Third Quarter Economic Data: Which Clues Need Attention

In the third quarter of 2025, China's actual GDP grew by 4.8% year-on-year, while nominal GDP increased by 3.73%. The economic growth rate slowed compared to the first half of the year, but still demonstrated resilience. The capacity utilization rate of industrial enterprises rose to 74.6%, although it remains below last year's level. The growth rate of per capita disposable income and consumption expenditure for residents has slowed, with the growth rate of consumption expenditure significantly lower than in the past three quarters. Economic data in September showed some stabilization compared to July and August

Abstract

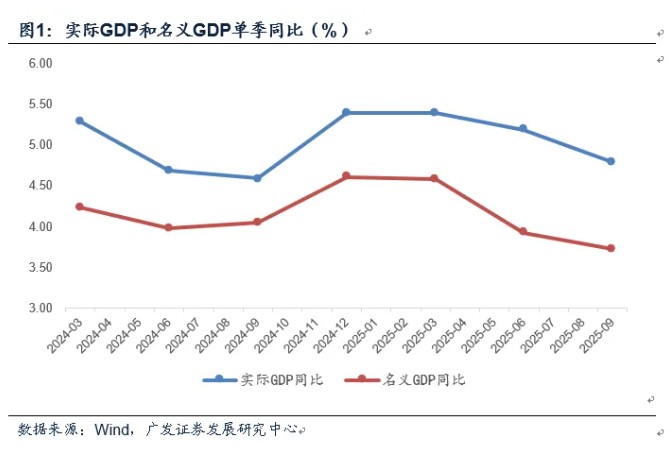

First, the actual GDP growth in the third quarter of 2025 was 4.8% year-on-year, which aligns with our previous report's estimate of 4.79%. The nominal GDP grew by 3.73% year-on-year, slightly higher than our expected 3.60%. The economic growth rate in the third quarter slowed compared to the first half of the year, but overall it was within expectations. The actual GDP growth in the first three quarters domestically was 5.2% year-on-year, which remains a relatively high growth rate in the global economy, demonstrating the strong resilience of the Chinese economy. The latest forecast by the IMF for global economic growth in 2025 is 3.2%, with developed economies and emerging markets at 1.6% and 4.2%, respectively. However, the nominal GDP growth of 4.1% year-on-year in the first three quarters remains relatively low, which is one of the factors constraining microeconomic sentiment.

Second, the capacity utilization rate of industrial enterprises showed some improvement in the quarter. The capacity utilization rate in the third quarter was 74.6%, up 0.6 percentage points from the second quarter. Notably, the capacity utilization rates for electrical machinery and automobiles increased significantly, reflecting the positive impact of "de-involution"; the capacity utilization rates for general equipment and computer communication electronics also increased quarter-on-quarter, related to relatively active investment demand in new industries. The capacity utilization rate for black metallurgy decreased quarter-on-quarter but remained above 80%, higher than last year's level; coal and non-metallic minerals are in fields with low capacity utilization rates and a quarter-on-quarter decline, and efforts should continue to promote capacity optimization. However, it should be noted that the cumulative capacity utilization rate of 74.2% in the first three quarters of this year is lower than last year's annual rate of 75.0%, which is related to the rapid decline in fixed asset investment on the demand side this year. Based on the growth rate of industrial added value in the numerator and the growth rates of exports, consumption, and fixed investment in the denominator, the "supply-demand ratio" for the first three quarters of this year is estimated to be 2.2, higher than last year's 1.5.

