Nestlé's Q3 sales exceeded expectations, plans to lay off 16,000 employees, stock price hits the largest increase since 2008 | Earnings Report Insights

Nestlé's third-quarter sales increased by 4.3%, exceeding analysts' expectations, and the stock price rose by 8.2%, marking the largest increase since 2008. The company plans to lay off 16,000 employees, approximately 6% of its total workforce, to undertake a major restructuring and restore investor confidence. Nestlé maintains its performance outlook for 2025, expecting organic sales growth to improve, with the underlying trading operating profit margin reaching or exceeding 16%. Newly appointed CEO Philipp Navratil stated that Nestlé needs to change quickly to respond to market changes

Nestlé's performance has rebounded, with growth exceeding analysts' expectations, and its stock price once surged over 8%, marking the largest increase since 2008. At the same time, the company announced a large-scale personnel restructuring plan, intending to lay off 16,000 employees.

On Thursday, Nestlé released its financial report showing that its organic sales in the third quarter grew by 4.3%, surpassing analysts' expectations of 3.7%. The company's sales for the first nine months of 2025 reached CHF 65.87 billion, with an organic growth rate accelerating to 3.3%, slightly above the analysts' forecast of 3.2%. This growth was primarily driven by price increases in the coffee and candy categories, with most categories showing positive organic growth.

In terms of performance guidance, Nestlé maintained its outlook for 2025, expecting organic sales growth to improve compared to 2024, and the basic trading operating profit margin for 2025 to reach or exceed 16%.

Notably, the company announced it would cut 16,000 positions over the next two years, accounting for about 6% of its total workforce. This food giant is attempting to revitalize its performance through a large-scale reorganization and restore investor confidence. The company also raised its cost-saving target by the end of 2027 from CHF 2.5 billion to CHF 3 billion.

Newly appointed CEO Philipp Navratil stated in a statement,

"The world is changing, and Nestlé needs to change faster. This will include making difficult but necessary decisions to reduce the workforce."

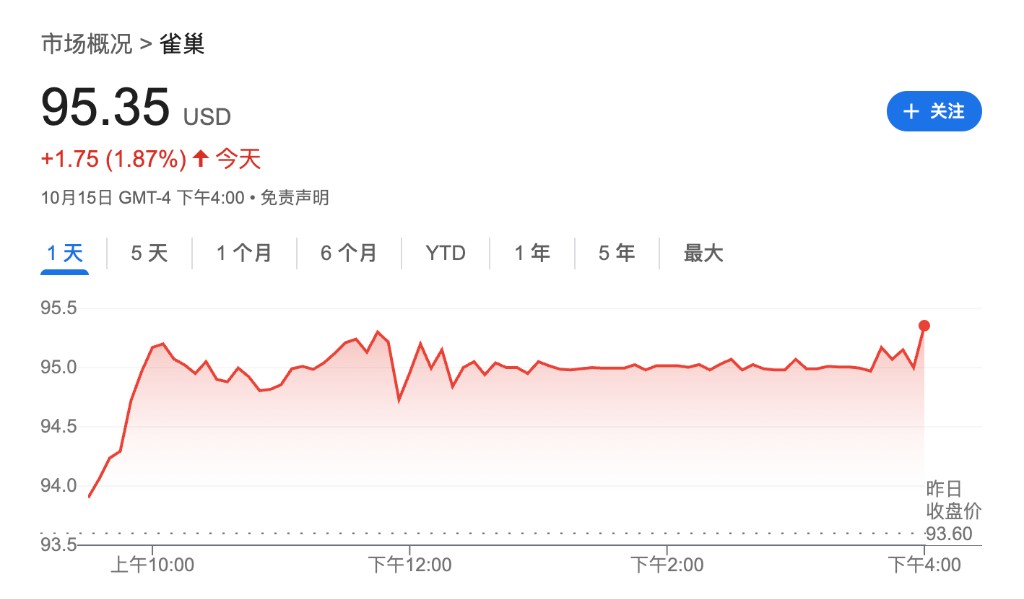

The combination of improved performance and organizational changes has boosted market confidence, with Nestlé's stock price soaring 8.2% in early trading on the Swiss exchange on Thursday, marking the largest single-day increase since 2008.

Improved Growth, New CEO Still Faces Challenges

The key to the sales growth in the third quarter lies in the improvement of actual internal growth , a core metric that has been a focal point for analysts and investors. Vontobel analyst Jean-Philippe Bertschy stated:

“Although still very fragile, we believe this set of results will help Nestlé partially restore investor confidence.”

Previously, Nestlé faced turmoil at the executive level, with the new leadership tasked with revitalizing sales growth and addressing governance issues. Nestlé appointed Navratil as CEO last month, following the dismissal of his predecessor Laurent Freixe, who was ousted just a year into his tenure due to allegations of concealing a romantic relationship with a subordinate.

Navratil has worked at Nestlé for over 20 years, most recently overseeing the Nespresso business. He stated that he would continue Freixe's strategy, including increasing advertising spending, focusing on fewer but larger product plans, and divesting underperforming business units In a conference call with reporters on Thursday, Navratil pointed out that further improving organic growth has been identified as Nestlé's top priority, and stated that the company is evaluating all its businesses. His predecessor had initiated a restructuring plan, which includes the potential sale of struggling vitamin brands and seeking potential partners for Nestlé's bottled water business.

Navratil told the media that any job losses resulting from asset divestitures would not be included in the planned reduction of 16,000 positions.

Risk Warning and Disclaimer

The market carries risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk