Channel transformation! New opportunities in China's snack industry have arrived

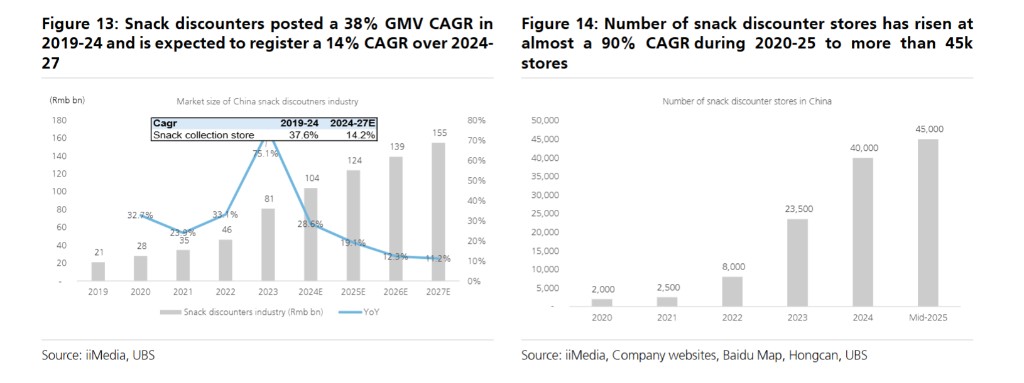

UBS believes that the Chinese snack market is undergoing structural changes in its channels, with clear trends of fragmentation and decentralization. The rise of emerging channels such as snack discount stores, content e-commerce, and overseas markets injects new opportunities into the industry. The remarkable rise of snack discount stores is particularly notable, with a compound annual growth rate of 38% from 2019 to 2024, and it is predicted that the number of stores will exceed 70,000 in the future, indicating a 30% expansion potential

For China's trillion-yuan snack industry, channel transformation may become a key variable in determining future winners.

According to news from the Chase Wind Trading Desk, a research report released by UBS on October 14 shows that the Chinese snack industry is at a critical turning point. Although overall market growth is slowing, the trends of channel fragmentation and decentralization, especially the rise of snack discount stores, are creating significant structural growth opportunities.

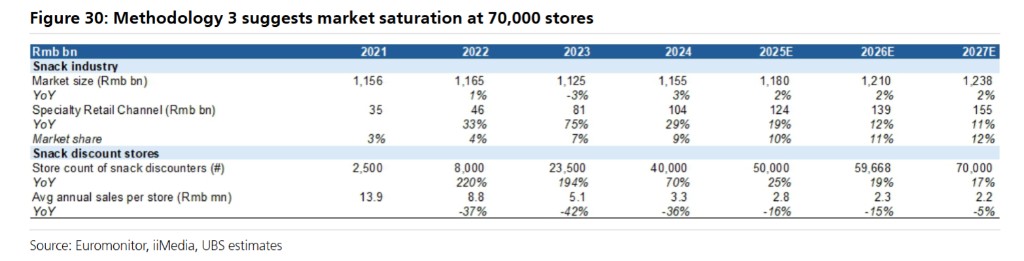

Snack discount stores are the main growth engine in the current market. This channel achieved an astonishing annual compound growth rate of 38% from 2019 to 2024. The number of stores has surged to 45,000, and even so, the bank believes the market is far from saturated, with an expected ceiling of over 70,000 stores.

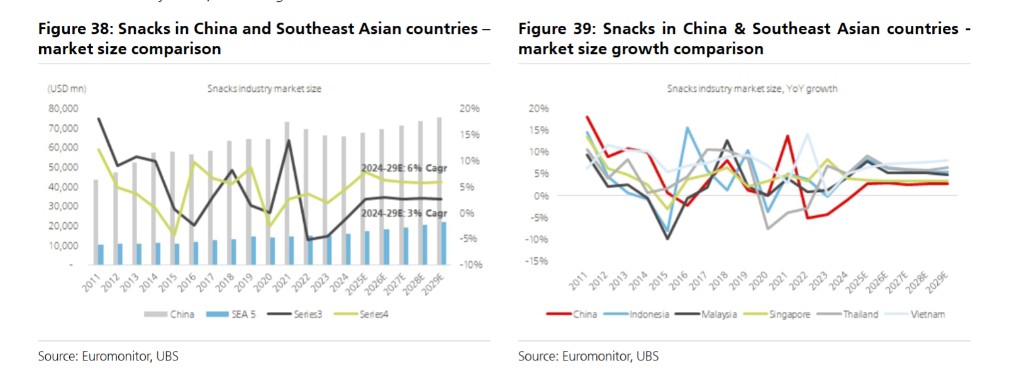

At the same time, the growth focus of the industry's e-commerce channels is shifting to content platforms, whose entertainment, social, and O2O conversion capabilities bring new opportunities for brands. The Southeast Asian market also provides emerging growth space for Chinese snack companies going abroad, with an expected compound annual growth rate of 6% from 2024 to 2029.

