Minsheng Securities: In the fourth quarter, the core inflation in the United States will face an upward turning point year-on-year

Minsheng Securities released a research report indicating that in the fourth quarter, the core inflation in the United States will face an upward turning point year-on-year, and the inflation in September is just the beginning of data shocks. It is expected that accelerating inflation and better-than-expected employment data will make the Federal Reserve's easing path more cautious, leading to a cooling period for the market's blind euphoria, with precious metals and risk assets undergoing fluctuations and adjustments. Inflationary pressures in the fourth quarter will further intensify, potentially causing the Federal Reserve to pause interest rate cuts in December or January next year

According to the Zhitong Finance APP, Minsheng Securities released a research report stating that the inflation in September is just the beginning of a series of "data shocks." The acceleration of inflation in the fourth quarter and the possibility of better-than-expected employment data may make the Federal Reserve's easing path more cautious. This means that the market's previous "blind frenzy" is entering a cooling period, and the short-term oscillation and adjustment phase of precious metals and risk assets may continue.

Minsheng Securities believes that the core inflation in the fourth quarter will face an upward turning point year-on-year. With the release of a new round of replenishment demand in the U.S., the inventory in bonded areas gradually leaving the zone after the tariffs take effect, coupled with the dilution of corporate profit margins, the month-on-month increase may further accelerate. This means that inflation pressure in the fourth quarter will be further amplified. Against the backdrop of accelerating inflation, the final interest rate path may not be as optimistic as the market expects (the current market pricing indicates three rate cuts by January next year). It is very likely that a reverse correction of expectations will occur in the fourth quarter: a gradually recovering job market after rate cuts coexisting with accelerating inflation, which may lead the Federal Reserve to pause rate cuts in December or January next year.

The main points of Minsheng Securities are as follows:

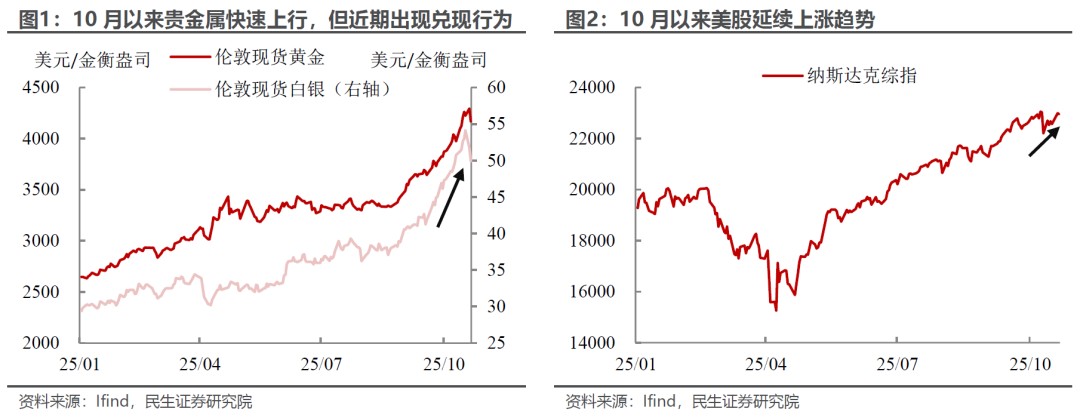

Since October, the data missing due to the government shutdown has plunged macro traders into a "fog where one cannot see one's hand." Market participants relying on macro indicators for investment research, after losing their sense of direction, can only grip the steering wheel tightly and drive forward at full speed.

Therefore, we see that the strongest momentum in precious metals and risk assets has accelerated upward. However, with the upcoming data verification, the market is beginning to hesitate whether it has gone too far in the wrong direction (as reflected in profit-taking). As the first official inflation data released since the U.S. government shutdown, the appearance of the September CPI will undoubtedly impact the market.

We expect that under the "cold and hot" differentiation of services and goods, the core CPI in September is expected to maintain moderate growth, while Powell's recent remarks also indicate that the urgency of the job market temporarily outweighs concerns about rising inflation. Therefore, this data may disturb the interest rate cut expectations priced in for October, but it is unlikely to have a disruptive impact.

We believe that the September inflation is just the beginning of a series of "data shocks." The acceleration of inflation in the fourth quarter and the possibility of better-than-expected employment data may make the Federal Reserve's easing path more cautious. This means that the market's previous "blind frenzy" is entering a cooling period, and the short-term oscillation and adjustment phase of precious metals and risk assets may continue.

