Zhongce Rubber's first quarterly report after going public opens with a bang: Q3 net profit increased by 76.6%, overseas expansion accelerates, and exchange rate gains boost gross profit|Financial Report Insights

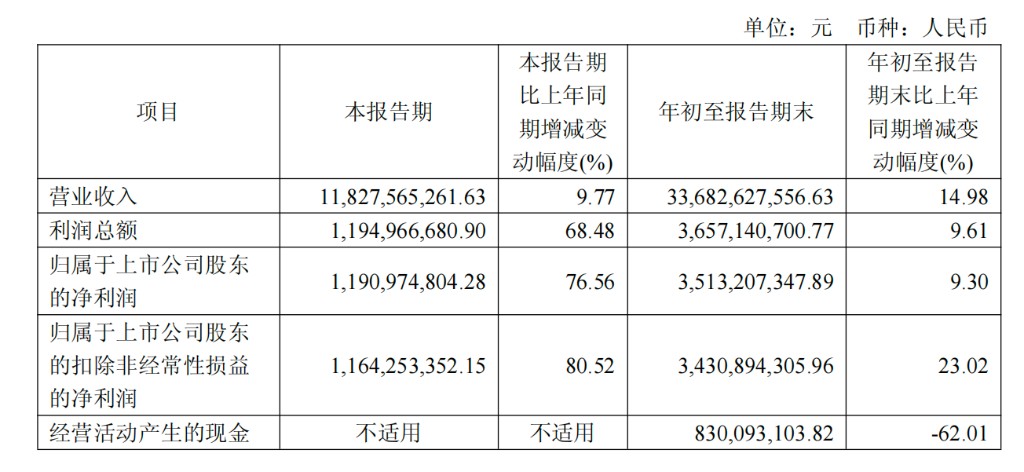

The company's Q3 revenue was 11.83 billion yuan, a year-on-year increase of 9.77%, and net profit was 1.19 billion yuan, a year-on-year surge of 76.56%. The gross profit margin increased in Q3, and under the backdrop of the company's rising market share overseas, foreign exchange losses significantly decreased, becoming the core driver of profit growth

In the context of overall weak demand in the rubber industry and increased fluctuations in raw material prices, Zhongce Rubber has delivered its first impressive quarterly report since going public.

On the 20th, the company announced its third-quarter report, showing that both revenue and net profit increased in the third quarter, with revenue growing nearly 10% year-on-year and net profit soaring by 76%. The company's profitability has significantly improved. With a year-on-year increase in gross profit, Zhongce Rubber has achieved a substantial reduction in exchange losses through strong financial management capabilities, becoming the core driver of profit growth amid accelerated market share expansion overseas and increased exchange rate risks.

Key points are as follows:

- Strong financial performance: Third-quarter revenue reached 11.83 billion yuan, a year-on-year increase of 9.77%; net profit was 1.19 billion yuan, a year-on-year surge of 76.56%; cumulative revenue for the first three quarters was 33.68 billion yuan, a year-on-year increase of 14.98%, and net profit was 3.51 billion yuan, a year-on-year increase of 9.30%.

- Significant improvement in profitability: The gross profit margin increased year-on-year in Q3, while the substantial reduction in exchange losses became the core driver of profit growth.

- Cash flow under pressure: The net operating cash flow for the first three quarters was 830 million yuan, a sharp decline of 62.01% year-on-year, mainly due to a significant increase in procurement expenses.

- Accelerated expansion: Total assets reached 51.08 billion yuan, an increase of 13.96% compared to the beginning of the year; construction in progress reached 4.35 billion yuan, doubling compared to the beginning of the year, indicating the company's accelerated capacity expansion.

- Changes in equity structure: The equity attributable to shareholders reached 24.14 billion yuan, a surge of 38.14% compared to the beginning of the year, mainly due to profit accumulation and an increase in capital reserves.

Improvement in gross profit margin combined with exchange gains, profit growth far exceeds revenue

Zhongce Rubber delivered an impressive performance in the third quarter. The net profit for the quarter was 1.19 billion yuan, a year-on-year surge of 76.56%, which far exceeds the revenue growth of 9.77%, indicating a clear improvement in profitability. Cumulative revenue for the first three quarters was 33.68 billion yuan, net profit was 3.51 billion yuan, and basic earnings per share reached 4.25 yuan, a year-on-year increase of 4.17%.

Behind this disparity between profit and revenue growth are two core driving factors. First, the company's gross profit margin has improved compared to the same period last year. The operating costs for the first three quarters were 26.74 billion yuan, a year-on-year increase of 16.07%, lower than the revenue growth of 14.98%, indicating progress in product structure optimization and cost control.

Second, the significant reduction in exchange losses has made a notable contribution to profits. Financial expenses amounted to 282 million yuan, although interest expenses still reached 239 million yuan, the overall financial expenses have significantly decreased from 305 million yuan in the same period last year.

What is even more noteworthy is that the growth rate of net profit excluding non-recurring items was 80.52%, higher than the overall net profit growth rate, reaching 1.16 billion yuan, indicating a genuine improvement in the company's main business profitability rather than relying on one-time gains

The company's operating net cash flow and profit performance show a divergence

However, behind the impressive profit data, the cash flow situation appears quite awkward. The net operating cash flow for the first three quarters was only 830 million yuan, a year-on-year plunge of 62.01%, in stark contrast to the net profit of 3.51 billion yuan. This divergence mainly stems from the "cash paid for purchasing goods and receiving services" reaching 23.499 billion yuan, a year-on-year surge of 51.1%, far exceeding the revenue growth rate.

This phenomenon may reflect several issues: first, the company has made significant inventory preparations to cope with demand growth or fluctuations in raw material prices; second, there is increased pressure on accounts receivable management. Data shows that accounts receivable reached 7.71 billion yuan, an increase of 27.8% from the beginning of the year, and notes receivable also reached 2.09 billion yuan, up 41.7% from the beginning of the year. Although the company's revenue recognition scale has expanded, the efficiency of cash recovery has significantly declined.

The ending balance of cash and cash equivalents was 5.29 billion yuan, although it increased by 35.7% from the beginning of the year, it mainly relied on financing activities—net inflow from financing activities in the first three quarters was 2.81 billion yuan, including 3.93 billion yuan from equity financing. This indicates that the company's cash generation ability at the operational level is actually weakening