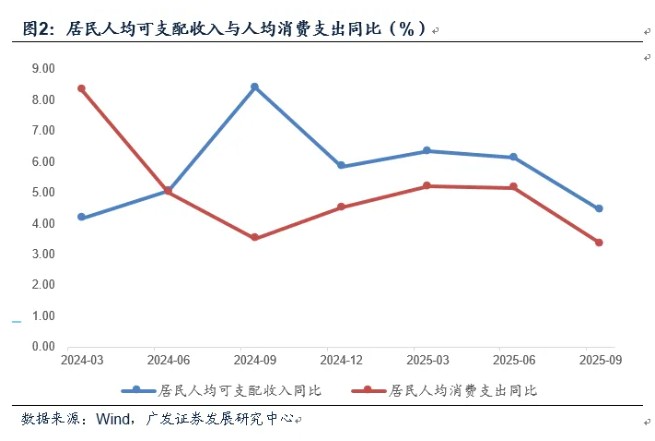

Third, both ends of residents' income and expenditure have slowed to varying degrees, with the slowdown in expenditure growth being greater than that in income. The year-on-year growth rates for per capita disposable income and per capita consumption expenditure in the third quarter were 4.5% and 3.4%, respectively. The growth rate of consumption expenditure is significantly lower than in the past three quarters and is roughly comparable to that of the third quarter of last year. This may include a short-term shift from consumption to investment due to increased activity in the capital markets; at the same time, the decline in consumption propensity due to marginal income slowdown may be another reason. From a breakdown perspective, the growth rates of expenditures on food, tobacco and alcohol, clothing, housing, and healthcare have shown a noticeable decline in the quarter.

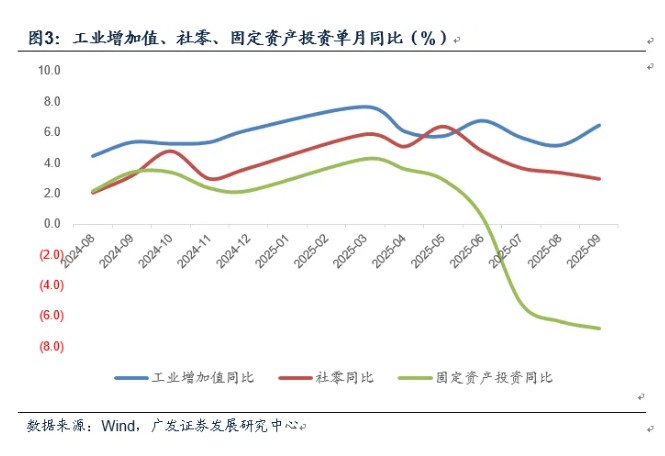

Fourth, when splitting the third quarter, September showed overall marginal stabilization compared to July and August, which is consistent with the three major "soft indicators" released earlier. Based on the industrial added value, service production index, and rough estimates of social retail in September, the year-on-year actual GDP index for the month was 4.91%, with industrial added value growth reaching as high as 6.5%, exhibiting seasonal characteristics of the autumn peak season. However, compared to the relatively strong supply side of the economy in September, the demand side showed more obvious differentiation, with exports performing better than previous values, while social retail and fixed asset investment further weakened.

Fifth, the industrial added value in September once again verified the pattern of a year-end surge observed this year. In our previous report "Why Economic Rhythm is High at Year-End and Low at Year-Start," we analyzed that this tendency is influenced by two factors: first, the rhythm of export delivery values; second, the influence of policy rhythm In September, the export delivery value growth rate indeed rose again. This year, excluding the month of the Spring Festival, the months with a growth rate above 1% are only the three quarters' ends. From the perspective of major industrial product output, the main products with higher output growth are industrial robots, metal cutting machine tools, and automobiles; the growth rate of power generation equipment is relatively high but has slowed down; the output growth rate of smartphones is low; and the year-on-year decline in cement has further expanded.

Sixth, the consumption data in September has slowed down year-on-year for the fourth consecutive month, with a seasonally adjusted month-on-month rate of -0.18%, which is also weak. Urban consumption is weaker than rural consumption, with the year-on-year growth of rural social retail sales in September slightly higher at 4.0% compared to December last year; however, the year-on-year growth of urban social retail sales at 2.9% is significantly lower than December last year, a trend that started in July this year. We understand this may be related to the impact of real estate and the "two new" influences. The new round of volume and price slowdown in real estate has a more obvious impact on urban household balance sheets, thereby affecting consumption tendencies. The trade-in program has driven durable consumer goods to be more concentrated in urban areas, while in September, home appliance sales declined rapidly against a backdrop of a high base. Among other categories, cultural and office supplies have slowed down under a high base; sports and entertainment products have seen a slowdown in growth; the growth rate of gold, silver, and jewelry has slowed down; the retail sales growth of automobiles has stabilized at a low level; and the growth rate of mobile phones has rebounded somewhat.

