JP Morgan Global Quantitative Team: Be Cautious of Short-Term Gold Prices Repeating 2006

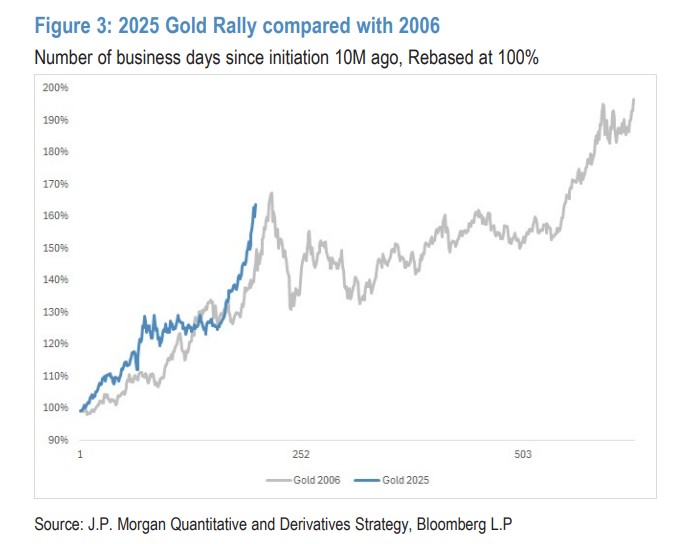

JP Morgan's global quantitative team warns that the recent buying of a large number of short-term bullish options in the gold market has led to a net short gamma imbalance, increasing the risk of price volatility. Although this position has decreased, market sentiment is overheated, with the current momentum indicators for gold and short-term implied volatility both at high levels. The team compares this situation to the 30% pullback in gold prices after a rapid rise in May 2006, suggesting a historical pullback risk

From the end of September to the beginning of October, due to a large number of short-term call options being purchased in a low volatility environment, the net short gamma imbalance of the world's largest gold ETF (GLD) reached 10 times its historical standard deviation. This extreme market position has exacerbated the risk of price volatility. Although this position has decreased with the expiration of October options, the current momentum indicators for gold and short-term implied volatility are both at the 100th percentile, indicating that market sentiment is overheated.

JP Morgan's global quantitative team compared this rapid rise in gold to the situation in May 2006, when gold prices experienced a 30% pullback within a month after a significant increase, suggesting a historical pullback risk.