This year's return is 104%. Invesco Great Wall Jiangshan: AI investment focuses most on computing power and applications, with two investment clues for computing power: one clear and one obscure, and the core application is large models

At the Invesco Great Wall Fund's fourth-quarter strategy meeting, fund manager Jiang Shan shared his outlook on AI investments, focusing mainly on two directions: computing power and applications. Computing power investments have both clear and obscure lines, with potential new demands such as storage cabinets emerging in the future. It is expected that the price-to-earnings ratio will be reasonable next year, and market confidence may enhance valuations. Market sentiment is quite volatile for emerging directions such as power supplies and storage. The core AI application remains large models, and future investment models will shift towards enhancing the valuation of deterministic supply chains. Jiang Shan has 12 years of industry experience and manages a total asset scale of 10.81 billion yuan

On October 21, at the Invesco Great Wall Fund's fourth-quarter strategy meeting, fund manager Jiang Shan shared his investment outlook for the AI sector.

The investment representative summarized the key points as follows:

- For AI investments, we mainly focus on two directions: computing power and applications.

Looking ahead to the next six months to a year, the investment logic in the computing power sector has a clear line and a hidden line...

- In addition to computing power, another important direction is the evolution of models after reaching the current stage, including long thinking chains, long contexts, and unified multimodality. These directions all point to greater storage demands.

In the future, in network architecture solutions, we may not only see computing cabinets and switching cabinets, but also new storage cabinets.

- At the current point in time, the price-to-earnings ratio level for computing power next year is very reasonable. In the next six months to a year, at some point, the market may raise the valuation for that year to over 20 times or even 30 times due to confidence in orders after 2027. This represents the potential return space for these "old" computing power targets.

Of course, if new application scenarios emerge in the future and market confidence in the industry further strengthens, valuations may further trend towards pricing the market space three to five years down the line. This is an upside option for future valuations.

Therefore, for this segment of computing power, our strategy is to hold and look forward to valuation switching and expansion next year.

For emerging directions, such as power supply and storage, the market often has a certain "preference for the new and aversion to the old" sentiment, and these directions may have greater stock price elasticity at certain stages.

- The current investment approach to applications has changed significantly compared to one or two years ago. From the perspective of investable targets, the core AI applications may still be these large models themselves.

Among overseas and domestic model companies, we are more optimistic about internet companies that are relatively leading in models and computing power.

- In the past year or so, the A-share market related to robotics has been more focused on small and new stocks. However, once the product strength of leading companies is recognized and enters the mass production stage, the investment model will shift from speculation on small and new stocks to a phase of valuation enhancement based on a certain supply chain.

Jiang Shan has 12 years of experience in the securities and fund industry and currently manages a total fund asset scale of 10.81 billion yuan.

He has previously served as a product manager in the product planning department of Baoying Fund, a researcher in the research department, a researcher in the asset allocation department of Guotou Ruijin, an investment manager in the separate account investment department, a researcher in the research department, and a fund manager in the equity investment department of Chang'an Fund, as well as the deputy director of the research department and fund manager. He joined Invesco Great Wall Fund in December 2023 and has been serving as the fund manager of the mixed asset investment department since July 2024.