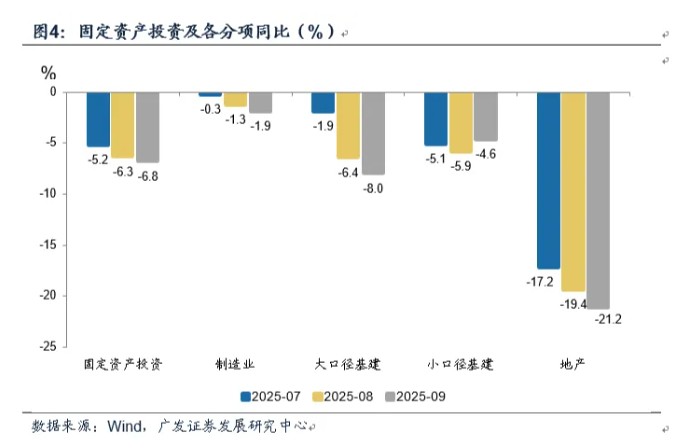

Seventh, fixed asset investment continued to slow down in September, with the cumulative year-on-year rate further turning negative, implying a month-on-month year-on-year rate of -6.8%. Among them, the month-on-month decline in manufacturing, real estate, and all-caliber infrastructure has all expanded. Excluding real estate, the cumulative year-on-year fixed asset investment is 3.0%, which is also significantly down from the previous value of 4.2%, indicating that infrastructure and other areas are also important drags on investment. Among them, water conservancy investment, after experiencing a year and a half of double-digit high growth, has seen a rapid decline in growth rate, which is one of the dragging factors; investment in public facility management, representing local infrastructure investment, has also declined rapidly, which is another dragging factor.

Eighth, in September, among the main indicators in the real estate sector, the year-on-year decline in sales area and investment completion amount continued to expand, while new construction, construction, completion, and funds in place year-on-year have improved somewhat. Price pressure remains quite evident, with the new residential prices in 70 large and medium-sized cities declining by 0.4% month-on-month, a larger decline than the previous value; it is particularly noteworthy that the month-on-month decline in first-tier cities has also expanded.

Ninth, the urban surveyed unemployment rate in September was 5.2%, slightly lower than the previous value of 5.3%, indicating stable performance in existing employment. However, it is worth noting that the incremental employment data still shows certain pressure. In the first eight months of this year, the cumulative year-on-year new urban employment was 0.21%, corresponding to a high survey unemployment rate of 16-24 years old during the same period. We understand that existing employment depends on the month-on-month stability of sectors with large employment absorption in the economy (such as exports and services); while incremental employment also needs to consider the willingness to recruit new employees, which is influenced by nominal growth and corporate profitability. Improving incremental employment requires promoting the rebound of the central level of corporate profit growth rate.

Tenth, overall, one of the highlights of the data is that the economy in the first three quarters has laid a good foundation for achieving the annual target, and the single-quarter growth rate in the third quarter also meets expectations; secondly, the industrial capacity utilization rate has improved month-on-month, especially in several key industries Third, the month-on-month industrial production in September rebounded significantly, providing strong support for economic data. At the same time, the shortcomings in the data are also worth noting: first, the quarterly growth rate of household consumption expenditure has significantly slowed; second, the volume and price of real estate have yet to stabilize; third, the decline in fixed asset investment has further widened. We understand that insufficient fixed asset investment may be one of the sources of contraction on the demand side. Policies should have already taken this into account, as evidenced by the recent acceleration in the implementation of new policy financial tools; at the same time, the central government has allocated 500 billion yuan from the local government debt limit to localities, which, in addition to resolving existing debt and settling overdue corporate payments, will also be arranged for "project construction in economically significant provinces that meet the criteria." The subsequent effects remain to be further observed.

