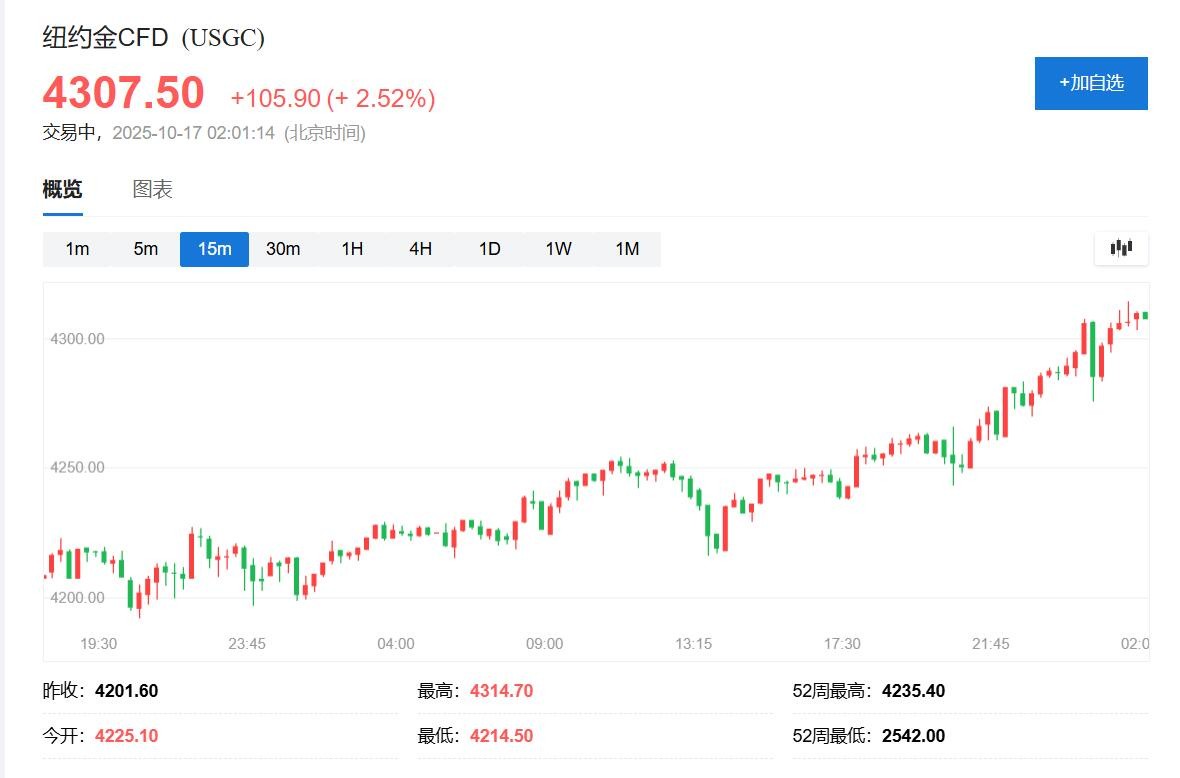

Gold and silver surge to new highs! Futures gold breaks above $4,300 for the first time, and futures silver rises over 4% during the session

The U.S. government shutdown, trade situation, and expectations of interest rate cuts by the Federal Reserve have become the driving forces behind the recent surge in precious metals. Some analysts claim that gold is currently in the most stable bull market in years, with prices rising about 15% over the past month and a pullback of less than 2%, indicating strong demand from both institutional and retail investors. Other analyses suggest that while high gold prices may persist, given the current upward trend, a certain pullback may be on the horizon

This Thursday, gold and silver jointly reached historic highs. The U.S. government shutdown, trade tensions, and expectations of interest rate cuts by the Federal Reserve have become the driving forces behind the recent surge in precious metals.

On October 16th, during midday trading in the U.S. Eastern Time, gold hit a new intraday high for the fourth consecutive trading day. New York futures gold broke through the $4,300 mark for the first time, with COMEX December gold futures rising about 2.5% during the day. London spot gold once rose above $4,290, gaining 2% intraday. Gold has accumulated an increase of about 60% since the beginning of this year.

At the beginning of midday trading on Thursday, New York silver futures and London spot silver prices refreshed the intraday highs set on Tuesday. COMEX December silver futures rose above $53.60, gaining about 4.4% during the day, while spot silver approached $54.17, rising over 2.1% intraday.

Market analysts pointed out that as the U.S. government shutdown entered its 15th day and the release of economic data was interrupted, investors are accelerating their influx into safe-haven assets like gold. Traders currently believe that the probability of the Federal Reserve cutting interest rates by 25 basis points in October and December is 98% and 95%, respectively.

The silver market is facing a more severe supply crunch. A rare spot premium phenomenon has appeared in the London silver market, with inventories down one-third compared to 2021. Traders are even booking cargo flights to airlift silver to take advantage of price arbitrage.

Bank of America raised its gold price target for 2026 to $5,000 per ounce this Monday, setting the silver target price at $65, becoming the first major investment bank to provide such a high forecast. The bank expects that policy uncertainty and structural supply shortages will continue to support precious metal prices.