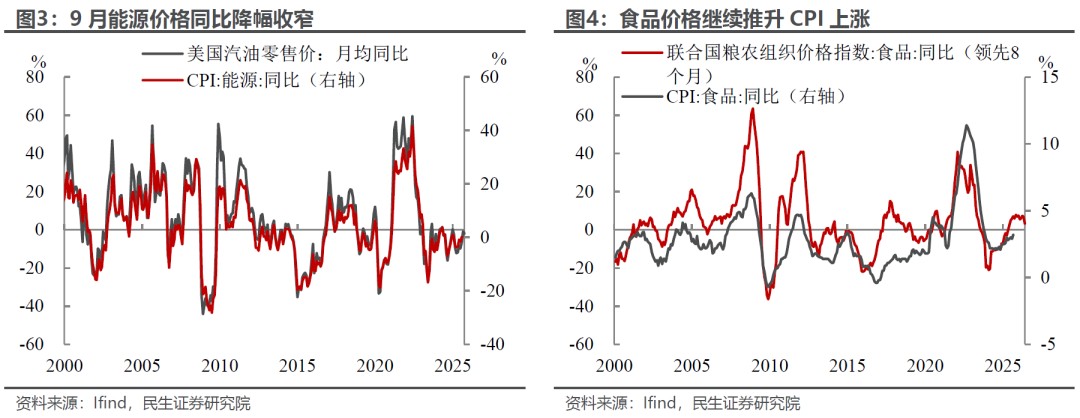

Specifically, what picture will the September inflation present? We expect that driven by energy and food inflation, the September CPI will further rise to above 3%, which is basically consistent with the characteristics shown by high-frequency data. The growth rate of core CPI is expected to remain flat compared to the previous value, maintaining at 3.1%—despite the continuous rise in commodity prices under tariff impacts, the decline in service inflation such as housing provides a certain buffer, resulting in an overall slower growth rate of core CPI under the differentiation of the two

Among them, the rise in commodity prices is mainly driven by two factors:

On one hand, new models stimulate car purchase demand, combined with the "consumption rush" effect brought by tax credits before the end of September, automobiles remain a significant force in the recovery of core commodities;

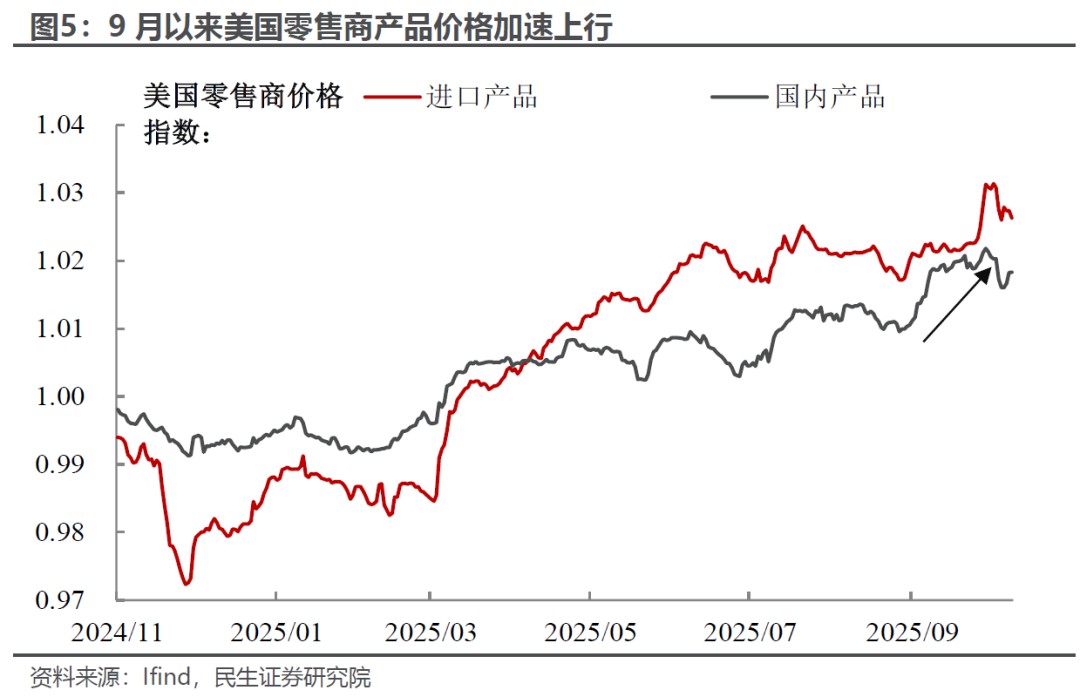

On the other hand, the impact of tariffs on commodity price increases is becoming more evident. According to the product prices of major U.S. retailers (calculated by Harvard University), retail prices of imported related goods in the U.S. rose again in September, with the scope and intensity of tariff impacts on prices expanding. It is expected that imported related goods such as furniture, clothing, and leisure products will maintain moderate growth month-on-month.