Main Text

In the third quarter of 2025, the actual GDP grew by 4.8% year-on-year, consistent with our previous report's estimate of 4.79%. The nominal GDP grew by 3.73% year-on-year, slightly higher than our expected 3.60%. The economic growth rate in the third quarter slowed compared to the first half of the year, but overall it was within expectations. The actual GDP growth rate in the first three quarters domestically was 5.2%, which remains a relatively high growth rate in the global economy, demonstrating the strong resilience of the Chinese economy. [1] The IMF's latest forecast for global economic growth in 2025 is 3.2%, with developed economies and emerging markets expected to grow by 1.6% and 4.2%, respectively. However, the nominal GDP growth rate of 4.1% in the first three quarters domestically is still relatively low, which is one of the factors constraining microeconomic sentiment.

In the report "Asset Revaluation to Date: Constraints and Momentum," we pointed out that based on the adjusted values released by the National Bureau of Statistics for July and August, the actual GDP for the third quarter is expected to be 4.79%, and the nominal GDP is expected to be 3.6%.

On October 14, the IMF released the latest edition of the "World Economic Outlook Report," which forecasts that global economic growth will be 3.2% in 2025 and 3.1% in 2026. Among them, developed economies are expected to grow by 1.6% this year and 1.6% next year. The U.S. and Eurozone economies are expected to grow by 2% and 1.2% this year, and 2.1% and 1.1% next year, respectively. Emerging markets and developing economies are expected to grow by 4.2% this year and 4% next year.

The capacity utilization rate of industrial enterprises has improved slightly in the quarter. The capacity utilization rate in the third quarter was 74.6%, up 0.6 percentage points from the second quarter. Among them, the capacity utilization rates in electrical machinery and automobiles increased significantly month-on-month, reflecting the positive impact of "de-involution"; the capacity utilization rates in general equipment and computer communication electronics also increased month-on-month, related to relatively active new industry investment demand. The capacity utilization rate in black metallurgy decreased month-on-month but remained above 80%, higher than last year's level; coal and non-metallic minerals are areas with low capacity utilization rates that have decreased month-on-month and should continue to promote capacity optimization. However, it should be noted that the cumulative capacity utilization rate of 74.2% in the first three quarters of this year is lower than last year's annual rate of 75.0%, which is related to the rapid decline in fixed asset investment on the demand side this year According to the growth rate of industrial added value in the numerator and the growth rates of exports, consumption, and fixed asset investment in the denominator, the "supply-demand ratio" for the first three quarters of this year is 2.2, higher than last year's 1.5.

In the third quarter of 2025, the capacity utilization rate of the electrical machinery industry is 74.9% (previous value 73.5%); the capacity utilization rate of the automotive industry is 73.3% (previous value 71.3%); the capacity utilization rate of the general equipment industry is 78.9% (previous value 78.3%); the capacity utilization rate of the computer communication electronics industry is 79.0% (previous value 77.3%); the capacity utilization rate of the ferrous metallurgy industry is 80.1% (previous value 80.8%); the capacity utilization rate of the coal mining industry is 68.9% (previous value 69.3%); the capacity utilization rate of the non-metallic mining industry is 62.0% (previous value 62.3%).

In the third quarter of 2025, the capacity utilization rate of industrial enterprises is 74.6%, higher than the 74.0% in the second quarter and 74.1% in the first quarter. The cumulative capacity utilization rate for the first three quarters is 74.2%, lower than the annual rate of 75.0% for 2024 and the 74.6% for the first three quarters of 2025.

We use 40% * year-on-year fixed asset investment + 40% year-on-year consumption + 20% year-on-year exports as a shadow indicator for total demand growth, and year-on-year industrial added value as a shadow indicator for supply growth, using the latter/ former as the "supply-demand ratio" (see "Guiding the Optimization of the Supply-Demand Ratio: 2025 Mid-term Environmental Outlook"), thus the first three quarters of 2025 is 2.2, higher than the annual 1.5 for 2024.

