Bank of America Hartnett: When the U.S. is $38 trillion in debt, should we buy U.S. Treasuries, corporate bonds at a 20-year low spread, U.S. stocks at a 40 times CAPE, or soaring gold? This is tricky

Hartnett pointed out that against the backdrop of global central bank interest rate cuts, mainstream assets all imply risks: U.S. Treasuries are weighed down by massive debt, corporate bond spreads offer weak protection, U.S. stock valuations are high, and gold has surged significantly. Despite numerous risks, the market still plays out a "buy everything" frenzy, with funds pouring into technology stocks and gold. He himself continues to maintain a positive outlook on the combination of bonds, international markets, and gold

As the yield on money market funds is expected to drop (Federal Reserve) by at least 100 basis points in the coming quarters, should I buy U.S. Treasury bonds when the U.S. government debt reaches $38 trillion? Or should I buy corporate bonds when the credit spread is at a 20-year low?

Or should I invest in stocks with a cyclically adjusted price-to-earnings ratio (CAPE) of up to 40 times? Or in gold, which has just experienced a "vertical rise"? This is tricky.

As global central banks enter a rate-cutting cycle, investors are being pushed to a challenging crossroads. Recently, Michael Hartnett, Chief Investment Strategist at Bank of America, painted this complex investment picture: against the backdrop of declining expectations for money market yields, mainstream assets are presenting their own tricky dilemmas, leaving investors in a bind.

Hartnett's statement clearly reveals the risks in the current market: the high U.S. government debt undermines the safe-haven appeal of sovereign bonds; corporate bonds offer insufficient risk compensation due to narrow spreads; U.S. stock valuations are at historical highs, creating significant pullback pressure; and while gold has strong momentum, the risks of chasing prices are also significant.

Capital Flows into Risk Assets and Gold

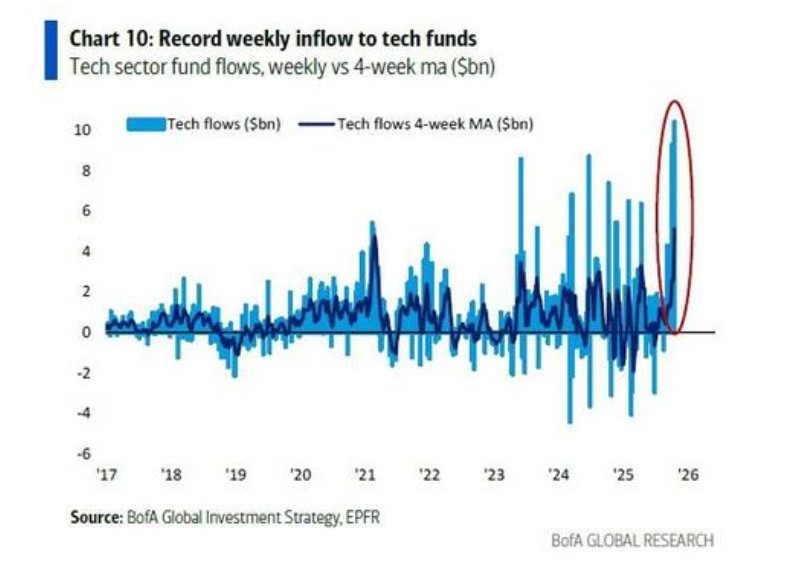

Despite Hartnett's cautious outlook, recent capital is flowing into risk areas such as tech stocks and gold with unprecedented momentum.

According to data cited in the report, in the past week, funds have been massively flowing out of cash-like assets ($24.6 billion) and into risk assets. Specifically, the stock market attracted $28.1 billion, with tech stocks recording a record $10.4 billion inflow in a single week.

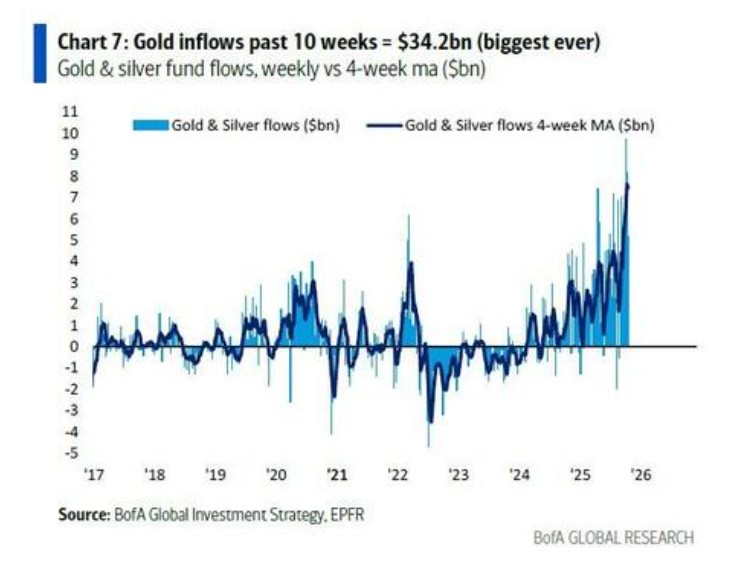

The gold market is also hot, with a cumulative inflow of $34.2 billion over the past 10 weeks, setting a historical record.

