"Disrupting human resources first, economic benefits take time"! The Federal Reserve speaks the truth: AI is about to impact the job market

Federal Reserve Governor Waller cited research from Stanford University stating that the number of jobs most affected by AI has decreased by about 13%, primarily concentrated in support and administrative positions. This is corroborated by the Beige Book report: more employers are reducing their workforce through layoffs and natural attrition, with some companies explicitly attributing the reasons to increased investment in AI technology. However, Goldman Sachs stated that the current AI adoption rate in the U.S. is only 9.2%, and Morgan Stanley expects the productivity benefits of AI to materialize only by the end of this decade

The profound impact of AI on the economy is transitioning from theory to reality, and its shock to the job market may precede the realization of productivity dividends. This is the latest clear signal from Federal Reserve officials!

Federal Reserve officials have rarely acknowledged that AI is reshaping the job market, with technological unemployment already beginning to manifest. Thomas Barkin, President of the Richmond Federal Reserve, recently stated, AI is accelerating applications in call centers and programming positions, with corporate executives reporting a surge in the number of applicants for each vacant position. Federal Reserve Governor Christopher Waller further pointed out that recent research from Stanford University shows that the number of jobs in occupations most affected by AI has decreased by about 13%, primarily concentrated in support and administrative roles.

These statements corroborate the latest Federal Reserve Beige Book report. The report indicates that more employers are reducing their workforce through layoffs and natural attrition, with some companies explicitly attributing the reasons to increased investment in AI technology. Retailers, in particular, are cutting back on call center and IT-related positions, with several companies indicating that further layoffs may occur next year.

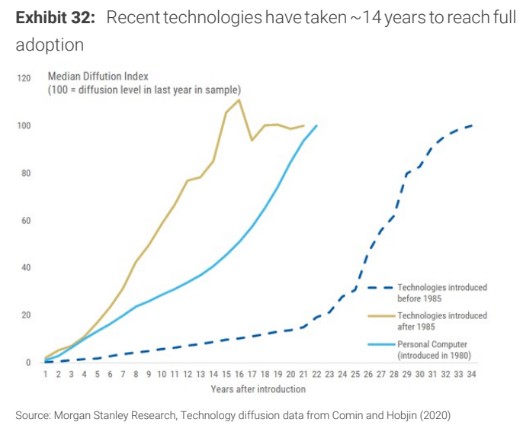

However, Federal Reserve officials also emphasized that the benefits of technological disruption have a time lag. Morgan Stanley analysts expect that the substantial impact of AI on economic data will not become apparent until the end of this decade and into the next decade. Goldman Sachs stated that the current AI adoption rate across the U.S. is only 9.2%.

Cracks in the Job Market

The Federal Reserve Beige Book report documents subtle changes in the labor market. In most districts, more employers report reducing their workforce through layoffs and natural attrition, citing reasons such as weak demand, high economic uncertainty, and, in some cases, increased investment in artificial intelligence technology.

Barkin observed a noticeable shift in hiring dynamics during a speech at the Aiken Chamber of Commerce in South Carolina. He noted, corporate executives report a surge in the number of applicants for each vacant position, which coincides with the accelerated application of AI in call centers and programming roles.

The Stanford University research cited by Waller provides quantitative evidence. The number of jobs in occupations most affected by AI has decreased by about 13% compared to those less affected, with these contractions primarily occurring in support and administrative roles—typically the first areas to be automated. He stated:

This early impact aligns with what I have learned from corporate contacts. Retailers, in particular, are cutting jobs in call centers and IT-related positions, with most companies currently managing through natural attrition, but several retailers have indicated potential layoffs next year.

AI Reshaping Recruitment but Not Yet Triggering a Layoff Wave

A survey by the New York Federal Reserve shows that few companies report layoffs due to AI; instead, they are using technology to retrain employees. However, AI is influencing the recruitment of these companies, with some reducing hiring due to AI while others are increasing the hiring of employees proficient in AI usage.

Looking ahead, it is expected that layoffs and reductions in hiring plans due to the use of AI will increase, especially for employees with college degrees. This trend indicates that the impact of AI on the labor market is spreading from low-skilled positions to high-skilled roles Barkin also mentioned the change in consumer spending patterns. "While consumers are still spending, we are no longer in 2022. Consumers are not as affluent anymore, and they are making choices." He added that demand from high-income groups remains strong.

Economic Benefits Take Time to Materialize

Waller elaborated on the issue of the time inconsistency of technological innovation in his speech at Washington Fintech Week. The disruption brought by innovation appears first, while the benefits take time. When new technologies emerge, it is always easier to see the jobs that may disappear, but harder to see the jobs that will be created.

He used the automotive industry as an example, explaining that when cars appeared, it was easy to see that the jobs of saddle makers would disappear, but it was not obvious that the skills of saddle makers could be used to make car seats, and that more productive car manufacturing would create more and higher-paying jobs.

Waller emphasized that the capital stock in the U.S., measured at constant prices, is seven times that of 1950, yet the unemployment rate in September 1950 was 4.4%, while in August 2025 it is projected to be 4.3%. This is why economists are generally technology optimists—history repeatedly shows that the adoption of new technologies leads to economic growth and more jobs, not fewer.

Waller pointed out that companies are leveraging AI to improve productivity, thereby achieving greater output based on the same level of input. These gains will be reflected in GDP and its corresponding Gross National Income.

He stated that a common feature of great technological innovations in the U.S. is that competitive pressures quickly drive down costs and lead to rapid and widespread adoption. If hardware and software innovations continue to lower the costs of AI, he believes there are almost no barriers to the continued diffusion of AI throughout the economy.

According to a recent report by Goldman Sachs, the current AI adoption rate across the entire economy is about 9.2%, while skeptics like Elliott Management claim that this round of the AI cycle is "overhyped."

Morgan Stanley analyst Stephen Byrd stated, "While the pace of AI adoption may be faster than past technologies, we believe it is still too early to see its reflection in economic data, aside from corporate investment." He expects the impact of AI to appear in economic data by the end of this decade and into the next decade.