There is a varying degree of slowdown in both ends of residents' income and expenditure, with the slowdown in expenditure growth being greater than that of income. The year-on-year growth rates for per capita disposable income and per capita consumption expenditure in the third quarter are 4.5% and 3.4%, respectively. The growth rate of consumption expenditure is significantly lower than in the past three quarters and is roughly comparable to that of the third quarter of last year. This may include a short-term shift from consumption to investment due to increased activity in the capital market; at the same time, the decline in consumption propensity due to marginal income slowdown may be another reason. From a breakdown perspective, the growth rates of expenditures on food, tobacco and alcohol, clothing, housing, and healthcare have all decreased significantly in a single quarter.

In the first three quarters, the year-on-year growth rates for per capita disposable income and per capita consumption expenditure are 5.1% and 4.6%, respectively, implying single-quarter year-on-year growth rates of 4.5% (previous value 5.1%) and 3.4% (previous value 5.2%).

From the perspective of single-quarter expenditure growth rates, food, tobacco, and alcohol year-on-year growth is 0.6% (previous value 4.0%); clothing has zero growth year-on-year (previous value 3.3%); housing year-on-year growth is 1.1% (previous value 3.8%); daily necessities and services year-on-year growth is 10.8% (previous value 8.1%); transportation and communication year-on-year growth is 8.1% (previous value 6.3%); education, culture, and entertainment year-on-year growth is 8.1% (previous value 9.5%); healthcare year-on-year growth is -2.4% (previous value 3.8%); other goods and services year-on-year growth is 10.0% (previous value 11.1%).

Splitting the third quarter, September overall stabilized marginally compared to July and August, which is consistent with the three major "soft indicators" released earlier. According to the September industrial added value, service production index, and rough estimates of the monthly actual GDP index, the year-on-year growth rate is 4.91%, with industrial added value growth reaching 6.5%, showing seasonal characteristics of the autumn peak season. However, compared to the strong supply side of the economy in September, the demand side shows more obvious differentiation, with exports better than previous values, while retail sales and fixed asset investment further weakened.

Splitting the third quarter, September overall stabilized marginally compared to July and August, which is consistent with the three major "soft indicators" released earlier. According to the September industrial added value, service production index, and rough estimates of the monthly actual GDP index, the year-on-year growth rate is 4.91%, with industrial added value growth reaching 6.5%, showing seasonal characteristics of the autumn peak season. However, compared to the strong supply side of the economy in September, the demand side shows more obvious differentiation, with exports better than previous values, while retail sales and fixed asset investment further weakened.

In September, BCI, EPMI, and PMI all showed month-on-month improvements. In the report "Seven Signals of September PMI," we pointed out that the slopes of the three soft indicators vary in strength but point in the same direction, indicating a seasonal improvement in the economy in September.

From the main economic indicators, September's industrial added value grew by 6.5% year-on-year (previous value 5.2%); the service production index grew by 5.6% year-on-year (previous value 5.6%); exports grew by 8.3% year-on-year (previous value 4.3%); and retail sales for the month grew by 3.0% year-on-year (previous value 3.4%).

September's industrial added value once again verified the pattern of a year-end surge, which we analyzed in the previous report "Why the Economic Rhythm is High at the End of the Season and Low at the Beginning." This is likely influenced by two factors: first, the rhythm of export delivery value; second, the influence of policy rhythm. The growth rate of export delivery value in September indeed rose again, with the only months this year, excluding the Spring Festival month, where the growth rate exceeded 1% being the three quarter-ends. From the perspective of major industrial product output, the main products with high output growth rates are industrial robots, metal cutting machine tools, and automobiles; the growth rate of power generation equipment is relatively high but has slowed down; the growth rate of smartphone production is low; and the year-on-year decline in cement production has further widened.