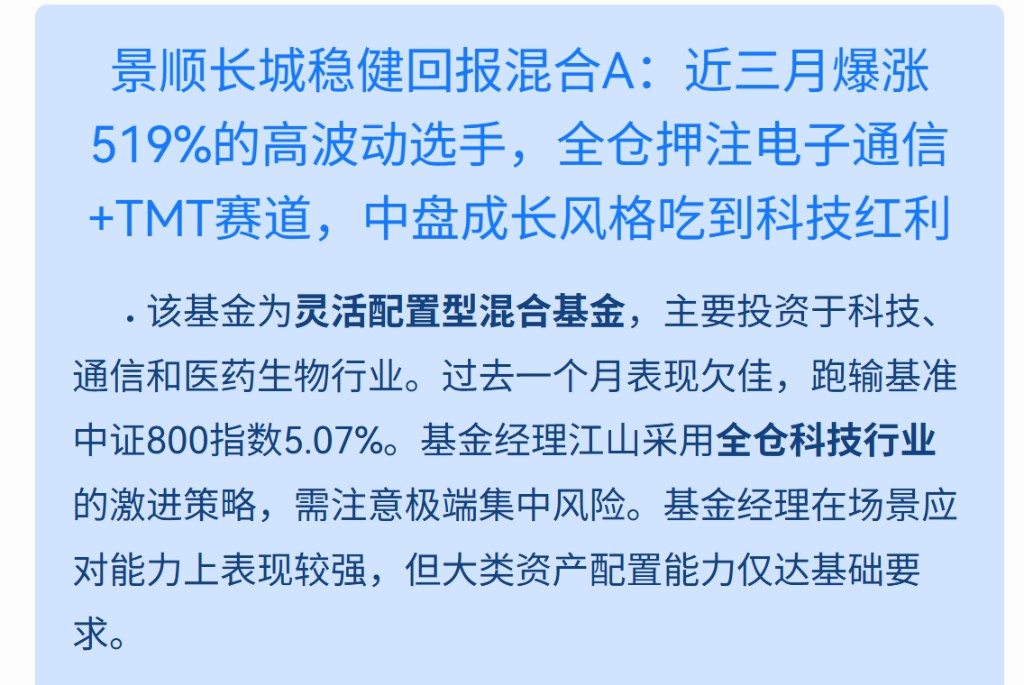

The following chart shows the performance and ranking details of the funds he manages, among which Invesco Great Wall Stable Return Mixed A has the highest return, achieving 103.97% this year, leading the market ranking.

However, the Workbook Sailing Index analysis points out that this product is fully invested in technology, and attention should be paid to concentration risk.

However, the Workbook Sailing Index analysis points out that this product is fully invested in technology, and attention should be paid to concentration risk.

Jiang Shan previously pointed out in the interim report that what excites us most at the industrial level is still AI. The narrative logic of the industry continues to strengthen, model iterations are steadily advancing, and token usage is even accelerating.

He stated that the AI industry is transitioning from a competitive training investment-driven phase to a stage dominated by inference demand, where the demand for inference training creates a virtuous cycle. This means that more stable and continuous demand will be released, and the prosperity of applications is approaching.

Jiang Shan emphasized that from the perspective of applications, in addition to focusing on the endless new species such as agents, robots, and intelligent driving, we also look forward to AI reshaping existing scenarios. This process will further strengthen the advantages of leading internet applications and public clouds.

In addition, Jiang Shan is optimistic about investment opportunities in the second half of the year in areas such as non-ferrous metals, innovative drugs, and self-controllable technologies.

The following are the highlights organized by the investment representative of Workbook (WeChat ID: touzizuoyeben), sharing with everyone:

AI Investment Focuses on Two Directions: Computing Power and Applications

I am honored to share with you today. I will mainly discuss some thoughts on AI investment for the next six months to a year.

First, from the perspective of the entire industry, I believe this year is the first time we have seen a "flywheel effect" among computing power, models, and applications, which may be an important underlying logic behind this year's market.

For example, in scenarios such as code generation, we have seen the overall ROI turn to positive growth for the first time, which has injected a strong boost into the entire AI computing power investment and model training input.

Currently, many giants both domestically and internationally have begun to outline their investment plans for the next five years, even looking ahead to capital expenditures by 2030.

The current market has not yet priced stocks based on these long-term prospects. However, we believe that as more scenarios similar to "code generation" are implemented in the future, market confidence in the future will gradually increase, and the long-term prospects are expected to provide a strong boost to the valuations of the entire sector and individual stocks at some point in the future. This is a direction we can look forward to.

Returning to AI investment, we mainly focus on two directions: computing power and applications. I will elaborate on each.

First is computing power, and second is applications.

Computing Power Investment Logic: One Clear Line, One Hidden Line

Within the scope of investable areas, I will first discuss the computing power field. Looking ahead to the next six months to a year, the investment logic in the computing power field has one clear line and one hidden line.

The clear line is that in computing power investment, we pay more attention to the demand situation of downstream customers. The hidden line concerns the power situation in North America North America's power infrastructure is not as well-developed as that of the domestic market, lacking a unified large power grid and ample power supply. Currently, electricity has become a key bottleneck for computing power investment and development.

We can see that the stock prices of new direction stocks related to electricity in North America are performing very strongly. It is referred to as the "dark line" because the future energy consumption per unit of computing power or per unit token will become an important underlying logic that restricts investment in network equipment.

In other words, the solutions with the lowest unit energy consumption are expected to capture a larger share of the overall market. Currently, cabinet solutions remain the lowest cost option for energy consumption per unit token. Therefore, customers are not only concerned about initial capital expenditures but also about subsequent operating costs.

This dark line forms a closed loop with the bright line logic we mentioned: more mature models and better computing power solutions have advantages under limited energy supply conditions.

In addition, the dark line itself also brings some investment opportunities, such as the emergence of new types of power supplies and transformers in the market, which we are paying close attention to.

Aside from computing power, another important direction is the evolution of models at the current stage, including long thinking chains, long contexts, and unified multimodal. These directions all point to increased storage demand.