Safe-Haven Demand Drives Gold Prices to New Highs

As of Thursday, spot gold has risen for five consecutive trading days, accumulating at least a 6% increase since Thursday.

The demand for safe-haven assets has increased due to multiple factors.

Nitesh Shah, a commodity strategist at WisdomTree, stated that trade frictions have exacerbated uncertainty in global supply chains, leading investors to increasingly turn to gold. He added that the breakthrough in gold prices also reflects investors' unease about the credibility of U.S. policies. Shah believes that gold prices are likely to remain above $4,200.

Ahmad Assiri, a market strategist at Pepperstone, pointed out that the U.S. government shutdown has resulted in the absence of key economic data such as the non-farm payroll report, as well as the upcoming CPI data that is about to be missed. This leaves investors groping in the dark for short-term uncertainty ahead of the Federal Reserve meeting at the end of this month, lacking hard data support U.S. Treasury officials stated on Thursday that the ongoing U.S. federal government shutdown, which has lasted for two weeks, could lead to a loss of up to $15 billion in domestic economic output each week.

Gold Plays a Dual Role

The recent rise in gold prices is driven by multiple factors, including expectations of interest rate cuts, ongoing political and economic uncertainty, robust central bank purchases, inflows into gold ETFs, and a weakening dollar. As a non-yielding asset, gold typically performs well in low-interest-rate environments.

Aakash Doshi, head of gold strategy at State Street Global Advisors, stated that for gold prices to reach $5,000 by 2026, the market may need to see stable physical demand while financial allocation demand rises further.

ANZ analysts believe that investors are willing to pay a higher premium to diversify portfolio risks, and gold remains both a risk diversification tool and a strategic asset. The bank now expects gold to reach $4,400 by the end of the year and peak at $4,600 in June 2026. However, analysts added that as the Federal Reserve ends its easing cycle and the outlook for U.S. economic growth and tariffs becomes clearer, a gradual decline may occur in the second half of 2026.

While the market compares the current rally to the price peaks of the 1980s, ANZ points out that the current price increase is supported by structural driving factors, indicating that high price levels may persist. However, the bank believes that at the current pace of increase, some pullback may be faced.

Joseph Chai, an analyst at RHB Retail Research, stated in a research report that the bullish momentum for New York gold futures appears to remain intact, supported by the latest bullish candlestick patterns and the rising relative strength index on the daily chart. After gold prices broke through $4,200, bulls are now targeting the next resistance level at $4,400. If the market experiences profit-taking, gold may find immediate support at the $4,000 level.

Central Bank Purchases and Collateral Demand

Fawad Razaqzada, a market analyst at City Index and FOREX.com, stated that traders are trying to push up gold prices to get ahead of central bank actions. Ongoing expectations of central bank purchases provide support for gold prices.

According to macro strategist Simon White, the historic rise in gold prices indicates that the market is eager to find safe collateral. One of the biggest misconceptions about gold is viewing it solely as an inflation hedge, but its role extends far beyond that—it is a hedge against the financial system itself. When held in a non-financialized form, gold does not constitute anyone's liability.

The pursuit of safer collateral began with the buying by central banks in emerging economies following the outbreak of the Russia-Ukraine conflict. In an environment where the U.S. is willing to weaponize the dollar, the dollar is no longer seen as a reliable reserve. This behavior has spread to broader markets, prompting investors to seek safer collateral in a financial system where risks are accumulating.

Assiri from Pepperstone noted that gold seems to be in the most stable bull market in years. Over the past month, gold prices have surged about 15%, with a pullback of less than 2%, indicating strong demand from both institutional and retail investors. As concerns about overvaluation in the U.S. stock market grow and discussions about a potential tech bubble increase, gold is becoming a core component of diversified portfolios

Silver Faces Severe Supply Shortage

After experiencing a drop during Tuesday's intraday trading, silver rebounded on Wednesday and surged even more than gold on Thursday.

Bank of America has set its average silver price forecast for 2026 at $56.25, with a peak target of $65. The bank's chief analyst, Michael Widmer, expects that despite a potential 11% decline in physical demand in 2026, the ongoing supply shortage will still drive silver prices up.

The London Bullion Market Association, as the world's most important silver trading center, is facing severe impacts. Bank of America analyst David Jensen pointed out that the market is effectively at a standstill due to insufficient physical silver to meet the delivery demands of billions of dollars in spot contracts. London silver inventories have decreased by one-third since 2021.

A clear sign of market tension is the rare spot premium in the silver futures market. On Monday morning, the spot silver price was $50.21, while the December futures price was only $48.03. Typically, due to storage and financing costs, the silver market exhibits a contango structure with futures trading at a premium.

Reports indicate that traders are booking cargo space to airlift physical silver to London to exploit price differentials for arbitrage. The largest silver ETF, SLV, requires 15,415 tons of silver to back all its shares, equivalent to seven months of global production. Bank of America noted that the transfer of silver from London to New York has significantly tightened the London market, reflected in sharply rising borrowing rates. According to data from the Silver Institute, the silver market is about to face its fifth consecutive year of structural supply shortages