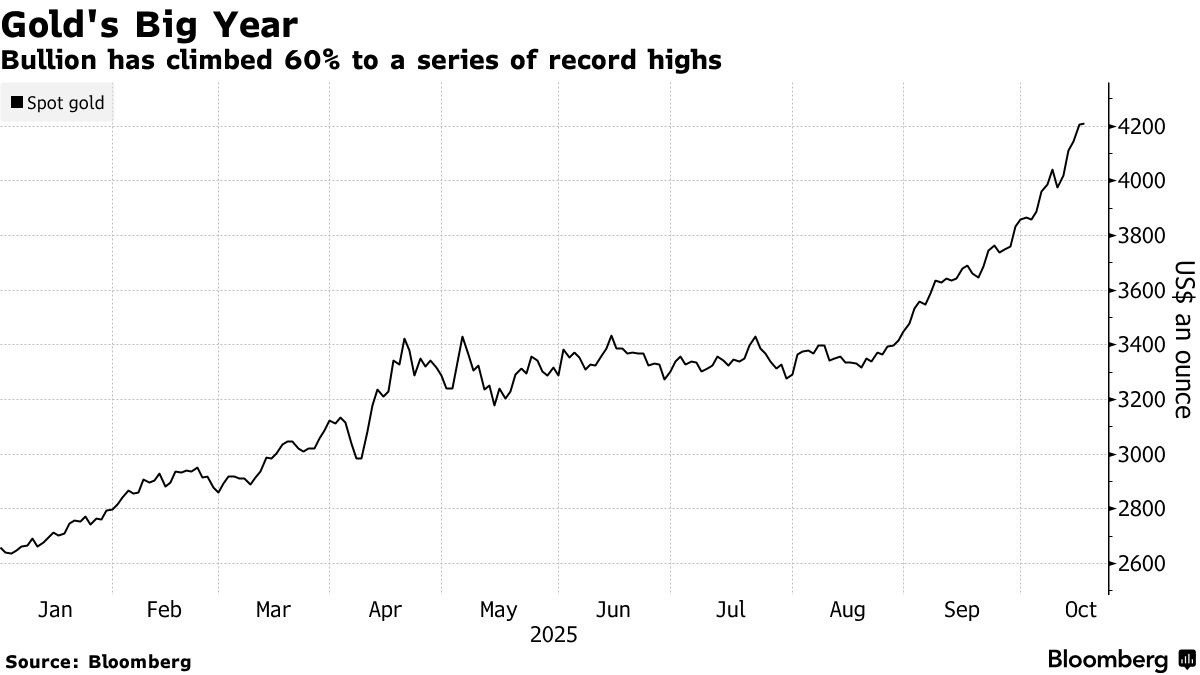

The foundation of the gold bull market is solid! Gold prices have reached a new high, breaking through $4,220! A cumulative surge of 60% this year!

Gold prices continue to rise, breaking through $4,220, with an annual increase of nearly 60%. The tension in China-U.S. trade relations and the market's expectation of increased monetary easing by the Federal Reserve have supported the safe-haven demand for gold. Silver prices have also risen due to supply shortages. The Federal Reserve Chairman hinted at interest rate cuts, further benefiting precious metals. Strong gold purchasing demand from central banks around the world is an important factor driving up gold prices

According to Zhitong Finance APP, gold has not stopped its upward momentum. As of the time of writing, spot gold is up 0.35%, priced at $4,223.13 per ounce. The escalation of trade tensions and market bets that the Federal Reserve will increase monetary easing before the end of the year have supported safe-haven demand for gold, driving it to continuously set new highs.

So far this week, gold has risen nearly 5%, maintaining its rapid upward trend since mid-August, with an increase of nearly 60% year-to-date. The buying frenzy has also spread to other precious metals. Spot silver rose 3.1% on Wednesday due to continued tight supply in the London market.

Traders are increasingly betting that the Federal Reserve will implement at least one rate cut before the end of the year. Federal Reserve Chairman Jerome Powell hinted this week that the Fed plans to cut rates by 25 basis points later this month. Lower borrowing costs typically benefit precious metals, as assets like gold do not generate interest income.

U.S. President Trump stated that he believes the U.S. is already in a trade war. This remark has raised concerns about potential long-term damage to the global economy, which could further enhance gold's appeal as a safe haven. Meanwhile, U.S. Treasury Secretary Mnuchin suggested that extending the "truce period" could be considered, but he also noted that the recent volatility in U.S. stocks caused by the trade war has not deterred federal officials from maintaining a tough negotiating stance.

Additionally, the ongoing shutdown of the U.S. federal government has provided support for gold. The so-called "debasement trade" is also heating up, as investors turn to physical assets like gold to guard against sovereign debt and currency devaluation caused by uncontrolled budget deficits. Strong demand for gold purchases from central banks is also a key supporting factor, contributing to a roughly 60% increase in gold prices year-to-date.

Saad Rahim, chief economist at Trafigura Group, stated: "The main driving force behind this round of gold price increases is physical buying. If you look at central banks around the world, they are buying gold in large quantities." He added that concerns about debt sustainability and expectations of future interest rate declines have led investors to "view gold as a store of value and a safe-haven tool."