In September, the year-on-year growth of export delivery value was 3.8% (previous value -0.4%), with March and June this year being 7.7% and 4.0%, respectively.

In September, the production of industrial robots grew by 28.3% year-on-year (previous value 14.4%); the production of metal cutting machine tools grew by 18.2% year-on-year (previous value 16.4%); automobile production grew by 13.7% year-on-year (previous value 10.5%); power generation equipment production grew by 19.8% year-on-year (previous value 30.7%); smartphone production grew by 0.1% year-on-year (previous value 3.2%); and cement production declined by 8.6% year-on-year (previous value -6.2%).

In September, consumption data slowed for the fourth consecutive month year-on-year, with a seasonally adjusted month-on-month decline of -0.18%, which is also weak. Urban consumption was weaker than rural consumption, with rural retail sales year-on-year in September slightly higher at 4.0% compared to December last year; however, urban retail sales year-on-year at 2.9% were significantly lower than December last year, a trend that began in July this year. We understand this may be related to the impact of real estate and the "two new" influences. The new round of volume and price slowdown in real estate has more significantly affected urban household balance sheets, thereby impacting consumption tendencies. The trade-in for new products has driven durable goods consumption to be more concentrated in urban areas, while in September, appliance sales declined rapidly against a backdrop of high base figures. In other categories, cultural office supplies have slowed down under a high base; the growth rate of sports and entertainment products has slowed; the growth rate of gold, silver, and jewelry has slowed; the growth rate of automobile retail sales has stabilized at a low level; and the growth rate of mobile phones has rebounded somewhat.**

In September, the year-on-year growth of retail sales of consumer goods was 3.0% (previous value 3.4%), with rural retail sales year-on-year at 4.0% (previous value 4.6%, last December 3.8%); urban retail sales year-on-year at 2.9% (previous value 3.2%, last December 3.7%).

In September, the year-on-year growth of home appliance retail sales was 3.3% (previous value 14.3%); communication equipment retail sales year-on-year at 16.2% (previous value 7.3%); sports and entertainment products retail sales year-on-year at 11.9% (previous value 16.9%); cultural office supplies retail sales year-on-year at 6.2% (previous value 14.2%); automobile retail sales year-on-year at 1.6% (previous value 0.8%); gold, silver, and jewelry retail sales year-on-year at 9.7% (previous value 16.8%).

In September, fixed asset investment continued to slow down, with cumulative year-on-year turning negative, implying a month-on-month year-on-year of -6.8%. Among them, the decline in manufacturing, real estate, and broad infrastructure investment has all expanded. Excluding real estate, the cumulative year-on-year fixed asset investment was 3.0%, significantly down from the previous value of 4.2%, indicating that infrastructure and other fields are also important drags on investment. Among them, water conservancy investment, after experiencing a year and a half of double-digit high growth, has seen a rapid decline in growth rate, which is one of the drag factors; investment in public facility management, representing local infrastructure investment, has also declined rapidly, which is another drag factor.

In September, the cumulative year-on-year fixed asset investment was -0.5%, lower than the previous value of 0.5%. Implying a month-on-month year-on-year of -6.8%, previous value -6.3%.

Among them, manufacturing investment year-on-year for the month was -1.9%, previous value -1.3%; real estate investment year-on-year for the month was -21.2%, previous value -19.4%; broad infrastructure investment year-on-year for the month was -8.0%, previous value -6.4%; narrow infrastructure investment year-on-year for the month was -4.6%, previous value -5.9%.

In September, water conservancy investment cumulative year-on-year was 3.0%, previous value 7.4%, and July was 12.6%; in September, public facility management investment cumulative year-on-year was -2.8%, previous value -1.1%, and July was 0.5%.

In September, among the main indicators in the real estate sector, the year-on-year decline in sales area and investment completion amount continued to expand, while new starts, construction, completion, and funds in place year-on-year showed some improvement. Price pressure remains quite evident, with new residential prices in 70 large and medium-sized cities down 0.4% month-on-month, a larger decline than the previous value; notably, the month-on-month decline in first-tier cities has also expanded.