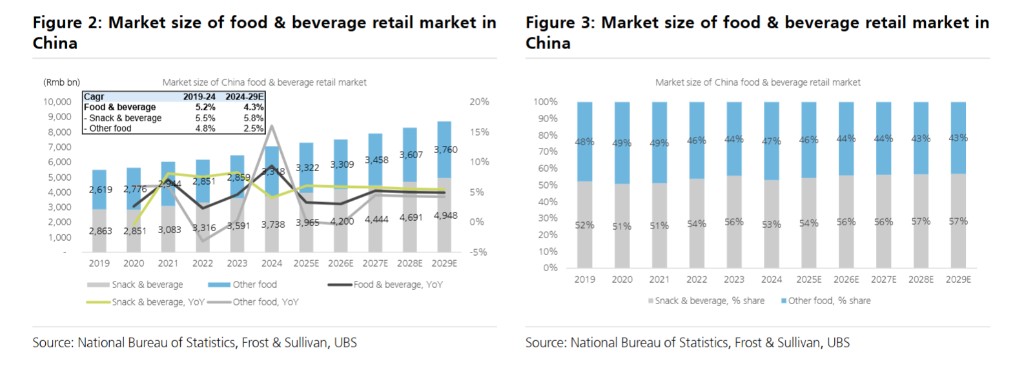

Market size exceeds one trillion, industry annual growth will slow to 2-3%

The report points out that by 2024, the scale of China's snack market will reach 1.1 trillion yuan. However, UBS predicts that from 2024 to 2027, the annual compound growth rate (CAGR) of the entire industry will slow to 2-3%.

In this context, investors may easily lose interest in the entire sector. However, the report emphasizes that the real story lies in the evolution of channels. The share of traditional channels (such as supermarkets and grocery stores) is shrinking, while emerging channels represented by snack discount stores are rapidly rising, becoming a new battleground for brand growth.

"Game Changer": The Rise of Snack Discount Stores

Snack discount stores are undoubtedly the most eye-catching "dark horse" in this round of channel transformation.

According to data from iiMedia Consulting, this channel achieved a compound annual growth rate of up to 38% in sales from 2019 to 2024. UBS predicts that from 2024 to 2027, it will continue to grow at a high speed with a compound annual growth rate of 14%, and its contribution to the overall sales of the snack industry is expected to increase from 9.0% in 2024 to 12.5% in 2027.

This innovative retail format is rapidly expanding due to its core advantages:

-

Supply Chain Optimization and Cost Advantage: Snack discount stores significantly shorten the traditional retail value chain (snack manufacturers/brands—distributors—retailers) by purchasing directly from upstream producers, thereby improving channel efficiency and enabling them to sell products at more competitive prices. UBS analysts estimate that the pricing of snack discount store channels can be 25% lower than that of traditional large chain supermarket (KA) channels

**

** -

Product Diversification and Customization: Snack discount stores typically offer a rich variety of product stock-keeping units (SKUs). Additionally, they provide customized products based on consumer demand, such as small packages or bulk snacks sold by weight, lowering the barrier for consumers to try new products.

-

Rapid Expansion of Store Network: The number of snack discount stores has rapidly increased from about 1,000 before 2020 to over 45,000 by mid-2025, with a compound annual growth rate close to 90%. UBS estimates, based on demographics and market size, predicts that the ceiling for the number of snack discount stores is expected to exceed 70,000, indicating that there is still over 30% growth potential in the future.

Currently, the snack discount store market has formed a dual oligopoly pattern, dominated by the "Snack Busy Group," formed by the merger of "Snack Busy" and "Zhao Yiming," and the "Wancheng Group," which integrates five major brands. The two groups together occupy nearly two-thirds of the market share in terms of store count.

