Citigroup's third-quarter performance is strong: revenue from all five business segments hits record highs, with shareholder returns reaching $6.1 billion

Citigroup's Q3 net income was USD 22.1 billion, a year-on-year increase of 9%; earnings per share were USD 1.86. It is worth mentioning that all five major business segments flourished: services, markets, banking, wealth management, and U.S. personal banking all set revenue records for the third quarter, demonstrating significant results from the business transformation; shareholder returns were unprecedented, with approximately USD 6.1 billion returned to shareholders in a single quarter

Citibank's third-quarter financial report showed strong performance, with revenue of $22.1 billion, a year-on-year increase of 9%. More importantly, all five core business segments performed well, setting revenue records for the third quarter, reflecting the effectiveness of Citibank's business restructuring and digital transformation investments in recent years.

On Tuesday, before the U.S. stock market opened, Citibank released its third-quarter financial report, specifically:

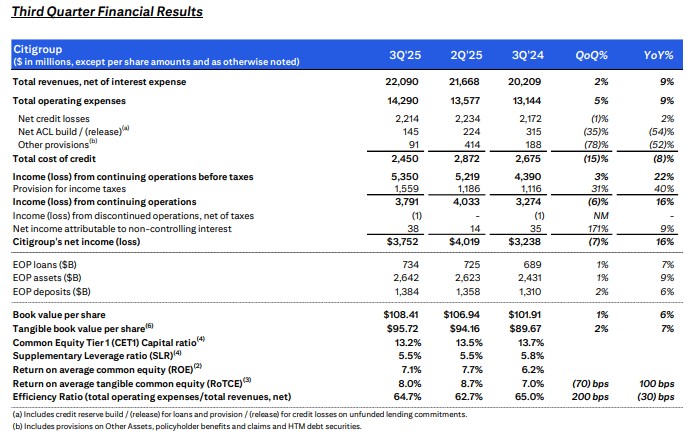

• Strong financial performance: Net income for the third quarter was $22.1 billion, a year-on-year increase of 9%; earnings per share were $1.86, reaching $2.24 after excluding one-time items; ROE was 7.1%, and 8.5% after excluding one-time items.

• All five business segments flourished: Services, Markets, Banking, Wealth Management, and U.S. Personal Banking all set revenue records for the third quarter, indicating significant effects from business transformation.

• Unprecedented shareholder returns: Approximately $6.1 billion was returned to shareholders in a single quarter, with a payout ratio of 176%; $12 billion has been returned year-to-date.

• Solid capital position: CET1 capital adequacy ratio was 13.2%, with tangible book value per share at $95.72, a year-on-year increase of 7%.

• Strategic progress: Announced the important transaction of selling a 25% stake in Banamex in Mexico, reflecting the execution of the divestiture strategy.

• Future focus: Credit cost control, return on transformation investments, changes in regulatory capital requirements, and progress on divestitures.

Trading business leads growth, investment banking recovery momentum strong

Citibank's market business rose against a backdrop of low volatility, with total revenue of $5.6 billion setting a record for the third quarter. Fixed income trading revenue surged from $3.6 billion in the same period last year to $4 billion, while equity trading revenue reached $1.5 billion, with both core trading businesses exceeding analyst expectations.

The main brokerage balances in the market department surged 44% to a record high, reflecting increased activity from institutional clients. This performance aligns with the strong performance of Goldman Sachs and JP Morgan's investment banking businesses, indicating an overall improvement in the trading environment.

The investment banking business also performed well, with fee income growing 17%, benefiting from the continued recovery in the M&A transaction environment. Fraser's recent strategy of aggressively recruiting Wall Street talent to strengthen the trading facilitation business is beginning to show results.

Service and wealth businesses show steady growth, digital investments yield results

Service business revenue reached $5.4 billion, a year-on-year increase of 7%, marking the strongest performance for the third quarter. The asset custody scale reached $30 trillion, a 13% increase from the same period last year, reflecting institutional clients' continued trust in Citibank's custody services.

U.S. personal banking business revenue also grew by 7%, achieving the best historical performance for the same period. The wealth management department's revenue grew by approximately 8%, primarily driven by the Citigold investment platform. This platform specifically serves affluent clients who have not reached the private banking wealth threshold and has been a focus of Fraser's development efforts over the years These growth figures reflect that Citigroup's investments in digital transformation and system upgrades are beginning to yield returns. Fraser stated in a statement that everything we have done over the past few years—transformation, strategic refresh, business simplification—has placed Citigroup in a distinctly different position in terms of competitiveness.

Credit Quality Under Pressure, Capital Allocation Strategy Draws Attention

Credit costs were $2.5 billion, down 8% from the same period last year, but the total amount of non-performing loans reached $3.7 billion, a significant increase of 70% year-on-year. Among them, corporate non-performing loans surged 119% to $2.1 billion, mainly due to individual credit downgrades in market and banking operations. Consumer non-performing loans increased by 32% to $1.6 billion, largely affected by housing mortgages impacted by California wildfires.

The CET1 capital adequacy ratio fell from 13.5% in the previous quarter to 13.2%, mainly due to the effects of stock buybacks, an increase in risk-weighted assets, and dividend payments. Although it remains within the comfortable range required by regulators, the downward trend is worth noting.

Cost Control Under Pressure, Regulatory Compliance Investments Continue

Despite strong revenue growth, Citigroup's expense control still faces challenges. Total operating expenses were $14.3 billion, a year-on-year increase of 9%, which is in line with revenue growth, indicating that operational leverage is not significant. The increase in expenses mainly comes from three areas: higher performance-related compensation and benefits, the talent recruitment program led by Fraser, and costs related to the sale of Banamex bank in Mexico.

Fraser continues to increase investments across the company, aiming to enhance competitiveness and repair business segments that previously incurred regulatory penalties due to system issues. Although these investments suppress profitability in the short term, they are seen as necessary measures for long-term competitiveness enhancement.

Citigroup's stock price has outperformed nearly all of its U.S. peers this year, second only to Goldman Sachs, with the market maintaining a relatively optimistic outlook on its transformation prospects.

Acceleration of Mexican Business Divestiture, Ongoing Strategic Simplification

The sale agreement for Banamex bank announced by Citigroup last month marks an important progress in its strategy to divest non-core assets. The transaction will involve selling part of Banamex's equity before a public stock offering, which, although incurs related one-time costs, helps simplify the business structure and release capital.

This divestiture initiative aligns with Fraser's business focus strategy since taking office, which involves exiting retail banking operations in low-margin or non-core regions and concentrating on business segments such as institutional services and wealth management where competitive advantages exist