U.S. Stock Market Outlook | Three Major Index Futures Rise Together, Taiwan Semiconductor's Q3 Performance Exceeds Expectations

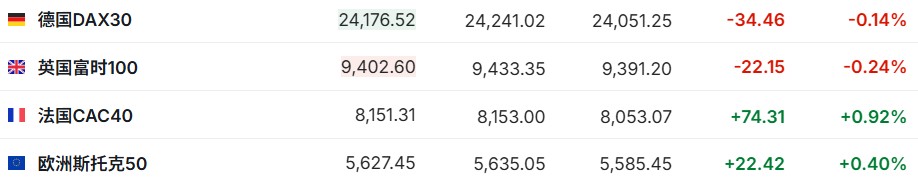

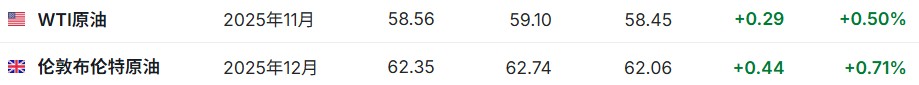

U.S. stock index futures are all up, and Taiwan Semiconductor's Q3 performance exceeded expectations. Dow futures rose by 0.23%, S&P 500 futures rose by 0.35%, and Nasdaq futures rose by 0.48%. Meanwhile, Germany's DAX index fell by 0.14%, and the UK's FTSE 100 index fell by 0.24%. WTI crude oil rose by 0.50%. Job seekers are flocking to holiday temporary positions, with seasonal job search volume increasing by 27% year-on-year. Traders are betting that the Federal Reserve will implement an extraordinary rate cut of 50 basis points

- As of October 16th (Thursday) before the US stock market opened, the three major US stock index futures all rose. As of the time of writing, Dow futures rose by 0.23%, S&P 500 index futures rose by 0.35%, and Nasdaq futures rose by 0.48%.

- As of the time of writing, the German DAX index fell by 0.14%, the UK FTSE 100 index fell by 0.24%, the French CAC40 index rose by 0.92%, and the Euro Stoxx 50 index rose by 0.40%.

- As of the time of writing, WTI crude oil rose by 0.50%, priced at $58.56 per barrel. Brent crude oil rose by 0.71%, priced at $62.35 per barrel.

Market News

"Too many monks and too little porridge" holiday hiring: American job seekers flock to temporary positions to "get through the winter." According to research from the job platform Indeed, many job seekers seem to be settling for less and starting to seek short-term holiday jobs in the face of difficulty finding full-time work. Indeed data shows that as of the end of September, the search volume for seasonal positions increased by 27% compared to the same period last year, and surged by 50% compared to 2023. The demand from job seekers has risen sharply, but the number of seasonal positions posted by employers has only increased slightly by 2.7%, which means that even temporary holiday positions will be hard to come by. "The current state of the seasonal hiring market is a microcosm of the entire job market," said Cory Stahle, a senior economist at Indeed, in an interview. "People are actively going out to find jobs, but they find that the number of available positions has decreased." Stahle also mentioned that another signal reflecting the pressure on the job market is the rising proportion of people holding multiple jobs.

