After Powell's "dovish" stance, copper prices rebounded, with industry insiders predicting a rise to USD 12,000 per ton

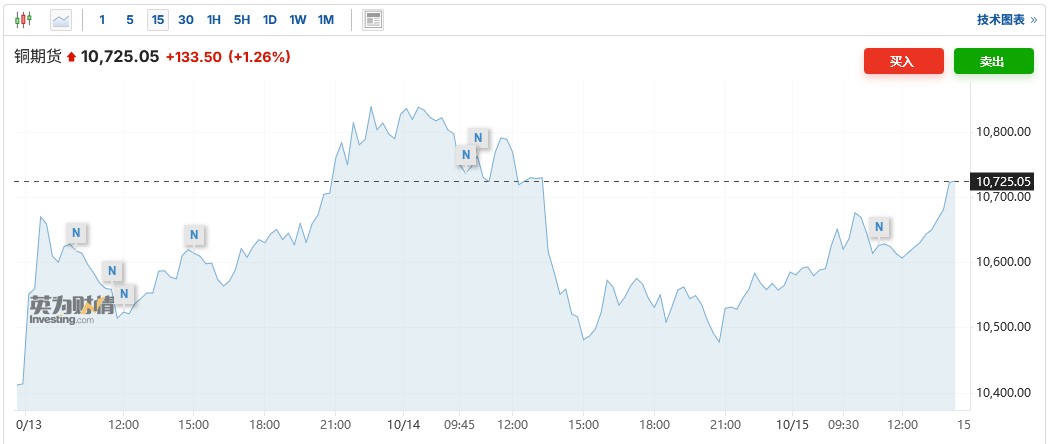

After Federal Reserve Chairman Jerome Powell hinted at a possible rate cut again, copper prices rebounded, with industry insiders expecting copper prices to reach USD 12,000 per ton. Boosted by Powell's speech, LME copper futures rose 1.26%, closing at USD 10,725.05 per ton. Copper prices are influenced by the prospects of a Federal Reserve rate cut and disruptions in global copper mine production, particularly the suspension of operations at Freeport-McMoRan's Grasberg mine in Indonesia, which is expected to have a significant impact on copper supply

According to the Zhitong Finance APP, copper prices rebounded after Federal Reserve Chairman Jerome Powell hinted at another possible rate cut this month. Industry insiders also indicated that copper prices could reach $12,000 per ton. Copper prices had previously fluctuated sharply due to geopolitical tensions. Boosted by Powell's remarks, as of the time of writing, LME copper futures rose 1.26%, trading at $10,725.05 per ton.

In his speech on Tuesday, Powell stated that the Federal Reserve is likely to implement another 25 basis point rate cut later this month, despite the severe impact of the U.S. government shutdown on its assessment of economic conditions. Powell repeatedly mentioned the slow pace of hiring and noted that this situation could worsen further.

In recent months, copper prices have been supported by the prospect of Federal Reserve rate cuts and significant disruptions in copper production globally. The most notable incident was the temporary suspension of operations at Freeport-McMoRan, a major U.S. mining giant, following a landslide at the Grasberg mine in Indonesia on September 8. The company has announced the activation of force majeure clauses and expects its output to be significantly affected until 2027. Freeport-McMoRan has lowered its 2026 production guidance for the Grasberg mine by 35%, indicating a reduction of approximately 270,000 tons of copper supply.

In fact, since 2025, several of the world's largest copper mines have faced challenges. In late May, the world's fourth-largest copper mine, Kamoa-Kakula in the Democratic Republic of the Congo, experienced a seismic event that led to a downward revision of its 2025 production guidance from 520,000-580,000 tons to 370,000-420,000 tons. At the end of July, the world's largest underground copper mine, El Teniente in Chile, suffered a mine collapse due to an earthquake. The state-owned copper company operating the mine stated that this year's output would be reduced by 300,000 tons, about 11% lower than previously expected.

