The panic in the US credit market spreads, global stock markets collectively decline, US Treasury bonds rise, gold and silver are strong, and cryptocurrencies are weak

The credit crisis of two regional banks in the United States has once again heightened market risk aversion, leading to setbacks in global stock markets, declines in European and American bank stocks, and strong demand for U.S. Treasuries and gold and silver from investors. The U.S. dollar weakened due to dovish signals from the Federal Reserve and the banking credit crisis, while cryptocurrencies experienced widespread declines

Concerns over credit triggered by U.S. regional banks have impacted the market, and risk aversion sentiment has risen again.

On October 17, global stock markets declined, U.S. stock index futures fell, European stocks opened lower collectively, and Asian markets dropped. Driven by risk aversion sentiment, gold and silver strengthened to reach historical highs, U.S. Treasury bonds continued to rise, the U.S. dollar index fell, and cryptocurrencies weakened.

Currently, investors are facing a series of concerns, including a potential U.S. government shutdown, worries about an artificial intelligence bubble, and trade tensions. Regarding the recent credit crisis in U.S. banks, Dilin Wu, a strategist at Pepperstone Group Ltd., stated that the impact on the U.S. banking sector is more about market sentiment and liquidity issues rather than a systemic credit collapse. This is a good example of the current global risk aversion sentiment—fundamentals are still good, but fear is dominating the trading sector.

- U.S. stock index futures continued to decline, with the Nasdaq 100 index futures down 1%, S&P 500 index futures down 0.85%, and Dow futures down 0.61%.

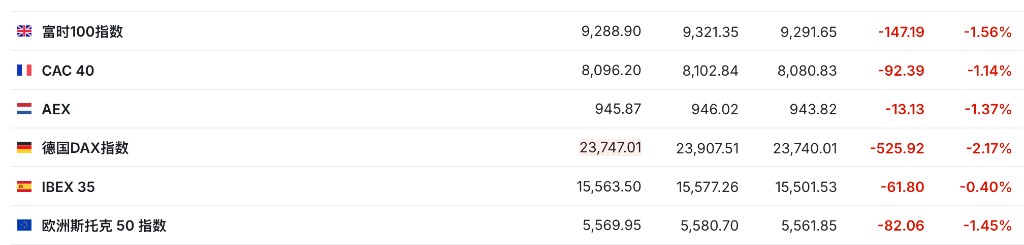

- European stocks opened lower collectively, with the German DAX index's decline widening to 2%, falling below 24,000 points; the Euro Stoxx 50 index fell 1.35%, and both the French CAC 40 index and the UK FTSE 100 index fell over 1%.

- German bank stocks fell, with Commerzbank and Deutsche Bank down over 3% and 5%, respectively.

- UK government bond yields fell by 4-5 basis points, with the 10-year government bond yield dropping to 4.45%, the lowest level since July.

- The 2-year U.S. Treasury yield fell to a six-week low.

- The U.S. dollar index fell over 0.2%, currently at 98.14.