Traders bet heavily on the Federal Reserve's "extraordinary" rate cut of 50 basis points, SOFR options open interest surges. Traders are making large bets that the Federal Reserve will implement at least one extraordinary rate cut before the end of the year. They believe that the Fed's policy may be more aggressive than currently expected by other market observers. Recent trading activity in options linked to the Secured Overnight Financing Rate (SOFR) shows that the market is accumulating bets that the Fed may cut rates by 50 basis points at its meeting later this month or in December. This magnitude exceeds the two 25 basis point cuts priced in by the current interest rate swap market. Although the US government's weeks-long shutdown has delayed the release of employment data and other key economic indicators, once the shutdown ends, a wealth of information reflecting the latest economic conditions will be released Record performance cannot hide concerns! Wall Street executives warn of AI bubble risks. Major U.S. banks reported record quarterly earnings—trading activity and receivables reached new highs, partly driven by the artificial intelligence (AI) boom. However, several Wall Street executives warned that the AI industry may be falling into excessive enthusiasm. As the earnings season kicks off this week, many bank executives emphasized how they are utilizing AI technology in their internal operations. From Bank of America's (BAC.US) virtual financial assistant "Erica" to JP Morgan's (JPM.US) use of AI to further cut costs. However, despite their generally optimistic view of AI's potential, many expressed caution. This includes Citigroup's (C.US) Chief Financial Officer Mark Mason. Mason stated during a conference call on Tuesday, "Looking at current stock valuations and price-to-earnings ratios, we have to admit that some sectors clearly have bubbles and are overvalued."

Gold bull market logic reinforced! Government shutdown weakens growth narrative, U.S. economy may lose $15 billion weekly. A senior official from the U.S. Treasury Department stated on Wednesday evening that the ongoing federal government shutdown, which has lasted for two weeks, could result in a loss of up to $15 billion in economic output per week. This corrected an earlier incorrect statement made by U.S. Treasury Secretary Scott Basset, who had claimed losses could reach $15 billion per day. However, Basset used this incorrect estimate in two public appearances earlier on Wednesday while urging Democrats to "actively be heroes" and stand with Republicans to end the shutdown. This is undoubtedly a significant positive catalyst for gold prices, which have soared over 60% this year, outperforming the MSCI global stock market benchmark and repeatedly hitting record highs.

Individual Stock News

Taiwan Semiconductor (TSM.US) fuels "AI faith"! Raises 2025 guidance after Q3 performance exceeds expectations. Taiwan Semiconductor raised its revenue growth forecast for 2025 to the mid-30% range, reflecting strong confidence in demand for AI components such as Nvidia's chips. The earnings report showed that Taiwan Semiconductor's Q3 revenue was $33.1 billion, a year-on-year increase of 40.8%, far exceeding market expectations; earnings per share were $2.92, higher than the market's expected $2.60. After a 39% surge in profits in Q3 to NT$452.3 billion (approximately $14.8 billion), Taiwan Semiconductor also raised the lower limit of its capital expenditure target for this year. The company has now allocated at least $40 billion for capacity expansion and upgrades in 2025, up from the previous lower limit of $38 billion. In the third quarter, 3-nanometer shipments accounted for 23% of total wafer revenue; 5-nanometer accounted for 37%; and 7-nanometer accounted for 14%. Advanced technologies accounted for 74% of total wafer revenue.

Charles Schwab (SCHW.US) net new assets of $134.4 billion, exceeding market expectations. Charles Schwab's total net new assets in the third quarter reached $134.4 billion, a significant year-on-year increase of 48%, surpassing analysts' previous forecast of $130.2 billion; daily trading revenue grew by 30% to $7.42 trillion, exceeding the expected $7.25 trillion. The number of new brokerage accounts opened exceeded one million for the fourth consecutive quarter, continuing the trend of organic growth The company's CEO Rick Wurst emphasized that the increase in the adoption rate of wealth solutions and a favorable macroeconomic environment have jointly driven revenue and earnings per share to new highs. In addition, the company's stock repurchase plan is progressing steadily, with 28.9 million shares repurchased in the third quarter at a cost of $2.7 billion, supported by an additional $20 billion repurchase authorization.

Nestlé (NSRGY.US) reported better-than-expected sales growth in Q3 and plans to lay off 16,000 employees globally over the next two years. Nestlé announced Thursday that its sales growth exceeded expectations, primarily due to revenue growth from its candy and coffee products driven by price increases. The actual internal growth (RIG, a measure of sales volume) in the third quarter rose by 1.5%, far exceeding analysts' expectations of a 0.3% increase. Nestlé stated that organic sales (excluding the impact of exchange rate fluctuations and acquisitions) grew by 4.3% in the third quarter, higher than analysts' expected increase of 3.7%. The company maintained its outlook for 2025, emphasizing that organic sales growth should improve compared to 2024, and it expects the basic operating profit margin to reach or exceed 16%. This is also the first sales announcement since Philippe Naefratil took over as CEO of Nestlé, the world's largest packaged food company.