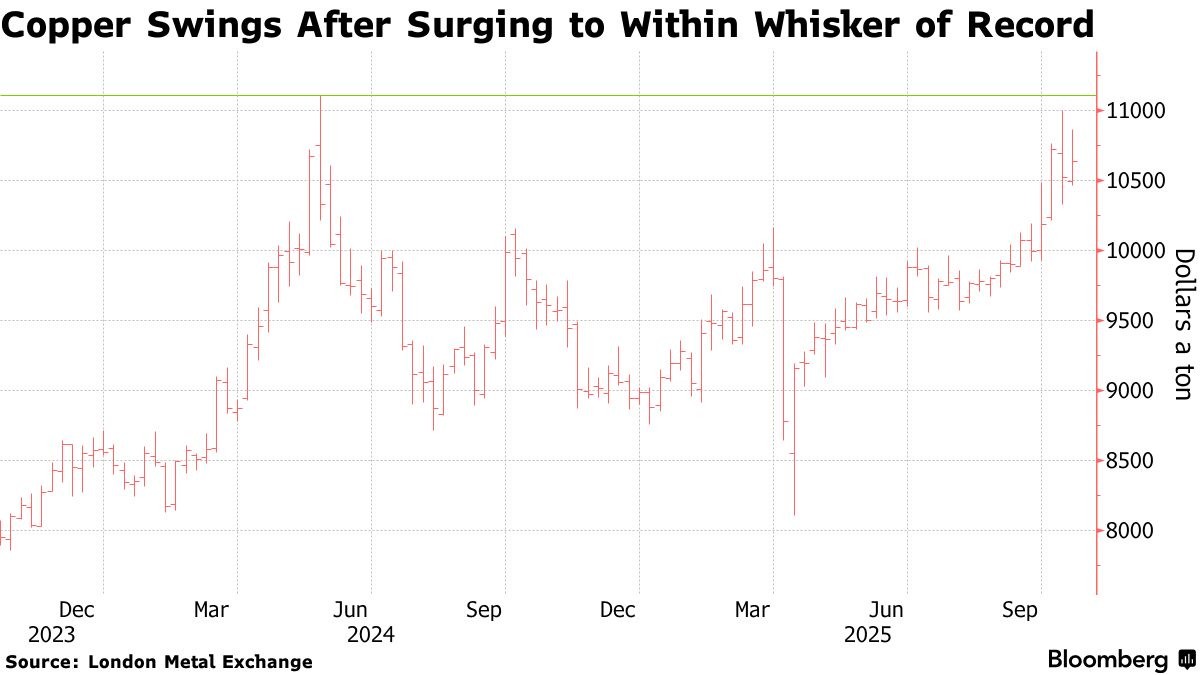

These supply disruptions not only led to a reduction in copper output but also highlighted the significant challenges mining companies face in meeting the growing demand. Last week, copper prices surged to their highest level since May 2024.

During LME Week, Kenny Ives, head of the trading division of Chinese mining giant CMOC, stated that copper prices could reach $11,000 per ton, or even $12,000 per ton by the end of the year. Nick Snowdon, head of metals research at Mercuria Energy Group, also pointed out at the same event that given the severe supply disruptions and the continuous influx of investment funds into commodities, especially the metals market, it would be "relatively easy" for copper prices to reach this higher level. If this price point is achieved, it would set a new historical high for copper prices, which previously reached a record of $11,104.50 per ton in May 2024 However, there are also more cautious voices at the same event. Goldman Sachs analyst Eoin Dinsmore stated that the global copper market is currently still in a state of surplus, and it is expected to return to balance next year. It is worth mentioning that Goldman Sachs analyst Eoin Dinsmore also indicated in a report last week that copper prices are resetting into a whole new price range. Structural constraints on the supply side, strong demand in key areas (such as power grids, AI, and defense), and potential strategic reserve actions are collectively pushing the bottom support level for copper prices up to $10,000 per ton. For investors, this means that the downside potential for copper prices is very limited, with $10,000 becoming a solid "new bottom line." However, due to the market still being slightly oversupplied in the short term, and high prices triggering an increase in scrap copper supply and aluminum substitution effects, there is also a clear $11,000 "ceiling" for copper price increases in the next two years