. The Bloomberg Dollar Spot Index rose 0.3%, reaching its highest level since August 1, alongside an increase in government bonds, while the stock market declined. The currency that led the decline was the Australian dollar, which fell 1% to a nearly two-month low; the British pound also hit a two-month low following the release of UK employment data.

Goldman Sachs: US households will become the "strongest buyers" of US stocks by 2026, with net purchases expected to reach $520 billion. Goldman Sachs stated that driven by accelerated economic growth, declining unemployment rates, and slowing inflation, US households are expected to become the largest buyers of US stocks by 2026. The firm predicts that net purchases of stocks by US households will reach $520 billion in 2026, a year-on-year increase of 19%; net purchases of corporate stocks are expected to be $410 billion, a year-on-year increase of 7%. Goldman Sachs analyst David Kostin pointed out that a rebound in merger and acquisition activity will further boost demand for corporate stocks, but the continued recovery in IPO sizes will somewhat offset this growth Goldman Sachs' U.S. stock sentiment indicator recorded +0.3, marking the first positive value since February of this year, indicating that various investors currently hold neutral positions. However, Kostin noted that among the nine components included in this indicator, only the fund flows of passive funds and retail financing debt were significant.

U.S. junk bonds recorded their worst decline in six months, prompting sensitive investors to recall 2007. The strong rally in U.S. junk bonds this year came to an abrupt halt last Friday, with the largest single-day price drop in six months, primarily due to Trump's plan to impose an additional 100% tariff on China, severely impacting global financial market risk appetite. The risk premium indicator in the bond market surged to nearly a four-month high of 304 basis points. The overall yield in the U.S. junk bond market rose to 6.99%, the highest in over two months. Notably, in addition to the overall price of U.S. junk bonds experiencing the largest drop in six months, the U.S. credit market is also undergoing a series of alarming bond flash crash events. Some cautious investors have even begun to pray: these are not "the prelude to a new round of subprime mortgage crisis."

Individual Stock News

JP Morgan (JPM.US) Q3 trading and investment banking performance exceeded expectations. JP Morgan's GAAP earnings per share were $5.07, up $0.26 from the same period last year; revenue was $47.1 billion, up $1.53 billion from the same period last year. The company's Q3 trading and investment banking fee income surpassed analysts' expectations, benefiting from ongoing volatility related to President Donald Trump's tariffs, which led to a rebound in trading and underwriting activities. The stock fell slightly in pre-market trading.

Ericsson (ERIC.US) Q3 profit doubled due to significant optimization after divesting its call routing business Iconectiv. Ericsson's Q3 sales fell from 61.8 billion Swedish Krona in the same period last year to 56.2 billion Swedish Krona, with organic sales down 2% year-on-year. Despite a 9% year-on-year decline in sales for the third quarter, the adjusted quarterly profit still exceeded analysts' expectations, driven by significant improvements in gross margin due to operational optimization. Adjusted EBIT reached 15.5 billion Swedish Krona (approximately $1.62 billion), higher than analysts' previous estimate of 14.1 billion Swedish Krona, compared to 7.3 billion Swedish Krona in the same period last year. The adjusted EBITDA for the third quarter was 15.8 billion Swedish Krona (approximately $1.67 billion), while the figure for the same period last year was 7.76 billion Swedish Krona. The company's adjusted gross margin improved from 46.3% in the same period last year to 48.1%, a growth attributed to excellent operational execution and cost optimization measures. The stock rose over 14% in pre-market trading.

BlackRock (BLK.US) attracted $205 billion in Q3, with assets under management reaching a record high of $13.46 trillion. Boosted by a recovery in global markets, the world's largest asset management company, BlackRock (BLK.US), achieved profit growth in Q3, with assets under management hitting a historic high of $13.46 trillion. Despite rising borrowing costs, robust consumer spending has maintained momentum in the U.S. economy, driving stock market gains and prompting investors to return to low-cost index strategies The institution headquartered in New York announced on Tuesday that investors net injected $153 billion into stocks, bonds, and other exchange-traded funds (ETFs) in the third quarter. As a result, the scale of BlackRock's ETFs has surpassed $5 trillion for the first time, highlighting the explosive growth of these products this year. The net inflow into BlackRock's long-term investment funds reached $171 billion, exceeding analysts' expectations of $161.6 billion. The stock slightly declined in pre-market trading.

Johnson & Johnson (JNJ.US) raises full-year sales forecast and plans to spin off orthopedic business. Johnson & Johnson reported better-than-expected third-quarter sales and earnings and raised its full-year revenue guidance. It maintained its adjusted earnings guidance for 2025, indicating it is absorbing higher tax burdens. The financial report showed that Johnson & Johnson's third-quarter revenue was $24 billion, a year-on-year increase of 6.7%, surpassing analysts' average expectation of $23.7 billion; earnings per share were $2.80, higher than the expected $2.76. The company also raised the median of its expected sales for 2025 by $300 million to $93.7 billion. Johnson & Johnson announced plans to spin off its slow-growing orthopedic business from the company within the next 18 to 24 months to allow for greater growth opportunities for its innovative drugs and devices business. The current Trump administration continues to pressure pharmaceutical companies to lower drug prices in the U.S. The stock slightly declined in pre-market trading.