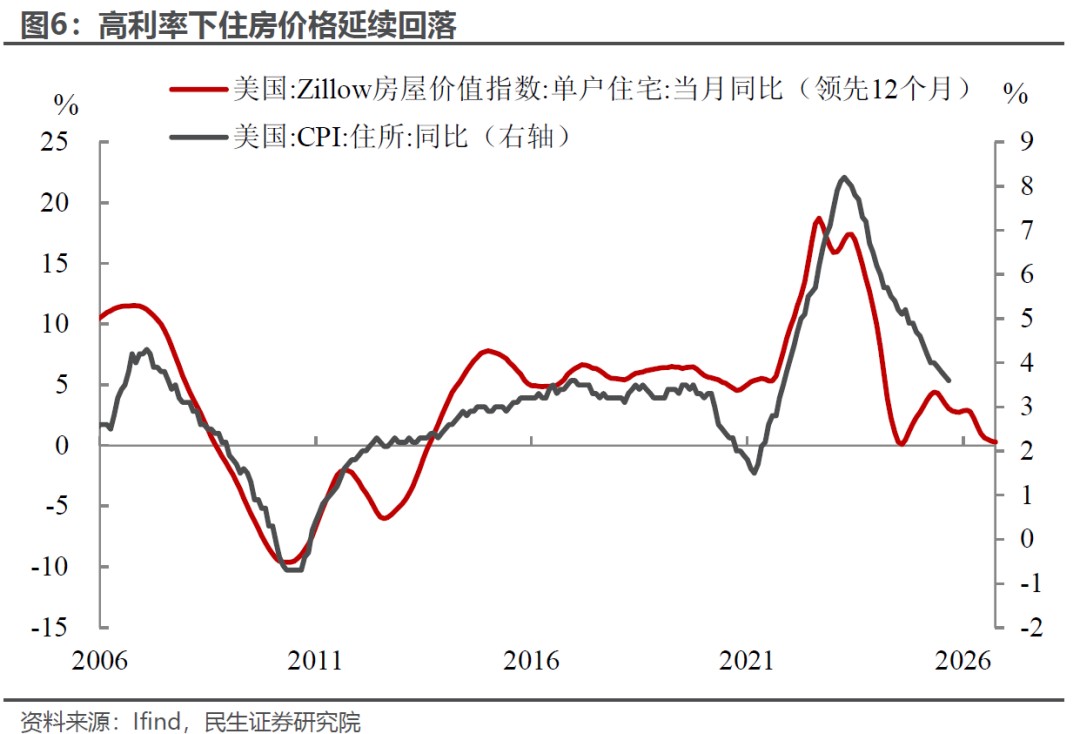

However, the slowdown in service inflation may partially offset the upward pressure on commodity inflation. Especially in a high-interest-rate environment, housing inflation continues to weaken. According to high-frequency leading indicators such as the Zillow Home Price Index, housing CPI still faces significant downward pressure. Additionally, with the end of summer, transportation and leisure service prices driven by travel are showing a downward trend (such as airfare prices), which partially offsets the price increase momentum brought by tariffs.

In summary, core inflation in September is expected to continue a moderate upward trend, which also means that the market's basic pricing of the October interest rate cut expectation is difficult to reverse. In the short term, the Federal Reserve's weighing of risks in the labor market temporarily outweighs inflation concerns. Recently, Powell has repeatedly emphasized that there are increasing signs of weakness in the labor market. Even in the absence of government data during the shutdown, the risk of employment decline has clearly increased. At least from the current standpoint, moderate inflation retains the Federal Reserve's room for an interest rate cut in October, which may prioritize alleviating employment issues.

So, how to assess the subsequent inflation and interest rate cut rhythm? We believe that core inflation will face an upward turning point year-on-year in the fourth quarter. Even assuming that core CPI continues the current moderate growth rate of 0.3% month-on-month, its year-on-year growth rate will enter an upward channel in October, breaking away from the stable state of the past three months (around 3.1%). The year-on-year core CPI is expected to rise to 3.2%, 3.4%, and 3.7% in October, November, and December, respectively.

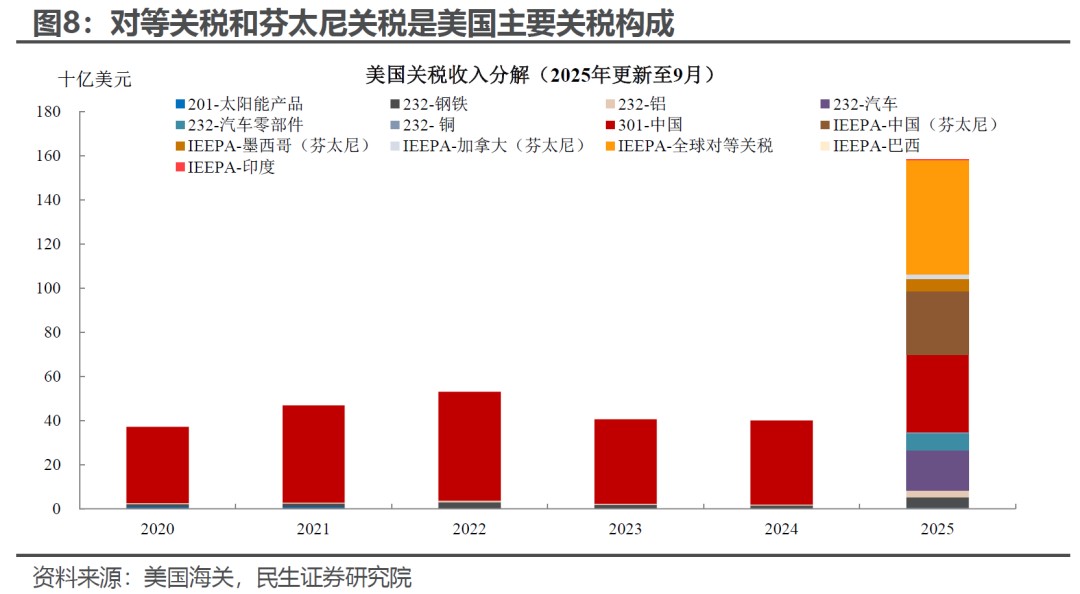

In addition, our previous reports have mentioned multiple times that the excess inventory generated by the earlier "import rush" and corporate tax avoidance strategies have led to a slow transmission of tariffs to the cost side. According to the latest research from the Federal Reserve Bank of St. Louis, the current transmission of tariffs to prices is only about 35%, with price adjustment lags and price-cutting behaviors under corporate competition making the pass-through of tariffs to the consumer side not yet apparent. As the new round of restocking demand in the U.S. is released and the inventory in bonded areas gradually leaves after the tariffs are implemented, combined with the dilution of corporate profit margins, the month-on-month increase may further accelerate, indicating that inflation pressure will further intensify in the fourth quarter.

In addition, our previous reports have mentioned multiple times that the excess inventory generated by the earlier "import rush" and corporate tax avoidance strategies have led to a slow transmission of tariffs to the cost side. According to the latest research from the Federal Reserve Bank of St. Louis, the current transmission of tariffs to prices is only about 35%, with price adjustment lags and price-cutting behaviors under corporate competition making the pass-through of tariffs to the consumer side not yet apparent. As the new round of restocking demand in the U.S. is released and the inventory in bonded areas gradually leaves after the tariffs are implemented, combined with the dilution of corporate profit margins, the month-on-month increase may further accelerate, indicating that inflation pressure will further intensify in the fourth quarter.

Therefore, even if the interest rate is cut by 25 basis points as scheduled in October, the subsequent path of monetary easing by the Federal Reserve will be more "constrained." Against the backdrop of accelerating inflation, the ultimate interest rate path may not be as optimistic as the market expects (the current market pricing indicates three more rate cuts by January next year). It is very likely that there will be a reverse correction of expectations in the fourth quarter: a gradually recovering labor market post-rate cut coexisting with accelerating inflation, which may lead the Federal Reserve to pause rate cuts in December or January next year.

Of course, fourth-quarter inflation also faces an important potential disturbance—the Trump tariff ruling, which may provide a more lenient decision-making window for the Federal Reserve. The Supreme Court is expected to start oral arguments in early November, followed by a ruling. If the final decision is found unlawful, Trump's efforts to promote reciprocal tariffs will be in vain; although Trump has recently accelerated the introduction of Section 232 tariffs as an alternative and emergency measure, the impact of industry tariffs on inflation will be correspondingly weakened compared to comprehensive reciprocal tariffs, which would actually be more supportive of the Federal Reserve's rate cut decision.

The more important "deciding factor"—employment data—may be temporarily disturbed by the "government department unemployment" caused by short-term shutdowns, and the timing of its release remains uncertain, keeping market uncertainty high