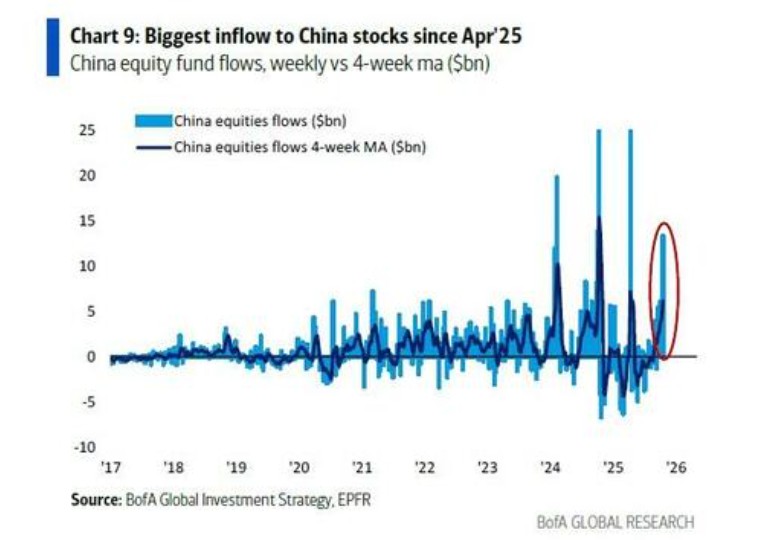

Additionally, the Chinese stock market has seen its largest single-week capital inflow since April 2025, reaching $13.4 billion. This " buy everything" momentum highlights the market's strong risk appetite under the expectation of rate cuts.

The current global wave of rate cuts has generated enormous liquidity. According to Hartnett's statistics, the global stock market capitalization has surged by $20.8 trillion this year.

However, beneath the market's fervent sentiment, risks are quietly accumulating. He warns that if asset prices fall and impact the wealthy class, the economy could deteriorate sharply. At the same time, the credit market has begun to show cracks ("Krunchy Kredit"). Hartnett predicts that if key sectors such as banks and brokerages continue to weaken, or if the high-yield bond credit default swap (HY CDX) spread widens to over 400 basis points, it will signal deeper deleveraging or liquidation risks, at which point the Federal Reserve will be forced to take more aggressive rate cuts.

Hartnett's "BIG" Strategy: Finding Direction Amid Uncertainty

In the face of a complex market environment, Hartnett reiterated his "BIG" portfolio, which favors Bonds, International markets, and Gold.

In terms of Bonds, he maintains a bullish view on long-term U.S. Treasuries, expecting the 30-year Treasury yield to fall below 4%.

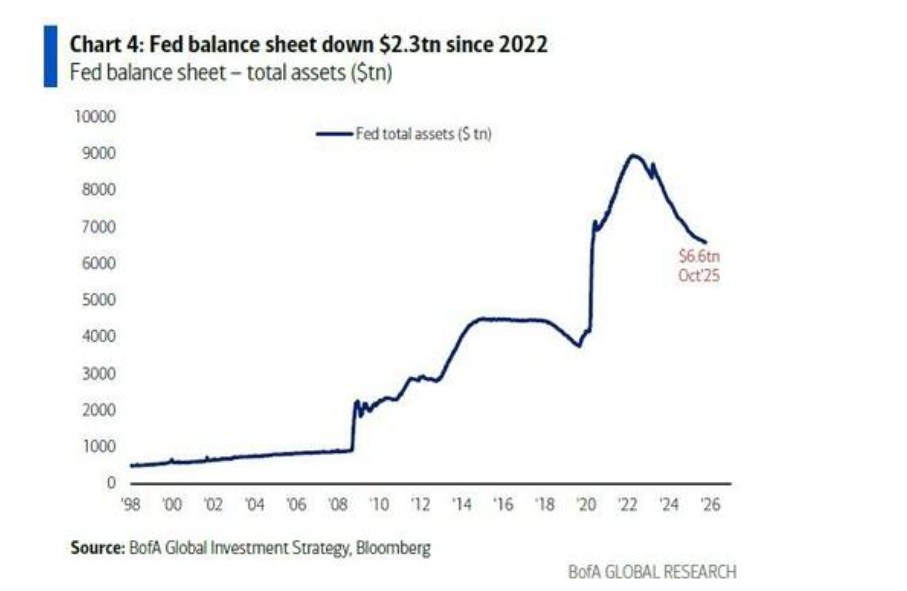

He believes that the Federal Reserve's rate cuts, the end of quantitative tightening (QT), and the deflationary effects of artificial intelligence (AI) on the labor market will support bond prices. The report also specifically mentions that zero-coupon bonds are the best hedging tool against credit event risks.

