U.S. stock bulls on alert! Morgan Stanley's Wilson: Two major issues unresolved, short-term pullback risk remains

Morgan Stanley stock strategist Michael Wilson warned of a pullback risk in the U.S. stock market in the short term, due to unresolved issues such as trade tensions and slow earnings expectation adjustments. The S&P 500 index has not fully recovered, and the loan crisis among U.S. regional banks has intensified market unease. Wilson pointed out that if the China-U.S. trade dispute is not resolved before November, the U.S. stock market could decline by 11%. Despite the short-term caution, he is optimistic about economic recovery in the next 6 to 12 months

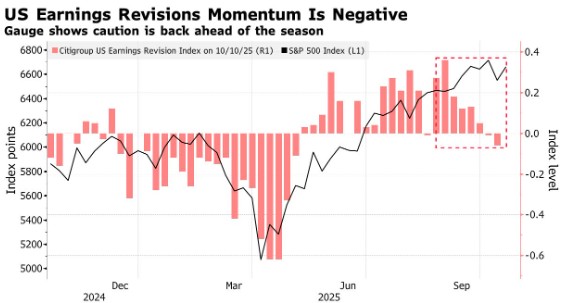

According to the Zhitong Finance APP, Morgan Stanley stock strategist Michael Wilson stated that due to unresolved issues such as trade tensions and the slowing pace of earnings forecast revisions, there remains uncertainty risk in the U.S. stock market, and investors should maintain a cautious attitude in the short term. The S&P 500 index has not fully recovered from the decline earlier this month caused by escalating U.S.-China tensions. Meanwhile, the revision of earnings forecasts (the difference between the number of upward and downward revisions by analysts) is slowing down, while the earnings season is in full swing. Adding to market unease is the credit strain caused by the loan crisis at two regional banks in the U.S.

The strategists wrote in a report: "Before the risks of a recent further pullback are fully eliminated, it is necessary to see both the U.S. and China more effectively ease trade tensions, maintain more stable earnings per share forecasts, and ensure more ample liquidity."

Wilson stated last week that if the trade dispute between the U.S. and China is not resolved before the November deadline, the U.S. stock market could fall by as much as 11%.

Although he is cautious in the short term, Wilson stated that his view on the gradual recovery of the U.S. economy remains unchanged over the next 6 to 12 months. This strategist has been optimistic about the U.S. stock market this year and is one of the few who accurately predicted a strong recovery following the sell-off triggered by tariffs in April. On Monday, U.S. stock index futures rose slightly after President Trump softened his stance on tariffs against China, alleviating market concerns.

Concerns about trade and the broader impact of losses at U.S. regional banks led to increased market volatility over the weekend. The volatility index (VIX) remains near the critical 20-point level, close to the highest range in the past six months. Data from Deutsche Bank Group shows that overall U.S. stock holdings significantly decreased last week, marking the largest weekly decline since the sell-off triggered by tariff issues in April.

Meanwhile, Wilson noted that the momentum of the earnings revision index is weakening and has now fallen into negative territory, which is a situation investors need to pay attention to. However, he stated that the decline in earnings revisions aligns with seasonal trends and may just be a temporary pause before an upward trend.

As the earnings season officially kicks off, Oppenheimer Chief Investment Strategist John Stoltzfus stated that the current results look quite optimistic. In a report on Monday, Stoltzfus wrote that the earnings of S&P 500 constituent companies that have reported so far have grown by 16%, exceeding the expected growth of 12%.

Stoltzfus stated that despite various risks, large U.S. companies have exceeded expectations and completed their earnings guidance, indicating that "companies still have enough resilience to sustain the stock market's upward trend."