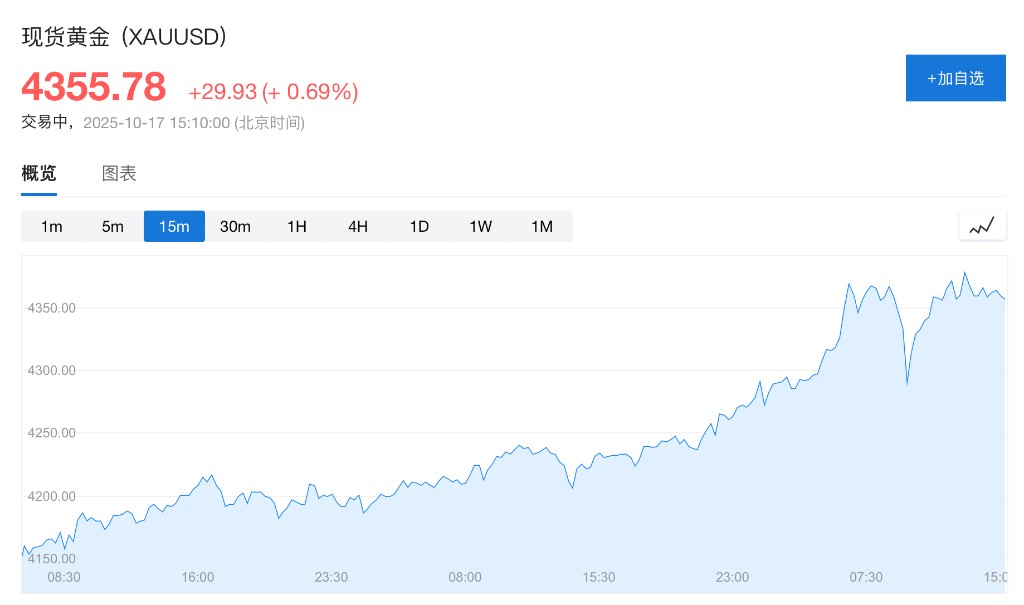

- Spot gold rose nearly 0.7%, currently at $4,355 per ounce.

- Brent crude oil fell 0.7% to $60.61 per barrel.

- Ethereum touched down to $3,800 per coin, down 2.61% for the day.

U.S. stock index futures continued to decline, with the Nasdaq 100 index futures down 1%, S&P 500 index futures down 0.85%, and Dow futures down 0.61%.

European stocks opened lower collectively, with the German DAX index's decline widening to 2%, falling below 24,000 points; the Euro Stoxx 50 index fell 1.35%, and both the French CAC 40 index and the UK FTSE 100 index fell over 1%.

The U.S. dollar index fell over 0.2%, currently at 98.14. Federal Reserve officials have signaled a dovish stance, and the market is concerned about U.S. regional banks. The dollar has fallen for the fourth consecutive day, on track for its largest weekly decline in over three months.

Spot gold rose nearly 0.7%, currently reported at $4,355 per ounce. Risk aversion sentiment has boosted gold prices, continuously breaking historical records.

Spot gold rose nearly 0.7%, currently reported at $4,355 per ounce. Risk aversion sentiment has boosted gold prices, continuously breaking historical records.

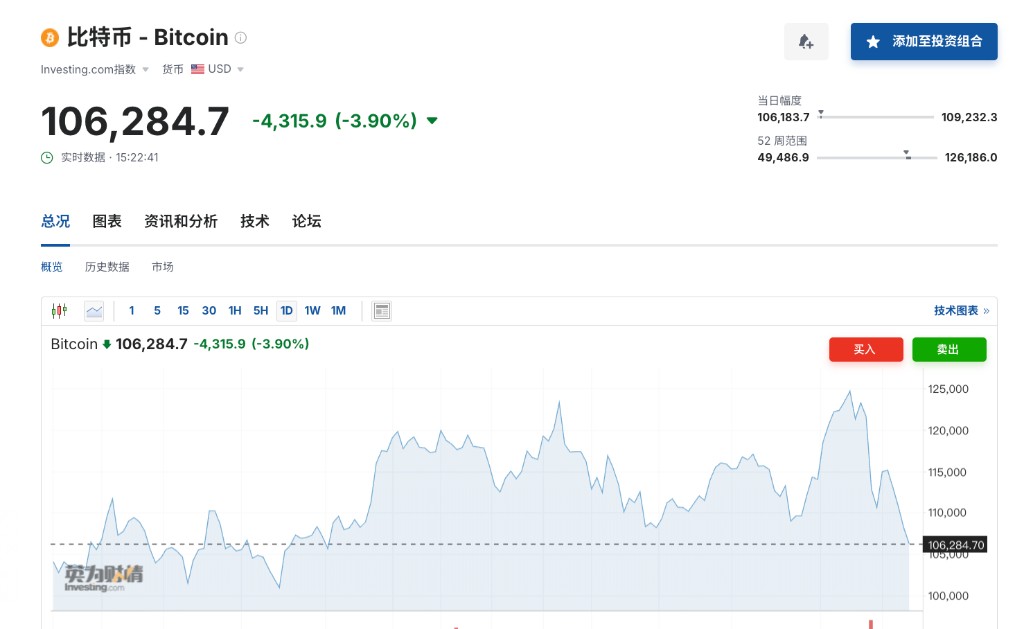

Bitcoin fell below $107,000. Trade tensions have triggered record market liquidations, and so far, cryptocurrencies are still struggling to achieve a sustained rebound.

Updating