Goldman Sachs (GS.US) Q3 net revenue was $15.18 billion, a year-on-year increase of 20%. Goldman Sachs achieved record revenue of $15.18 billion in the third quarter, a year-on-year increase of 20%, marking the highest for the quarter and the third highest across all quarters. Investment banking fees reached $2.66 billion, significantly exceeding analysts' expectations of $2.18 billion, with advisory revenue of $1.4 billion, equity underwriting of $465 million, and debt underwriting of $788 million, all surpassing forecasts. Fixed income trading revenue was $3.47 billion, and equity trading revenue was $3.74 billion (slightly below expectations), with the gap between the two narrowing further. The asset and wealth management division's management fees reached a record high, with assets under management climbing to $3.45 trillion, and it announced the acquisition of a venture capital firm to expand its private market business. Global merger and acquisition transaction volume in the third quarter surpassed $1 trillion, marking the second highest level in history, primarily driven by several major deals. The stock fell nearly 2% in pre-market trading.

Wells Fargo (WFC.US) CET1 capital ratio is 11%, net interest income is $11.95 billion. Wells Fargo's net interest income (NII) for the third quarter was $11.95 billion, slightly below analysts' expectations of $12.01 billion, but it maintained its guidance for 2025 NII to be flat compared to last year; the common equity tier 1 capital ratio (CET1) is planned to be reduced from 11% or higher over the past nine quarters to 10%-10.5% to support growth investments. Investment banking fees increased by 25% year-on-year to $840 million, driving non-interest income to $9.49 billion (up 9.3% year-on-year, exceeding analysts' expectations of $9.09 billion), with the investment banking business ranking rising from 17th globally in the same period of 2024 to 7th, participating in significant transactions such as the $72 billion acquisition of Norfolk Southern by Union Pacific. Loan loss provisions were $954 million, lower than analysts' expectations of $1.09 billion, indicating that the quality of consumer and commercial credit has not significantly deteriorated The stock rose over 2% in pre-market trading.

Users join forces to sue Microsoft (MSFT.US): "Secret agreement" with OpenAI monopolizes computing power, leading to inflated ChatGPT prices. Microsoft is facing a new consumer class action lawsuit. The plaintiffs accuse the tech giant of illegally inflating the market price of generative artificial intelligence products through a secret agreement with ChatGPT developer OpenAI. This proposed class action has been filed in federal court in San Francisco. The lawsuit claims that Microsoft, through its exclusive cloud computing partnership with OpenAI, has restricted the supply of computing resources needed to run ChatGPT. To date, Microsoft's investment in OpenAI has exceeded $13 billion. The lawsuit points out that the partnership agreement Microsoft reached with OpenAI in its early development limited market competition, artificially raised ChatGPT subscription prices, and harmed the product experience of millions of users on the AI platform, violating federal antitrust laws.

NVIDIA (NVDA.US) continues to write the myth of AI computing power! DGX Spark is launched, bringing data center-level computing power to desktops. NVIDIA, the "AI chip giant," is set to officially launch the world's smallest AI supercomputer on Wednesday local time, providing an AI stack based on the NVIDIA Grace Blackwell architecture in a compact desktop form. The emergence of this seemingly mini version of a high-performance AI server, dubbed the "world's smallest AI supercomputer," suggests that NVIDIA may welcome an incredibly strong new growth point, making it possible to hit the $300 target stock price recently set by Wall Street financial giant Cantor Fitzgerald—corresponding to a market value of over $7 trillion. Meanwhile, this significant technological development from NVIDIA largely indicates that the current "super bull market" in the global AI computing power industry chain is far from over.

Important Economic Data and Event Forecasts

Beijing time 20:45: Federal Reserve Governor Bowman speaks.

Beijing time 21:00: IMF releases the "World Economic Outlook Report."

Beijing time 23:30: Federal Reserve Chairman Powell speaks at an event hosted by the National Association for Business Economics.

Next day Beijing time 01:00: U.S. President Trump meets with Argentine President Milei.

Next day Beijing time 03:25: Federal Reserve Governor Waller speaks at a panel on payments hosted by the Institute of International Finance.

Next day Beijing time 03:30: 2025 FOMC voting member and Boston Fed President Collins speaks.

Earnings Forecast

Wednesday pre-market: ASML (ASML.US), Bank of America (BAC.US), Morgan Stanley (MS.US), Abbott (ABT.US)