Strong demand from high-end travelers! United Airlines (UAL.US) Q3 earnings exceeded expectations, and Q4 revenue is expected to hit a new high. United Airlines reported better-than-expected earnings for the third quarter. The airline expects that its loyal customers and demand for high-end seats will drive profit growth by the end of the year. The financial report showed that, driven by a rebound in demand for basic economy tickets and strong sales of premium tickets, United Airlines' Q3 revenue increased by 2.6% year-on-year to $15.23 billion, slightly below the market expectation of $15.28 billion; adjusted earnings per share were $2.78, better than the market expectation of $2.66. United Airlines and its competitor Delta Air Lines (DAL.US) have been actively promoting high-end products in recent years, trying to differentiate themselves from low-cost carriers and profit from the recovery in demand for luxury travel experiences.

Expensive AI chips squeeze profit margins, Hewlett Packard Enterprise (HPE.US) new fiscal year earnings and cash flow guidance fall short of expectations. Hewlett Packard Enterprise's forecast for earnings and cash flow for the next fiscal year is below analysts' expectations, reflecting the issue of shrinking profit margins in the era of artificial intelligence. The company expects adjusted earnings per share for the fiscal year ending in October 2026 to be between $2.20 and $2.40. In a statement on Wednesday, the company indicated that its free cash flow would be between $1.5 billion and $2 billion. The average profit forecast from analysts is $2.41, with free cash flow at $2.41 billion. As one of the largest computer equipment manufacturers, Hewlett Packard Enterprise is positioning its networking business as a key pillar for future expansion. The company acquired Juniper Networks for approximately $13 billion in July.

Walmart (WMT.US) takes off again with the tailwind of AI! It may join the trillion-dollar market cap club. As Walmart announced a partnership with OpenAI that drove its stock price to a historic high, Mizuho Securities analyst David Bellinger stated that the company is expected to join the "trillion-dollar market cap elite club." Walmart has become the latest company to announce a partnership with OpenAI. Walmart stated that customers will be able to use the "instant checkout" feature to shop and purchase items directly through the ChatGPT platform. Although this service does not currently cover fresh food, users can still purchase packaged foods, clothing, and other items from Walmart and its subsidiary Sam's Club. Additionally, on Walmart's main website and the Sam's Club website, customers can also interact with ChatGPT through the search bar.

Important Economic Data and Event Forecast

Beijing time 20:30: Initial jobless claims in the U.S. for the week ending October 11 (10,000), U.S. October Philadelphia Fed Manufacturing Index, U.S. September PPI year-on-year (%), U.S. September retail sales month-on-month (%).

Next day, Beijing time 00:00: U.S. EIA crude oil inventory change for the week ending October 10 (10,000 barrels).

Beijing time 21:00: Federal Reserve Governor Waller speaks, Federal Reserve Governor Barr speaks on "stablecoins," Federal Reserve Governor Mester speaks at the 2025 International Finance Association Annual Meeting.

Beijing time 22:00: Federal Reserve Governor Bowman delivers an online speech at the 2025 Federal Reserve Stress Test Research Conference.

Next day, Beijing time 04:15: Federal Reserve Governor Mester speaks at the Semafor 2025 Fall World Economic Summit.

Next day, Beijing time 06:00: 2026 FOMC voting member, Minneapolis Fed President Kashkari speaks.

Earnings Forecast

Friday morning: Interactive Brokers (IBKR.US)

Friday pre-market: American Express (AXP.US), Schlumberger (SLB.US)