CATL Q3 revenue increased by 12.9% year-on-year, net profit increased by 41.21% | Financial Report Insights

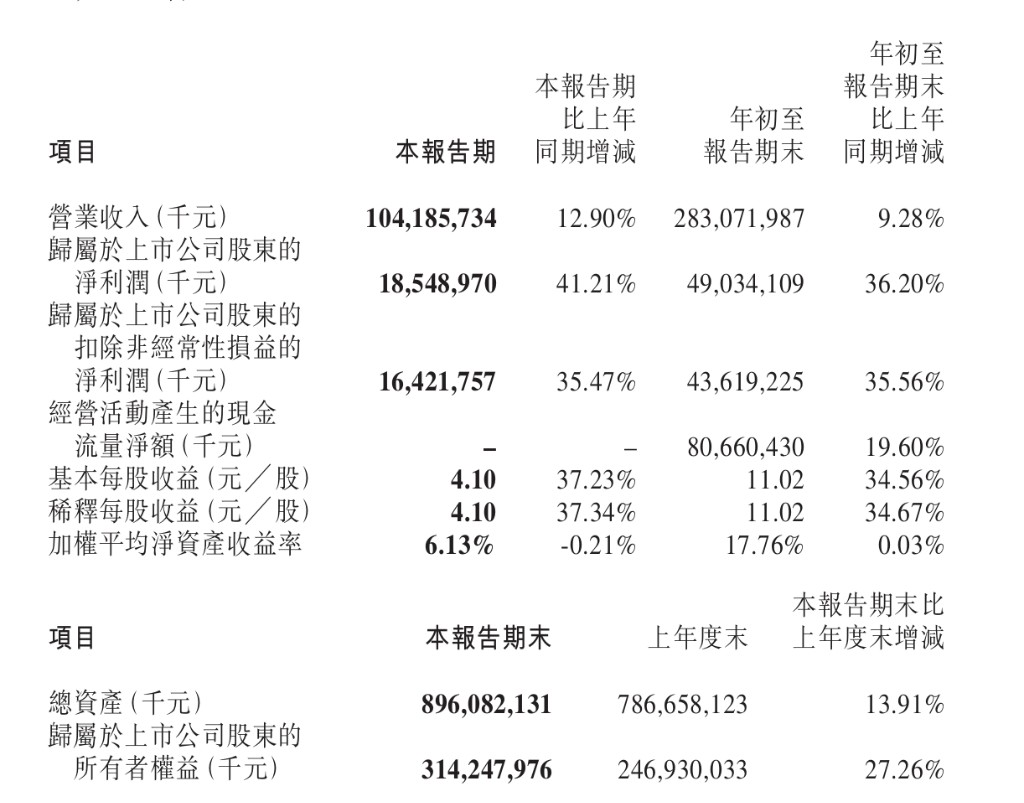

In the third quarter of 2025, CATL achieved a net profit attributable to shareholders of listed companies of RMB 18.55 billion, a significant year-on-year increase of 41.21%. The profit growth rate significantly exceeded the revenue growth rate, with operating revenue of RMB 104.19 billion, a year-on-year increase of 12.90%

In the third quarter of 2025, CATL achieved a net profit attributable to shareholders of listed companies of RMB 18.55 billion, a significant year-on-year increase of 41.21%. The profit growth rate significantly outpaced the revenue growth rate, with operating revenue reaching RMB 104.19 billion, a year-on-year increase of 12.90%.

On the 20th, CATL announced its third-quarter performance:

- Revenue of RMB 104.19 billion, a year-on-year increase of 12.90%, estimated at RMB 120.9 billion.

- Net profit of RMB 18.5 billion, a year-on-year increase of 41.21%, estimated at RMB 18.58 billion.

- Net profit after deducting non-recurring gains and losses reached RMB 16.42 billion, a year-on-year increase of 35.47%.

According to the announcement, the company implemented a mid-term dividend plan for 2025, distributing cash of RMB 10.07 per 10 shares (tax included) to all shareholders, with a total dividend amount of approximately RMB 4.57 billion. This dividend plan has been fully implemented in the A-share and H-share markets before September this year.

CATL Q3 Profit Increased by 41%, Revenue Growth Slowed

In the first three quarters of 2025, the company achieved revenue of RMB 283.1 billion, a year-on-year increase of 9.28%; net profit attributable to shareholders was RMB 49 billion, a year-on-year increase of 36.20%; net profit after deducting non-recurring gains and losses was RMB 43.6 billion, an increase of 35.56%.

Looking solely at the third quarter, revenue of RMB 104.2 billion increased by 12.90%, and net profit of RMB 18.5 billion increased by 41.21%, with the profit growth rate being more than three times that of revenue growth. After deducting non-recurring gains and losses, the net profit for the first three quarters was RMB 43.6 billion, a year-on-year increase of 35.56%.

During the reporting period, financial expenses were -RMB 7 billion, while in the same period last year, it was only -RMB 2.9 billion, a year-on-year improvement of 142.41%, mainly due to foreign exchange gains from currency fluctuations and increased net interest income.

In addition, asset impairment losses significantly decreased by 38.69% compared to the same period last year, as there were large impairment provisions for mineral resource-related assets in the same period last year, while there were no such matters affecting this period, which also provided strong support for net profit.

Balance Sheet Expansion, Abundant Cash Flow

While achieving high-quality profit growth, CATL's balance sheet continues to expand, and cash flow remains strong, indicating the company's healthy financial condition and sustained business growth momentum.

As of September 30, 2025, the company's total assets reached RMB 896.08 billion, an increase of 13.91% compared to the end of the previous year. Among them, inventory increased by 34.05% year-on-year to RMB 80.21 billion, which the company attributed mainly to the increase in business scale. At the same time, the contract liabilities reflecting customer prepayments and order status also increased significantly by 46.14% from RMB 27.83 billion at the beginning of the year to RMB 40.68 billion, indicating that the company has sufficient orders on hand.

In terms of cash flow, CATL's net cash flow from operating activities in the first three quarters reached RMB 80.66 billion, a year-on-year increase of 19.60%, reflecting the company's strong self-financing capability. In addition, influenced by the fundraising from the H-share IPO, the net cash flow from financing activities turned from a net outflow in the same period last year to a net inflow of RMB 4.28 billion