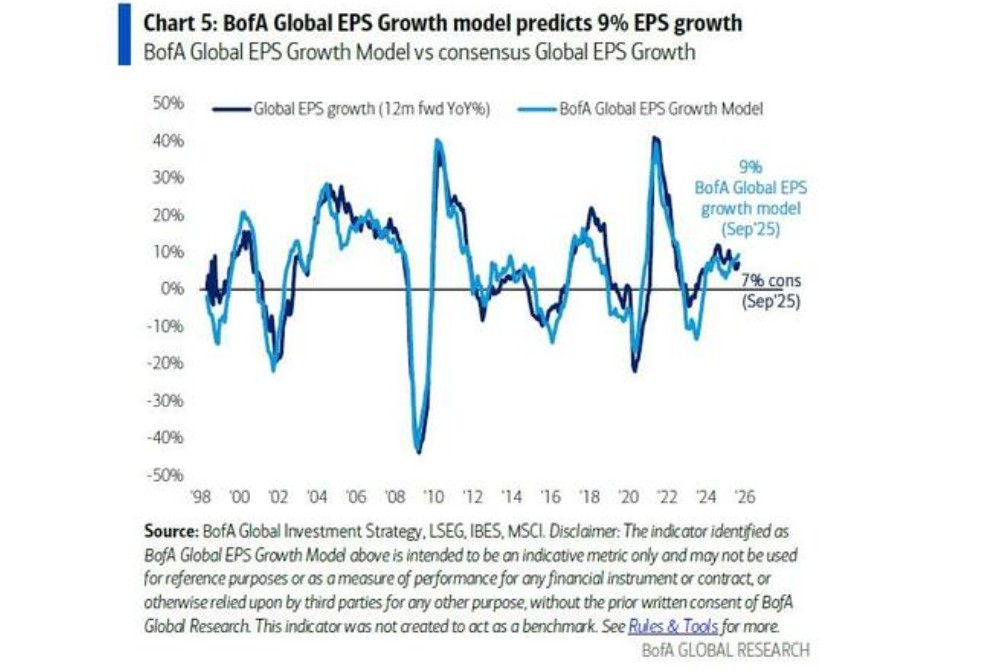

Regarding the International markets, Hartnett continues to be optimistic about international equities, predicting that the Hang Seng Index will rise above 33,000 points. Bank of America's global earnings per share (EPS) growth model forecasts a 9% increase in global EPS over the next 12 months, above market consensus.

Additionally, although the MSCI global index has a price-to-earnings (P/E) ratio of 19.6 times, the global stock market P/E ratio excluding the U.S. is only 15 times, making valuations more attractive. He firmly believes that market style will shift from the "American exceptionalism" of the first half of the 2020s to "global rebalancing" in the second half.

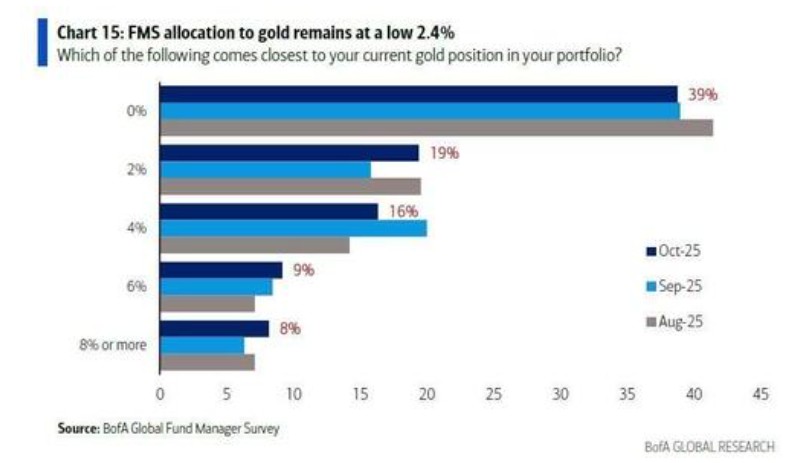

As for Gold, Hartnett remains extremely bullish and maintains his prediction that gold prices could break $6,000 per ounce by next spring. Although gold was listed as the "most crowded trade" in the latest fund manager survey, he believes this is a misunderstanding.

He points out that the allocation of gold among Bank of America’s high-net-worth clients is only 0.5%, while the global fund managers' allocation is just 2.4%, far from saturation. In his view, only significant geopolitical easing or black swan events such as a bursting AI bubble leading to soaring real interest rates could end the gold bull market.