In the future, in network architecture solutions, we may not only see computing cabinets and switching cabinets but also new storage cabinets.

Therefore, this industry is no longer merely a cyclical investment logic from the past few years; we will see more growth-oriented demands emerge in the future. Storage is also a direction we are very focused on.

To summarize the computing power direction: targets on the main chain, such as optical modules, PCBs, servers, etc., have been humorously referred to as "old Deng" in the computing power field. Our core focus is that their current valuations are very reasonable, and next year's price-to-earnings ratio may be at a low level.

Hold "Old Deng" computing power stocks, anticipating valuation switching and expansion next year

In the past few years, we often saw the market willing to give these stocks a growth valuation of twenty to thirty times or higher only when downstream customers provided order guidance for the following year by the second quarter of that year; otherwise, there would be ongoing concerns about whether demand could be sustained.

We believe that the current level of next year's price-to-earnings ratio is very reasonable. In the next six months to a year, at some point, the market may raise the valuation for that year to over twenty times or even thirty times due to confidence in orders after 2027. This represents the potential profit space for these "old Deng" computing power targets.

Of course, if new application scenarios emerge in the future and market confidence in the industry further strengthens, valuations may further trend towards pricing based on market space three to five years down the line. This represents an upside option for future valuation levels.

Therefore, our strategy for this segment of computing power is to hold and anticipate valuation switching and expansion next year.

For emerging directions such as power supplies and storage, the market often exhibits a certain "new is better than old" sentiment, and these directions may have greater stock price elasticity at certain stages. This is our perspective and thinking on the computing power direction.

The second focus is on applications. I believe that the current investment approach to applications has changed significantly compared to one or two years ago The market and industry are the same. Independent to C AI startup teams have not launched many exciting products in the past few years, and many of their functions have been absorbed by the large models themselves. Therefore, at the software level, we currently cannot look too far ahead.

Models are the Core AI Applications

However, in the next six months to a year, this trend may continue, and the models themselves will still be the core AI applications. From this perspective, there are two manifestations:

First, the model itself is an application. The chatbots and other models we see now, as well as the internet companies they belong to, are integrating more and more software and internet functions into the models. Current chatbots are already relatively general-purpose intelligent agents, and their functions will become even more powerful in the future.

Second, model companies are also beginning to dominate the updates and innovations of end-side devices. In addition to startup teams, giants like OpenAI have also entered the field. This is a change we may observe in the next year or two.

Therefore, from the perspective of investable targets, the core AI applications may still be these large models themselves. Whether domestically or internationally, within large internet companies, models, computing power, and application scenarios and directions are more likely to form a unified state.

Thus, our strategy is relatively simple: among model companies overseas and domestically, we are more optimistic about internet companies with relatively leading models and computing power.

This is also a characteristic of our portfolio.

The Second Direction of Special Focus at the Application Level: Robotics

Second, apart from software, hardware or end-side directions are also very important at the application level. The most attractive new direction on the end side is robotics. From the market performance of A-shares and US stocks, we have already seen market recognition of this.

In the coming year, we expect companies represented by specific firms to launch competitive products and gradually enter the mass production stage. This is crucial for secondary market investments.

Looking back at the A-share market related to robotics over the past year, the market has mainly focused on small and new stocks. This kind of market is not suitable for funds like ours to participate in, at least I personally am not good at it.

However, once the product strength of leading companies is recognized and enters the mass production stage, the investment model will shift from speculation on small and new stocks to valuation enhancement of a certain supply chain.

This process is similar to the 0 to 1 stage in the innovation diffusion curve, which is a stage that institutional investors find easier to participate in.

We believe that as the industry continues to develop and iterate, we need to keep tracking it, but in the next six months to a year, we are likely to enter this stage: seeing competitive products and gradually entering mass production. This will change the investment thinking and paradigm in the robotics field and bring very good investment opportunities in the secondary market.

This is the second direction we are particularly focused on at the application level.

Summary

To summarize my points: First, at the computing power level, based on recent feedback from OCP, the demand for computing power remains very strong. The prosperity is expected to last at least until the range of orders we can currently see, not just next year, but even the year after. We can also see good growth from many leading indicators Therefore, traditional computing power-related targets such as PCB, optical modules, and servers currently have very reasonable valuations and good potential for the future.

In addition, new directions brought about by the development of computing power, such as power supplies and storage, may provide good flexibility for the portfolio.

At the application level, in terms of software, the current investment win rate and odds are still relatively high for core internet companies; in terms of hardware, we believe that robots will see very positive changes in the next six months to a year.

Source: Investment Workbook Pro, Author: Wang Li

For more insights from industry leaders, please follow↓↓↓

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investing based on this is at your own risk