Profit is king, AI leads the way! The U.S. stock earnings season kicks off with a bang, and Wall Street increasingly believes in the "long-term bull market narrative."

The U.S. earnings season has begun, and Wall Street is optimistic about corporate profit outlooks, especially for tech giants and the AI computing power industry chain. Despite facing government shutdowns and debt issues, analysts believe corporate earnings will dominate the market, driving U.S. stocks to continue reaching new highs. Data from Yardeni Research shows that the net upward adjustment has reached its highest level in four years, indicating increased market confidence in a long-term bull market. The AI investment boom is still in its early stages and is expected to enhance productivity and operational efficiency

According to the Zhitong Finance APP, as concerns about the unstable state of the global macroeconomy, dominated by unfavorable factors such as the U.S. government shutdown and the debt crisis in developed countries, intensify, and the dominance of massive investments in artificial intelligence may obscure deeper issues beneath the surface of the U.S. economy, Wall Street analysts are becoming more optimistic about the profit outlook for U.S. companies. Coupled with the momentum of exceeding performance expectations this year, the bullish trend in the U.S. stock market, which continues to hit new highs, may remain strong for a long time.

During a period of significant uncertainty regarding Trump's tariff policies on China, the U.S. government shutdown, and the increasing debt burden in developed countries, the earnings disclosure season for U.S. stocks is crucial. From the latest general expectations of Wall Street analysts and the disclosed performance, the "Magnificent Seven" tech giants, which hold a high weight in the S&P 500 index, along with leaders in the AI computing power industry such as Broadcom and AMD, are expected to show strong performance, driving the continuous new highs in the U.S. stock market.

Currently, "corporate profits, not macro" occupies a core influence in the pricing of global stock markets. Wall Street's confidence in U.S. corporate profits is significantly warming, especially for the tech giants and leaders in the AI computing power industry that drive this round of the U.S. stock market bull run (the "Magnificent Seven" and core AI computing power companies like Broadcom, AMD, and TSMC) — still at the intersection of positive revisions and exceeding expectations, providing strong "performance fundamental driving force" for the continuous new highs in U.S. stocks and major global benchmark indices.

Wall Street Analysts Are Increasingly Confident in Corporate Profit Strength

Goldman Sachs analysts emphasize that this wave of AI investment is still in the "opening stage," mainly based on the actual scenarios of AI applications like ChatGPT and Claude being deployed in enterprises, which have already brought improvements in productivity and operational efficiency (for example, AI deployment is just beginning within Wall Street institutions like Goldman Sachs). To achieve these improvements, an incredibly vast AI computing power infrastructure is required.

Since 2023, the unprecedented AI investment boom has driven a long-term bull narrative in AI computing power, which is the core logic behind the continuous new highs in the U.S. stock market and the increasing weight of tech stocks, particularly those of the "Magnificent Seven." Based on current core trend indicators and news dynamics regarding the AI bull market, the AI-driven global stock market bull run is far from over.

