Hedging or gambling? Retail investors in South Korea, known as the "global retail capital trend indicator," are flocking to leveraged VIX

South Korean retail investors are actively investing in leveraged VIX futures ETFs to hedge against risks in the U.S. stock market or to speculate. This year, the ETF has attracted approximately $130 million, making it one of the most popular U.S.-listed ETFs. As U.S. stock valuations approach historical highs, South Korean retail investors hope to protect their long positions or speculate on market corrections through this method. Although leveraged securities can amplify gains, they also exacerbate losses, so investors need to exercise caution

The Zhitong Finance APP noted that South Korean retail investors seeking to hedge against risks in heavily weighted U.S. stocks or make the next round of bets are embracing a new type of trading: leveraged bets on the volatility index (VIX).

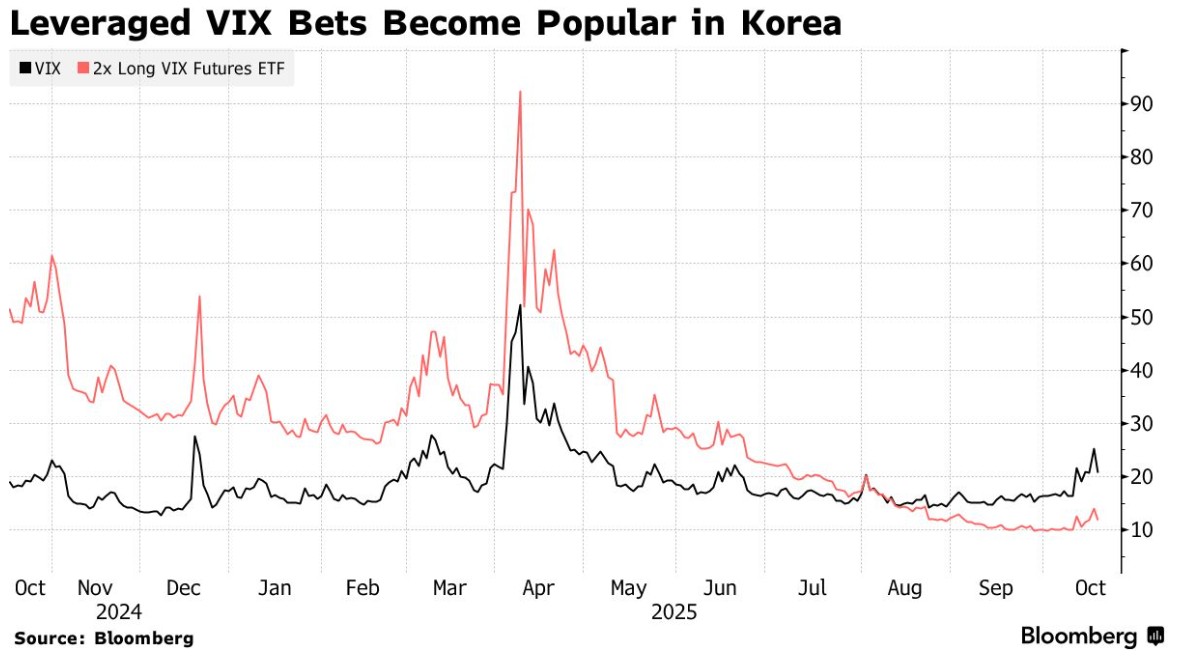

According to data from the Korea Securities Depository, this year, the inflow of approximately $130 million into the 2x long VIX futures ETF (designed to achieve double the returns of the Cboe Volatility Index futures benchmark) has become one of the most favored U.S.-listed ETFs, and in July, it was the seventh most purchased ETF by South Korean investors. These additional funds accounted for about one-fifth of the global inflow into this ETF.

After years of heavy investment (often using leveraged tools) in large tech stocks and cryptocurrencies, many South Koreans are preparing for a potential sell-off. As U.S. stock valuations approach historical highs and discussions about bubbles dominate social media, this enhanced VIX bet as a means to protect long positions or simply speculate on market corrections has become increasingly popular. Retail investors from South Korea are known as the "most reckless" retail group globally, having previously made large bets on high-leverage ETF products associated with Tesla and Nvidia, resulting in substantial profits and serving as a barometer for global retail capital flows.

Francis Oh, Head of Business Development for Rex Shares LLC in Asia, stated: "These leveraged VIX ETFs are used by those investors to gain greater profits during fear-driven sell-offs."

He added that South Korean retail investors may not fully understand the technical details and risks of these securities. "They may think they are buying an undervalued asset, which could also provide protection during a significant market crash."

The risks of leveraged securities are well known: while they amplify gains, they also exacerbate losses.

For products linked to volatility, there is an additional layer of risk: they are constructed using futures positions, which require constant rebalancing, a process that typically involves "selling low and buying high" under normal market conditions.

This means that even if the securities rise in the short term, holding them long-term usually leads to declines. Professional traders are less affected by this roll cost because they tend to enter and exit positions quickly, which South Korean retail investors may not be able to do.

Despite the recent resurgence in volatility causing the 2x long VIX futures ETF to rise 19% this month, the fund is still down 65% for 2025. This fund, coded UVIX, has declined by more than 75% annually since its inception.

Charlie McElligott, Managing Director of Macro Strategy at Nomura Holdings, emphasized that the significant inflow of funds into VIX securities from South Korea should not be interpreted "in isolation." These capital inflows coincided with "huge long positions," marking investors' enthusiasm for the U.S. market—especially considering their holdings in leveraged ETFs.

"They've put so much money into long-side leveraged ETFs," McElligott said, "it's like 'steroids' meeting 'steroids.'"

Capital inflows into volatility products often drive up the cost of buying crash insurance in the VIX futures market, which is much smaller than the S&P 500-related markets.

Retail investors in South Korea, known locally as "ants," are famous for their willingness to take risks. Overseas leveraged or inverse securities (which provide returns opposite to their tracked assets) are particularly attractive as they currently have no trading restrictions. In contrast, trading derivatives like futures and options requires up to 17 hours of education and simulated trading.

On the country's most popular chat app, Kakao Talk, there are about a dozen public groups with hundreds of users dedicated to discussing VIX or leveraged products.

One trader on the X platform, nicknamed @hell_inflection, noted that South Koreans became interested in UVIX during the market turbulence around the April Korean Liberation Day holiday. Industry officials stated he has 16,800 followers, and his posts helped drive retail trading of the ETF. He vowed in August that despite losing 18%, he would "stick it out" with his position.

Jung Hyundoo resigned from Hanwha Investment & Securities to start his own investment research center, where he explains financial concepts on television and shares his views with over 35,000 YouTube subscribers. His nickname is "Money Teacher," and he believes that given the fierce AI competition and the Federal Reserve's easing policies, the U.S. market is unlikely to crash anytime soon, stating that UVIX investors are destined to lose money.

"There are some fanatics aggressively using leverage to seek greater returns," he said in a recent interview, "I don't think there will be a massive market crash in the foreseeable future to save those holding UVIX."