In September, the year-on-year sales area of commercial housing was -10.5%, previous value -10.3%; the year-on-year sales amount of commercial housing was -11.8%, previous value -13.7% In September, real estate investment decreased by 21.2% year-on-year, compared to a previous value of -19.4%; among them, the area of new construction decreased by 14.4% year-on-year, compared to a previous value of -20.3%; the area under construction decreased by 19.9% year-on-year, compared to a previous value of -20.5%; the area completed increased by 1.2% year-on-year, compared to a previous value of -21.5%.

In September, the funds in place for real estate development decreased by 11.5% year-on-year, compared to a previous value of -11.9%; among them, domestic loans decreased by 14.6% year-on-year, compared to a previous value of 1.1%; self-raised funds decreased by 12.1% year-on-year, compared to a previous value of -11.7%; deposits and advance payments decreased by 8.6% year-on-year, compared to a previous value of -15.2%; personal mortgage loans decreased by 11.5% year-on-year, compared to a previous value of -19.4%.

In September, the price index of newly built commercial residential properties in 70 large and medium-sized cities decreased by 0.4% month-on-month, compared to a previous value of -0.3%; year-on-year, it decreased by 2.7%, compared to a previous value of -3.0%. Among them, the price in first-tier cities decreased by 0.3% month-on-month, compared to a previous value of -0.1%; the price in second-tier cities decreased by 0.4% month-on-month, compared to a previous value of -0.3%; the price in third-tier cities decreased by 0.4% month-on-month, compared to a previous value of -0.4%.

The urban surveyed unemployment rate in September was 5.2%, slightly lower than the previous value of 5.3%, indicating stable performance in existing employment. However, it is worth noting that the incremental employment data still shows certain pressure. In the first eight months of this year, the cumulative year-on-year increase in urban employment was 0.21%, which corresponds to a relatively high surveyed unemployment rate for the 16-24 age group during the same period. We understand that existing employment depends on the month-on-month stability of sectors with significant employment absorption in the economy (such as exports and services); while incremental employment also needs to consider the willingness for new recruitment, which is influenced by nominal growth and corporate profitability. Improving incremental employment requires promoting the rebound of the central level of corporate profit growth.

Therefore, policies place great importance on employment issues, continuously emphasizing the "employment priority strategy."

In September 2024, the "Opinions of the Central Committee of the Communist Party of China and the State Council on Implementing the Employment Priority Strategy to Promote High-Quality and Full Employment" was issued, emphasizing "making high-quality full employment a priority goal of economic and social development," and "improving the employment impact assessment mechanism, major policy formulation, major project determination, and major productivity layout must be carried out simultaneously with job creation and unemployment risk assessment, constructing an employment-friendly development model."

**Overall, one of the highlights of the data is that the economy in the first three quarters has laid a good foundation for achieving the annual target, and the single-quarter growth rate in the third quarter also met expectations; secondly, the industrial capacity utilization rate has improved month-on-month, especially in several key industries; thirdly, the month-on-month industrial production in September rebounded significantly, providing strong support for economic data. At the same time, the shortcomings in the data are also worth noting: first, the quarterly growth rate of household consumption expenditure has significantly slowed down; second, the volume and price of real estate have not yet stabilized; third, the decline in fixed asset investment has further expanded. We understand that insufficient fixed asset investment may be one of the sources of contraction forces on the demand side. Policies should have already paid attention to this point, and recently, the implementation of new policy-based financial tools has accelerated; at the same time, the central government has allocated 500 billion yuan from the local government debt limit to local governments, in addition to resolving existing debts and clearing overdue corporate accounts, it will also be arranged for "project construction in economically significant provinces that meet the conditions," with subsequent effects awaiting further observation **

Author of this article: Guo Lei from GF Macro, original source: Guo Lei Macro Tea House, original title: "【GF Macro Guo Lei】Third Quarter Economic Data: Which Clues Need Attention"

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk