Cost reduction and AI demand surge, Intel turns a profit in Q3, revenue recovers growth, guidance optimistic, stock rises in after-hours trading | Earnings Report Insights

In the third quarter, Intel's revenue saw its first year-on-year positive growth in a year and a half, and it achieved net profit for the first time since the end of 2023, with gross margin reaching a year and a half high. The CFO stated that the company's chips are currently in short supply, a situation that will continue into next year, partly due to the upgrade CPU demand from data center operators. Intel's fourth-quarter revenue guidance, excluding the Altera business, is slightly below analyst expectations, but it actually performed better because some analysts' forecasts included Altera revenue. Intel stated that it received a $5.7 billion investment from the U.S. government in the third quarter; NVIDIA's $5 billion investment will be completed within the year. Intel's stock price rose by as much as 9% in after-hours trading

In the third quarterly report released after taking office, Intel CEO Eric Wu proved that his cost-cutting measures while attracting external investments are effective, as the company is riding the wave of AI chip demand to get back on track.

In the third quarter of this year, Intel's revenue achieved year-on-year positive growth for the first time in a year and a half, regaining momentum after two consecutive quarters of zero growth. The earnings per share (EPS) turned profitable, exceeding Wall Street's slightly profitable expectations and also surpassing Intel's own guidance provided three months ago: breakeven. Moreover, it marked the first net profit in over a year.

Commentators believe that Intel's revenue guidance for the fourth quarter, excluding Altera's business, appears optimistic, bringing hope for the company's resurgence. Some also believe that with the upcoming preparations for the U.S. midterm elections next year, the Trump administration may provide greater support to Intel, which is a relatively long-term positive.

After the earnings report was released, Intel's stock price rose about 3.4% on Thursday and further surged in after-hours trading, at one point increasing by 9%. Over the past three months, Intel has received a series of investment or equity commitments from SoftBank, the Trump administration, and NVIDIA. Since announcing a $2 billion investment agreement with SoftBank on August 18, Intel's stock price has cumulatively risen over 30% as of Wednesday's close, with an overall increase of 86% this year.

On October 23rd, Thursday, after U.S. stock market hours, Intel announced its financial data for the third quarter of 2025 and its performance guidance for the fourth quarter.

1) Key Financial Data:

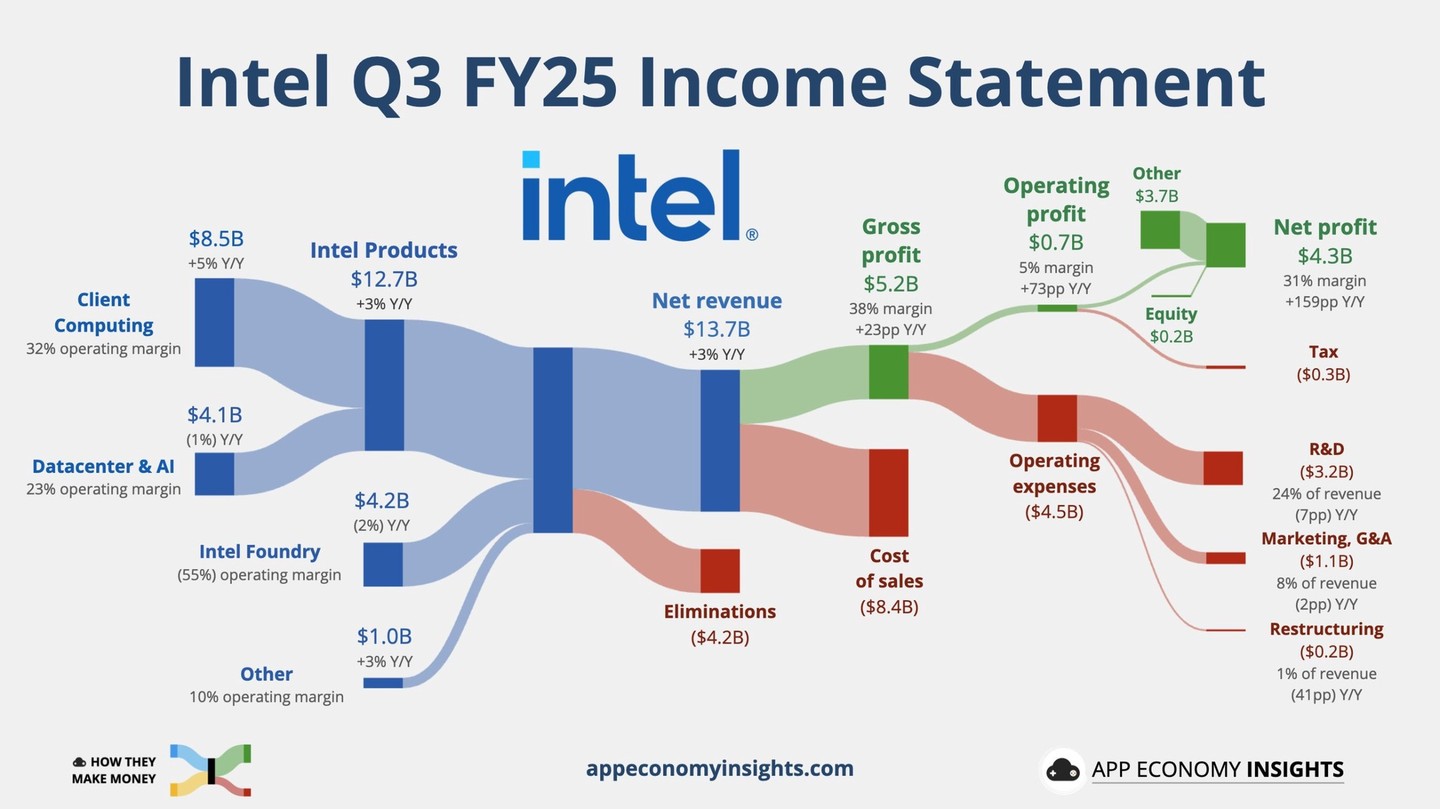

Revenue: Third-quarter revenue was $13.7 billion, a year-on-year increase of 3%, while analysts expected $13.2 billion. Intel's guidance was $12.6 billion to $13.6 billion, with zero growth year-on-year in the second quarter.

EPS: The adjusted EPS under non-GAAP for the third quarter was $0.23, while analysts expected $0.01. Intel's guidance was zero, and the EPS loss in the second quarter was $0.10.

Gross Margin: The adjusted gross margin for the third quarter was 40.0%, while analysts expected 35.7%. Intel's guidance was 36.0%, compared to 29.7% in the second quarter and 18% in the same period last year.

Operating Margin: The adjusted operating margin for the third quarter was 11.2%, compared to -3.9% in the second quarter and -17.8% in the same period last year.

2) Segment Business Data:

CCG: The Client Computing Group (CCG) generated $8.5 billion in revenue in the third quarter, a year-on-year increase of 5%, while analysts expected $8.2 billion, with a year-on-year decline of 3% in the second quarter.

DCAI: The Data Center and Artificial Intelligence (DCAI) segment generated $4.1 billion in revenue in the third quarter, a year-on-year decrease of 1%, while analysts expected $3.97 billion, with a year-on-year growth of 4% in the second quarter.

Foundry: The foundry business generated $4.2 billion in revenue in the third quarter, a year-on-year decrease of 2%, with a year-on-year growth of 3% in the second quarter

3) Performance Guidance:

Revenue: Expected revenue for the fourth quarter is between $12.8 billion and $13.8 billion, with analysts expecting $13.44 billion.

EPS: Expected adjusted EPS for the fourth quarter is $0.08.

Gross Margin: Expected adjusted gross margin for the fourth quarter is 36.5%.

Revenue Shows Positive Year-on-Year Growth for the First Time in a Year and a Half; First Net Profit Since the End of 2023

The financial report shows that Intel's revenue in the third quarter exceeded the company's entire guidance range, marking the first quarter of year-on-year growth this year, and the first positive year-on-year revenue growth in a year and a half since the first quarter of last year. Analysts had previously expected Intel's revenue to be slightly lower than the same period last year or roughly flat compared to a year ago, still indicating zero growth.

Intel's EPS in the third quarter was $0.23, far exceeding analysts' expectations of $0.01 and Intel's own forecast of zero. On a non-GAAP basis, Intel recorded a net profit of $1 billion in the third quarter, achieving profitability for the first time since the end of 2023.

Intel's gross margin in the third quarter exceeded expectations, increasing by 22 percentage points compared to the same period last year, reaching a new high since the first quarter of last year.

Including $5 billion from Nvidia, $8.9 billion from the U.S. federal government, and $2 billion from SoftBank, Intel has announced a total of $15.9 billion in external financing over the past three months.

Michael Schulman, Chief Investment Officer of Running Point Capital, believes that this new strategic financing of about $15 billion supports Intel's balance sheet. These financings, along with the significant improvement in Intel's gross margin in the third quarter, cost control, the AI PC boom, and stronger-than-expected guidance, collectively drove Intel's stock price higher in after-hours trading.

Chen Liwu previously stated that he would adopt a strategy similar to that of former Intel CEO Kissinger, but with much stricter financial discipline. This means that if the return on investment is unclear, he will lay off employees and suspend manufacturing plans.