It is worth noting that the payback period for individual snack discount stores has extended from about 1 year in the early stages to approximately 2 years currently, and it is expected to further extend to over 3 years in the future, reflecting the impact of intensified market competition and increased store density.

New E-commerce Trend: Content Platforms Become the Main Battlefield

In this context, the influence of traditional channels is weakening. According to data from Euromonitor, the sales share of traditional channels, composed of large supermarkets, hypermarkets, and small grocery stores, is expected to shrink from 80% in 2015 to 50% in 2025.

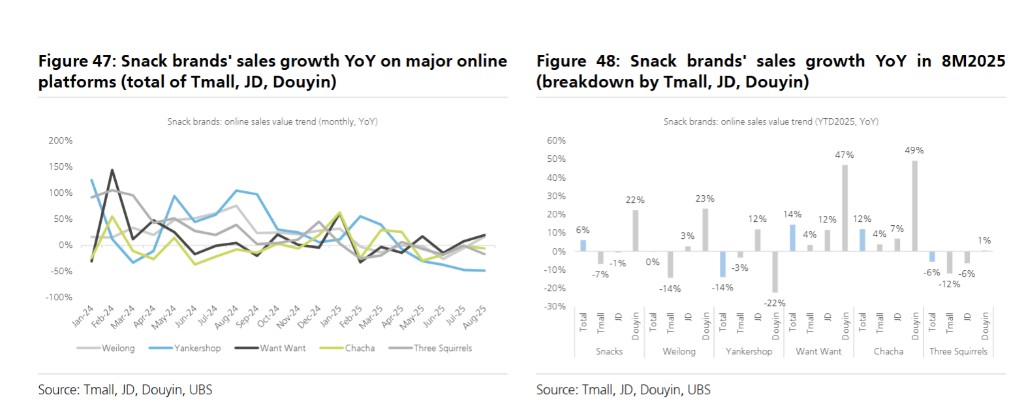

At the same time, emerging channels are rapidly capturing market share. Among them, specialized retailers, mainly snack discount stores, and e-commerce channels are the biggest beneficiaries. The report points out that the growth momentum of e-commerce channels is also shifting from traditional platforms to content platforms that can better stimulate immediate consumption.

Content platforms such as Douyin and Kuaishou, with their entertainment, social interaction, and scenario-based consumption characteristics, can better stimulate spontaneous, passive, and lifestyle-integrated purchases among consumers. A NielsenIQ survey shows that 91.8% of respondents use content platforms daily, higher than the 86.4% for comprehensive e-commerce platforms, and content platforms have a far greater appeal to customers than traditional media platforms.

Overseas Opportunities: Huge Potential in the Southeast Asian Market

The overseas market is becoming an emerging growth opportunity for Chinese snack companies, with Southeast Asia being the primary testing ground due to cultural similarities and market competition.

Since 2021, the snack industry in five Southeast Asian countries—Indonesia, Malaysia, Singapore, Thailand, and Vietnam—has consistently grown at a rate higher than that of China.

According to Euromonitor data, the total snack market size in these five countries is only equivalent to 24% of the Chinese market in 2024, but it is expected to grow at a compound annual growth rate of 6% from 2024 to 2029, reaching a market size of 29% of the Chinese market by 2029.

Brand Insight: Adapting to Channel Changes is Key

In the face of structural changes in channels, snack companies need to adopt proactive strategies to adapt to the new environment.

UBS analysis emphasizes that brands not only need strong product capabilities but also need to successfully execute an omnichannel strategy, implement agile marketing plans, and establish a consumer-oriented innovation cycle; otherwise, they risk being eliminated by the rapidly changing channel environment.

Currently, leading snack brands such as Wei Long and YANKERSHOP have established a strong presence in the snack discount store channel. At the same time, the operational strategies for online channels also need to balance sales growth with profit margins, with some brands shifting from purely pursuing growth to a strategy that considers both sales and profits.

The above content is from [Zhui Feng Trading Platform](https://mp.weixin.qq.com/s/uua05g5qk-N2J7h91pyqxQ).

For more detailed interpretations, including real-time analysis and frontline research, please join the【 [Zhui Feng Trading Platform ▪ Annual Membership](https://wallstreetcn.com/shop/item/1000309)】

[](https://wallstreetcn.com/shop/item/1000309)