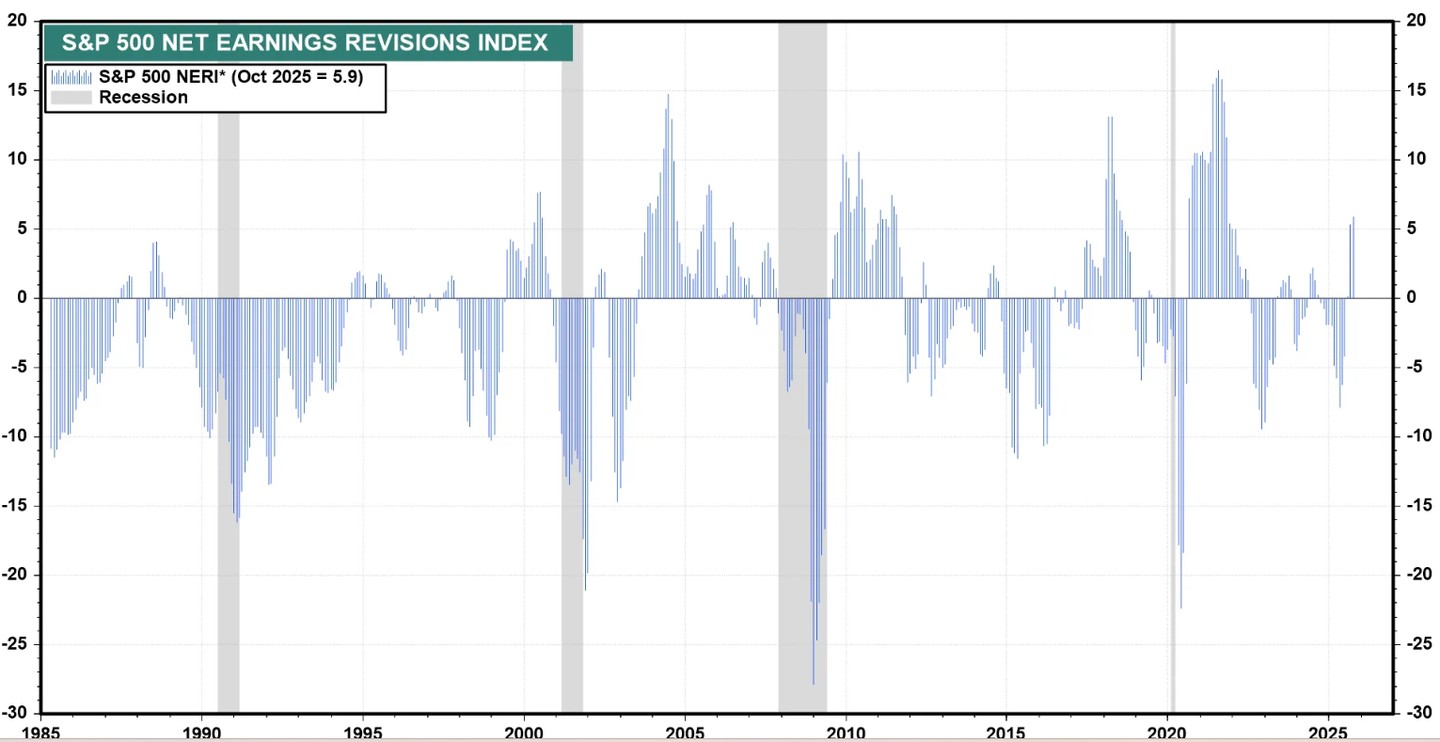

Wall Street forecasters have been busy this month raising profit expectations for U.S. companies, especially leaders in AI computing power and tech giants, pushing an indicator tracked by Yardeni Research that measures the "ratio of net upward revisions to total earnings expectation changes" to its highest level in four years. The net earnings revision index (NERI) for the S&P 500 index has risen by 0.6 percentage points in October, marking a significant increase for five consecutive months since hitting a low of -7.8% in May (the lowest in 28 months).

The latest readings compiled by Yardeni Research generally reflect the warming optimism of Wall Street analysts regarding earnings growth. The sustained positive value — indicating an increase in the proportion of upward revisions over the past three months — suggests that bullish sentiment in the market is strong. The NERI turned positive in August for the first time in nearly a year, as analysts' confidence in the profit growth momentum of U.S. companies, especially in the tech sector, continues to strengthen The speed and magnitude of the NERI rebound are particularly remarkable. The soaring trend over the past five months since May marks the largest improvement in NERI since December 2020, ranking in the top 3% of all comparable trends since 1985. From a historical data perspective, such a rapid reversal is often accompanied by at least 12 months of positive earnings revisions, a trend that typically supports further bullish trajectories in the stock market.

The unstoppable tide of AI, the long-term bull market in U.S. stocks continues

"Earnings in the coming quarters could achieve double-digit growth—primarily contributed by tech giants, laying a solid fundamental foundation for this market," said Jeffrey Buchbinder, Chief Equity Strategist at LPL Financial Holdings. "The economic growth expectations boosted by stimulus policies, unprecedented AI infrastructure construction and application boom driving earnings growth, along with expectations of Federal Reserve interest rate cuts, should allow this bull market to continue for quite some time."

