The new IP "Star People" is rising rapidly, Labubu's production capacity has increased tenfold but is still sold out, JP Morgan has upgraded POP MART to "Overweight"

JP Morgan believes that POP MART has not only proven that it does not rely on a single IP through the continued popularity of Labubu and the success of "Star People," but has also demonstrated its ability to withstand external risks through global expansion and strong pricing power. The current 20 times expected price-to-earnings ratio for 2026 is quite attractive compared to its high growth prospects

JP Morgan believes that the fundamentals of POP MART have not changed, but rather have become stronger, and the market's panic provides an excellent allocation opportunity.

According to news from the Trend Trading Desk, on October 15, JP Morgan released a research report, upgrading POP MART's rating from "Neutral" to "Overweight," and raising the target price from HKD 300 to HKD 320. This adjustment is mainly based on two key factors:

- First, popular IPs continue to be strong. Although Labubu's production capacity has increased tenfold compared to the first quarter, Labubu 3.0 and Mini Labubu are still sold out in all regions. In addition, the new IP "Twinkle Twinkle" is rapidly rising and is expected to contribute 8% of sales in 2027.

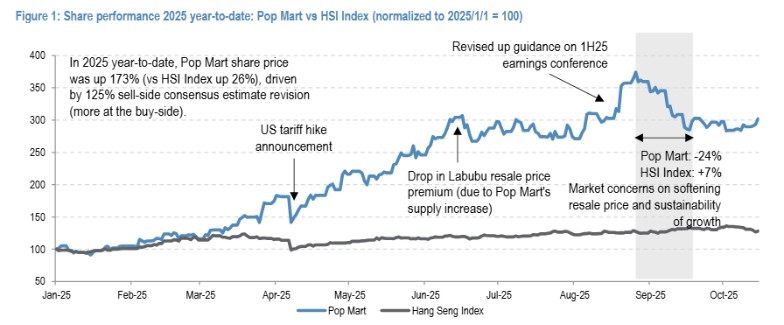

- Second, valuation attractiveness has significantly improved. The stock price has corrected 24% from its August peak, while the Hang Seng Index has risen 7% during the same period. Currently, JP Morgan predicts only a 20 times price-to-earnings ratio for 2026, making the risk-reward ratio more attractive.

The research report emphasizes that POP MART has proven it does not rely on a single IP through the continued popularity of Labubu and the success of "Twinkle Twinkle," and has demonstrated its ability to withstand external risks through global layout and strong pricing power.

Core Engine Labubu, Production Capacity Soars Tenfold, Still in Short Supply

The astonishing popularity of Labubu is the core engine supporting POP MART's growth.

According to JP Morgan's observations, even though the company has increased Labubu's production capacity tenfold compared to the first quarter of 2025, its Labubu 3.0 and Mini Labubu series products are still sold out at all sales points. This directly dispels market concerns about the sustainability of its demand.

The secondary market price is a barometer for measuring IP popularity.

Data shows that in the Halloween "Why So Serious" plush series released on October 9, the resale price of the Labubu model in the secondary market has a premium of up to 290%.

In addition, the company plans to release the "Labubu & Friends" animation in December and launch Labubu 4.0 in March or April 2026, which will serve as catalysts for future growth.

Rising Star "Twinkle Twinkle," Validating IP Matrix Diversification Capability

Even more exciting for investors than Labubu's continued popularity is the successful incubation of new IPs.

POP MART's new IP "Twinkle Twinkle" is rapidly becoming a new growth driver. In the Halloween series released on October 9, products featuring five IPs (Labubu, Twinkle Twinkle, Molly, Dimoo, and Hacipupu) sold out within minutes on mainstream online platforms.

Notably, in this series, "Twinkle Twinkle" has a secondary market premium of up to 130%, second only to Labubu's 290%, but far higher than other IPs (-18% to +26%).

JP Morgan believes this indicates that "Twinkle Twinkle" is attracting its "true fan base," rather than just being a substitute for consumers when Labubu is unavailable. Based on this strong performance, JP Morgan predicts that "Star People" will contribute 8% of the company's total sales by 2027, on par with mature IPs like Skullpanda, Molly, and Crybaby (expected to contribute 8-9% each), while Labubu's contribution is expected to be 35%.

This strongly demonstrates POP MART's powerful IP discovery and commercialization capabilities, as well as the successful implementation of its strategy to maintain long-term growth through a diversified IP matrix.

Market Overly Pessimistic? Strong Fundamentals, Attractive Valuation

POP MART's stock price has fallen 24% from a recent high of HKD 335.40 to HKD 254, while the Hang Seng Index has risen 7% during the same period.

(Comparison of POP MART and the Hang Seng Index performance this year)

(Comparison of POP MART and the Hang Seng Index performance this year)

JP Morgan believes that this drastic relative underperformance indicates that investors have established overly conservative expectations.

However, the company's fundamentals remain strong. Based on the strong sales momentum of Labubu and new IPs, JP Morgan has raised its earnings forecasts for the company from 2025 to 2027 by 5-7%.

After adjustments, POP MART's sales and adjusted earnings are expected to grow by 165% and 276% year-on-year in 2025, respectively, with continued year-on-year growth of 28% and 29% in 2026.

Supported by strong growth expectations, the current price-to-earnings ratio based on JP Morgan's 2026 forecast is only 20 times. This valuation level shows a more favorable risk-return profile compared to other consumer goods companies with lower growth quality.

Accelerating Global Supply Chain

Regarding investors' general concerns about the tariff risks brought by global trade frictions, JP Morgan believes that its financial impact on POP MART will be limited.

First, POP MART has prepared inventory for the shopping season in the fourth quarter of 2025 to cope with recent tariff fluctuations.

Second, the company has the right to directly raise prices to offset rising costs. In fact, the company successfully conducted a price increase in overseas markets in April 2025, raising blind box prices by 12% (from $17 to $19) and plush toy prices by 27% (from $22 to $28).

JP Morgan estimates that POP MART only needs to raise prices by about 15% to fully offset the impact of tariffs on gross profit in the Americas market.

More importantly, to support long-term global expansion, POP MART is planning six major manufacturing centers globally (four in China and two overseas).

JP Morgan estimates that the sales contribution from the Americas market will increase from about 21% in 2025 to about 28% in 2027, and the contribution of overseas business to the group's earnings will approach 60% by 2027, highlighting the importance of global layout.

JP Morgan expects that the intensification of tariff uncertainties will instead prompt the company to accelerate its global supply chain layout, fundamentally reducing geopolitical risks