In July, Intel stated that by the end of this year, the company's workforce would be reduced by more than 20% compared to last year. Intel recently disclosed that the total number of employees is 88,400, a decrease of nearly 29% from 124,100 a year ago.

CFO States Intel Chip Shortage Will Continue Until Next Year

Intel's Chief Financial Officer (CFO) Dave Zinsner stated that demand for Intel's chips was strong in the third quarter, leading to supply constraints for the company. One reason is that data center operators realize they need to upgrade their central processing units (CPUs) to keep up with the application of advanced AI chips. Zinsner stated in a statement:

"Currently, there is a supply shortage, and we expect this trend to continue until 2026." Based on "the potential strength of our core markets," the company's third-quarter performance exceeded expectations From the perspective of segmented business data, Intel's largest business unit, Client Computing Group (CCG), which includes PC processors, became a direct driver of Intel's revenue in the third quarter, reflecting the driving effect of the PC chip business.

In the third quarter, CCG's revenue grew by 5% year-on-year, while the other two business segments—Data Center and AI (DCAI), which includes data center chips, and the foundry business that is seeking external customers—both saw revenue declines.

Before Intel's earnings report was released, some analysts had already anticipated that Intel's PC processor sales might exceed expectations. John Vinh, an analyst at KeyBanc Capital Markets, wrote in a report this week: "We expect Intel to report better performance and higher guidance. Intel should benefit from broad growth in its server business and customers upgrading to Granite Rapids server processors."

Earlier this month, Intel announced that the first products based on its Panther Lake architecture would begin "mass production" later this year at its new chip factory in Arizona. These processors will use the company's latest 18A chip manufacturing process, with shipments expected by the end of the year and a "broad market launch" starting in January.

Revenue Guidance Median Slightly Below Expectations but Excludes Altera Revenue

In terms of performance guidance, Intel's fourth-quarter revenue guidance median is $13.3 billion, slightly below Wall Street expectations.

However, it was noted that in forecasting revenue, some analysts included Intel's programmable chip business Altera, which was just divested in September, while Intel's guidance did not include it. Altera's fourth-quarter revenue is expected to be between $400 million and $500 million. Considering this difference, Intel's guidance should look better than it appears.

Intel CFO Zinsner also stated in an interview that if the forecast excluded Altera's revenue, Intel's guidance would look even better.

Intel's earnings report shows that since September 12 of this year, Altera, which was previously a wholly-owned subsidiary of Intel, is no longer included in the company's consolidated financial statements, as the company had completed the sale of 51% of Altera's equity. During the period ending September 11, Altera's financial operating performance was included in Intel's consolidated financial performance and its "All Other" business segment category.

$5.7 Billion Investment from U.S. Government in Q3, NVIDIA Investment to be Completed This Year

Intel's earnings report on Thursday revealed that the company had previously announced an agreement with the Trump administration to support the ongoing expansion of U.S. technology and manufacturing through $8.9 billion in funding provided by the U.S. government. In the third quarter, Intel received $5.7 billion in government investment.

However, Intel warned investors: "There is limited precedent for the accounting treatment of such transactions."

Intel stated that the company has met with the U.S. Securities and Exchange Commission (SEC) to seek approval for the accounting treatment of government holdings, but has not yet received a response due to the federal government shutdown. Intel warned that it may modify its investment disclosures in the future.

Chen Liwu stated during the earnings conference call that Intel is committed to fully advancing the Trump administration's vision of restoring semiconductor production and welcomes the government as an important partner in the company's efforts In the earnings report this Thursday, Intel also mentioned that it had previously reached an agreement with NVIDIA to jointly develop multiple generations of customized data center and PC products aimed at the hyperscale data center, enterprise, and consumer markets. NVIDIA also agreed to invest $5 billion to purchase Intel common stock.

Intel expects NVIDIA's investment to be completed before the end of the fourth quarter.

Betting on Intel's Future Rather Than Earnings Data

Before Intel released its earnings report, analysts pointed out that the overall view among investors and analysts is that betting on Intel is not about what has already happened, but rather about future possibilities. Earnings reports are essentially retrospective, so the performance data for the third quarter is unlikely to affect the stock price, but any comments about the future could have a significant impact.

Ryuta Makino, a research analyst at Gabelli Funds, which manages $35 billion in assets as of September 30, recently stated that investors are not overly focused on Intel's earnings numbers. At least in the short term, he views Intel as a trading stock, more driven by events and news.

Analysts at Seeking Alpha commented that many people will focus on Intel's quarterly performance this Thursday, but in the long run, the most critical factor remains the willingness of the U.S. government to support domestic chip manufacturing. Especially with the midterm elections approaching, it is believed that government-encouraged deals and investments are likely to become further catalysts for the stock price