It is under the leadership of large tech giants such as NVIDIA, Meta, Google, Oracle, TSMC, and Broadcom, as well as the epic stock price surge of leaders in the AI computing industry, that an unprecedented AI investment boom has swept through the U.S. stock market and global stock markets. This has driven the S&P 500 index and the global benchmark index—MSCI World Index to significantly rise since April, recently setting new historical highs.

Recently, the prices of high-performance storage products in the global DRAM and NAND series have surged. Additionally, the cloud computing giant Oracle recently announced a contract reserve of $455 billion, far exceeding market expectations, and the world's highest-valued AI startup OpenAI has reached over $1 trillion in AI computing infrastructure deals. Together, these developments have significantly reinforced the "long-term bull market narrative" for AI GPU, ASIC, HBM, data center SSD storage systems, liquid cooling systems, and core power equipment. The demand for AI computing driven by generative AI applications and AI agents at the inference end is described as "the stars and the sea," expected to drive the AI computing infrastructure market to continue showing exponential growth. The "AI inference system" is also considered by Jensen Huang to be the largest source of future revenue for NVIDIA.

The indicators compiled by Yardeni Research do not take into account the absolute level of growth expectations. According to data compiled by Wall Street analysts, the profit growth of the S&P 500 index in the third quarter is expected to slow from nearly 14% in the first quarter to a still robust 7.2%. Worryingly, among the 11 sectors of the S&P 500 index, five are expected to experience profit contraction, while the tech sector's growth expectation of up to 21% strongly supports the overall data, led by seven major tech giants and leaders in AI computing infrastructure However, here, the NERI indicator compiled by Yardeni Research also brings some comfort. Wall Street analysts are significantly raising profit expectations for the entire market, with 7 out of 11 sectors seeing more upward revisions than downward ones. Data from Yardeni Research shows that this is the highest number since August 2024, surpassing the 5 sectors in August. The technology, financial, communication services, and healthcare sectors lead the way, with NERI readings of 12.4%, 11.4%, 11.2%, and 5.6%, respectively.

So far, this optimism seems very reasonable. According to the latest data compiled by institutions, about 82% of the U.S. publicly listed companies that have reported earnings since the start of this week’s earnings season have exceeded Wall Street expectations—slightly better than the long-term average. The largest commercial banks on Wall Street have generally reported earnings that exceed expectations, with strong profit growth driven by a continued rebound in mergers and acquisitions and stock underwriting, benefiting JPMorgan (JPM.US), Goldman Sachs (GS.US), Bank of America (BAC.US), and Morgan Stanley (MS.US).

The bullish camp on Wall Street believes that the S&P 500 index will continue to rise during the new earnings reporting season, supported by historical data: statistics from Deutsche Bank indicate that the S&P 500 index has risen during earnings seasons up to 75% of the time historically, with a median increase of 2%.

"This is an absolute bullish signal for the stock market," said Ed Yardeni, Chief Investment Officer and founder of Yardeni Research. "When Wall Street analysts are generally raising profit expectations, it often provides strong support for a bullish market atmosphere."

Binky Chadha, a stock market analyst from Deutsche Bank, recently raised the institution's year-end target for the S&P 500 index to 7,000 points. Analysts from Bank of America, Barclays, and Wells Fargo have also raised their forecasts, generally expecting the S&P 500 index to rise to 7,000 points by the end of the year or early next year. As of Thursday's close, the S&P 500 index stood at 6,629 points.

Julian Emanuel, an analyst from the well-known Wall Street institution Evercore ISI, expects that driven by the "once-in-a-generation" transformative change of artificial intelligence (AI) technology, the S&P 500 index will climb to 7,750 points by the end of 2026, with a potential increase of about 20%.

Overall, Emanuel's long-term outlook is more optimistic, emphasizing that the proliferation of AI will drive both corporate profits and valuations higher. Emanuel stated that during this process, a correction of 10% or more in the S&P 500 index is possible, but he believes that such corrections represent good buying opportunities in the context of a structural bull market. This analyst's forecast for a bull market scenario in U.S. stocks is even more aggressive: Emanuel predicts that if an "AI-driven asset bubble" occurs, the S&P 500 index could even rise to 9,000 points